Cell Culture Media & Cell Lines Market Size, Share, Trends, Industry Analysis Report

By Product (Traditional Cell Lines, Classical Media), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6141

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

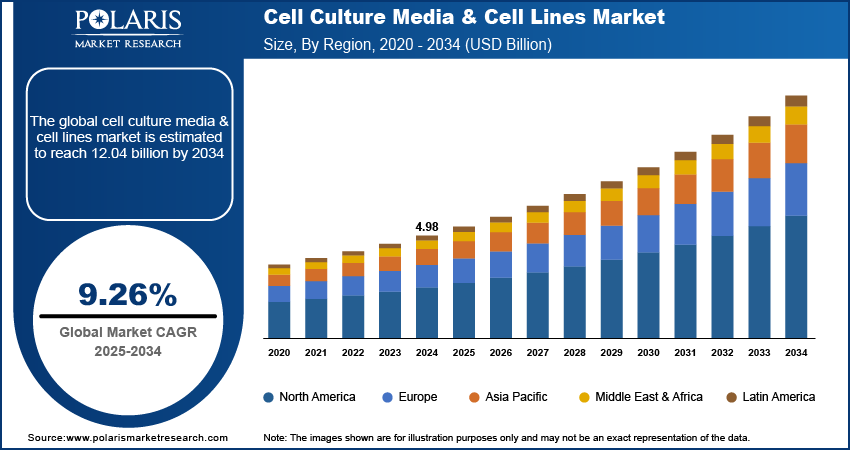

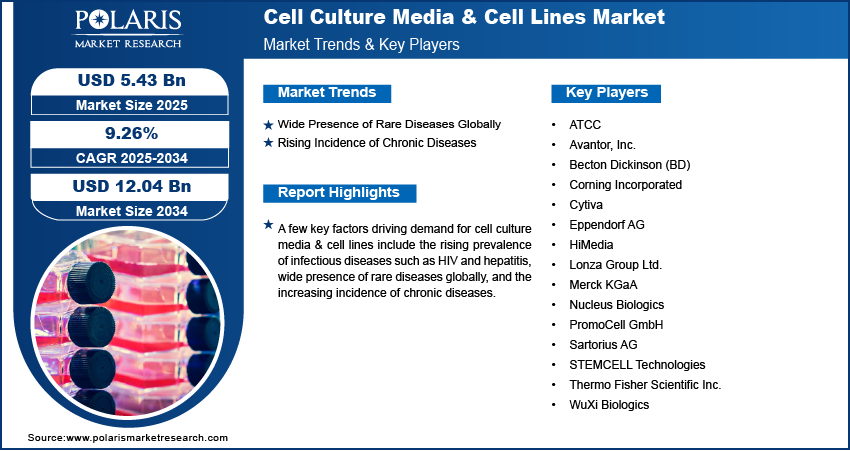

The global cell culture media & cell lines market size was valued at USD 4.98 billion in 2024, growing at a CAGR of 9.26% from 2025 to 2034. A few key factors driving demand for cell culture media & cell lines include the rising prevalence of infectious diseases, such as such as HIV and hepatitis, wide presence of rare diseases globally, and rising incidence of chronic diseases.

Key Insights

- The specialty media segment accounted for 43.17% of revenue share in 2024, due to its growing usage in advanced biopharmaceutical research.

- The biopharmaceutical production segment held 45.21% of revenue share in 2024, due to rising demand for biologics.

- North America accounted for a 44.15% share of the global cell culture media & cell lines market revenue in 2024. This dominance is attributed to huge investments in biopharmaceutical R&D.

- The U.S. held the largest revenue share of the North America cell culture media & cell lines landscape in 2024, established biopharmaceutical industry.

- The market in Europe is projected to hold a substantial market share in 2034, increasing biopharmaceutical production.

- The demand for cell culture media & cell lines in Germany is projected to rise during the forecast period, owing to its strong biotechnology sector and rising healthcare expenditure.

Industry Dynamics

- The wide presence of rare diseases globally is fueling the demand for cell culture media & cell lines as researchers need these tools to understand the underlying genetic and molecular mechanisms of rare diseases.

- The rising incidence of chronic diseases is propelling the adoption of cell culture media & cell lines as they are used in the development of chronic disease therapy to investigate cellular responses, genetic mutations, and the effects of new drugs in vitro.

- The increasing healthcare expenditure and ongoing cancer research are creating a lucrative market opportunity.

- The high cost and specialized expertise associated with cell culture media & cell lines impede the market growth.

Market Statistics

- 2024 Market Size: USD 4.98 Billion

- 2034 Projected Market Size: USD 12.04 Billion

- CAGR (2025–2034): 9.26%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Cell culture media and cell lines play a foundational role in modern biological research, pharmaceutical development, and biotechnology. Cell culture media refers to a nutrient-rich solution used to support the growth and maintenance of cells in vitro. This media usually contains essential amino acids, vitamins, glucose, salts, and a buffering system to maintain pH balance. Cell lines, on the other hand, are populations of cells derived from a single cell and grown under controlled conditions for extended periods. These cells can be categorized into primary cells, finite cell lines, and continuous or immortalized cell lines.

The usage of cell culture media and cell lines spans across a wide range of applications. Cell culture media and cell lines are utilized in drug discovery, as they are crucial for screening and evaluating the efficacy and toxicity of potential therapeutic compounds before clinical testing. In vaccine production, cell lines are used to cultivate viruses or express proteins used in vaccine formulations. Cell culture also enables genetic engineering, monoclonal antibody production, and recombinant protein synthesis, especially using mammalian cell lines such as CHO due to their ability to perform human-like post-translational modifications. Additionally, in cancer research, scientists use tumor-derived cell lines to study disease mechanisms, test anticancer agents, and explore resistance pathways. Diagnostic laboratories use cultured cells to detect viral infections and to produce diagnostic reagents.

The global cell culture media & cell lines market demand is attributed to the rising prevalence of infectious diseases, such as HIV and hepatitis. World Health Organization (WHO) 2024 Global Hepatitis Report stated that hepatitis is the second leading cause of death globally, with 1.3 million deaths per year. This is driving scientists and researchers worldwide to accelerate the development of targeted treatments, which is increasing the need for cell lines, as these lines are used to replicate disease mechanisms and test therapeutic responses in controlled environments.

Drivers and Opportunities

Wide Presence of Rare Diseases Globally: The wide presence of rare diseases globally is fueling the demand for cell culture media and cell lines, as researchers need advanced tools to understand the underlying genetic and molecular mechanisms of these rare conditions. According to data published by the World Economic Forum in 2023, an estimated 400–475 million people across the world are affected by a rare disease. Scientists use specialized cell lines to model rare diseases in vitro, allowing them to study disease progression and identify potential therapeutic targets. Pharmaceutical and biotech companies are also investing in the development of rare disease drugs, driven by a wide presence of rare disease patients. This is increasing the need for specialty media formulations. Moreover, governments and regulatory bodies are encouraging rare disease research through incentives and funding, which further are accelerating the use of cell culture technologies. Therefore, as awareness and diagnosis of rare conditions improve, demand for precise and reliable culture systems continues to rise across academic, clinical, and industrial research settings.

Rising Incidence of Chronic Diseases: Scientists involved in the development of therapy for various chronic diseases are using disease-specific cell lines to investigate cellular responses, genetic mutations, and the effects of new drugs in vitro. Pharmaceutical companies are also expanding their pipelines for chronic disease treatments, increasing the need for consistent, high-performance culture media that support large-scale cell growth and experimentation. Additionally, hospitals and diagnostic laboratories rely on cell-based assays for personalized medicine approaches and biomarker discovery for the treatment of chronic diseases. Thus, as the burden of chronic diseases increases globally, demand for effective research tools, including cell culture products, continues to intensify.

Segmental Insights

Product Analysis

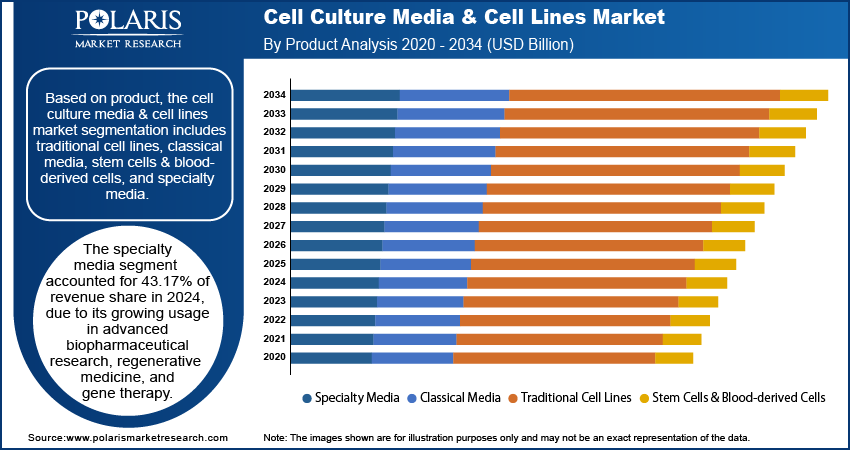

Based on product, the segmentation includes traditional cell lines, classical media, stem cells & blood-derived cells, and specialty media. The specialty media segment accounted for 43.17% of revenue share in 2024 due to its growing usage in advanced biopharmaceutical research, regenerative medicine, and gene therapy. Researchers increasingly preferred these media formulations as they offer optimized and targeted nutrient compositions that support the growth and maintenance of specific cell types under stringent conditions. The rise in biologics and monoclonal antibody production further drove demand for specialized media that ensure higher cell viability and consistent yields. Moreover, the surge in chronic and rare diseases prompted pharmaceutical companies to intensify R&D efforts, relying heavily on specialty media solutions to streamline drug development workflows. The expansion of contract manufacturing and research organizations also contributed to the widespread adoption of specialty media, as these players focused on scalable and efficient production systems.

The stem cells & blood-derived cells segment is projected to grow at a robust pace in the coming years owing to the rapid advancements in cell-based therapies and personalized medicines. Increasing investments in stem cell research, coupled with breakthroughs in induced pluripotent stem cells (iPSCs) and hematopoietic stem cells, spurred demand for high-quality cell lines derived from human sources. The growth of the segment is further propelled by its usage in tissue engineering, disease modeling, and immunotherapy, particularly in oncology and neurodegenerative disorders.

Application Analysis

In terms of application, the segmentation includes biopharmaceutical production, diagnostics, drug screening and development, tissue engineering and regenerative medicine, and others. The biopharmaceutical production segment held 45.21% of revenue share in 2024, due to rising demand for biologics, including monoclonal antibodies, recombinant proteins, and vaccines. Biopharma manufacturers increasingly relied on advanced cell culture systems to ensure consistent, scalable, and high production processes. The global rise in the prevalence of chronic diseases, coupled with a growing aging population, fueled the need for targeted biologic therapies, prompting companies to expand their manufacturing capacities. Additionally, the expansion of biosimilar pipelines and government support for biopharma innovation in key regions such as North America, Europe, and Asia Pacific strengthened the dominance of the application area.

End Use Analysis

In terms of end use, the segmentation includes large biopharmaceutical companies, small and mid-sized biotechnology companies, contract research and manufacturing organizations (CROs/CMOs), research and academic institutes, hospitals and diagnostic laboratories, and others. The large biopharmaceutical companies segment dominated the revenue share in 2024 due to their huge investments in biologics development and large-scale manufacturing capabilities. These companies expanded their production infrastructure to meet the growing demand for monoclonal antibodies, vaccines, and cell-based therapies, which drove the adoption of cell culture media & cell lines.

The contract research and manufacturing organizations (CROs/CMOs) segment is expected to grow at a rapid pace in the coming years. Biotech startups and mid-sized firms are increasingly outsourcing development and production processes to these service providers to reduce operational costs. The rising complexity of biologic drugs and personalized therapies are further driving demand for specialized outsourcing partners with expertise in custom media formulation and scalable cell culture systems.

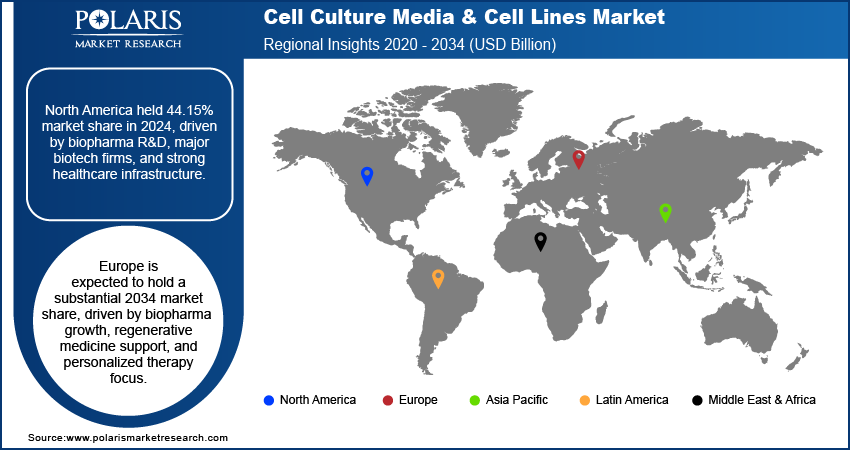

Regional Analysis

The North America cell culture media & cell lines market accounted for 44.15% of global revenue share in 2024. This dominance is attributed to huge investments in biopharmaceutical R&D, a strong presence of major biotech and pharmaceutical companies, and advanced healthcare infrastructure. The high prevalence of chronic diseases and the growing demand for biologics and biosimilars further drove demand for cell culture media & cell lines in North America. Health of Canadians report, published by Statistics Canada, revealed that 45.1% of Canadians had at least one major chronic disease in 2021. Additionally, government funding for stem cell research and regenerative medicine, along with the expansion of personalized medicine, further fueled market growth in the region.

U.S. Cell Culture Media & Cell Lines Market Insights

The U.S. held the largest revenue share in the North America cell culture media & cell lines landscape in 2024 due to high R&D expenditure, the established biopharmaceutical industry, and the increasing adoption of cell-based therapies. The rise in cancer research, vaccine development, and advancements in gene therapy further contributed to cell culture media & cell lines demand in the U.S. Regulatory support from agencies such as the FDA, along with collaborations between academic institutions and biotech firms, fueled innovation and commercialization of cell-based products such cell culture media & cell lines in the U.S. in 2024.

Europe Cell Culture Media & Cell Lines Market Trends

The market in Europe is projected to hold a substantial revenue share in 2034 due to increasing biopharmaceutical production, strong government support for regenerative medicine, and a growing focus on personalized therapies. The presence of prominent pharmaceutical companies and academic research hubs in countries such as Germany, the UK, and France is driving innovation in the industry. Additionally, the European Medicines Agency (EMA) is providing a favorable regulatory environment for advanced therapies, further boosting industry growth. Rising investments in stem cell research and cancer immunotherapy are also contributing to cell culture media & cell lines demand in Europe.

Germany Cell Culture Media & Cell Lines Market Overview

The demand for cell culture media & cell lines in Germany is projected to expand during the forecast period, owing to its strong biotechnology sector and rising healthcare expenditure. Health expenditure in Germany rose to USD 526.3 billion in 2022 from USD 499.9 billion in 2021. The country’s focus on precision medicine, increasing clinical trials for cell-based therapies, and government initiatives promoting life sciences research further propel demand for cell culture media. Germany’s well-developed pharmaceutical industry and collaborations between research institutes and biotech firms are also enhancing the adoption of advanced cell culture technologies. The growing need for monoclonal antibodies and vaccines is further fueling market expansion.

Asia Pacific Cell Culture Media & Cell Lines Market Assessment

The market in the Asia Pacific is projected to grow at the fastest pace in the coming years, owing to increasing biopharmaceutical manufacturing, rising R&D investments, and expanding contract research organizations (CROs). Countries such as China, India, Japan, and South Korea are major contributors in the industry, driven by government initiatives to strengthen biotechnology infrastructure and the outsourcing of drug development. The growing prevalence of chronic diseases, increasing vaccine production, and advancements in stem cell research further accelerate industry growth. Additionally, cost advantages in manufacturing and a large patient pool make Asia Pacific an attractive hub for cell culture-based research and production, leading to market growth.

Key Players & Competitive Analysis

The cell culture media and cell lines landscape is highly competitive, characterized by the presence of established pharmaceutical, biotechnology, and life sciences companies, as well as specialized suppliers. Major players such as Thermo Fisher Scientific, Merck KGaA, and Sartorius AG dominate the share, leveraging their extensive product portfolios, strong R&D capabilities, and global distribution networks. Thermo Fisher Scientific, through its Gibco brand, offers a wide range of cell culture media, sera, and reagents, maintaining a competitive edge through continuous innovation and strategic acquisitions. Similarly, Merck KGaA provides high-performance media formulations and cell lines, supported by advanced bioprocessing technologies. Sartorius AG has strengthened its position through acquisitions, enhancing its cell culture solutions for biopharmaceutical applications.

The industry is witnessing increasing competition from regional players and low-cost manufacturers, particularly in Asia Pacific, where companies such as HiMedia are expanding their presence. Technological advancements, such as serum-free and chemically defined media, along with the shift toward 3D cell culture systems, are driving innovation and intensifying competition. Strategic collaborations, partnerships, and M&A activities remain key growth strategies as companies aim to expand their product offerings and geographic reach.

A few major companies operating in the cell culture media & cell lines industry include ATCC; Avantor, Inc.; Becton Dickinson (BD); Corning Incorporated; Cytiva; Eppendorf AG; HiMedia; Lonza Group Ltd.; Merck KGaA; PromoCell GmbH; Sartorius AG; STEMCELL Technologies; Thermo Fisher Scientific Inc.; and WuXi Biologics.

Key Players

- ATCC

- Avantor, Inc.

- Becton Dickinson (BD)

- Corning Incorporated

- Cytiva

- Eppendorf AG

- HiMedia

- Lonza Group Ltd.

- Merck KGaA

- Nucleus Biologics

- PromoCell GmbH

- Sartorius AG

- STEMCELL Technologies

- Thermo Fisher Scientific Inc.

- WuXi Biologics

Cell Culture Media & Cell Lines Industry Developments

In August 2024, Nucleus Biologics announced the launch of QuickStart Media, a groundbreaking addition to its comprehensive line of cell culture products and solutions.

In April 2024, Cytiva introduced new cell lines to meet the challenges and increasing demand of viral vector manufacturing.

In November 2023, Lonza announced the launch of its new GS Effex cell line for the development of therapeutic antibodies with enhanced potency.

Cell Culture Media & Cell Lines Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Traditional Cell Lines

- Classical Media

- Stem Cells & Blood-derived Cells

- Specialty Media

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Biopharmaceutical Production

- Diagnostics

- Drug Screening and Development

- Tissue Engineering and Regenerative Medicine

- Other

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Large Biopharmaceutical Companies

- Small and Mid-sized Biotechnology Companies

- Contract Research and Manufacturing Organizations (CROs/CMOs)

- Research and Academic Institutes

- Hospitals and Diagnostic Laboratories

- Other

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell Culture Media & Cell Lines Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.98 Billion |

|

Market Size in 2025 |

USD 5.43 Billion |

|

Revenue Forecast by 2034 |

USD 12.04 Billion |

|

CAGR |

9.26% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.98 billion in 2024 and is projected to grow to USD 12.04 billion by 2034.

The global market is projected to register a CAGR of 9.26% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are ATCC; Avantor, Inc.; Becton Dickinson (BD); Corning Incorporated; Cytiva; Eppendorf AG; HiMedia; Lonza Group Ltd.; Merck KGaA; PromoCell GmbH; Sartorius AG; STEMCELL Technologies; Thermo Fisher Scientific Inc.; and WuXi Biologics.

The specialty media segment dominated the market revenue share in 2024.

The contract research and manufacturing organizations (CROs/CMOs) segment is projected to witness the fastest growth during the forecast period.