Carry Deck Crane Market Share, Size, Trends, Industry Analysis Report

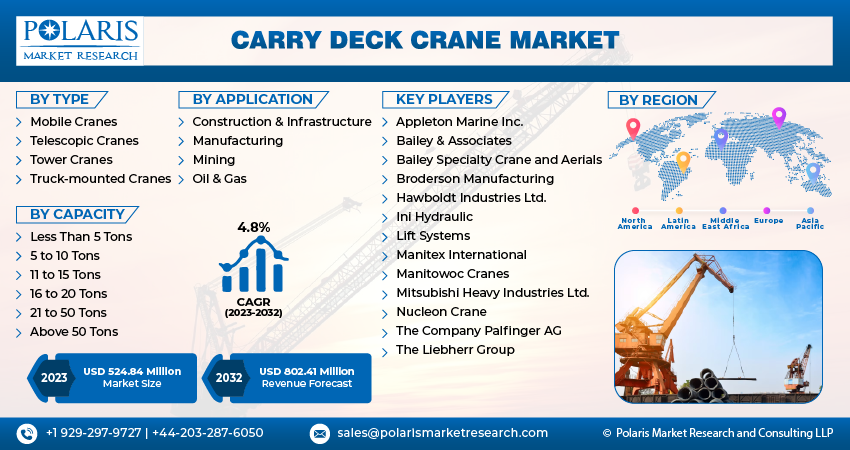

By Type (Mobile Cranes, Telescopic Cranes, Tower Cranes, and Truck-mounted Cranes); By Capacity; By Application; By Region; Segment Forecast, 2023 – 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM4097

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

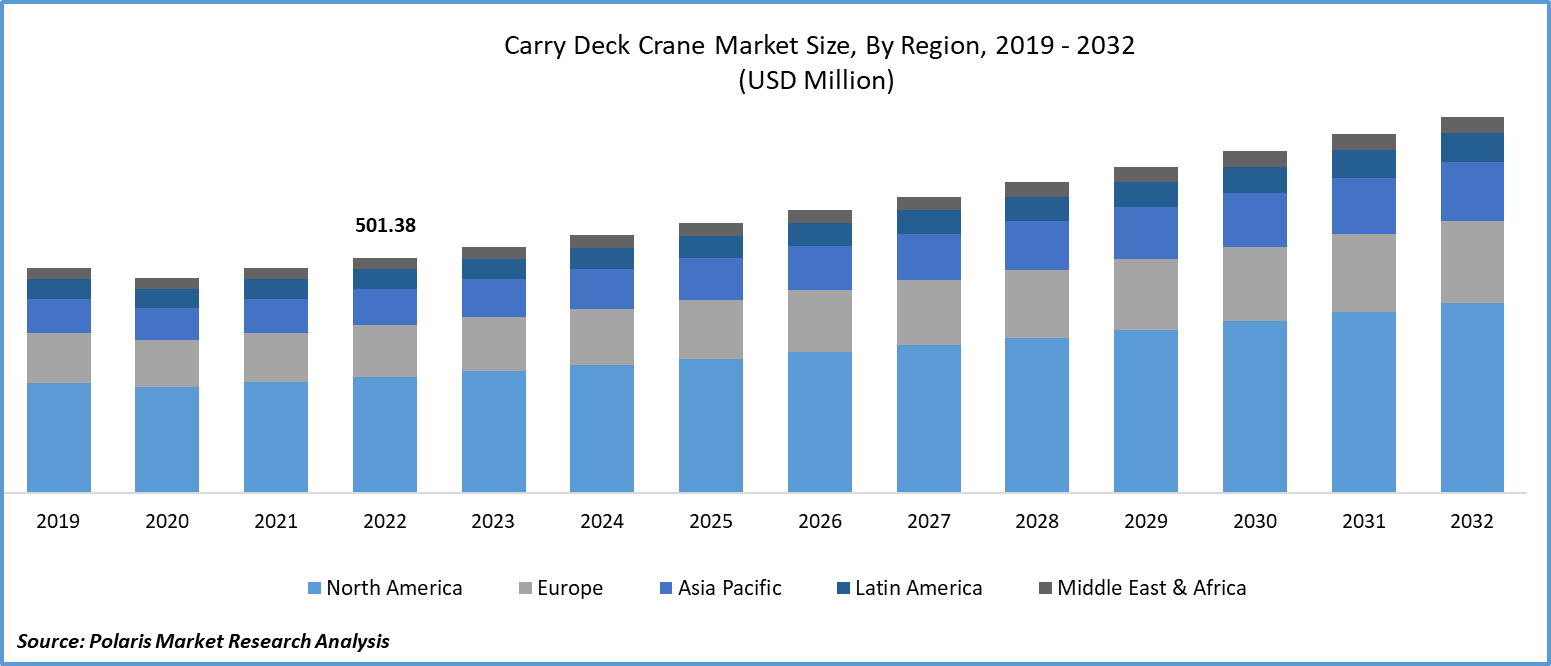

The global carry deck crane market was valued at USD 501.38 million in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period.

The rising integration of various advanced and state-of-the-art technologies, including hydraulic, cabling, and electronic, that offer unprecedented strength and maneuverability and growing incorporation of various new features such as non-sparking cables, non-sparking hubs in LNG areas, and explosion-proof motors by key product manufacturers globally, is driving the global market growth at a significant pace.

To Understand More About this Research: Request a Free Sample Report

Apart from this, the rising adoption of cranes in the construction business for the installation of prefabricated components and a growing number of carry deck crane applications in other industrial sectors, including petrochemical, oil & gas, and mining for material handling and other purposes, is further escalating the demand for innovative and developed cranes globally.

- In May 2022, Escorts Construction, introduced NXT13DC CNG, Hybrid based pick-n-carry crane. The newly developed crane has a power of around 49.5 HP BSI engine that is compatible with the CNG & straight axle back-end and offers low operating costs and rear deck utility for better movement of material and workforce.

In recent years, carry deck cranes that are equipped with telematics systems that enable real-time monitoring of crane performance, maintenance needs, and safety parameters are gaining huge traction among businesses globally, as they lead to better fleet management and reduce downtime and could enhance overall processes.

For Specific Research Requirements: Request for Customized Report

However, the high initial cost required for the acquisition and purchasing of carry deck cranes, especially advanced and larger models, and its limited awareness and popularity as compared to other lifting equipment available in the market are the key factors expected to hinder the global market.

Industry Dynamics

Growth Drivers

- The rapid increase in the number of construction and mining activities worldwide boosts the demand for these cranes.

There has been a drastic increase in the need for construction and mining activities mainly because of the rising population burden and their increasing residential and commercial needs, which led to significant infrastructure development and higher focus on new construction projects by both governments and private organizations, which often requires cranes for several purposes including equipment lifting and material handling. Thereby, with the continuous growth in the construction & mining sector, the demand and adoption for carry deck cranes also increases. For instance, as per a recent report by Reuters, new home construction in the United States has surged by most in the last three decades in 2023. The housing starts reached 1.631 million units in May, a significant increase compared to housing starts in April 2023.

Report Segmentation

The market is primarily segmented based on type, capacity, application, and region.

|

By Type |

By Capacity |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The mobile cranes segment accounted for the largest market share in 2022

The mobile cranes segment accounted for the largest share. This growth is largely due to its ability to be used in various tasks, including equipment, lifting heavy materials, and personnel. This makes it an ideal and highly preferred choice for construction projects like roads, bridges, and buildings. Furthermore, the higher reliance on mobiles of various energy sectors like oil & gas, renewable energy, and power generation for performing several crucial tasks like installation, equipment maintenance, and transportation of heavy components is further boosting the segment market growth.

The tower cranes segment is projected to exhibit a significant growth rate over the next coming years on account of their emergence as very crucial or essential equipment for large-scale construction projects, including high-rise buildings and industrial or manufacturing facilities and continuous improvements in tower crane technology and capabilities that make them more appealing to construction companies who are looking to optimize their operations better.

By Capacity Analysis

- 21 to 50 tons segment held the maximum market share in 2022

The 21 to 50 tons’ segment held the majority market share in terms of revenue in 2022, which is majorly driven by its surging use in port and shipyard operations that often require heavy lifting equipment for easier and convenient loading and unloading of cargo containers coupled with its ability to offer a balance between maneuverability and lifting capacity that allow it to also operate in confined spaces. Besides this, the exponential rise in the e-commerce industry and a growing number of people shopping through online platforms is resulting in a significant burden on ports to manage a large number of containers, which, in turn, positively influences the growth of the market.

By Application Analysis

- The mining segment is projected to exhibit the highest growth over the projected period.

The mining segment is projected to grow at the highest growth rate over the next coming years, mainly due to a surge in the need and demand for various minerals and sources, including coal, iron ore, copper, and gold, among others, and greater need for advanced and specialized equipment like carry deck cranes in mining sectors to improve or enhance the versatility and safety the operations.

The construction & infrastructure segment led the industry market with a substantial share in 2022 and is mainly driven by a large number of potential applications of these types of cranes in manufacturing plants and industrial facilities and a growing trend of urbanization that leads to the construction of new buildings & infrastructure in the cities.

Regional Insights

- North America region dominated the global market in 2022.

The North American region dominated the global market, which is mainly attributable to rising investments in infrastructure projects such as bridges, highways, and airports and the growing renewable energy sector, including wind and solar energy projects that all require carry deck cranes for the installation and maintenance of crucial equipment.

The Asia Pacific region is anticipated to emerge as the fastest growing region, owing to the presence of several favorable government initiatives and policies that support or promote infrastructure development and industrial growth, such as the growing implementation of high-speed trains in countries like India and Indonesia. Apart from this, the substantial increase in international trade and maritime activities in the Asia Pacific region and significant economic growth and FDIs also drive the demand for carry deck cranes at a rapid pace.

Key Market Players & Competitive Insights

The carry deck crane market is moderately competitive, with the presence of several large global and regional market players. The top market players operating in the market are significantly focusing on various business development and expansion strategies, including partnerships, collaborations, acquisitions & mergers, and new product launches, which helps them to expand their customer base and geographical presence.

Some of the major players operating in the global market include:

- Appleton Marine Inc.

- Bailey & Associates

- Bailey Specialty Crane and Aerials

- Broderson Manufacturing

- Hawboldt Industries Ltd.

- Ini Hydraulic

- Lift Systems

- Manitex International

- Manitowoc Cranes

- Mitsubishi Heavy Industries Ltd.

- Nucleon Crane

- The Company Palfinger AG

- The Liebherr Group

Recent Developments

- In February 2021, Broderson Manufacturing introduced an 18 tn capacity IC-280-A carry deck crane. The newly launched crane features a 19.6 m 4-section, compact boom head, & 20-ft boom extension, which offsets at 0,15, & 30 degrees.

- In October 2022, Manitowoc introduced its new Grove GRT8100-1 rough-terrain crane, which comes with a series of improvements over the previous GRT8100. It has the same impressive 360º load charts and maintains the same positions in every dimension, counterweight, & 5-section full-power MEGAFORM boom.

Carry Deck Crane Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 524.84 million |

|

Revenue Forecast in 2032 |

USD 802.41 million |

|

CAGR |

4.8% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Capacity, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |