Candidate Skills Assessment Market Size, Share, Trends, & Industry Analysis Report

By Component, By Deployment Model, By Product, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM2332

- Base Year: 2024

- Historical Data: 2020-2023

What is the candidate skills assessment market size?

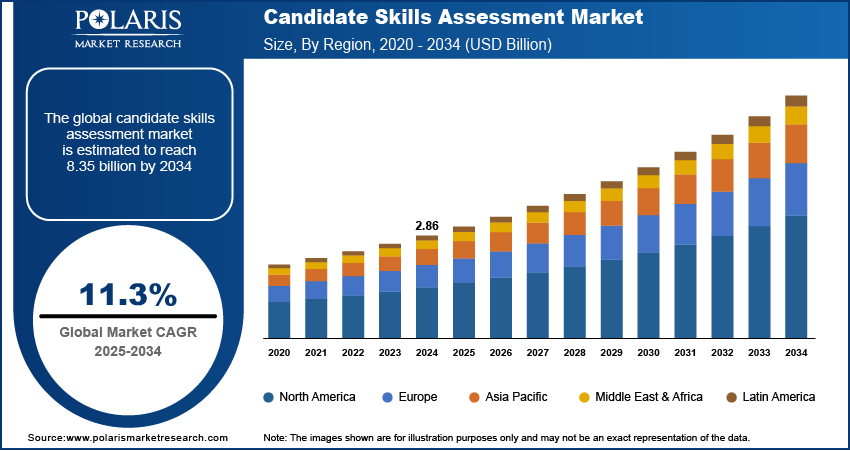

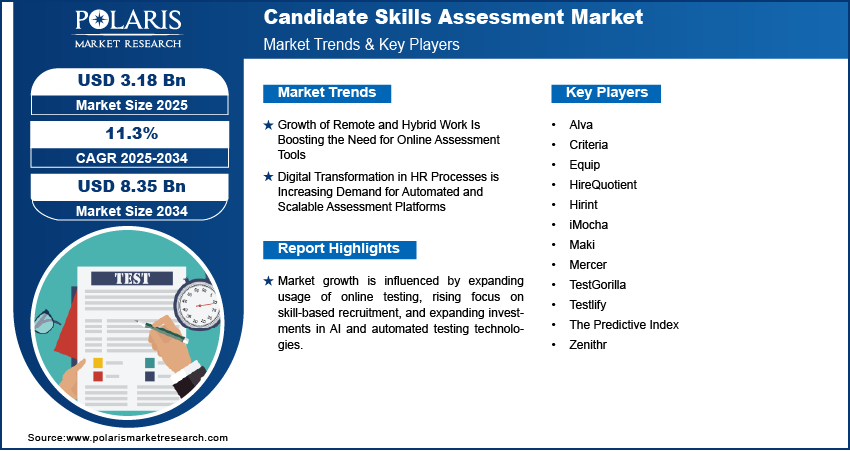

The global candidate skills assessment market size was valued at USD 2.86 billion in 2024, growing at a CAGR of 11.3% from 2025–2034. Expansion of remote and hybrid employment in conjunction with HR digital transformation is fueling the need for online assessment platforms.

Key Insights

- Software dominated the 2024 market through extensive usage and integrability across enterprises and educational institutions.

- Coding tests are likely to achieve the highest CAGR through rising demand for technical talent evaluation and automated testing.

- North America led in 2024 with the advancement of HR infrastructure and early take-up of AI-powered assessment platforms.

- The U.S. had the largest regional contribution due to solid digital HR methodologies and business investment in online tests.

- Asia Pacific expected to growth with highest CAGR as a result of swift EdTech uptake and increasing remote recruitment practices.

- India led in Asia Pacific with increasing online education courses and government drives enforcing digital skill acquisition.

Industry Dynamics

- Rapid expansion of remote and hybrid work is increasing the demand for online assessment tools.

- HR process digitalization is driving up the need for scalable and automated assessment platforms.

- Excessive cost of implementation and data privacy are limiting market growth.

- Development in AI, machine learning, gamification, and LMS integration is building big opportunities for growth in the market.

Market Statistics

- 2024 Market Size: USD 2.86 billion

- 2034 Projected Market Size: USD 8.35 billion

- CAGR (2025–2034): 11.3%

- North America: Largest Market Share

What are candidate skills assessment?

Candidate skills assessment solutions enable data-driven recruitment, employee assessment, and workforce development for enterprises, staffing agencies, and educational institutions. Such platforms allow objective measurement of technical, cognitive, and behavioral skills via online tests, simulations, and game-based assessments. Advanced technologies like AI, machine learning, and data analytics improve the precision, fairness, and effectiveness of candidate evaluation processes.

Digitalization of human resource management, growth of remote and hybrid work patterns, and increased emphasis on soft skill measurement are driving the use of online test platforms. Companies are increasingly merging assessment solutions with learning management systems (LMS) and applicant tracking systems (ATS) in order to automate recruiting, onboarding, and training processes. In June 2025, ETS Solutions introduced Futurenav Adapt AI, an AI literacy assessment tool that helps workforce upskilling.

Increased demand for effective talent acquisition, hiring cost-cutting, and enhanced employee retention is fueling market growth. Organizations operating in developed geographies like North America and Europe are leveraging AI-powered assessment solutions to drive hiring accuracy, minimize bias, and enhance candidate experience. Leading vendors launched integrated assessment suites that integrated video analytics, gamified testing, and psychometric evaluation to advance talent identification and workforce planning competencies.

Drivers & Opportunities

Growth of Remote and Hybrid Work Is Boosting the Need for Online Assessment Tools: The emergence of remote and hybrid work arrangements has transformed classical recruitment trends, with a heavier emphasis on online evaluations. A Robert Half survey determined 88% of U.S. employers provide hybrid working, 25% offering it to their entire workforce, while Q2 2025 job ads indicated 24% hybrid and 12% fully remote positions. Companies are employing online platforms to screen candidates effectively across various locations. These tools guarantee consistency, lower time-to-hire, and lower recruitment costs. As more workforces go remote, the need for online tests continues to increase across industries.

Digital Transformation in HR Processes is Increasing Demand for Automated and Scalable Assessment Platforms: Digitalization of HR is encouraging businesses to move away from manual hiring to data-based systems. Automated evaluation platforms simplify the recruitment process, enhance transparency, and minimize human bias. Integration with HR software helps organizations handle high volumes of candidates with ease. As businesses seek agility and scalability, intelligent assessment solution adoption accelerates at an increasing rate.

Segmental Insights

Component Analysis

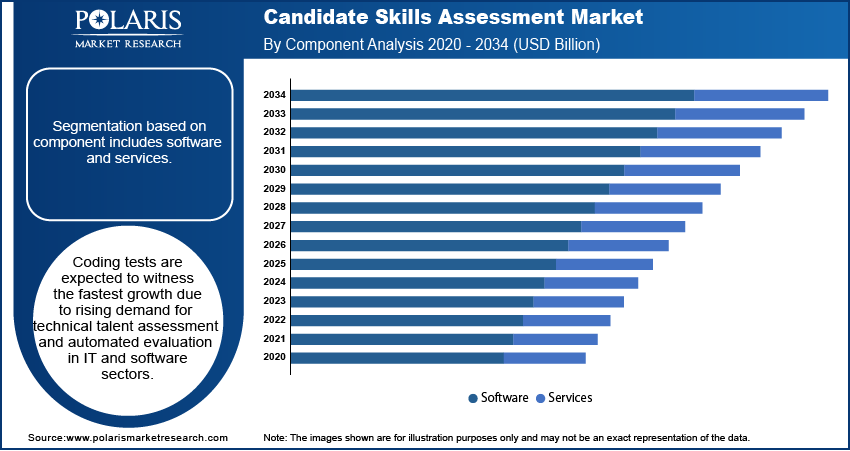

In terms of component, segmentation includes software and services. Software segment ruled the market in 2024 due to increasing usage of AI-based assessment solutions and automated analytics solutions that simplify recruitment. Additionally, businesses opt for software solutions due to scalability, customization, and compatibility with HR management systems.

The services segment is projected to grow at the fastest CAGR during the forecast period due to increasing demand for implementation support, customization and managed assessment services. In addition, organizations are outsourcing assessment operations to enhance efficiency and reduce administrative burdens.

Deployment Model Analysis

By deployment model, the market is divided into on-premises and cloud. The cloud segment held the largest market share in 2024 driven by increased need for flexible and cost-effective assessment delivery models. Additionally, organizations are deploying cloud-based platforms due to scalability, remote access, and ease of integration across global hiring processes.

The on-premises segment is expected to grow steadily, driven by organizations requiring data privacy and control over internal systems. In addition, large enterprises with in-house IT infrastructure prefer on-premises deployment to comply with strict data governance and security standards.

Product Analysis

On the basis of product, segmentation includes aptitude/psychometric test, personality test, coding test, and others. The aptitude/psychometric test segment led the market in 2024, which was influenced by its extensive application in assessing cognitive and behavioral qualities. Further, employers also depend on psychometric testing for cultural fit and better decision-making at the early stages of hiring.

The coding test segment is also expected to expand at the highest CAGR over the forecast period owing to rising demand for technical professionals in the IT and software sectors. Furthermore, companies are using automated coding tests to assess programming skills effectively.

End User Analysis

Based on end user, the market is divided into education and corporate. The corporate segment led the market in 2024 due to the increasing usage of skills assessments in recruitment, performance measurement, and internal mobility. During July 2025, Thomas International introduced its Personality assessment on a new Talent Assessment Platform, providing fast, data-rich insights that enhance hiring decisions. Further, organizations apply assessment tools to increase workforce productivity and harmonize talent plans with business targets.

The education sector projected to experience the highest CAGR over the forecast period owing to increased use of online assessment tools in educational testing and evaluation of student skills. Institutions are also consolidating these platforms to facilitate online learning initiatives.

Regional Analysis

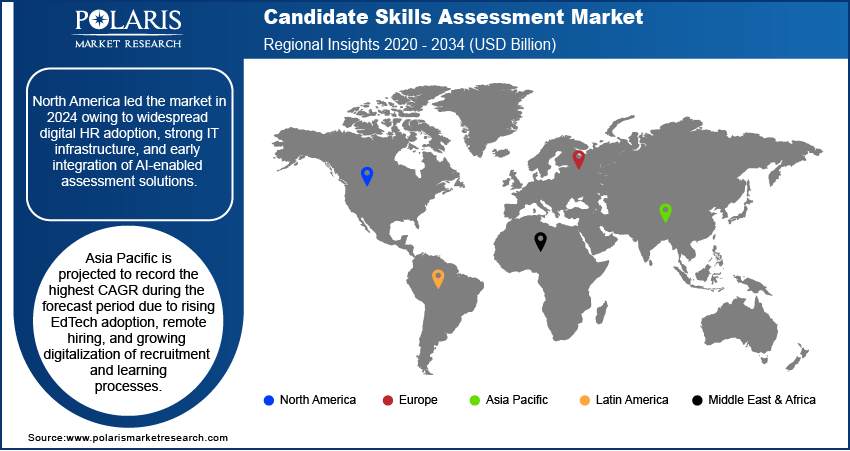

North America led the candidate skills assessment solutions market in 2024 due to the high uptake of AI-based hiring solutions across business and education verticals. Further, the IT maturity in the region, combined with the emphasis on remote employee assessment, continues to fuel platform adoption in enterprises.

The U.S. Candidate Skills Assessment Market Insight

The U.S. possesses the highest market share in North America due to extensive digitalization in human resources management and e-learning organizations. Furthermore, escalating requirements for remote candidate screening and skills-based recruitment across technology-based companies reinforce market expansion. For example, during September 2025, Psymetrics introduced Psy, an artificial intelligence hiring assistant that delivers data-backed insights for enhancing the process of making recruitment decisions.

Europe Candidate Skills Assessment Market

Europe has the significant market share, which is facilitated by government-initiated digital education programs and the growth of skill-based recruitment in businesses. Further, growing emphasis on employee standardization and multilingual test tools enhances the use of cloud platforms.

Asia Pacific Candidate Skills Assessment Market

Asia Pacific is expected to expand at the highest CAGR over the forecast period, led by increasing investment in EdTech startups and growing usage of cloud-based HR tools by small and medium-sized businesses. In addition, growing internet penetration in India, China, and Southeast Asia facilitate online education and recruitment tests.

India Candidate Skills Assessment Market Overview

India held the dominating share in Asia Pacific, due to the rapid digitalization of the education system and the expansion of remote hiring practices among corporates. As per the Indian Ministry of Electronics & IT, India’s digital economy contributed 11.74% of GDP (USD 402 billion) in 2022-23, employed 14.67 million people, and proved nearly five times more productive than the rest of the economy, with core digital industries adding 7.83% of GVA, digital platforms 2%, and digitalization in traditional sectors another 2%.

Key Players & Competitive Analysis Report

The market for online assessment platforms is moderately competitive, with players strengthening capabilities in software, services, and AI-driven evaluation tools. Moreover, investments in cloud infrastructure, data analytics, and strategic partnerships with corporates, universities, and EdTech providers strengthen platform efficiency, scalability, and global market reach.

Who are the key players in the candidate skills assessment market?

Key players in the market include iMocha, Criteria, The Predictive Index, Maki, Mercer, TestGorilla, Testlify, Alva, Hirint, Zenithr, HireQuotient, and Equip.

Key Players

- Alva

- Criteria

- Equip

- HireQuotient

- Hirint

- iMocha

- Maki

- Mercer

- TestGorilla

- Testlify

- The Predictive Index

- Zenithr

Industry Developments

- October 2025: TestGorilla launched AI-powered video interviews to replace manual screening calls, using skill-based assessments and explainable AI to help recruiters shortlist candidates efficiently.

- September 2025: CodeSignal expanded its platform to assess finance, accounting, and business roles using AI-driven skills evaluations for efficient hiring.

- July 2025: Fosway Group published its AI Market Assessment for Talent Acquisition, analyzing vendor AI features and guiding European HR teams on AI adoption in 2025.

Candidate Skills Assessment Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Software

- Services

By Deployment Model Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Aptitude/Psychometric Test

- Personality Test

- Coding Test

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Corporate

- Education

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Candidate Skills Assessment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.86 Billion |

|

Market Size in 2025 |

USD 3.18 Billion |

|

Revenue Forecast by 2034 |

USD 8.35 Billion |

|

CAGR |

11.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.86 billion in 2024 and is projected to grow to USD 8.35 billion by 2034.

The global market is projected to register a CAGR of 11.3% during the forecast period.

North America led the market due to advanced HR infrastructure and widespread adoption of digital assessment platforms.

A few of the key players in the market are iMocha, Criteria, The Predictive Index, Maki, Mercer, TestGorilla, Testlify, Alva, Hirint, Zenithr, HireQuotient, and Equip.

Software dominated the market due to scalable deployment, integrability, and pervasive usage in enterprises and educational institutions.

Education organizations are likely to develop at the highest rate due to expanding online learning programs and use of digital assessment technologies.