Cannabis in Food and Beverage Market Share, Size, Trends, Industry Analysis Report

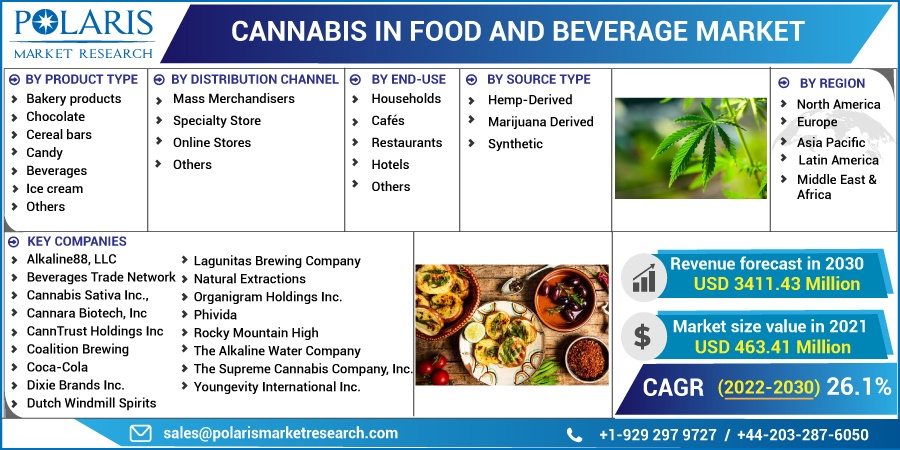

By Product Type (Bakery products, Chocolate, Cereal bars, Candy, Beverages, Ice cream, Others); By Distribution Channel; By End-Use; By Source Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 112

- Format: PDF

- Report ID: PM2289

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

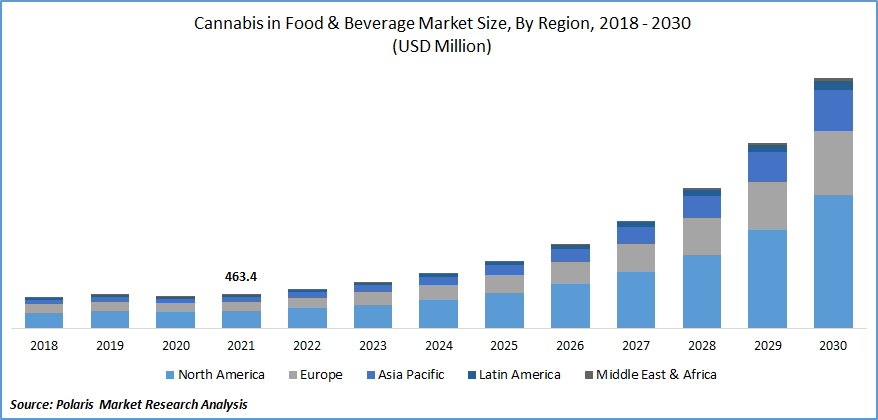

The global cannabis in food and beverage market was valued at USD 463.41 million in 2021 and is expected to grow at a CAGR of 26.1% during the forecast period. Factors such as increasing demand for medicinal marijuana, and rising health benefits, are the factors that are propelling the cannabis in food and beverage market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The growing demand for medicinal marijuana is propelling marijuana's expansion in the food and drinks business, where it is advertised as a health food or drink and consumed. The fast development of therapies, medicines and other related products made from marijuana and its positive health benefits has led to a surge in approvals of such food products.

Moreover, marijuana users are changing their focus away from smoking and other forms of marijuana consumption, such as drinks, tinctures, chocolates, and other edibles. Consumers are altering their preferences from soft drinks to health drinks, increasing the sale of marijuana drinks. The product's low sugar content and an adequate amount of marijuana for consumption are among the drivers expected to propel the industry.

Also, cannabis in food and beverage market is expected to grow due to the rising demand for healthy drinks. For instance, in February 2021, Daytrip, the leading marijuana company, has released a new candy that incorporates Hemp CBD oil. CBD is most commonly utilized to address human life issues such as insomnia and anxiety.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The increasing usage of marijuana to treat various ailments such as neurological disorders, cancer, and pain management is expected to boost the demand for marijuana food and drinks. CBD (Cannabidiol) are gaining popularity among consumers due to their pain-relieving, anti-depressant, anti-anxiety, and neuroprotective effects, which are projected to drive cannabis in food and beverage market expansion over the forecast period.

Aspirin, acetaminophen, ibuprofen, and naproxen are just several of the painkillers available on the market, and they all have hazardous adverse effects. Besides, these products can assist in the reduction of chronic pain by increasing endocannabinoid receptor activity, lowering inflammation, and acting with neurotransmitters. Over the forecast period, such health benefits are expected to fuel marijuana in food and drinks demand.

Furthermore, increased anxiety and depression have been seen worldwide due to increased pressure among working people and students. According to the Anxiety and Depression Association of America, anxiety is the common mental illness in the U.S., with more than 40 million individuals age 18 and older suffering from the disorder.

Moreover, cannabidiol (CBD) gummies are in high demand due to the increased usage of marijuana to treat neurological disorders, management, mental disorders, and cancer. According to Johns Hopkins University, 26% of Americans aged 18 and above – or about one in every four persons – may experience a diagnosable mental condition in any given year. The demand for marijuana is expected to rise over the forecast period, owing to the rising prevalence of anxiety, depression, and neurological disorders, among others.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, end user, source type, and region.

|

By Product Type |

By Distribution Channel |

By End Use |

By Source Type |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Distribution Channel

Based on the distribution channel segment, the specialty store systems segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. This is due to specialty store operators' increased adoption of marijuana food products in mature and growing economies. Furthermore, the one-stop purchasing solution is given by hypermarkets and supermarkets, wherein consumers can purchase all forms of cannabis food and beverage market, making it a desirable option for consumers.

Geographic Overview

In terms of geography, North America had the largest revenue share in 2021. Legalizing marijuana for medical, therapeutic, and entertainment activities propels market growth. Marijuana use for recreational and medical purposes became legal in Canada in 2018. Several states in the U.S. have authorized the incorporation of marijuana infusions into food and drinks lawful. This aspect is expected to accelerate the growth of the cannabis food and beverage market in North America.

Moreover, Europe witnessed a high CAGR in the global cannabis in food and beverage market in 2021 and is expected to increase significantly throughout the anticipated period due to rising consumer demand in the region. According to the Cannabis Trade Association, enterprises in the region are producing new products to keep up with the growing popularity of wellness drinks. The existence of marijuana-friendly cafes and restaurants has also helped build demand in the Netherlands. The expansion of marijuana tourism in the country is expected to drive demand even more. Nations such as Australia and Uruguay are also expected to see a significant increase in product demand due to the legalization of marijuana for medical and recreational purposes.

Competitive Insight

Some of the major players operating in the global cannabis in food and beverage market include Alkaline88, LLC., Beverages Trade Network, Cannabis Sativa Inc., Cannara Biotech, Inc, CannTrust Holdings Inc, Coalition Brewing, Coca-Cola, Dixie Brands Inc., Dutch Windmill Spirits, Energy Drink, GENERAL CANNABIS CORP., HEXO Corp, Koios Beverage Corporation, Lagunitas Brewing Company, Natural Extractions, New Age Beverages Corporation, Organigram Holdings Inc., Phivida, Rocky Mountain High, The Alkaline Water Company, The Supreme Cannabis Company, Inc., and Youngevity International Inc.

Cannabis in Food and Beverage Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 463.41 million |

|

Revenue forecast in 2030 |

USD 3,411.43 million |

|

CAGR |

26.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Distribution, By End-User, By Source Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Alkaline88, LLC., Beverages Trade Network, Cannabis Sativa Inc., Cannara Biotech, Inc, CannTrust Holdings Inc, Coalition Brewing, Coca-Cola, Dixie Brands Inc., Dutch Windmill Spirits, Energy Drink, GENERAL CANNABIS CORP., HEXO Corp, Koios Beverage Corporation, Lagunitas Brewing Company, Natural Extractions, Organigram Holdings Inc., Phivida, Rocky Mountain High, The Alkaline Water Company, The Supreme Cannabis Company, Inc., and Youngevity International Inc. |