Carbon Tape Market Share, Size, Trends, Industry Analysis Report

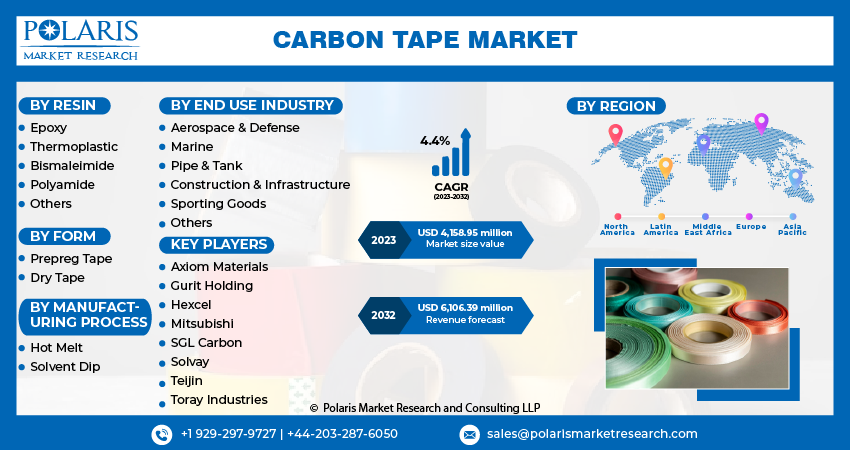

By Resin (Epoxy, Thermoplastic, Bismaleimide, Polyamide, Others); By Form; By Manufacturing Process; By End Use Industry; By Region; Segment Forecast, 2023 - 2032

- Published Date:Oct-2023

- Pages: 116

- Format: PDF

- Report ID: PM3842

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

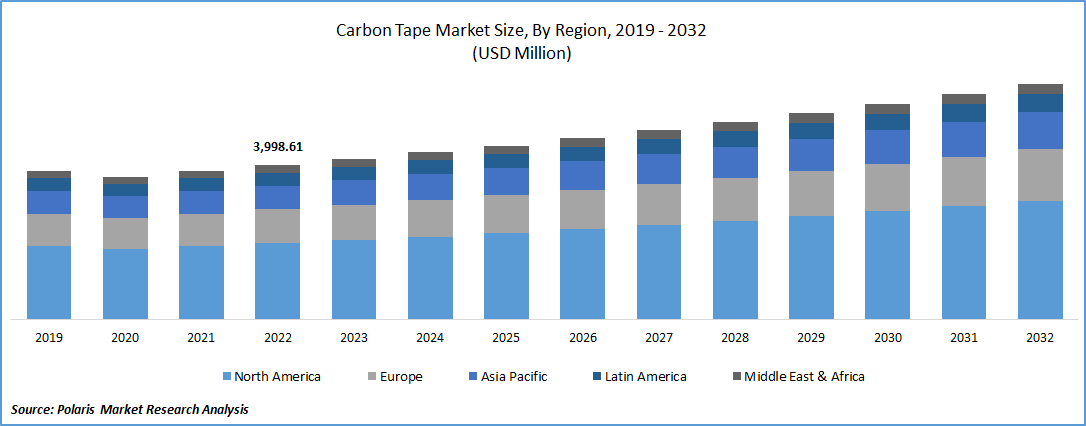

The global carbon tape market was valued at USD 3,998.61 million in 2022 and is expected to grow at a CAGR of 4.4% during the forecast period.

Research and development activities are driving the demand for carbon tape, as exemplified by a recent study that focused on processing waste carbon polyamide fibers for thermoplastic composites. The study introduced an eco-friendly, sustainable manufacturing technology that converts waste fibers into a fibrous structure, known as a "unidirectional tape structure." These tapes exhibit properties comparable to traditional prepreg materials, including homogeneity, uniformity, orientation, and thermal stability. This research showcases the increasing focus on research and development efforts to enhance the efficiency and performance of carbon tape.

To Understand More About this Research: Request a Free Sample Report

Carbon tape offers several benefits when used in the construction industry. It provides exceptional strength and stiffness, allowing for effective structural reinforcement and strengthening of various construction elements. Its high tensile strength and low weight make it an ideal material for applications where weight reduction and increased load-bearing capacity are desired. By using carbon tape, construction projects can achieve improved structural integrity, enhanced durability, and increased resistance to external forces such as earthquakes and high winds. In addition to its structural applications, carbon tape finds utility in the construction industry for ensuring air- and watertight sealing in modern buildings.

Industry Dynamics

Growth Drivers

Benefits offered by carbon fiber composites

One of the key drivers of this growth is the recognition of the benefits offered by carbon fiber composites. These composites, in which carbon tapes play a crucial role, exhibit high strength, corrosion resistance, and fatigue resistance compared to metals and plastics. As industries increasingly realize these advantages, they are turning to carbon fiber composites for various applications, such as aerospace, automotive, wind energy, and sports equipment. Supporting the demand for carbon tapes, Toray Industries announced the development of a high-speed thermal welding technology for carbon fiber reinforced plastics (CFRP). This advancement enables high-rate production and weight savings in CFRP airframes. The company's commitment to further expanding CFRP applications and pushing for commercialization after 2030 demonstrates the industry's drive toward adopting carbon fiber composites on a larger scale.

Report Segmentation

The market is primarily segmented based on resin, form, manufacturing process, end use industry and region.

|

By Resin |

By Form |

By Manufacturing Process |

By End Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Resin Analysis

Epoxy segment is expected to witness fastest growth during forecast period

The epoxy segment is expected to have faster growth in the carbon tape market. Epoxy resin offers excellent adhesive properties, high strength, and good chemical resistance. These properties make it an ideal choice for manufacturing carbon tapes with enhanced mechanical properties, such as high tensile strength, stiffness, and durability. Carbon tapes reinforced with epoxy resin find applications across various industries. The aerospace and automotive sectors extensively use epoxy-based carbon tapes for structural reinforcement, reducing weight and improving overall performance.

Epoxy-based carbon tapes are also employed in sports equipment, wind energy, marine applications, electronics, and other industries. These tapes are also used for repair and maintenance purposes. They provide effective solutions for reinforcing and repairing damaged or weakened structures, including bridges, buildings, pipelines, and various infrastructure components. The need for cost-effective and durable repair solutions contributes to the growth of the epoxy resin segment.

By Form Analysis

Prepreg Tape segment accounted for the largest market share in 2022

Prepreg Tape segment holds the largest market share for the market in the study period. This offers convenience and efficiency in the manufacturing process. The tape is already impregnated with a resin system, typically epoxy resin, and partially cured. This eliminates the need for separate resin applications, resulting in time and labor savings during production. Manufacturers can focus on tape layup, consolidation, and curing steps, streamlining the overall manufacturing process. Prepreg carbon tape offers design flexibility and versatility, allowing manufacturers to create complex shapes, contours, and structures. The tape can be easily manipulated and conforms to different molds and tooling. This flexibility enables the production of customized components and enables innovative designs in industries like aerospace, automotive, and sporting goods.

By Manufacturing Process Analysis

Hot Melt segment is expected to hold the larger revenue share during forecast period

Hot Melt segment is projected to witness a larger revenue share in the coming years. The hot melt manufacturing process offers efficiency and streamlines production. It involves melting the resin and directly impregnating the carbon fibers. This eliminates the need for solvent-based processes or additional steps like dipping, resulting in reduced process complexity and increased production efficiency. This manufacturing process helps to produce carbon tape quickly and in large quantities. It involves melting the resin and applying it continuously to the carbon fibers, allowing for high-speed and continuous production.

By End-Use Industry

Airforce and Defense segment is expected to witness higher growth in the upcoming year

Airforce and Defense segment is projected to experience higher growth in the market. The sector has a continuous need for lightweight materials that offer high strength and stiffness. Carbon tape, with its exceptional strength-to-weight ratio, provides a solution to meet these requirements. It allows manufacturers to reduce the weight of aircraft and defense systems while maintaining structural integrity and performance. The Defense sector often requires materials with exceptional strength and durability to withstand harsh environments and heavy loads. Carbon tape is utilized in military applications such as armored vehicles, missile systems, and aerospace defense systems. These applications drive the demand for carbon tape, as it provides the necessary strength and protection required by the military.

By Regional Analysis

APAC expected to witness higher growth rate in the study period

APAC is projected to have a higher growth rate for the market. The growing demand for composite materials in various industries within this region is driving the growth of the global carbon tape market. According to the report by FRP Institute, the demand for composite materials in India is projected to increase significantly, reaching 7.68 lakh tonne (LT) by 2027. Various sectors, including renewable energy, electric vehicles, and defense, primarily drive this growth.

Composite materials, such as fiber-reinforced plastics, play a crucial role in supporting the circular economy as they are manufactured by combining multiple materials with diverse properties. The region is experiencing substantial growth. Carbon tape plays a vital role in the manufacturing of aircraft components due to its lightweight properties and high structural integrity. As the aerospace industry expands, the demand for carbon tape for applications such as wings, fuselages, and interior structures also increases.

North America is projected to experience a larger revenue share for the market. This expansion is supported by the ambitions of the U.S. Departments of Energy, Interior, and Commerce to increase offshore wind capacity to 30 gigawatts (GW) by 2030. These efforts to expand offshore wind power generation create a significant driver for the demand for carbon tape.

Wind turbine blades require high-performance materials that can withstand demanding environmental conditions, provide strength, and maintain aerodynamic efficiency. Carbon tape's lightweight, high-strength, and fatigue-resistant properties make it an ideal material for wind turbine blade manufacturing. As the wind industry grows and offshore projects are developed, the need for carbon tape as a vital component in wind turbine blade manufacturing increases, contributing to the region's growth.

Competitive Insight

The carbon tape market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- Axiom Materials

- Gurit Holding

- Hexcel

- Mitsubishi

- SGL Carbon

- Solvay

- Teijin

- Toray Industries

Recent Developments

- In April 2022, Gurit Holdings acquired a 60% stake in the Fiberline Composites. These are specialized in the production of pultruded carbon & glass fiber products utilized in wind blade manufacturing.

- In January 2023, Victrex received approval from the National Center for Advanced Materials Performance (NCAMP) for their new unidirectional tape (UDT) called VICTREX AE 250-AS4. This approval enables the use of it in aerospace programs.

Carbon Tape Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 4,158.95 million |

|

Revenue forecast in 2032 |

USD 6,106.39 million |

|

CAGR |

4.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Resin, By Form, By Manufacturing Process, By End Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global carbon tape market size is expected to reach USD 6,106.39 million by 2032.

Key players in the carbon tape market are Hexcel, Toray Industries, SGL Carbon, Mitsubishi, Teijin.

Asia Pacific contribute notably towards the global carbon tape market.

The global carbon tape market is expected to grow at a CAGR of 4.4% during the forecast period.

The carbon tape market report covering key segments are resin, form, manufacturing process, end use industry and region.