Broadcast Scheduling Software Market Share, Size, Trends, Industry Analysis Report

By Solution (Software, Service), By Deployment (On-premise, Cloud, Hybrid); By Application (TV, Radio, Digital Platforms); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2220

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

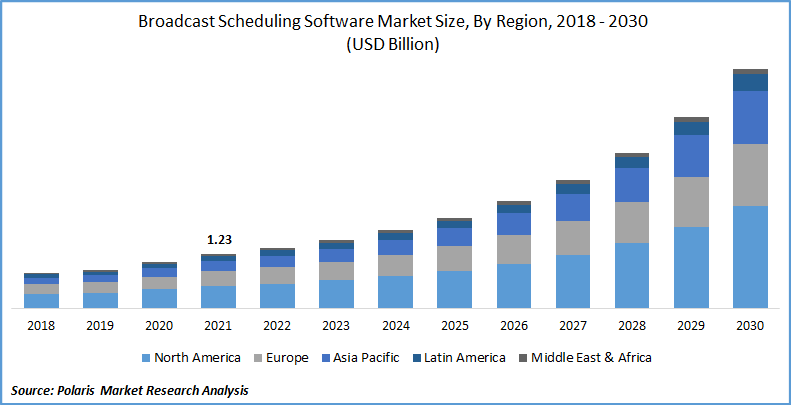

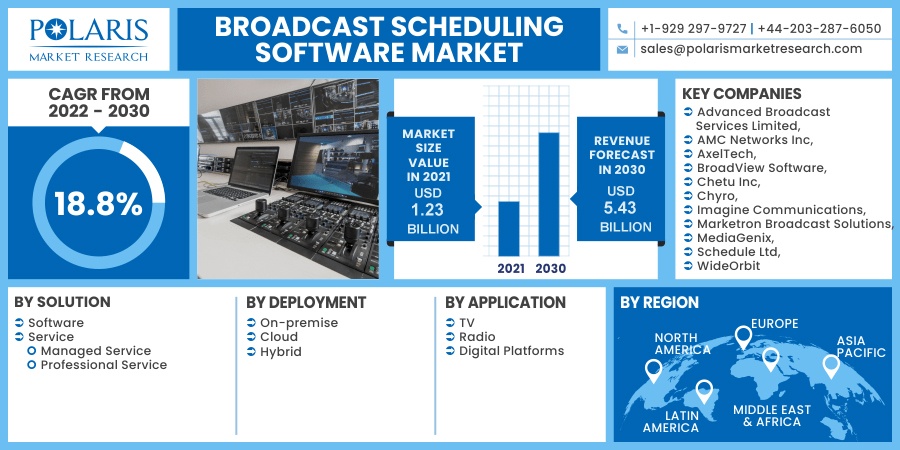

The global broadcast scheduling software market was valued at USD 1.23 billion in 2021 and is expected to grow at a CAGR of 18.8% during the forecast period. The key factors responsible for the growth include an increase in complications in the planning of the technicalities involved in broadcasting media coupled with rising in cloud-based solutions/services. Furthermore, with the growth of the media and entertainment industry and changing behavior of the listeners and viewers, presenters are undergoing more technological disruptions, which eventually create the demand for the broadcasting scheduling software market.

Know more about this report: request for sample pages

The COVID-19 pandemic has had a positive impact on the broadcasting scheduling software market. This is due to the imposition of lockdowns due to the COVID-19 outbreak has fueled the demand for digital content. However, the outbreak has also impacted the supply chain of the media & entertainment industry making the cost of components highly volatile, in turn restricting the growth of this scheduling software industry to some extent. Moreover, as the situation now becoming normalized, several end-user industries are recovering from the outbreak and the rising number of on-demand digital projects is anticipated to drive the broadcast scheduling software market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Over the past decade, the innovations in these technologies have favored this scheduling software market growth. The major fixed access technologies in use are radio broadcasting which is increasingly used by the Digital Terrestrial Television (DTT) and the satellite digital TV broadcasting services, wired technologies used by the Cable TV and IPTV, and IP-based access services. Furthermore, Internet Protocol Television (IPTV) and Over the Top (OTT) offer multimedia content over broadband connections using IP network protocols.

The main broadband access technologies that support IPTV and OTT are Digital Subscriber Loop (DSL) and optical fiber. These technological developments provide on-demand services and a higher degree of interactivity natively, which eventually contributes towards the huge industry success for this scheduling software over the forecast period. Moreover, the integration of Artificial Intelligence (AI) in the industry also creates high business prospects, thus this trend is expected to flourish in the upcoming years.

Report Segmentation

The market is primarily segmented on the basis of solution, deployment, application, and region.

|

By Solution |

By Deployment |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Deployment

On-premise segment accounted for the largest share in the global broadcast scheduling software market. The rising number of presenters depending on the customary broadcasting arrangement, particularly from developing countries like Brazil, India, and China, is one of the major factors driving the growth of the segment. Further, the broadcasters in these countries are primarily offering the consumers that are using DTH TV and satellite, hence depending on on-premise infrastructure and systems. For instance, India had nearly 72.44 million active DTH subscribers by the end of March 2019. In addition, the integrated features of flexibility and efficiency are anticipated to provide huge growth prospects to the segment worldwide.

However, the prevalent disruption of conventional business models along with the pandemic-driven broadcasters to shift from on-premise to the cloud-based approach will fuel the segmental growth in the forthcoming years. Whereas, the hybrid segment of the broadcast scheduling software market is accounting for a significant share in the overall industry. This can be acknowledged to the shifting consumer preference from conventional TV channels to online media and entertainment services on account of the rising penetration of smart devices. This, in turn, is expected to drive the growth of the segment.

Insight by Application

The TV segment is recorded with the largest revenue share in 2021 and is expected to lead the scheduling software market in the forecasting years. This can be accredited to the shifting consumer demand towards high picture quality, along with growing customer preference for watching sports actions and news on smart or usual TVs is the major factor driving the growth of the segment. As per the study of Wowza media systems, 43% of respondents use 4 to 6 devices on daily basis. While 41% preferred TV networks for viewing the high-quality video. Therefore, picture quality is becoming the prime requirement among customer base all over the world is anticipated to drive the growth of the segment.

On the contrary, the digital platform segment is projected to witness the fastest CAGR worldwide. This growth can be attributed to the escalating demand for the global plus national content, from each age grouping, coupled with the rising proliferation of connected devices and availability of good internet connections is anticipated to drive the growth of the segment.

Geographic Overview

Geographically, North America is accounted with the largest revenue share in the global industry in 2021 and is likely to dominate the scheduling software market over the upcoming scenario. This is due to the early implementation of innovative technologies. Further, the surging demand for extremely developed program scheduling resolutions in addition to services from the broadcasters is anticipated to provide huge growth opportunities to the scheduling software market in the region.

Moreover, the Asia-Pacific is anticipated to rapidly grow with the highest CAGR among all other regions. This fast growth of the industry can be attributed to the rising penetration of smart devices and digital television along with the improving standards of living (social-economic factors). The huge investment in media and entertainment across developing nations such as India and China, among others is further anticipated to stimulate the growth of the industry.

Competitive Insight

Some of the major players operating in the global industry include Advanced Broadcast Services Limited, AMC Networks Inc, AxelTech, BroadView Software, Chetu Inc, Chyro, Imagine Communications, Marketron Broadcast Solutions, MediaGenix, Schedule Ltd, WideOrbit.

Broadcast Scheduling Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.23 billion |

|

Revenue forecast in 2030 |

USD 5.43 billion |

|

CAGR |

18.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Solution, By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Advanced Broadcast Services Limited, AMC Networks Inc, AxelTech, BroadView Software, Chetu Inc, Chyro, Imagine Communications, Marketron Broadcast Solutions, MediaGenix, Schedule Ltd, WideOrbit |