Burn Care Centers Market Share, Size, Trends, Industry Analysis Report

By Facility Type (In-house, Standalone), By Treatment Type; By Severity (Minor Burns, Partial Thickness Burns, Full Thickness Burns); By Service Type (Inpatient, Outpatient, Rehabilitation); By Regions; Segment Forecast, 2021 - 2028

- Published Date:Feb-2021

- Pages: 127

- Format: PDF

- Report ID: PM1803

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

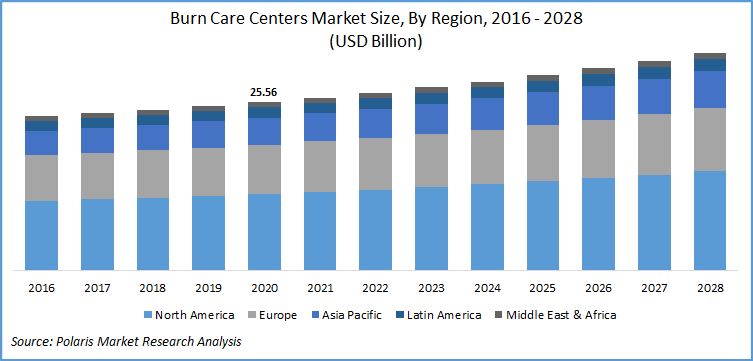

The global burn care centers market was valued at USD 25.07 billion in 2020 and is expected to grow at a CAGR of 3.3% during the forecast period. The factors responsible for the market growth include the rising number of fire-related emergency department visits coupled with rising hospital admissions for first and second-degree burns among a large section of the population.

Know more about this report: request for sample pages

Among all fire-related events, second degree and partial thickness were reported to be the frequent ones. For both, ED visits accounted around 56 percent and in-patient stays accounted for 51 percent of all the burn care cases, in the U.S. alone. The majority of the ED visits were reported due to hot steam and liquid.

Industry Dynamics

Growth Drivers

The high incidence of mortality rate due to burn-related events is the most prominent driver for the establishment of burn care centers. As per the statics published by National Health Service, in August 2018, it is being reported that there is a significant increase in emergency visits in the UK. Over the past decade, it has grown by around 42 percent, with burns accounted for more than 2 percent of all the visits.

Know more about this report: request for sample pages

Moreover, according to CDC, in 2016, approximately 338,000 people in the U.S alone have undergone emergency treatment for burns with 45,000 in-patient stays. Overall treatment cost related to such cases in the U.S was measured at around USD 7.1 billion. Thus, this factor has largely propelled the growth of the market.

Burn Care Centers Market Report Scope

The market is primarily segmented on the basis of facility type, by treatment type, by severity, by service type and geographic region.

|

By Facility Type |

Treatment Type |

By Severity |

By Service Type |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Facility Type

Based upon facility type, the global burn care centers market is categorized into in-house, and standalone. Of all, the in-hospital facilities segment held the largest share in the global market, in 2020. Such a high share is due to the presence of tertiary hospitals with the dedicated facilities. Moreover, the presence of dedicated burn care centers in the developed economies also propelled the segment’s growth. For instance, in 2018, the U.S. alone had 128 burn care centers.

The standalone care centers segment is projected to register the fastest growth rate over the assessment period. This is attributed to the rising preference of individuals towards personalized care and value-added services. Moreover, quality care offered by skilled doctors and nurses in these centers resulted in a reduction in infections. The out-patient appointments also reduced by more than 90 percent, owing to re-schedules and late burn effects, and has enabled the rise in tele-visits for most of the burn cases via pictures and video visits.

Insight by Treatment Type

The wound debridement segment held the largest share in the global market, in 2020. The treatment is the most common in the emergency departments. Around, 25 percent of the ED visits and 38 percent of the in-patient stays are usually treated with this procedure. Moreover, the cost of treatment is relatively less, as compared to other procedures.

However, the OTC pain medication segment is projected to register the highest growth rate over the assessment period. This is due to the high consumption of pain management medications in wound dressing procedures. More than one-third of the in-patient stays were due to in-patient stays, owing to accidents due to fire and explosives.

Insight by Severity

In 2020, the partial thickness segment held the largest share over the study period. Partial thickness is the most common burn severity for both in-patient and ED visits. Moreover, the growing need for long-term care for partial thickness injuries has resulted in high treatment costs, majorly associated with long-term stays, thereby propelling segment growth.

The full-thickness segment is projected to witness the highest growth rate over the assessment period. These injuries usually cover around 15 percent of the individual’s body and require a longer time to heal. Skin grafts procedures are mostly used for the treatment of full-thickness burns, aiding frequent healing of wounds.

Geographic Overview

Geographically, North America burn care centers market accounts for one of the largest revenue holders in the global market. Regional factors that contributed to the growth include the presence of established medical facilities and standalone centers. Moreover, the region has favorable reimbursement policies, covering almost 70 percent of the treatment cost, coupled with the availability of advanced treatment options. Moreover, growth in personalized quality treatment also favored the region’s growth.

Asia Pacific care center segment is projected to witness a lucrative growth rate over the assessment period. The region has a huge untapped population, particularly in India and China, seeking medical care. Moreover, the rising disposable income of the people and rising healthcare expenditure also favoring the region’s growth.

Competitive Insight

Some of the major players operating the global market include The MetroHealth System, Chelsea & Westminster Hospital, Pediatric Burn Care Center, University of Rochester Medical Center, Burn and Reconstructive Centers of America, National Burn Center (India), North Bristol NHS Trust, and University of Washington Regional Burn Center.