Cannabis Packaging Market Share, Size, Trends, Industry Analysis Report

By Type (Rigid, Flexible); By Material, By Product, By Application, By Region, Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 119

- Format: PDF

- Report ID: PM4935

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

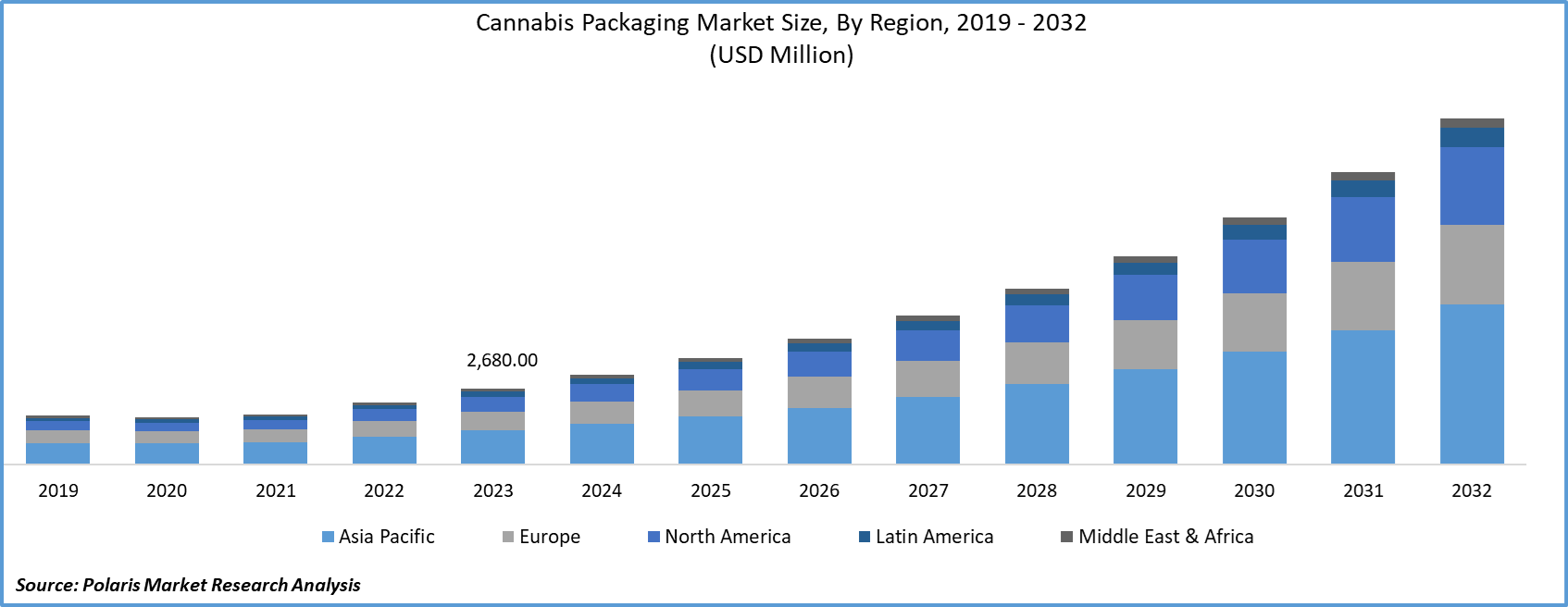

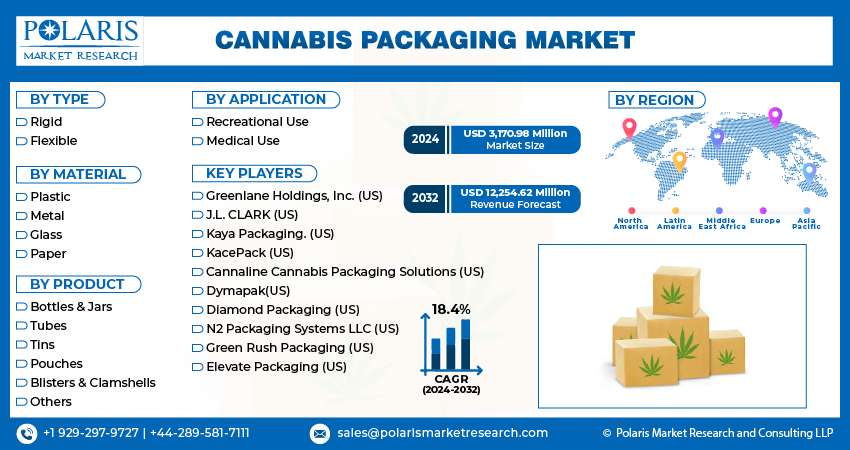

Cannabis Packaging Market size was valued at USD 2,680.00 million in 2023. The market is anticipated to grow from USD 3,170.98 million in 2024 to USD 12,254.62 million by 2032, exhibiting the CAGR of 18.4% during the forecast period.

Market Overview

The cannabis packaging market has witnessed significant growth and evolution in recent years, driven by the expanding legalization of cannabis for medical and recreational use across various regions globally. With the increasing acceptance and commercialization of cannabis products, the demand for specialized packaging solutions tailored to the unique requirements of the cannabis industry has surged.

The cannabis packaging market encompasses a wide range of packaging solutions designed to meet the specific needs of cannabis producers, retailers, and consumers. These packaging solutions not only serve to protect the integrity and potency of cannabis products but also ensure compliance with regulatory requirements related to child-resistant packaging, product labeling, and tamper-evident features.

To Understand More About this Research: Request a Free Sample Report

Key trends shaping the cannabis packaging market include the growing emphasis on sustainable and eco-friendly packaging materials, innovative designs to enhance product differentiation and brand recognition, and advancements in technology for improved product safety and security. Additionally, as the cannabis industry continues to mature, there is a rising focus on developing packaging solutions that cater to diverse product formats, such as flower, concentrates, edibles, and topicals, while addressing concerns related to dosage control and product information transparency.

Growth Drivers

Rising demand for medical and recreational cannabis products

The growing demand for recreational and medical cannabis products is expected to drive the market due to increasing legalization of cannabis packaging sector within the number of states and countries. The market is witnessing surge in demand for various product categories, concentrates, encompassing edibles and pre-rolls. This growth in demand has enabled the packaging enterprises to explore innovative packaging strategies in order to fulfill the demand.

This heightened demand has increased the need for secure & innovative packaging solutions in order to ensure the freshness and safety of cannabis products. Key players in the industry are developing new packaging designs which are tamper-evident, chill-resistant, and compliant with the regulations. For instance, in February 2021, Spee-Dee Launched new automated cannabis packaging system. The growing popularity of cannabis-based beauty products, and beverages has also contributed to the growth of the market. Moreover, the shift towards sustainable packaging such as bio-degradable plastics and recycled paper is further boosting the cannabis packaging market.

Ancillary demand for packaging is projected to boost the market growth

The marginal demand for packaging in the cannabis industry is expected to foster the growth of the cannabis packaging market. This is attributed to the factors such as the popularity of cannabis-infused edibles and concentrates, along with growing need for specialized packaging solutions. For example-chilled resistant packaging is required and tamper-evident packaging is required for edibles to comply with regulations.

Additionally, the cannabis concentrates such as waxes and oils require airtight and light-resistant packaging in order to preserve its quality and potency. This growth if demand for specialized packaging solutions in expected to create various opportunities for packaging manufacturers and suppliers in the market. Thus, the key players are developing advanced and innovative packaging solutions to meet the unique needs of cannabis products. For instance, in March 2024, according to Packaging Digest, several brands pair cannabis to sell their food and beverage products.

Restraining Factors

Stringent packaging standards and regulations

The companies that are seeking to leverage the burgeoning market are affected by the stringent packaging standards and regulations. For instance, the mandate for child-resistant packaging in numerous states imposes significant cost and implementation challenges, particularly for smaller enterprises.

Additionally, the branding constraints and labeling regulations can curtail the capacity of the companies to differentiate their offerings and gain visibility in a saturated market environment. Thus, these regulatory barriers hamper the activities of the companies to innovate and expand their product portfolios. However, various key players are applying various strategies such as research & development initiatives and partnerships with other enterprises which can overcome these hurdles and persevere in the dynamic cannabis packaging market.

Report Segmentation

The market is primarily segmented based on Type, Material, Product, Application, and region.

|

By Type |

By Material |

By Product |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Flexible segment is expected to witness the highest growth during the forecast period

The flexible segment is projected to grow at a CAGR during the projected period, owing to its capacity to comply to diverse product configurations and dimensions. Additionally, flexible packaging emerged as a versatile solution for the packaging of cannabis products, extend across pre-rolled joints to edibles and concentrates. Furthermore, the lightweight-ness of flexible packaging contribute to the diminished transportation expenses and environmental impact, rendering it a sustainable for cannabis industry players.

By Material Analysis

Plastic segment accounted for the largest market share in 2023

The plastic segment held the largest revenue share driven by to its cost-efficiency, versatility, durability. Additionally, plastic containers excel in shielding cannabis merchandise from various factors such as air and light thereby safeguarding its efficacy and integrity. Furthermore, the adaptability and lightweight nature of plastic makes it the preferred option for both manufacturers and consumers. Thus, numerous cannabis enterprises opt for plastic packaging due to its capacity for branding initiatives and captivating designs.

By Product Analysis

Bottles & jars segment held the significant market revenue share in 2023

The bottles & jars segment accounted for largest market share in 2023, owing to its adaptability and resilience. These products play a vital role in maintain the freshness of cannabis products by protecting them from diverse external factors such as light, air and moisture. Furthermore, these receptacles come in various configurations and sizes that cater to the changing consumer preferences and product requirements that drives the segment growth.

By Application Analysis

Recreational segment garnered with the significant revenue share in 2023

The recreational segment is anticipated to witness significant demand over the forecast period, primarily driven by growing legalization of recreational marijuana across multiple jurisdictions which boosted the demand for cannabis products among recreational consumers, consequently driving the demand for packaging solutions. Furthermore, the greater disposable income associated with recreational demographics, increases the cannabis purchase which drives the market in coming years. Moreover, the considerable importance on packaging convenience and aesthetic appeal by recreational segment is propelling the demand for inventive and visually appealing packaging solutions.

Regional Insights

North America region registered the largest share of the global market in 2023

The North America region held the dominant share in 2023, owing to widespread legalization of cannabis in numerous states and provinces across the region thereby fueling a pronounced demand for packaging solutions to adhere to regulations and to adhere the product integrity. For instance, in May 2023, the Governor of Minnesota approved legislation permitting the recreational use of cannabis for adults within the state.

Additionally, North America is considered to be largest cannabis producers across the globe, precipitating an increased necessity for streamlined and innovative packaging solutions to accommodate the burgeoning industry needs. Thus, well established infrastructure and supply chain networks in the region is fostering the growth of cannabis packaging market.

Asia-Pacific is expected to witness remarkable growth over the forecast period, owing to increased legalization of cannabis and its products in countries such as Australia, South Korea, and Japan that heightened the demand for regulatory-compliant and pioneering packaging solutions to accommodate the growing industry. For instance, countries, such as South Korea and Thailand, have legalized medical cannabis use. Moreover, the population and swiftly expanding middle-class demographics is boosting the consumption of cannabis products thereby driving the growth of the market.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The cannabis packaging market is fragmented. The growing research & developments in cannabis products & its packaging is positively impacting the global Cannabis Packaging market. The ongoing activities of market players such as partnerships, acquisitions, and collaborations, are fueling competition in the marketplace. For instance, in January 2024, an Israel-based producer of compostable packaging entered into a collaboration with Wyld to devise compostable packaging solutions tailored for edible cannabis products. Tipa, the manufacturer, has developed a 608-home compostable laminate, which will be utilized in the creation of pouches and wraps designed specifically for edible gummies.

Some of the major players operating in the global market include:

- Greenlane Holdings, Inc. (US)

- J.L. CLARK (US)

- Kaya Packaging. (US)

- KacePack (US)

- Cannaline Cannabis Packaging Solutions (US)

- Dymapak(US)

- Diamond Packaging (US)

- N2 Packaging Systems LLC (US)

- Green Rush Packaging (US)

- Elevate Packaging (US)

Recent Developments in the Industry

- In November 2023, Amcor Plc and CRATIV Packaging launched Crativ PCR50, which is cannabis container made from 50% PCR, and polypropylene material. The product is specifically engineered as a child resistant solution in order to safeguard edible, vape, pre-roll and flower products catering to cannabis sectors.

- In January 2022, Origin Pharma introduced specialized packaging solution tailored for the medical cannabis sector. A child-resistant jar designed to accommodate the ‘flower’ products which is commonly prescribed in selected European countries.

Report Coverage

The cannabis packaging market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, component, caliber, guidance mechanism, application, lethality, and their futuristic growth opportunities.

Cannabis Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3,170.98 million |

|

Revenue forecast in 2032 |

USD 12,254.62 million |

|

CAGR |

18.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Cannabis Packaging Market are Greenlane Holdings, Inc., J.L. CLARK, Kaya Packaging

Cannabis Packaging Market exhibiting the CAGR of 18.4% during the forecast period.

The Cannabis Packaging Market report covering key segments are Type, Material, Product, Application, and region.

key driving factors in Cannabis Packaging Market are Rising demand for medical and recreational cannabis products

The global cannabis packaging market size is expected to reach USD 12,254.62 Million by 2032