Bluetooth 5.0 Market Share, Size, Trends, Industry Analysis Report

By Component; By Application (Audio Streaming, Data Transfer, Location Services, Device Networks); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 119

- Format: PDF

- Report ID: PM2715

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

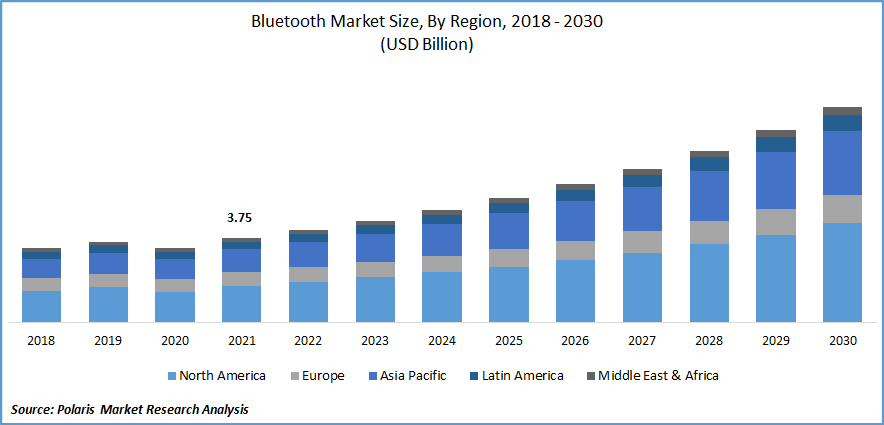

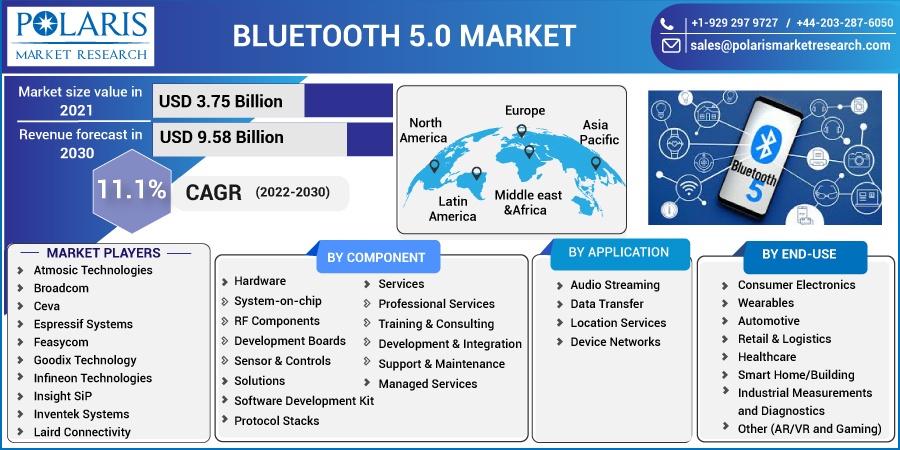

The Bluetooth 5.0 market was valued at USD 3.75 billion in 2021 and is expected to grow at a CAGR of 11.1% during the forecast period. The demand for Bluetooth 5.0 is driven by increased investments in IoT devices and rising demand for connected wearables. Additionally, rising awareness of bluetooth beacon technology has brought lucrative opportunities in the market.

Know more about this report: Request for sample pages

Bluetooth 5.0 represents the most significant development in the Bluetooth protocol. Bluetooth 5.0 has four major new features. These include an increased bit rate of 2 Mbps, a longer-range mode with improved sensitivity, an increased broadcast capability of 8 times with advertising extensions, and an improved channel selection algorithm that allows for better channel coordination and coexistence efficiency with other Bluetooth and non-Bluetooth traffic. These major features are supposed to propel the market’s growth.

Bluetooth enables the connection of individuals and products across numerous marketplaces. It can be helpful in a wide range of industries, including automotive, home automation, consumer electronics, healthcare, wearable technology, mobile and smartphone technology, sports and fitness, PC & peripherals, and medical. Additionally, it offers retail and location-based services.

Bluetooth technology propels growth in real-time locating system (RTLS) solutions for tracking objects. For the best resource and inventory control, commercial and industrial establishments are increasingly turning to Bluetooth asset management systems. Among Bluetooth Location Services, RTLS and tags have taken the lead in propelling continuing growth.

The Covid-19 pandemic positively influenced the Bluetooth 5.0 market, increased demand for hands-free medical equipment in hospitals and at home, and accelerated the Internet of Medical Things (IoMT) implementation. The adoption of wearable health monitors, such as blood pressure and blood glucose devices, has increased with the expansion of home care. Additionally, more hospitals have begun utilizing IoT connectivity to track resources and schedule distant visits.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The demand for audio devices, automotive entertainment and diagnostic equipment, innovative city initiatives, automation, and wearable electronics with Bluetooth capabilities is driving the market's growth. Increased investment in sensor technology to automate industrial activities is leading to increased revenue for the IoT connectivity industry.

Bluetooth is one of the world's most widely accepted technologies because of its low power needs, high efficiency, greater data rate, and more straightforward implementation. These factors are anticipated for the market's growth.

Compared to the previous version, Bluetooth 5.0 is two times faster in pairing time and less transmission delay, approximately 200 meters’ line of sight distance, eight times the data transfer rate, and supports a dual audio mode to connect multiple devices to the same source, and wireless coexistence with other technologies, this development of it is supposed to influence the market’s growth.

Increased utilization of wireless keyboards, mouse, and other peripherals, wireless speakers and high-quality audio systems; car audio systems & hands-free pairing with mobile devices, virtual reality and augmented reality devices, and high-definition audio and video streaming have driven the market of Bluetooth 5.0.

Report Segmentation

The market is primarily segmented based on component, application, end-use, and region.

|

By Component |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Hardware component segment is expected to grow at fastest rate in 2021

The hardware component is expected to grow fastest over the forecast period. Hardware for Bluetooth 5.0 consists of SoC, RF, development boards, sensors, and controllers. More opportunities in the Bluetooth 5.0 technology solutions have been developed, resulting in the rise in demand for high-speed, secure, and reliable wireless communication technology, which has also led to various use cases.

Device networks expected to account for the largest market revenue

Based on applications, the market has been segmented into audio streaming, data transfer, location services, and device networks. The device networks segment is expected to account for the largest market share as it is suitable for creating control, monitoring, and automation systems where tens to thousands of devices must communicate reliably and securely.

The launch of Bluetooth mesh has accelerated the growth of device network solutions. Lighting control systems and wireless sensor networks are two use cases driving the increase in device network implementations.

Moreover, the data transfer segment is expected to grow fastest over the forecast as it is suitable for sports & fitness, health & wellness, and PC peripherals and accessories. An increase in the utilization of numerous smartwatches by the consumer for sports and fitness has driven the segment’s growth.

Retail & logistics witness the largest market share

Bluetooth 5.0 is used by numerous end users. The retail and logistics segment is expected to witness the most considerable market revenue due to technologies that have significantly boosted retailers and landlords, particularly shopping centers and retail parks, by facilitating targeted advertising and marketing.

Bluetooth technology can be utilized to automatically send customized messages to shoppers' mobile phones, same as Wi-Fi assists in tracking customers as they move around the mall. Additionally, it aids landlords in comprehending client preferences and routines. The utilization of Internet data to send shipments to other areas of a facility is no longer required due to Bluetooth technology. Furthermore, logistics service providers can spot locations with repeating data. All these factors are responsible for the segment’s growth.

North America is projected to grow at the highest growth rate during the forecast period

North America is expected to drive the market's growth as it is the most technologically advanced region globally. It is anticipated to hold the most significant share of the Bluetooth 5.0 market. The economies of North American countries are stable and well-established, enabling them to make significant investments in R&D operations and contribute to the creation of new technology.

The region is renowned for rapidly adopting advanced technologies, including IoT, wearables, autos, smart cities, innovative businesses, smart agriculture, and linked and autonomous vehicles. It has driven the growth of the Bluetooth 5.0 market in this region.

Moreover, Asia Pacific is expected to grow fastest over the forecast timeline. Wearable technology, smart home technology, and other smart devices are being used more often worldwide. The region is expanding as people are choosing smart agricultural and smart healthcare technologies.

Competitive Insight

Some of the major players operating in the global market include Atmosic Technologies, Broadcom, Ceva, Espressif Systems, Feasycom, Goodix Technology, Infineon Technologies, Insight SiP, Inventek Systems, Laird Connectivity, MediaTek, Microchip Technology, Nordic Semiconductor, NXP Semiconductors, ON Semiconductor, Qorvo, Qualcomm, Realtek, Renesas, Silicon Labs, STMicroelectronics, Synopsys, Taiyo Yuden, Telit, Texas Instruments, and Virscient.

Recent Developments

In January 2020, Synopsys collaborated with Fraunhofer Institute for Integrated Circuits that release an implementation of the next-generation Bluetooth LE Audio Low Complexity Communication Codec (LC3). The LE Audio Codec delivers high-quality audio and voice playback in battery-powered devices incorporating ARC EM and HS DSP processors.

Bluetooth 5.0 Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.11 billion |

|

Revenue forecast in 2030 |

USD 9.58 billion |

|

CAGR |

11.1% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Atmosic Technologies, Broadcom, Ceva, Espressif Systems, Feasycom, Goodix Technology, Infineon Technologies, Insight SiP, Inventek Systems, Laird Connectivity, MediaTek, Microchip Technology, Nordic Semiconductor, NXP Semiconductors, ON Semiconductor, Qorvo, Qualcomm, Realtek, Renesas, Silicon Labs, STMicroelectronics, Synopsys, Taiyo Yuden, Telit, Texas Instruments, and Virscient. |