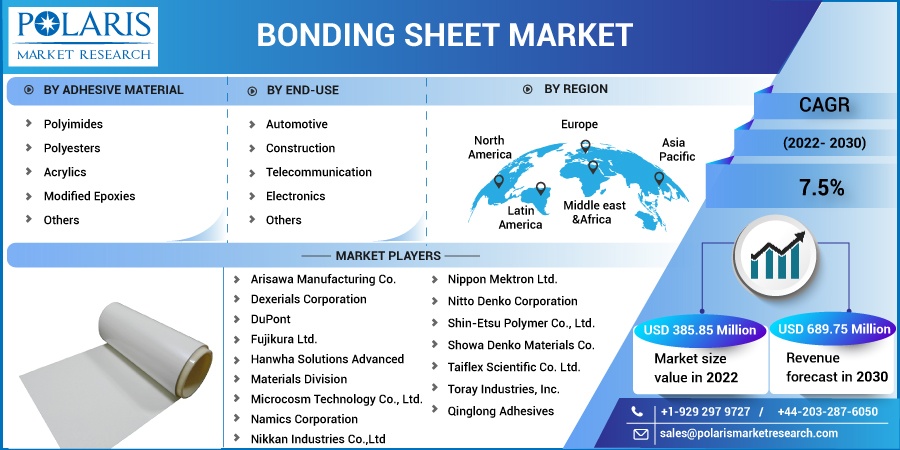

Bonding Sheet Market Share, Size, Trends, Industry Analysis Report, By Adhesive Material (Polyimides, Polyesters, Acrylics, Modified Epoxies, Others); By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 112

- Format: PDF

- Report ID: PM2641

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

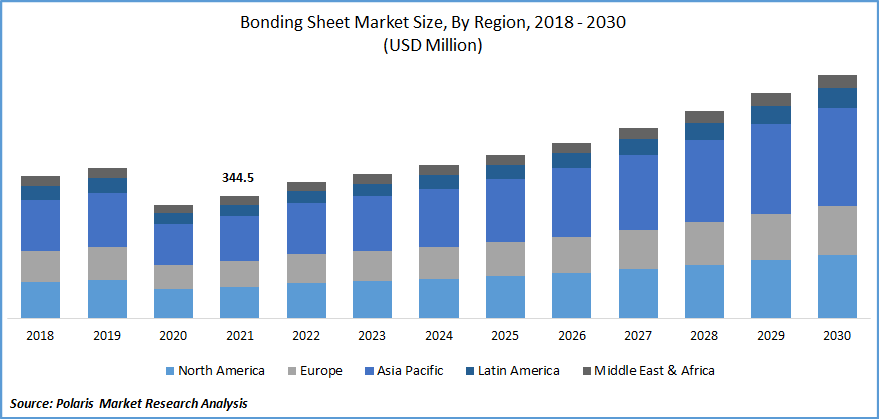

The global bonding sheet market was valued at USD 344.5 million in 2021 and is expected to grow at a CAGR of 7.5% during the forecast period. The growing focus on device miniaturization has increased the demand for bonding sheets in the electronic and automotive industries. In addition, technological advancement in the designing processes of electronic circuits is likely to increase the bonding sheets demand globally. Manufacturers’ focus on developing recycled material-based bonding sheets is expected to favor the global bonding sheet market growth.

Know more about this report: Request for sample pages

The bonding sheet integrates electronic circuits and other components to offer higher performance, stability, and durability. Bonding sheet is used in various medical devices. The rise in investments in research and development of advanced medical equipment, increasing healthcare expenditure, and government incentives and schemes boost the growth of the global market.

These sheets are also utilized in the building and construction sectors for the bonding of decorative laminates. This sheet offers strong bonding capability, high strength, and corrosion resistance. Strengthening the construction sector and developing public infrastructure would contribute to market growth in the coming years.

There has been increasing demand for bonding sheets from the automotive industry. These sheets are used for bonding display screens, circuit boards, and other components. Bonding sheet is also increasingly being utilized for holding and fixing electronics assembly for electronic control and advanced driver assistance systems units.

The growing automotive industry worldwide, rising focus on the modernization of passenger vehicles, and integration of advanced features such as driver assistance and monitoring systems lead to greater demand for bonding sheets over the forecast timeline. Furtherly, the growing development of autonomous vehicles, the rising need for high-performing and lightweight vehicles, and the increasing adoption of electric and hybrid vehicles would offer growth opportunities in the coming years.

The outbreak of COVID-19 impacted the global market. The global market was influenced by supply chain disruptions and workforce impairment. The imposition of lockdown restrictions in several countries across the world led to the closure of manufacturing facilities. Travel restrictions, limited availability of raw materials, operational limitations, and reduced import and export activities further affected the market during the pandemic.

Reduced demand from the automotive and construction industries was observed. However, there was increased demand for consumer electronics and mobile devices during the pandemic. Additionally, the increase in demand for medical devices further increased the demand for bonding sheets during the pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global market is driven by rising industrialization and growing demand for mobile devices. The rise in the penetration of automobiles and the introduction of new innovative products by leading players boost the market growth. Increasing disposable income of consumers, changing lifestyles, and increasing application in automotive, construction, and telecommunication equipment results in greater demand for bonding sheets.

The rising application of bonding sheets in the construction sector, driven by increased construction of residential and commercial buildings and the development of public infrastructure, further support the market growth.

Greater penetration of passenger vehicles, modernization of vehicles, and increasing electrification of vehicles support the market growth. A high inclination toward superior vehicle performance and lightweight passenger cars has further increased the application of bonding sheets in the automotive sector.

The rise in the adoption of automation technologies and the increase in penetration of electronic devices accelerate the demand for bonding sheets. Miniaturization of electronic devices, technological innovation in the telecommunication sector, and research and development activities are further expected to contribute to market growth in the coming years.

Report Segmentation

The bonding sheet market is primarily segmented based on adhesive material, end-use, and region.

|

By Adhesive Material |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Polyimides accounted for a major revenue share in 2021

Based on adhesive material, the global market is segregated into polyimides, polyesters, acrylics, modified epoxies, and others. The polyimide segment accounted for a major market share in 2021. Polyimides are widely used across various applications owing to their high efficiency, performance, and thermal properties. It offers improved mechanical properties, greater tensile strength, and resistance to heat and chemicals.

Polyimides are widely used in the electronics sector for bonding in various applications. The demand for polyimides is expected to increase from the automotive sector during the forecast period owing to the adoption of electric and hybrid vehicles and government schemes to promote the adoption of electric vehicles.

The electronics sector is expected to hold a significant revenue share

Based on the end-use industry, the global market has been segmented into automotive, construction, communication, electronics, and others. The electronics segment held a significant share of the global market in 2021. A bonding sheet is used in the electronics sector for holding and bonding chips, hard disks, LED modules, and other electronic components.

A rise in the adoption of automation solutions, greater penetration of electronic devices, and miniaturization of electronic devices have increased the demand for bonding sheets. Growth in consumer disposable income and a rise in penetration of smartphones and mobile devices support the market growth.

Asia-Pacific generated significant revenue in 2021

The Asia-Pacific region contributed a significant share of the global market in 2021. Population and urbanization have increased the demand for bonding sheets from the electronics sector. The rise in disposable income of consumers, improved lifestyle, and greater penetration of mobile devices boost the market growth. Economic growth and industrialization in India, Australia, Japan, and China, the rise in the sale of passenger vehicles, and the strengthening building and sector support the market growth in the region.

The global players are setting up manufacturing units in developing countries to leverage the availability of raw materials and labor. Increasing application of these sheets in electronics and automotive applications has been observed in the region. Technological advancements and investments in research and development would offer growth opportunities in the coming years.

Competitive Insight

The major players operating in the global market include Arisawa Manufacturing Co., Dexerials Corporation, DuPont, Fujikura Ltd., Hanwha Solutions Advanced Materials Division, Microcosm Technology Co., Ltd., Namics Corporation, Nikkan Industries Co.,Ltd, Nippon Mektron Ltd., Nitto Denko Corporation, Shin-Etsu Polymer Co., Ltd., Showa Denko Materials Co., Taiflex Scientific Co. Ltd., Toray Industries, Inc., Qinglong Adhesives.

These prominent companies in the market are introducing new innovative products to cater to a wider customer base and strengthen their offerings in the market. They are also collaborating with others players to enter new emerging markets.

Recent Developments

In May 2022, DuPont Interconnect Solutions completed the construction of a manufacturing site in Ohio, U.S. The manufacturing facility is aimed at strengthening the company’s production capabilities. This development would also enable the company to cater to the growing demand across the telecommunication, automotive, and consumer electronics sectors.

Bonding Sheet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 385.85 million |

|

Revenue forecast in 2030 |

USD 689.75 million |

|

CAGR |

7.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Adhesive Material, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Arisawa Manufacturing Co., Dexerials Corporation, DuPont, Fujikura Ltd., Hanwha Solutions Advanced Materials Division, Microcosm Technology Co., Ltd., Namics Corporation, Nikkan Industries Co.,Ltd, Nippon Mektron Ltd., Nitto Denko Corporation, Shin-Etsu Polymer Co., Ltd., Showa Denko Materials Co., Taiflex Scientific Co. Ltd., Toray Industries, Inc., and Qinglong Adhesives |