Brushless DC Motor Market Share, Size, Trends & Industry Analysis Report

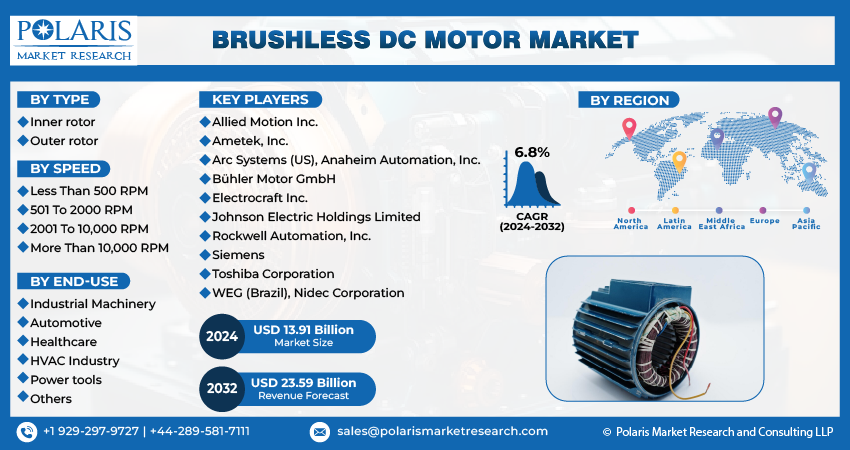

By Type (Inner Rotor, Outer Rotor); By Power Output; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM4284

- Base Year: 2024

- Historical Data: 2020-2023

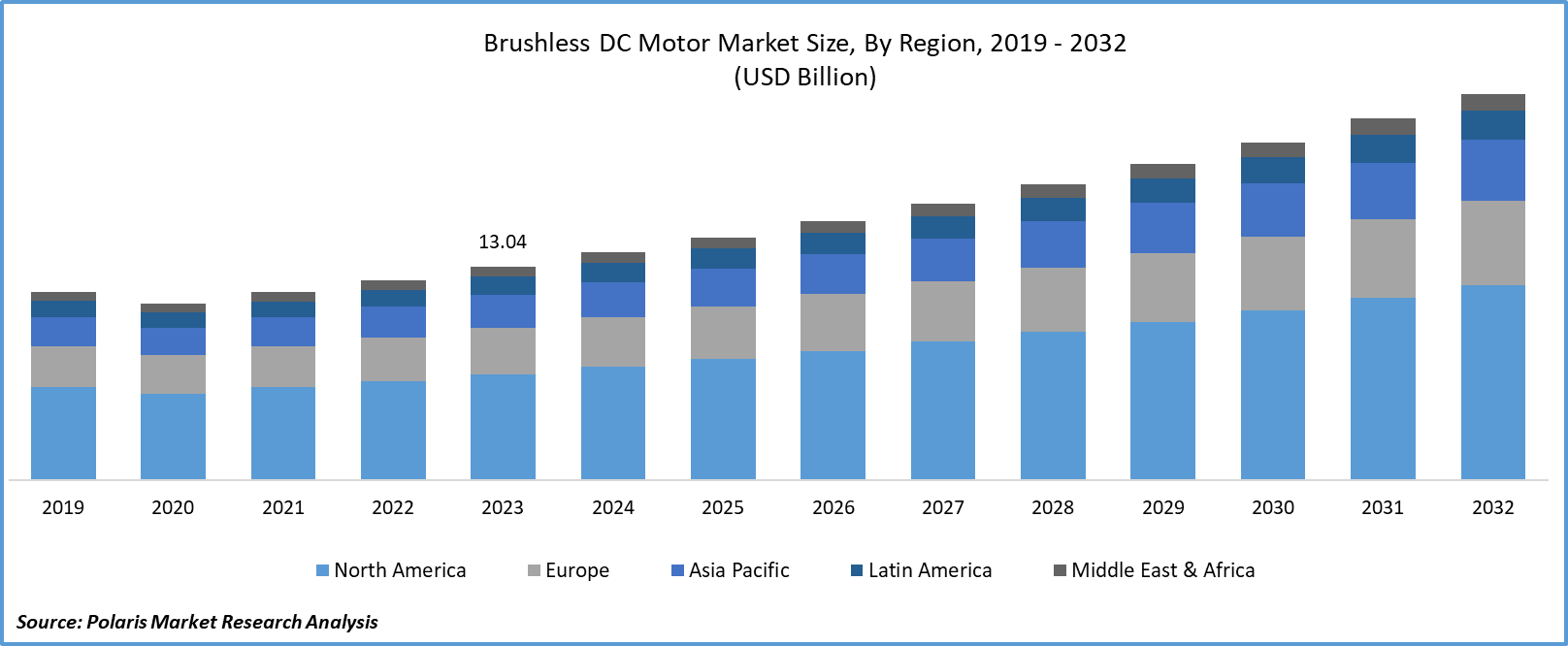

The global Brushless DC Motor Market was valued at USD 21.5 billion in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2034. Increasing adoption in electric vehicles, drones, and industrial automation due to their efficiency and reliability is boosting market growth.

Industry Trends

Electric motors with a brushless design that run on direct current (DC) are known as brushless DC (BLDC) motors. The brushless DC (BLDC) motor refers to electric motors that operate on direct current (DC) and utilize a brushless design. Brushless DC motors have gained popularity in various applications due to their efficiency, reliability, and lower maintenance requirements compared to traditional brushed DC motors.

However, unlike brushed DC motors, which use brushes and a commutator for the flow of electrical current, BLDC motors have a brushless design. This design typically involves electronic controllers to manage the motor's operation. BLDC motors are known for their high efficiency, which is attributed to the absence of friction and wear associated with brushes. This efficiency is particularly advantageous in applications where energy consumption is a critical consideration. These motors tend to have a longer lifespan and require less maintenance which drive the brushless dc motor market growth.

Furthermore, the growing interest in electric vehicles has significantly contributed to the demand for brushless dc motor market. These motors are commonly used in electric cars and e-bikes due to their high efficiency and compact design. The growing adoption of smart home technologies, including smart appliances and home automation systems, creates opportunities for BLDC motors. These motors are used in smart devices that require efficient and controllable motion. Ongoing advancements in motor control technologies, such as sensor less control and advanced control algorithms, enhance the performance and efficiency of bldc motors, expanding their applicability.

To Understand More About this Research: Request a Free Sample Report

Furthermore, there is an enormous expansion in the market. Both the rise in auto manufacturing and the quantity of BLDC motors found in cars are responsible for this. Power train systems, chassis, and safety fittings of vehicles all require automotive motors. Particularly for BLDC motors, the growing demand for these features is being driven by amenities like massaging seats, motorized wipers, doors, adjustable mirrors, and seats with motors. This growth worldwide anticipates the brushless DC motor market demand during the forecast period.

Key Takeaway

- North America dominated the largest market and contributed to more than 35% of share in 2024

- Asia Pacific region is projected to grow at the fastest CAGR during the forecast period

- By speed category, the 501 to 2000 RPM segment held the largest revenue share in 2024

- By end-use category, the automotive segment accounted for the highest market share in 2024

What are the market drivers driving the demand for brushless DC motor market?

- Increasing demand for HVAC system

Increasing demand for heating, ventilation, and air conditioning systems across the globe due to increasing population and urbanization, as well as increasing industrialization and hospitals, are the main factors for rising brushless dc motor market. Heating, ventilation, and air conditioning (HVAC) systems often use BLDC motors for their energy efficiency and precise control capabilities. As energy efficiency becomes a priority, the demand for BLDC motors in HVAC applications is expected to increase.

Compact BLDC motors are becoming more and more popular in industries like aerospace and defense, where small, light components are crucial. The scalability and adaptability of the motors to specific industries are demonstrated by their use in actuation systems, avionics, and uncrewed aerial vehicles (UAVs). Moreover, new automotive technologies that adapt to the shifting needs of the automotive industry, like advanced driver-assistance systems (ADAS) and electric power steering, use tiny BLDC motors to improve vehicle performance and safety.

Small BLDC motors are efficient and dependable, which is advantageous for consumer electronics such as wearables, cameras, and smartphones. Longer product lifespans, smooth operation, and energy efficiency are made possible by these motors. In today's fiercely competitive consumer electronics market, these parts are essential for improving device functionality and user experience.

Which factor is restraining the demand for brushless DC motor cells?

- Complexity and Control System Might Restrict Growth

The complexity and control systems associated with brushless DC (BLDC) motors can pose challenges that might restrict growth in the market. These motors often require a certain level of technical expertise for installation, operation, and maintenance. The complexity of the technology may result in a need for more skilled technicians, limiting the widespread adoption of BLDC motors.

The advanced control systems and electronics required for BLDC motors can contribute to higher initial costs compared to traditional brushed DC motors. This upfront expense might deter potential adopters, particularly in cost-sensitive industries.

BLDC motors, especially in certain applications like automotive or aerospace, need to comply with stringent regulations. Adhering to these regulations may increase development and manufacturing costs, potentially slowing down the market growth.

Report Segmentation

The market is primarily segmented based on type, speed, end-use, and region.

|

By Type |

By speed |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Speed Insights

Based on speed analysis, the market is segmented on the basis of less than 500 rpm, 501 to 2000 rpm, 2001 to 10,000 rpm, and more than 10,000 RPM. In 2024, the 501 to 2000 RPM segment held the largest revenue share. The 501 to 2000 RPM range is suitable for a diverse range of applications across industries. Motors operating within this RPM range may find use in industrial automation, robotics, HVAC systems, and various consumer electronics, contributing to a broad customer base and increased demand. Industry trends, such as the increasing demand for energy-efficient solutions and the integration of brushless DC motors in various technologies, can drive growth in specific RPM segments. Therefore, these factors are expected to contribute to the expansion of the market during the analysis period.

By End-Use Insights

Based on end-use analysis, the market is segmented on the basis of industrial machinery, automotive, healthcare, HVAC industry, power tools, and others. The Automotive segment accounted for the highest market share in 2024. The automotive industry is experiencing a significant shift towards electric vehicles. Brushless DC motors are commonly used in electric propulsion systems for EVs due to their efficiency, reliability, and precise control capabilities. The increasing adoption of electric vehicles globally contributes to the demand for brushless DC motors. Stringent emissions regulations and a growing emphasis on environmental sustainability have led automotive manufacturers to explore electric and hybrid vehicle technologies. Brushless DC motors play a crucial role in these applications, aligning with regulatory requirements. The integration of advanced technologies, including ADAS, in modern vehicles requires sophisticated and precise motor control. Brushless DC motors, with their precise control capabilities, can be employed in various ADAS applications, contributing to the overall market share in the automotive sector. The development of automated and electric vehicles often involves the use of various electric motors, including brushless DC motors. The automotive industry's focus on autonomous driving and electrification can drive the demand for these motors.

Regional Insights

North America

In 2024, North America dominated the largest market for brushless DC motors due to increasing industrialization, and manufacturing units for HVAC have seen tremendous growth in the market share during 2023. This Growth is expected to increase further during the coming years. The increasing use of electric vehicles, innovation in automotive industries, and increasing demands for electronic devices and cell phones have recorded the highest growth of revenue. These factors dominate the brushless dc motor market growth further.

Significant investments in research and development, as well as robust manufacturing infrastructure, give North American companies a competitive advantage in the global BLDC motor market. The companies are at the forefront of technological advancements in BLDC motor manufacturing, which contributes to their dominance in the market. Innovation and the ability to produce cutting-edge products often attract customers globally. Significant investments in research and development, as well as robust manufacturing infrastructure, give North American companies a competitive advantage in the global BLDC motor market.

Asia Pacific

Asia Pacific region is projected to grow at the fastest CAGR during the forecast period; the brushless DC motor market is expected to see considerable growth due to the significant pace of expansion of the automotive sector in Asia-Pacific. For example, the International Trade Administration estimates that by 2025, China's domestic car production will reach 35 million units. In addition, the Chinese government committed $60 billion to the electric vehicle industry in March 2021. Throughout the projection period, these variables should present growth possibilities for brushless DC motors.

Competitive Landscape

The brushless DC motor market is a dynamic and multifaceted terrain shaped by the presence and strategic maneuvers of key industry players. As these companies vie for market share and prominence, the landscape reflects the interplay of factors such as technological innovation, product differentiation, regional expansion, and strategic collaborations. This section delves into the profiles of major players, providing insights into their market strategies, product portfolios, and recent initiatives. From established industry giants to emerging innovators, the competitive landscape showcases the diversity of approaches and the intense competition that propels advancements in this critical segment of the electric motor industry.

Some of the major players operating in the global market include:

- Allied Motion Inc.

- Ametek, Inc.

- Arc Systems (US), Anaheim Automation, Inc.

- Bühler Motor GmbH

- Electrocraft Inc.

- Johnson Electric Holdings Limited

- Rockwell Automation, Inc.

- Siemens

- Toshiba Corporation

- WEG (Brazil), Nidec Corporation

Recent Developments

- In January 2024, Nidec unveiled a revised strategic direction for its electric vehicle traction motor division, shifting focus toward the development and deployment of high-efficiency brushless DC motors.

- In August 2021, Johnson Electric introduced the brushless DC motor platform ECI-040 by simplifying AC power integration via its control. These electronically commutated motors are a great option for a variety of applications, including smart furniture, window shutters, and coffee makers, since they offer improved controllability, outstanding reliability, higher efficiency, and less noise.

Report Coverage

The brushless dc motor market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, speed, end-user, and their futuristic growth opportunities.

Brushless DC Motor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 23.11 billion |

|

Revenue forecast in 2034 |

USD 44.31 billion |

|

CAGR |

7.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025– 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Speed, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |