Building Information Modeling (BIM) Market Size, Share, Trends, & Industry Analysis Report

: By Solution (Software and Services), By Deployment Type, By Building Type, By Project, By Application, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5097

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

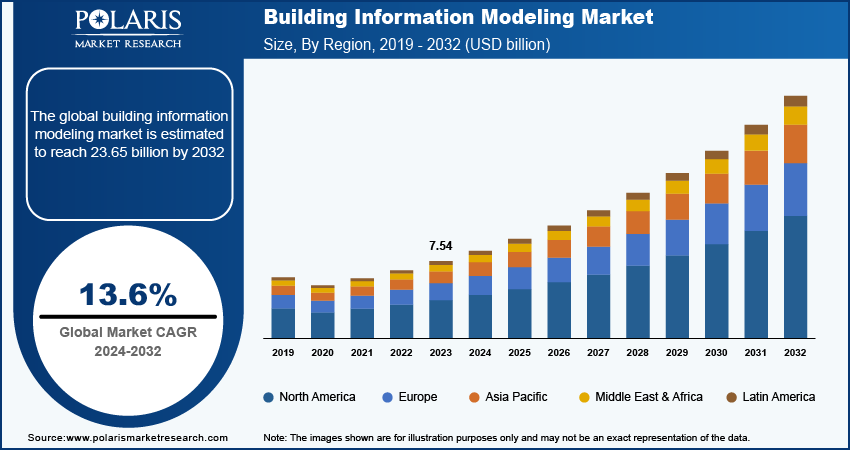

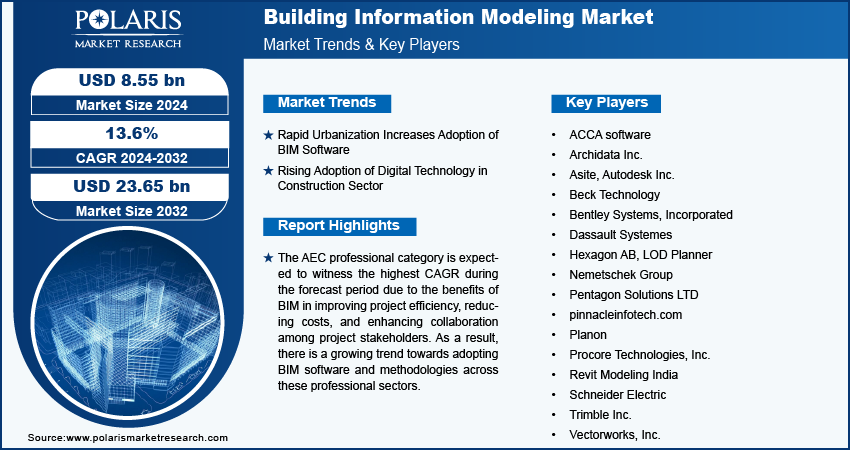

The global building information modeling (BIM) market size was valued at USD 7.92 billion in 2024, growing at a CAGR of 10.3% during 2025–2034. Government mandates and supportive policies worldwide and Increasing investments in the development of smart cities expand BIM demand.

Building information modeling (BIM) is a digital representation of the physical and functional characteristics of a building or infrastructure, serving as a shared knowledge resource for information about a building or infrastructure project. It is a collaborative process that involves the generation, management, and exchange of 3D models and associated data throughout a project's lifecycle from planning and design to construction, operation, and maintenance. BIM integrates geometric, spatial, and asset information, enabling stakeholders to visualize, simulate, and analyze a project before it is built. This reduces errors, improves efficiency, and enhances decision-making. BIM also supports sustainability by optimizing resource use and energy performance.

Building information modeling is most extensively used in commercial and high-rise construction, including office buildings, hospitals, educational institutions, and large-scale infrastructure projects. This is due to their complex designs, multiple stakeholders, and high costs, making BIM’s coordination, clash detection, and lifecycle management capabilities essential.

To Understand More About this Research: Request a Free Sample Report

The expanding urbanization across the globe is driving the BIM market. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. Urbanization increases the need for modern infrastructure such as roads, bridges, and public transit systems. BIM supports these projects by integrating geospatial data, enabling engineers to plan routes, assess environmental impacts, and coordinate utilities more effectively. Urbanization further increases the complexity of facility management, making BIM an essential tool as it allows facility managers to monitor assets in real time, predict maintenance needs, and plan renovations without disrupting occupants.

The competitive nature of urban real estate drives BIM adoption. Developers and investors in urban areas demand faster project delivery and higher ROI, and BIM helps achieve this by minimizing waste, improving accuracy, enhancing collaboration time, and improving reliability and stability. This ability of BIM increases its adoption among developers and investors in urban real estate.

Industry Dynamics

Increasing Investments in Development of Smart Cities Globally

Smart cities rely on interconnected systems, data analytics, and digital tools to optimize resources, reduce environmental impact, and enhance quality of life, all of which align with BIM’s capabilities. Smart cities further require smarter planning, construction, and management of buildings and infrastructure, making BIM a crucial tool for architects, engineers, and contractors. The Government of India allocated USD 19.25 billion (₹1,64,687 crore) for the development of 100 smart cities across the country through its Smart Cities Mission initiative.

Smart cities emphasize the integration of IoT sensors, smart grids, and automated systems into infrastructure, requiring advanced digital frameworks that BIM provides. BIM models incorporate IoT data to monitor real-time building performance, predict maintenance needs, and enhance operational efficiency. This level of integration reduces long-term operational costs and improves urban resilience, making BIM a critical component of smart city development. Thus, the rising investment in the development of smart cities globally is propelling the demand for building information modeling.

Rising Government Regulation and Mandates for BIM Adoption

Governments in countries such as the UK, Singapore, and Germany have implemented BIM mandates for publicly funded projects. These policies force contractors and designers to adopt BIM or risk losing lucrative contracts. For instance, the UK’s BIM Level 2 mandate requires all centrally procured public projects to use collaborative BIM, driving widespread industry adoption. Similarly, the Singaporean government mandated BIM submissions for building projects of more than 5,000 square feet, pushing firms to invest in BIM software to meet compliance standards. These regulations and mandates altogether are propelling demand for BIM by ensuring that BIM becomes an industry standard rather than an optional tool.

Government-backed incentives, such as tax benefits or grants for BIM training, are also stimulating demand by offsetting implementation costs. Countries such as Finland and Norway offer financial support to firms transitioning to BIM, making the technology more accessible. These incentives, combined with regulatory pressure, create a need for businesses to invest in BIM tools. Governments worldwide are also encouraging and mandating the use of BIM for asset management after project completion, extending BIM’s relevance into operations and maintenance.

Segmental Insights

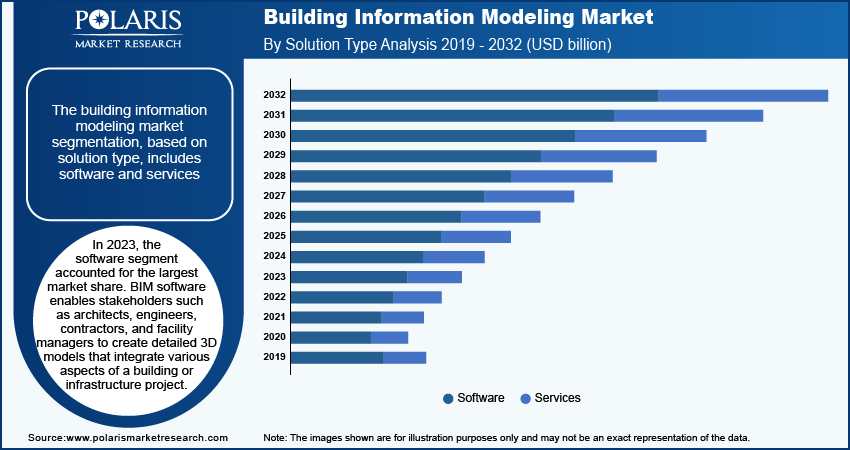

By Solution Analysis

The software segment is projected to reach USD 13.41 billion by 2034. This growth is attributed to the increasing pressure to improve efficiency and reduce waste in the construction industry, along with governments and regulatory bodies mandating BIM for public infrastructure projects. Technological advancements, such as cloud computing and artificial intelligence, are further fueling the adoption of BIM software by enhancing its capabilities, such as real-time collaboration and predictive analytics for risk management. This rapid advancement in technology is encouraging companies in the market to develop BIM software with integrated AI for designing and managing construction projects and gaining market share. In October 2024, ALLPLAN launched its latest version of BIM software, known as ALLPLAN 2025, to deliver high-quality projects with superior precision.

The services segment is projected to grow at a robust pace in the coming years, owing to the increasing construction challenges, such as budget overruns and delays. BIM services help mitigate these challenges by improving coordination, reducing rework, and enabling better project scheduling, leading to significant cost and time savings. The push for sustainability and green building practices globally is further promoting BIM usage and its affiliated services.

By Deployment Type Analysis

The cloud-based segment accounted for 66.53% market share in 2024 due to its ability to reduce hardware dependency. Governments and regulatory bodies are also pushing cloud-based BIM adoption by mandating BIM compliance for public projects, ensuring higher standards in construction quality and sustainability. The increasing development and introduction of cloud-based solutions for BIM workflows is also propelling the segment's growth. In January 2025, Solibri announced the launch of cloud-based Solibri CheckPoint for building information modeling workflows.

The on-premises segment is projected to grow at a significant pace during the forecast period, due to its ability to give complete control to organizations over project data, security protocols, and software customization. Construction firms, architectural agencies, and engineering consultancies are using on-premises BIM to streamline design processes, coordinate multidisciplinary workflows, and ensure seamless integration across the project lifecycle from initial planning and conceptual design to construction and facility management. Data security and confidentiality are playing a significant role in encouraging organizations to invest in on-premises BIM tools. Governments, defense contractors, and high-security facilities prefer on-premises solutions. Regulatory compliance is also propelling firms to adopt on-premises BIM, particularly in regions where data residency laws mandate that information must remain within national borders.

By Building Type Analysis

The commercial segment dominated the market, valued at USD 2.88 billion in 2024. This dominance is attributed to the growing complexity of modern commercial projects. The availability of cloud-based BIM platforms drove BIM adoption in commercial projects as they allow real-time collaboration across dispersed teams, making it easier to manage commercial projects globally. The growing global population is further propelling the demand for BIM solutions for commercial building projects. Increasing population surges complex commercial construction projects such as transit systems, hospitals, schools, and airports, which require advanced coordination and resource management tools such as BIM.

The industrial segment is estimated to hold a substantial market share by 2034 due to expanding industrialization across the globe, especially in emerging regions such as Asia Pacific, the Middle East, and Latin America. For instance, the Union Minister of Finance and Corporate Affairs of India presented the Economic Survey 2023-24 in July 2024, which stated industrial growth of 9.5% in India during the period. The growth of digital infrastructure and Industry 4.0 is further amplifying the BIM adoption in industrial applications, as industrial developers need intelligent systems and connected technologies that only a BIM-integrated solution offers.

By Project Analysis

The preconstruction segment is projected to register a CAGR of 9.8% during the forecast period. This rapid growth is attributed to the increasing focus on cost savings in infrastructure development among owners. Government mandates and industry standards are also pushing the adoption of BIM, as many public-sector projects now require BIM compliance in the preconstruction stage to ensure transparency and reduce risks. The increasing development of smart cities is further fueling the demand for building information modeling (BIM) in the preconstruction phase. Moreover, BIM improves communication among architects, engineers, contractors, and owners in preconstruction projects, which encourages them to adopt BIM tools in the preconstruction phase of projects.

The construction segment is estimated to hold a significant market share in 2034. Construction companies are actively adopting BIM tools to deliver projects faster and more cost-effectively by reducing inefficiencies and improving productivity. Increased collaboration requirements in complex construction projects are also pushing firms to adopt digital tools that enable seamless information sharing and coordination, and BIM offers a centralized platform for this purpose, leading to its high adoption. Moreover, the growing labor shortages in the construction industry are driving firms to maximize the performance of limited resources, and BIM helps in this scenario by increasing planning precision and reducing manual work, fueling construction companies to adopt BIM solutions.

By Application Analysis

The construction & design segment dominated the market, valued at USD 3.49 billion in 2024. This dominance is attributed to the rising pressure on construction companies to deliver complex projects on time and within budget. The global trend toward smart buildings and sustainable design increases BIM’s value as designers assess energy performance, daylight exposure, and material impact during early stages, aligning projects with green and smart building standards. The growing urbanization, rising disposable income, coupled with increasing demand for complex buildings, is also fueling the demand for BIM solutions, as these solutions help in designing complex structures.

The planning & modelling segment is projected to grow at a robust pace during the forecast period. This growth is driven by the growing complexity of construction projects that demand advanced tools in the planning and modeling phases to manage intricate designs. Governments and regulatory bodies worldwide mandate BIM for public infrastructure projects, accelerating its adoption in planning public infrastructure. Cost and time savings are also propelling BIM adoption in planning & modelling applications as it minimizes construction delays and budget overruns by identifying conflicts early and enabling precise quantity takeoffs.

By End User Analysis

The AEC professionals segment captured 46.96% market share in 2024 due to rising demand for efficient construction projects. AEC professionals widely use BIM as it helps them visualize, simulate, analyze designs, and reduces errors before construction begins. BIM also enables AEC professionals to work from a shared model. This collaborative approach minimizes conflicts, optimizes resource allocation, and ensures better decision-making at every stage. Moreover, the increasing investments in industrial smart globally, especially in emerging countries, fuel the demand for BIM solutions among ACE professionals as it helps these professionals develop industrial smart cities by enabling data-driven planning, efficient infrastructure management, and sustainable urban development.

The builders & contractors segment is estimated to register a significant CAGR from 2025 to 2034, owing to the need for improved project efficiency. The growing competition in the construction industry is further encouraging builders and contractors to adopt advanced tools that offer a competitive edge. BIM provides that advantage by enabling faster decision-making and better risk management. Additionally, the integration of BIM with other digital technologies, such as IoT and augmented reality, is encouraging its adoption among builders and contractors.

Regional Analysis

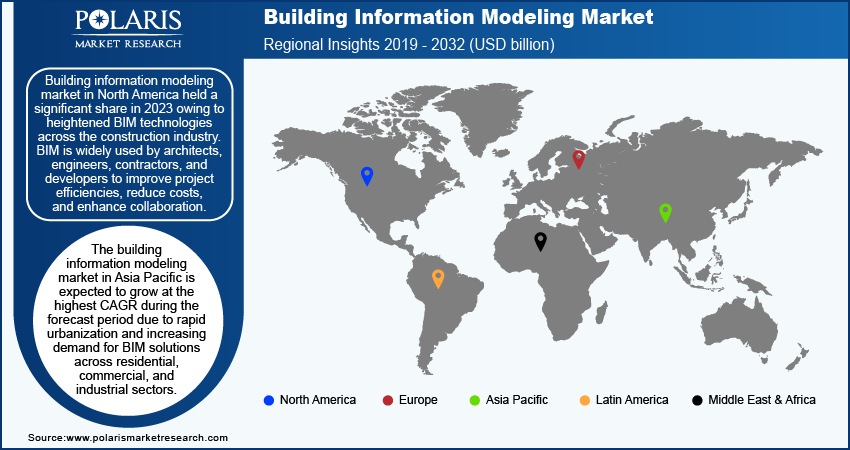

The North America building information modeling market accounted for 40.44% global market share in 2024 due to the growing demand for efficient construction project management and digital transformation in the architecture, engineering, and construction (AEC) industry. The region’s rapidly growing urban development and aging infrastructure contributed to a wide BIM demand as urban development requires advanced digital tools to streamline design, construction, and facility management. Sustainability goals and energy efficiency standards further drove BIM usage in North America, as they allow for better analysis of materials, carbon footprints, and lifecycle costs.

US Building Information Modeling Market Insight

The US, in particular, dominated with 79.21% regional market share. This dominance is attributed to mandates requiring BIM for public infrastructure projects and to promote digital transformation in the construction industry. In September 2022, the National Institute of Building Sciences (NIBS) launched the US National BIM Program to promote digital transformation in the construction industry by encouraging the adoption of building information modeling (BIM). Additionally, the rising complexity of large-scale developments, such as smart cities and sustainable buildings in the country, demanded advanced BIM solutions for seamless collaboration and data management.

Europe BIM Market

The Europe building information modeling market is projected to reach USD 6.62 billion by 2034. This growth is attributed to rising investments in smart infrastructure and digital construction. Governments in countries such as Germany, France, and the UK are increasingly mandating BIM usage in public infrastructure projects to enhance transparency, cost-efficiency, and project lifecycle management, leading to market growth. Since January 1, 2021, Germany has mandated BIM obligation for the procurement of public contracts. This regulatory push, combined with increasing awareness of the benefits of BIM, including reduced project delays, better coordination among stakeholders, and improved asset management, is driving demand for BIM tools in the region.

Construction firms across Western and Northern Europe are also prioritizing BIM to meet stringent sustainability goals and optimize operational workflows. The growing emphasis on green building certifications in the region, such as Building Research Establishment Environmental Assessment Method (BREEAM), is opening new avenues for BIM software providers to offer sustainability-focused solutions. Moreover, the growing investment and development of smart cities across Europe is driving the building information modeling market in Europe. Smart city projects require seamless integration of infrastructure, utilities, and digital systems, making BIM an essential tool for planning, design, and lifecycle management.

Asia Pacific Building Information Modeling Market Overview

The building information modeling market in Asia Pacific accounted for a 23.45% share in 2024, owing to the increasing demand for efficient construction practices and smart city development. Governments in countries such as Singapore and Australia have mandated BIM usage for public infrastructure projects, accelerating adoption among architects, engineers, and contractors. The region’s booming urbanization, coupled with the need for cost and time savings in construction, further fuels BIM implementation. For instance, United Nations Human Settlements Programme in its report stated that by 2050, the urban population in Asia is expected to grow by 50%, an additional 1.2 billion people. Additionally, rising investments in transportation, energy, and residential projects are creating a robust demand for BIM tools in the region. Technological advancements and growing digital literacy among construction professionals are also supporting the Asia Pacific market growth.

Key Players & Competitive Analysis Report

The building information modeling (BIM) industry is highly competitive, characterized by intense rivalry among key players focusing on expanding their product portfolios, enhancing production capacities, forming strategic partnerships, and pursuing mergers and acquisitions (M&A) to strengthen their market positions. Major companies are actively investing in product portfolio expansion to cater to diverse industrial, construction, and operation applications. Emerging technologies such as deep learning, machine learning, AI, cloud computing, and edge computing are also accelerating the competition in the market.

A few prominent companies in the building information modeling market are Autodesk, Bentley Systems, Nemetschek Group, Trimble Inc., Dassault Systèmes, Hexagon AB, AVEVA (Schneider), Procore Technologies, Siemens Digital, Asite, CYPE Ingenieros, and ACCA Software.

Key Players

- ACCA Software

- Asite

- Autodesk

- AVEVA (Schneider)

- Bentley Systems

- CYPE Ingenieros

- Dassault Systèmes

- Hexagon AB

- Nemetschek Group

- Procore Technologies

- Siemens Digital

- Trimble Inc.

Industry Developments

January 2025: AVEVA partnered with French firm Ingeloop to integrate BIM capabilities into AVEVA E3D Design. The collaboration enabled BCF issue management using Ingeloop’s BCFNode tool, enhancing communication and coordination across 3D design teams.

August 2024: CYPE launched its range of solutions by developing a new program, Open BIM SATO, which will be used to enter the maintenance phase of buildings.

June 2024: Hexagon acquired Voyansi to strengthen its BIM solutions portfolio. The acquisition enhanced Hexagon’s AECO offerings by integrating Voyansi’s BIM, VDC, and reality capture services, supporting advanced 3D modelling and improved construction lifecycle data accuracy.

Building Information Modeling (BIM) Market Segmentation

By Solution Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Services

By Deployment Type Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-Based

- On-Premises

By Building Type Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- Industrial

- Residential

- Public Infrastructure

- Others

By Project Outlook (Revenue, USD Billion, 2020–2034)

- Preconstruction

- Construction

- Operation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Construction & Design

- Planning & Modelling

- Asset Management

- Building System Analysis & Maintenance Scheduling

- Others

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- Builders & Contractors

- AEC Professionals

- Consultants & Facility Managers

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Building Information Modeling Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.92 Billion |

|

Market Size in 2025 |

USD 8.70 Billion |

|

Revenue Forecast by 2034 |

USD 21.06 Billion |

|

CAGR |

10.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global market size was valued at USD 7.92 billion in 2024 and is projected to grow to USD 21.06 billion by 2034.

• The global market is projected to register a CAGR of 10.3% during the forecast period.

• North America dominated the market share in 2024.

• A few of the key players in the market are Autodesk, Bentley Systems, Nemetschek Group, Trimble Inc., Dassault Systèmes, Hexagon AB, AVEVA (Schneider), Procore Technologies, Siemens Digital, Asite, CYPE Ingenieros, and ACCA Software.

• The software segment dominated the market share in 2024.

• The industrial segment is expected to witness the fastest growth during the forecast period.