Bone Growth Stimulator Market Size, Share, Trends, Industry Analysis Report

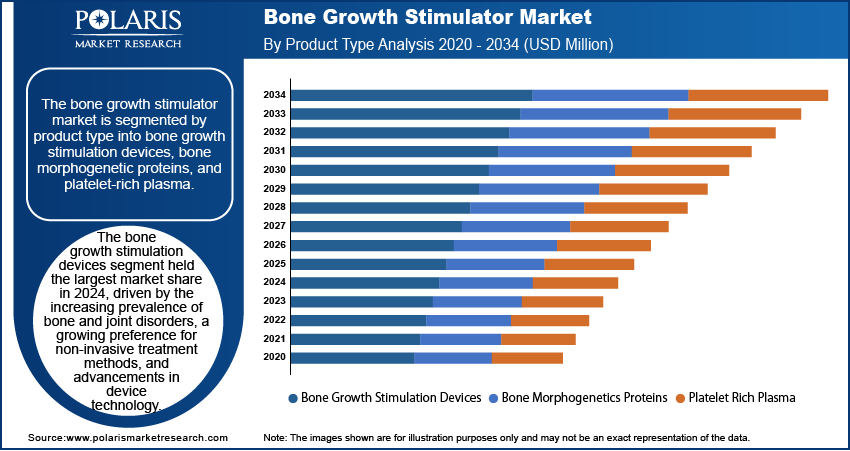

: By Product Type (Bone Growth Stimulation Devices, Bone Morphogenetics Proteins, and Platelet Rich Plasma), Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 118

- Format: PDF

- Report ID: PM3067

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

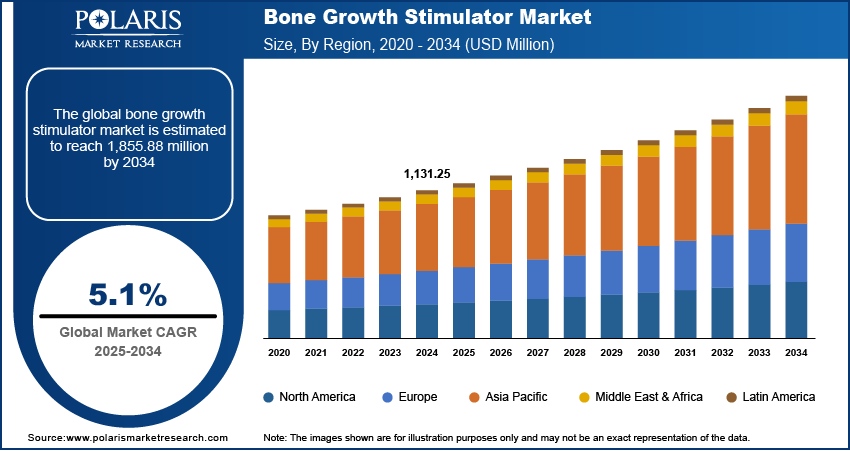

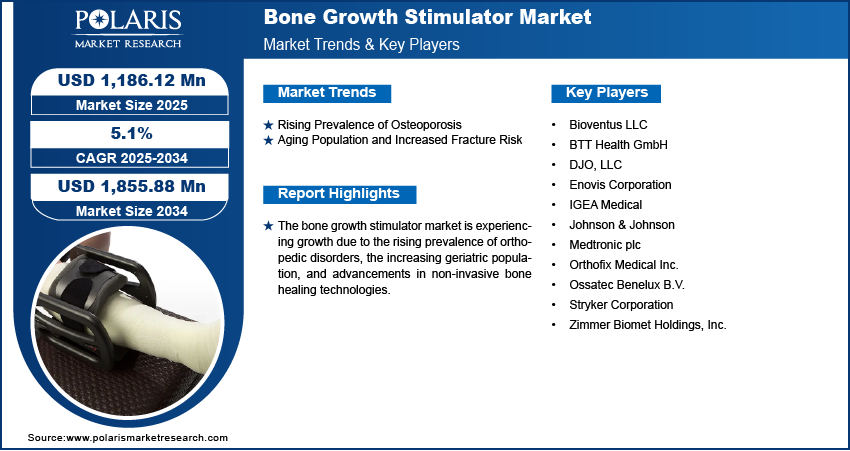

The bone growth stimulator market size was valued at USD 1,131.25 million in 2024, growing at a CAGR of 5.1% during 2025–2034. The growing incidence of bone fractures, rising osteoporosis cases, and advancements in biophysical stimulation technologies are a few of the key factors fueling market growth.

Key Insights

- The bone growth stimulation devices segment led the market in 2024. The rising prevalence of bone and joint disorders contributes to the segment’s leading market position.

- The spinal fusion surgeries segment represents the largest share, owing to advancements in surgical techniques and rising preference for minimally invasive procedures.

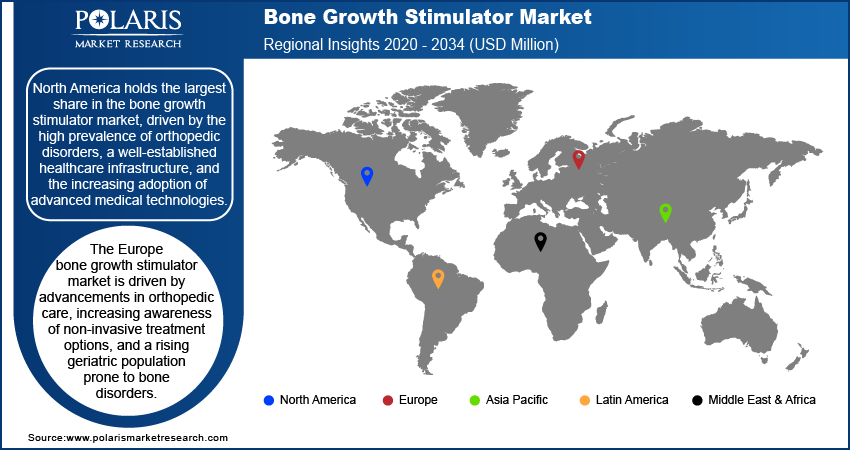

- North America dominates the market. The high prevalence of orthopedic disorders and growing adoption of advanced medical technologies drive the region’s leading market share.

- Asia Pacific is witnessing substantial growth. The increasing number of orthopedic surgeries and improving healthcare infrastructure fuel robust market growth in the region.

Industry Dynamics

- The growing incidence of osteoporosis, which is characterized by reduced bone density and increased fracture risk, drives market expansion.

- The aging population, which has a high risk of falls and subsequent fractures, is another factor fueling the demand for bone growth stimulators.

- Increasing awareness about advanced treatment options is expected to provide significant market opportunities in the coming years.

- High investment costs associated with bone growth stimulators may hinder market growth.

Market Statistics

2024 Market Size: USD 1,131.25 million

2034 Projected Market Size: USD 1,855.88 million

CAGR (2025-2034): 5.1%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Bone growth stimulators use electrical, ultrasonic, or magnetic stimulation to enhance bone healing, particularly in cases of delayed union or non-union fractures.

The bone growth stimulator market is driven by the rising prevalence of bone fractures, increasing cases of osteoporosis, and the growing demand for non-invasive treatment options. The market is experiencing growth due to advancements in biophysical stimulation technologies and the increasing adoption of these devices in orthopedic and spinal procedures. Additionally, the aging population and the rising number of sports-related injuries are contributing to the market expansion. For instance, a 2023 report by the NSC revealed a consistent rise in sports and recreational injuries, with a 20% increase in 2021, followed by 12% in 2022, and another 2% in 2023, compared to 2020 baseline figures.

The integration of wearable and portable bone growth stimulation devices is a key trend, improving patient compliance and treatment outcomes. Regulatory approvals and reimbursement policies also play a crucial role in shaping the market landscape.

Market Dynamics

Rising Prevalence of Osteoporosis

Osteoporosis, characterized by decreased bone density and increased fracture risk, significantly contributes to the bone growth stimulator market demand. For instance, a report published by the FDA in May 2024 revealed that approximately 10 million Americans have osteoporosis, with over 8 million of them (around 80%) being women. In the US, one in four women aged 65 or older is affected by osteoporosis, which increases the risk of fractures.

Aging Population and Increased Fracture Risk

The demographic shift toward an older population directly influences the bone growth stimulator market. For instance, an October 2024 report by the WHO stated that the population aged 60 years and older will increase from 1 billion in 2020

Segment Insights

Assessment – Product Type Insights

The bone growth stimulator market is segmented by product type into

The platelet-rich plasma segment is anticipated to experience the fastest growth during the forecast period. This surge is attributed to PRP's minimally invasive nature, which appeals to patients seeking alternatives to traditional bone grafting procedures. Platelet-rich plasma has demonstrated efficacy in enhancing bone healing across various conditions, leading to increased acceptance among healthcare providers and patients. The growing number of orthopedic surgeries and sports-related injuries also propels the demand for platelet-rich plasma treatments, as they offer promising outcomes with reduced recovery times.

Evaluation – Application Insights

The bone growth stimulator market is segmented by application into spinal fusion surgeries, delayed union and non-union bone fractures, oral & maxillofacial surgeries, and others. Among these, the spinal fusion surgeries segment represents the largest share. This dominance is attributed to the increasing prevalence of spinal disorders, advancements in surgical techniques, and a growing preference for minimally invasive procedures. Bone growth stimulators are integral in enhancing the success rates of spinal fusions by promoting effective bone healing and reducing recovery times. The rising incidence of degenerative spinal conditions, coupled with an aging population, further propels the demand for these devices in spinal fusion applications.

Outlook – End Use Insights

The bone growth stimulator market is segmented by end use into

Regional Analysis

By region, the study provides the bone growth stimulator market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest share, driven by the high prevalence of orthopedic disorders, a well-established healthcare infrastructure, and the increasing adoption of advanced medical technologies. For instance, a September 2024 report by the CDC indicated that in 2021, 80.5% of physicians working in office-based settings utilized telemedicine for patient care, highlighting the growing preference for advanced medical technologies. The region benefits from strong reimbursement policies, extensive research and development activities, and a rising number of spinal fusion and orthopedic procedures. The presence of key market players and favorable regulatory support further contribute to market growth. Additionally, an aging population and a growing incidence of osteoporosis-related fractures continue to drive demand for bone growth stimulation devices. Europe follows closely, supported by advancements in orthopedic care and increasing awareness of non-invasive treatment options. Meanwhile, Asia Pacific is witnessing significant growth due to improving healthcare infrastructure, a rising number of orthopedic surgeries, and increasing healthcare expenditure in countries like China and India.

Europe is driven by advancements in orthopedic care, increasing awareness of non-invasive treatment options, and a rising geriatric population prone to bone disorders. Countries such as Germany, France, and the UK are key contributors due to their well-established healthcare systems and high adoption rates of advanced medical technologies. Favorable reimbursement policies and government initiatives supporting orthopedic research further drive market growth. Additionally, the increasing incidence of spinal disorders and fractures, coupled with a growing preference for outpatient procedures, is fueling demand for bone growth stimulators in the region.

Asia Pacific is experiencing substantial growth in the bone growth stimulator market due to improving healthcare infrastructure, rising healthcare expenditure, and an increasing number of orthopedic surgeries. Countries such as China, India, and Japan are witnessing a growing demand for bone healing solutions, driven by a rising geriatric population and a higher prevalence of bone fractures and osteoporosis. The increasing awareness of advanced treatment options and expanding medical tourism in the region further support expansion opportunities. Additionally, government initiatives promoting healthcare access and local manufacturing of medical devices are enhancing the availability and affordability of bone growth stimulators in Asia Pacific.

Key Players and Competitive Insights

The bone growth stimulator market features several key players actively contributing to advancements in bone healing technologies. Notable companies include Medtronic plc; Zimmer Biomet Holdings, Inc.; Orthofix Medical Inc.; Bioventus LLC; and Stryker Corporation. These organizations are recognized for their innovative approaches to developing bone growth stimulation devices and therapies. Other significant participants in the market are Johnson & Johnson; DJO, LLC; Ossatec Benelux B.V.; BTT Health GmbH; Enovis Corporation; and IGEA Medical. These companies are actively engaged in providing solutions for bone growth stimulation.

In this competitive landscape, companies are focusing on technological innovation, strategic partnerships, and geographic expansion to strengthen their market positions. For instance, Medtronic plc offers the Infuse Bone Graft, which utilizes recombinant human bone morphogenetic protein-2 (rhBMP-2) to stimulate bone formation, enhancing spinal fusion and orthopedic trauma surgeries. Zimmer Biomet Holdings, Inc. provides the OrthoPak Non-invasive Bone Growth Stimulator System, designed to promote healing in fractures that have not adequately healed. Orthofix Medical Inc. specializes in pulsed electromagnetic field (PEMF) technology, offering devices that support spinal fusion and fracture healing.

Emerging companies like Xenco Medical are introducing innovative solutions, such as the TrabeculeX Continuum, which integrates regenerative biomaterials with digital health monitoring to enhance postoperative recovery. Bonesupport AB focuses on injectable bioceramic bone graft substitutes, aiming to improve bone healing in orthopedic surgeries. The Straumann Group, primarily known for dental implants, has expanded its portfolio to include products that support bone regeneration. Mathys Ltd Bettlach offers implants for joint replacement and biomaterials for bone defect treatment, contributing to the diverse range of options available in the bone growth stimulator market.

Medtronic plc is a prominent medical technology company specializing in a wide range of healthcare solutions, including bone growth stimulation devices. Their products are designed to enhance bone healing and are utilized in various orthopedic and spinal procedures.

Zimmer Biomet Holdings, Inc. is another key player in the bone growth stimulator market, offering a comprehensive portfolio of musculoskeletal healthcare products. Their innovations aim to improve patient mobility and health by providing advanced bone healing solutions.

List of Key Companies

- Bioventus LLC

- BTT Health GmbH

- DJO, LLC

- Enovis Corporation

- IGEA Medical

- Johnson & Johnson

- Medtronic plc

- Orthofix Medical Inc.

- Ossatec Benelux B.V.

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Bone Growth Stimulator Industry Developments

- January 2023: Orthofix Medical Inc. and SeaSpine Holdings Corporation finalized their merger, creating a combined entity focused on developing innovative bone growth therapies and spinal fusion devices. This strategic move aims to strengthen their position in the bone growth stimulator market by leveraging combined research and development capabilities.

- May 2022: Orthofix Medical Inc. received FDA pre-market approval for AccelStim, a LIPUS-based Class III device for treating fresh fractures and nonunions.

- March 2020: Medtronic launched the Adaptix Interbody System, a titanium spinal implant designed to enhance bone growth and spinal fusion procedures. This product launch signifies Medtronic's commitment to advancing technologies that support bone healing in spinal surgeries.

Bone Growth Stimulator Market Segmentation

By Product Type Outlook (Revenue – USD Million, 2020–2034)

- Bone Growth Stimulation Devices

- Bone Morphogenetics Proteins

- Platelet Rich Plasma

By Application Outlook (Revenue – USD Million, 2020–2034)

- Spinal Fusion Surgeries

- Delayed union & Non-Union Bone Fractures

- Oral & Maxillofacial Surgeries

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospital & Ambulatory Surgical Centres

- Home Care

- Academic & Research institutes

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,131.25 million |

|

Market Size Value in 2025 |

USD 1,186.12 million |

|

Revenue Forecast by 2034 |

USD 1,855.88 million |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The bone growth stimulator market has been segmented into detailed segments of product type, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the bone growth stimulator market focus on product innovation, strategic partnerships, and geographic expansion to strengthen their market presence. Research and development efforts aim to enhance device efficacy, improve patient compliance, and introduce minimally invasive solutions. Mergers and acquisitions help companies expand their product portfolios and enter new regional markets. Strong marketing strategies include physician education programs, direct-to-consumer advertising, and collaborations with healthcare providers to increase awareness of non-invasive bone healing solutions. Additionally, favorable reimbursement policies and clinical studies supporting product effectiveness play a crucial role in driving market adoption.

FAQ's

The bone growth stimulator market size was valued at USD 1,131.25 million in 2024 and is projected to grow to USD 1,855.88 million by 2034.

The market is projected to register a CAGR of 5.1% during the forecast period.

North America had the largest share of the market in 2024.

Notable companies include Medtronic plc; Orthofix Medical Inc.; Zimmer Biomet Holdings, Inc.; Johnson & Johnson; Bioventus LLC; DJO, LLC; Stryker Corporation; Ossatec Benelux B.V.; BTT Health GmbH; Enovis Corporation; and IGEA Medical.

The bone growth stimulation devices segment accounted for the larger share of the market in 2024.

The spinal fusion surgeries segment accounted for the largest share of the market in 2024.

A bone growth stimulator is a medical device or biologic therapy designed to enhance the natural bone healing process in cases of fractures, spinal fusion procedures, or delayed and nonunion bone fractures. These devices use electrical stimulation, ultrasound waves, or biologic materials such as bone morphogenetic proteins (BMPs) and platelet-rich plasma (PRP) to promote bone regeneration. Bone growth stimulators are commonly used in orthopedic and spinal surgeries to improve healing outcomes, reduce recovery time, and minimize the need for revision surgeries. They are available in both implantable and external forms, depending on the clinical requirement.

A few key trends in the market are described below: Technological Advancements – Increasing adoption of pulsed electromagnetic field (PEMF) and low-intensity pulsed ultrasound (LIPUS) technologies for enhanced bone healing. Growing Preference for Non-Invasive Treatments – Rising demand for external bone growth stimulators as a non-surgical alternative for fracture healing and spinal fusion. Expansion of Biologic Therapies – Increased use of bone morphogenetic proteins (BMPs) and platelet-rich plasma (PRP) to accelerate bone regeneration. Rising Incidence of Bone Disorders – Higher prevalence of osteoporosis, arthritis, and spinal disorders, driving the need for advanced bone healing solutions.

A new company entering the bone growth stimulator market could focus on developing cost-effective and technologically advanced non-invasive devices, such as smart stimulators with remote monitoring capabilities. Investing in biologic therapies like next-generation bone morphogenetic proteins (BMPs) and platelet-rich plasma (PRP) could offer a competitive edge. Expanding into emerging markets with high orthopedic surgery demand, such as Asia Pacific and Latin America, can provide growth opportunities. Strong partnerships with hospitals, research institutions, and orthopedic specialists can enhance market penetration. Additionally, securing regulatory approvals and favorable reimbursement policies would be crucial for long-term success.

Companies manufacturing, distributing, or purchasing bone growth stimulators and related products, and other consulting firms must buy the report