Cement Board Market Share, Size, Trends, Industry Analysis Report

By Construction Type (Commercial Buildings, Residential Buildings, Industrial Buildings, and Others); By Product Type; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 117

- Format: PDF

- Report ID: PM2857

- Base Year: 2024

- Historical Data: 2020-2023

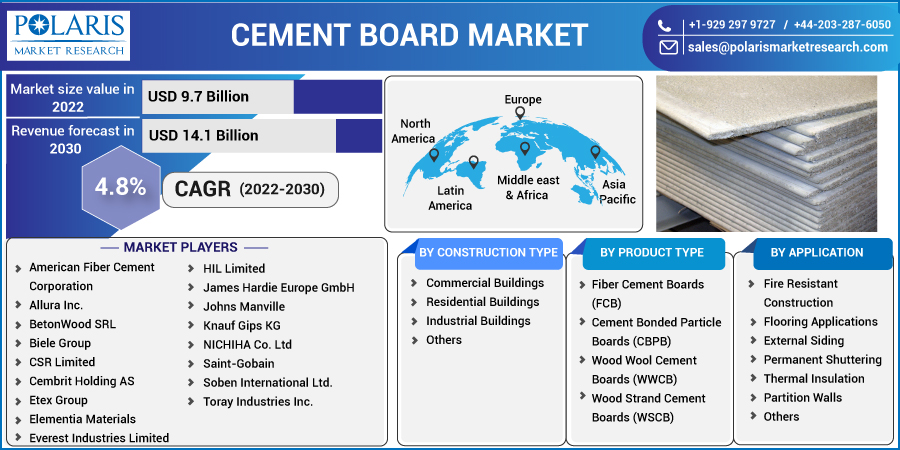

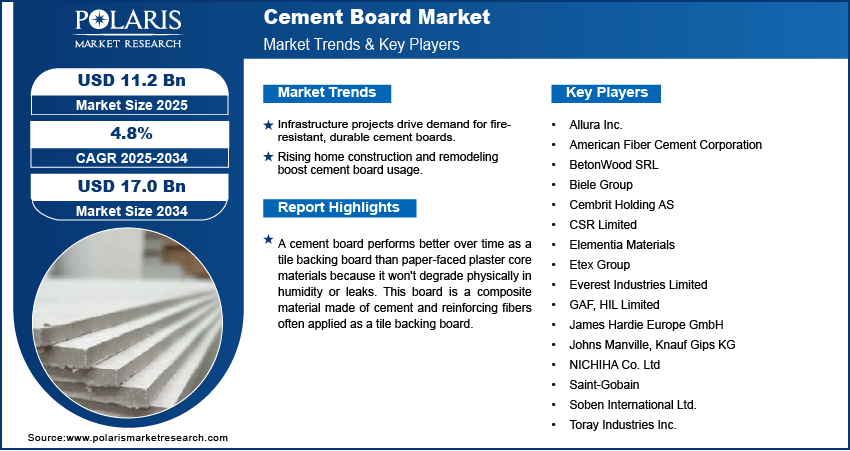

The global cement board market was valued at USD 10.7 billion in 2024 and is expected to grow at a CAGR of 4.8% during the forecast period. Key factors driving demand include rising investments from the government for infrastructure development and strong growth in residential sector.

Key Insights

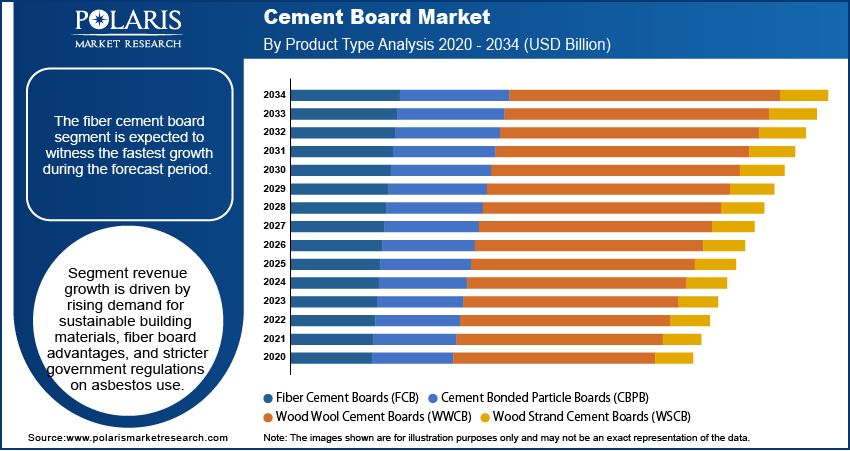

- The fiber cement board segment is expected to witness the fastest growth during the forecast period. This is due to the rise in consumer demand for environmentally friendly and sustainable building materials.

- The commercial segment industry dominated the market share in 2024. This is due to the increased use of cement panels in the commercial industry.

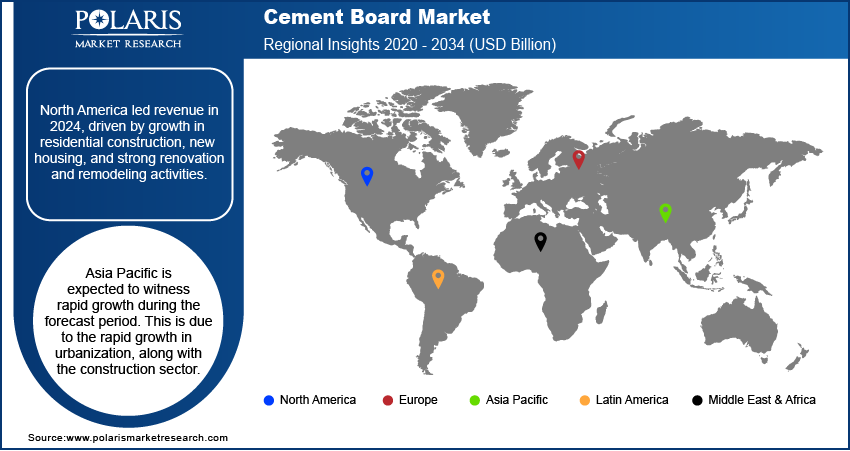

- North America accounted for the largest revenue share in 2024. This is attributed to the growth in the residential construction sector. New house construction and resilient activity in renovation and remodeling have boosted the demand for these products.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the rapid growth in urbanization, along with the construction sector.

Industry Dynamics

- Facilities and highway projects require fire-resistant and durable materials like cement board, which has boosted the demand for these applications..

- The growth in remodeling and new house construction boosts the use of these boards in areas such as the kitchen and bathroom as a durable product.

- Changes in raw material prices and the cost of energy impact the profit margins of the manufacturers, which makes production and planning difficult.

- Rise in demand for sustainable materials have created growth opportunities for green buildings and disaster resilient infrastructure.

Market Statistics

- 2024 Market Size: USD 10.7 billion

- 2034 Projected Market Size: USD 17.0 billion

- CAGR (2025-2034): 4.8%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A cement board performs better over time as a tile backing board than paper-faced plaster core materials because it won't degrade physically in humidity or leaks. This board is a composite material made of cement and reinforcing fibers often applied as a tile backing board. The benefits of cement boards across various applications, such as commercial and residential buildings, are the major factor boosting the market growth over the forecast period. Cement is also manufactured in thin sheets with polymeric modifications to enable bending for complex shapes.

Compared to standard gypsum board, cement board offers a stronger bond and support for tiles. Concrete paneling is not watertight. It also absorbs moisture, but it also dries things out quite well. A waterproofing substance is typically advised behind the floorboards or as a trowel-applied solution to the surface of the boards behind the finishing system in places constantly exposed to spray bottles.

Furthermore, the rising urbanization has led to an increase in the demand for building and construction of new facilities, driving market growth. For instance, as per the WHO, by 2050, 68% of the people worldwide, or more than 55%, are anticipated to reside in urban regions.

Also, for buildings and construction projects, cement boards create robust frameworks. These boards provide several advantageous qualities, including fire resistance, water resistance, shock resistance, and simplicity in transportation and installation. Because of these qualities, they are preferred for market applications, including floors and roofs, ceilings, external and partition walls, façade, fire-resistant furniture, etc. These benefits and various applications are boosting the demand for cement boards.

The market suffered as a result of the current coronavirus outbreak. The lockout badly hurt the construction sector, which badly affected the demand for cement boards. The COVID-19 epidemic and almost nonexistent economic activity will probably negatively influence construction growth, with short-term market effects being taken into account. Due to a lack of funding, several projects sputtered in the beginning. Due to changing consumer tastes, completed products remained unsold, indirectly contributing to the market's expansion. However, the COVID-19 pandemic is still actively spreading and very volatile, and it still needs to be determined how it will affect the company's operations and financial results in the long run.

Industry Dynamics

Growth Drivers

The market for cement boards will continue to expand due to rising infrastructure development and residential construction spending. According to the International Journal of Science, Engineering, and Technology Research (IJSETR), the Indian government initiated several measures to upsurge the infrastructure and construction industry and allocated around $16 billion to the Jawaharlal Nehru National Urban Renewal Mission (JNNURM). The funds provided by the government were aimed at integrating the expansion of innovative infrastructure in rural areas. It aims to develop smart cities and lifts allied sectors such as construction material, cement, and steel.

Moreover, the rapid migration of the population to cities from rural areas further escalates the demand for urban cities in India. In Union Budget (2022-23), by committing US$ 130.57 billion to improve infrastructure, the government has given the sector a significant boost. The Ministry of Housing and Urban Affairs would get USD 9.8 billion from the government.

According to IBEF, the Internal Trade department (DPIIT) estimates that foreign direct investments (FDIs) in the building construction sector (towns and villages, residences, built-up facilities, and building and construction projects) and construction activities between April 2000 and March 2022 totaled USD 26.2 billion and USD 27.9 billion, including both. Government officials added 9,335 new projects to the "National Infrastructure Pipeline" (NIP). By 2020, 217 projects totaling USD 15.1 billion were finished. Thus, the rising investments from the government for infrastructure development are boosting the demand for cement boards, driving market growth.

Report Segmentation

The market is primarily segmented based on construction type, product type, application, and region.

|

By Construction Type |

By Product Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Product Analysis

The fiber cement board segment is expected to witness the fastest growth during the forecast period. Rising consumer demand for environmentally friendly and sustainable building materials, the advantages of the fiber boards over competing materials, and tightening government rules on the use of asbestos are the main drivers influencing segment revenue growth. FCB is the building material created by combining cement in certain amounts with different types of organic or mineral fibers.

Furthermore, Sidings, carpeting, ceiling, roofing materials, roof structure and trimmings, and tiles backing board are a few of the major uses for fiber cement board. Due to qualities including exceptional durability and water resistance along with its waterproof nature, the material is increasingly being used for siding uses in bathrooms and kitchens. Rising construction expenditure, particularly for new dwellings, is anticipated to increase product demand.

In recent years, product acceptance has expanded in key end-use sectors such as residential, commercial, and others. The rapidly growing residential sector primarily drives the segment, and throughout the forecast period, favorable governmental policies and rising environmental awareness are anticipated to fuel market revenue growth.

Construction Type Analysis

The commercial segment industry accounted for the largest market share in 2024. A critical market segment for cement panels is the commercial sector. The business sector is one of the key markets for using cement panels in the commercial industry. Cement boards are in high demand in this market sector due to growing commercial activity worldwide. These reasons continue to fuel the need for cement boards in commercial construction, and steady growth is anticipated throughout the projection period.

Regional Analysis

North America Cement Board Market Insights

North America accounted for the largest revenue share in 2024. This is attributed to the growth in the residential construction sector. New house construction and resilient activity in renovation and remodeling have boosted the demand for these products. These activities resulted in steady demand for products, with cement board being the preferred product of choice with its performance and durability characteristics. Moreover, the strict building codes in this region dictate resistance to fire and stability in extreme weather conditions further contributes to expansion opportunities for the cement board market.

Asia Pacific Cement Board Market Assessment

Asia Pacific is expected to witness fastest growth during the forecast period. The rapidly rising urbanization along with the construction section is boosting the demand for cement boards in the Asia-Pacific region. For instance, as per the World Health Organization (WHO), China is actively encouraging and enacting a continuous urbanization process, with a 70% target rate for 2030. According to the “Healthy China 2030 Plan”, China will have established several pilot healthy cities by the year 2030. The country's housing market may be significantly impacted by the increased living spaces needed in the urban areas and booming middle class with high disposable income. This will likely lead to an increase in residential construction, which is then anticipated to positively impact the nation’s market.

Furthermore, the Indian government is pushing for massive projects to be completed in the following few years. By 2022, the "Housing for All by 2022" initiative seeks to construct 20 million low-income homes in both urban and rural locations at a budgeted amount of USD 31 billion. The Ministry of Housing and Urban Affairs is responsible for housing and residential areas in urban areas in India. The MoHUA anticipated a 30 million units housing problem, by 2022, due to the rising population. By the forecast period's conclusion, India's construction market is expected to grow to be the third-largest market globally. The worldwide hotel sector has been increasing primarily due to Asia-Pacific.

Key Players & Competitive Analysis Report

Some of the major players operating in the global market include American Fiber Cement Corporation, Allura Inc., BetonWood SRL, Biele Group, CSR Limited, Cembrit Holding, Etex Group, Elementia Materials, Everest Industries, GAF, HIL Limited, James Hardie Europe, Johns Manville, Knauf Gips, NICHIHA, Saint-Gobain, Soben International, and Toray Industries.

Industry Developments

June 2025: Adani Cement and CREDAI collaborated to advance sustainable and high-quality construction in India. Adani Cement will leverage CREDAI’s nationwide network of 13,000+ developers to strengthen its B2B outreach, while CREDAI members benefit from Adani Cement’s industry-leading solutions.

April 2025: The China Building Materials Federation, Conch Group, and Huawei launched their AI model for the cement building materials industry. The model is the first of its kind for the cement building materials sector.

January 2021: Sahyadri Industries launched Ecopro-S3 multi-use fiber cement in the Keralan market. Since the production facility at Perundurai in Coimbatore has a capacity of roughly 13,000 tonnes, the company is considering increasing the new product's production there. A manufacturing facility is also available for it in Vijayawada.

June 2020: Cembrit announced the release of Patina Rough, a distinctive through-colored cladding board with a sandblasted texture that gives the board a lovely, stone-effect appearance. With its directed surface of the particles, Patina Rough compliments the original Patina to provide architects and specifiers with a desirable selection of quality paneling for a wide range of exterior applications.

Cement Board Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.7 billion |

| Market size value in 2025 | USD 11.2 billion |

|

Revenue forecast in 2034 |

USD 17.0 billion |

|

CAGR |

4.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Product Type, By Construction Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

American Fiber Cement Corporation, Allura Inc., BetonWood SRL, Biele Group, CSR Limited, Cembrit Holding AS, Etex Group, Elementia Materials, Everest Industries Limited, GAF, HIL Limited, James Hardie Europe GmbH, Johns Manville, Knauf Gips KG, NICHIHA Co. Ltd, Saint-Gobain, Soben International Ltd., and Toray Industries Inc. |

FAQ's

• The global market size was valued at USD 10.7 billion in 2024 and is projected to grow to USD 17.0 billion by 2034.

• The global market is projected to register a CAGR of 4.8% during the forecast period.

• North America accounted for largest of global share in 2024.

• A few market players are American Fiber Cement Corporation, Allura Inc., BetonWood SRL, Biele Group, CSR Limited, Cembrit Holding AS, Etex Group, Elementia Materials, Everest Industries Limited, GAF, HIL Limited, James Hardie Europe GmbH, Johns Manville, Knauf Gips KG, NICHIHA Co. Ltd, Saint-Gobain, Soben International Ltd., and Toray Industries Inc.

• The commercial segment industry accounted for the largest market share in 2024.

• The fiber cement board segment is expected to witness the fastest growth during the forecast period.