Fiber Cement Market Size, Share, Trends, Industry Analysis Report

By Material (Portland, Silica, Cellulosic, Others), By Product, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6276

- Base Year: 2024

- Historical Data: 2020-2023

Overview

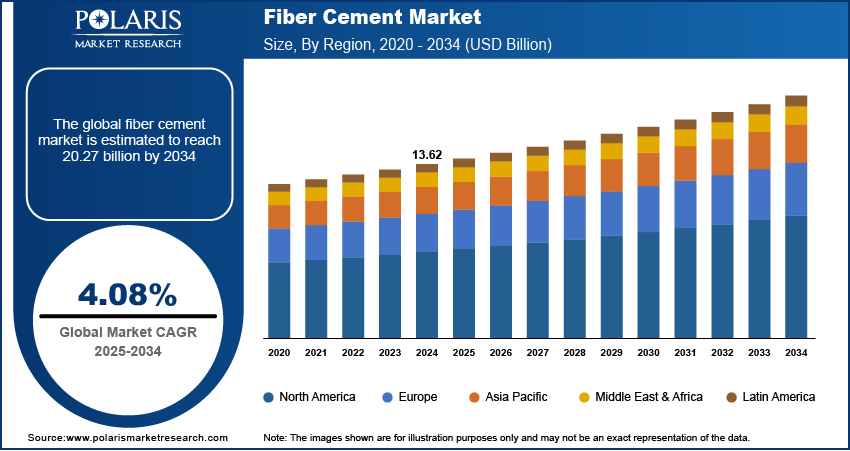

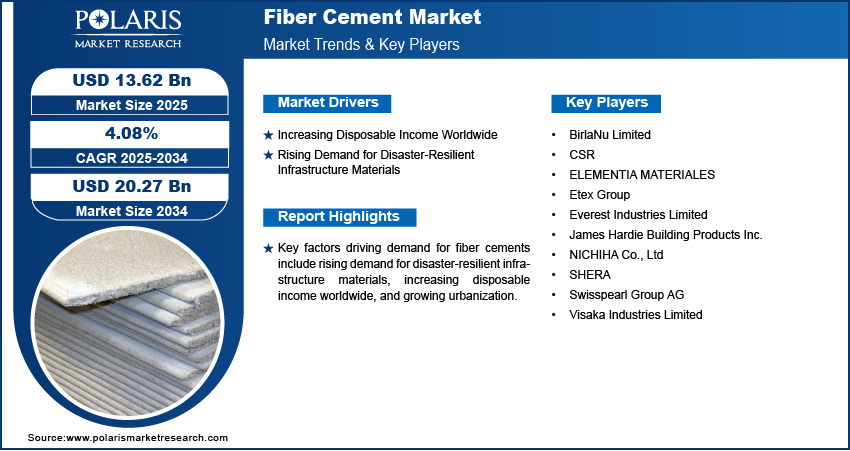

The global fiber cement market size was valued at USD 13.62 billion in 2024, growing at a CAGR of 4.08% from 2025 to 2034. Key factors driving demand for fiber cements include rising demand for disaster-resilient infrastructure materials, increasing disposable income worldwide, and growing urbanization.

Key Insights

- The portland segment accounted for a major revenue share in 2024 due to its cost-effectiveness.

- The siding/weatherboard segment dominated the revenue share in 2024 due to its resistance to termites and rot.

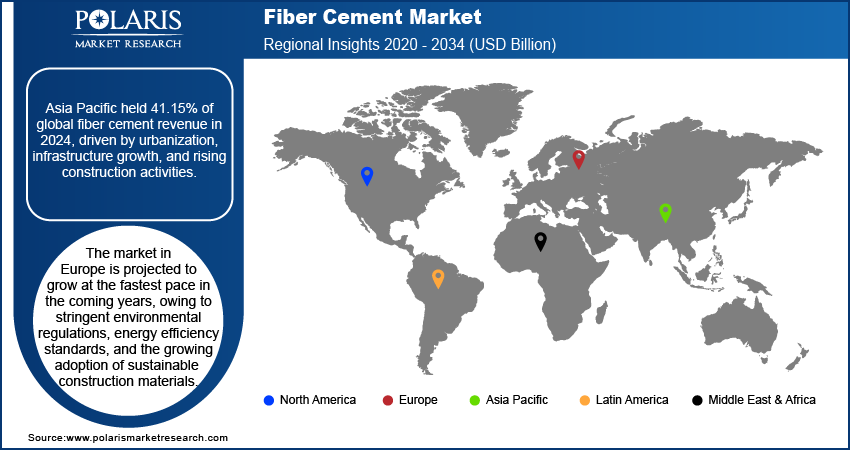

- Asia Pacific accounted for 41.15% of the global fiber cement market revenue share in 2024, owing to infrastructure development and increasing construction activities.

- China held the largest revenue share in the Asia Pacific fiber cement landscape in 2024, due to the push for green building materials.

- The industry in Europe is projected to grow at the fastest pace in the coming years, owing to energy efficiency standards and the growing construction activities.

Industry Dynamics

- The increasing disposable income worldwide is propelling the adoption of fiber cement by enabling people to prioritize durable and fire-resistant building materials.

- The rising demand for disaster-resilient infrastructure materials is fueling the fiber cement market growth as it offers superior resistance to hurricanes, wildfires, and moisture damage.

- The expanding fire regulation and sustainable building norms are expected to create a lucrative market opportunity during the forecast period.

- The high cost associated with fiber cement products, such as fiber cement boards and cladding, hinders the market growth.

AI Impact on Fiber Cement Market

- Artificial intelligence (AI) is streamlining fiber cement manufacturing by optimizing material mix and reducing waste.

- Predictive maintenance powered by AI is minimizing equipment downtime and boosting production efficiency.

- AI-driven quality control systems are ensuring consistent product standards and reducing defects.

- AI integration in supply chain management is enhancing logistics, inventory accuracy, and cost-efficiency.

Market Statistics

- 2024 Market Size: USD 13.62 Billion

- 2034 Projected Market Size: USD 20.27 Billion

- CAGR (2025–2034): 4.08%

- Asia Pacific: Largest Market Share

Fiber cement is a durable building material composed of cement, sand, cellulose fibers, and water. Manufacturers mix these materials to create a strong, weather-resistant product that mimics the appearance of wood, stucco, or masonry. Builders and architects use fiber cement for exterior siding, roofing, wall cladding, and even interior applications in high-moisture areas. It resists damage from rot, fire, insects, and extreme weather conditions, making it suitable for both residential and commercial buildings.

Fiber cement provides excellent fire resistance due to its non-combustible nature, which enhances safety in fire-prone regions. Unlike wood, it does not swell or deteriorate from moisture, reducing maintenance needs. Homeowners and developers also appreciate its design flexibility, as fiber cement replicates various textures and finishes. Fiber cement also holds paint well, maintaining vibrant colors longer than other exterior materials. Additionally, fiber cement contributes to sustainability as it uses natural and recyclable components.

The global demand for fiber cement is driven by the growing urbanization. United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population by 2050. This is fueling urban developers to use fiber cement as it offers fire resistance, weather durability, and design versatility, making it ideal for high-density housing and modern infrastructure projects. Rising urban populations are also driving the need for sustainable and cost-effective construction solutions, such as fiber cement. Additionally, stricter building codes in urban areas are mandating materials with higher safety and longevity standards, further boosting fiber cement adoption.

Drivers & Opportunities

Increasing Disposable Income Worldwide: Rising disposable income across the globe is expanding the financial flexibility of people, which enables them to prioritize durable and fire-resistant building materials such as fiber cement over cheaper, less resilient alternatives such as vinyl or wood. According to the National Bureau of Statistics of China, the per capita disposable income in China was 41,314 yuan or USD 5.75 thousand in 2024, a nominal increase of 5.3% from 2023. Rising income is also fueling demand for aesthetically pleasing and customizable exteriors, where fiber cement excels due to its versatility in mimicking wood, stone, or stucco. Additionally, homeowners with high disposable income usually opt for premium upgrades that enhance property value, and fiber cement’s weather durability makes it an attractive choice. Therefore, as disposable incomes grow, more people can afford fiber cement, driving its adoption in both residential and commercial construction.

Rising Demand for Disaster-Resilient Infrastructure Materials: Fiber cement offers superior resistance to hurricanes, wildfires, and moisture damage, making it a reliable choice for disaster-prone regions. Governments and insurers are encouraging their use in disaster-prone regions by offering incentives or stricter building codes that favor durable, non-combustible materials. Building developers are also turning to fiber cement for its long-term durability and safety benefits over traditional wood or vinyl siding. Therefore, this growing emphasis on infrastructure resilience ensures that fiber cement becomes a preferred material in both residential and commercial construction.

Segmental Insights

Material Analysis

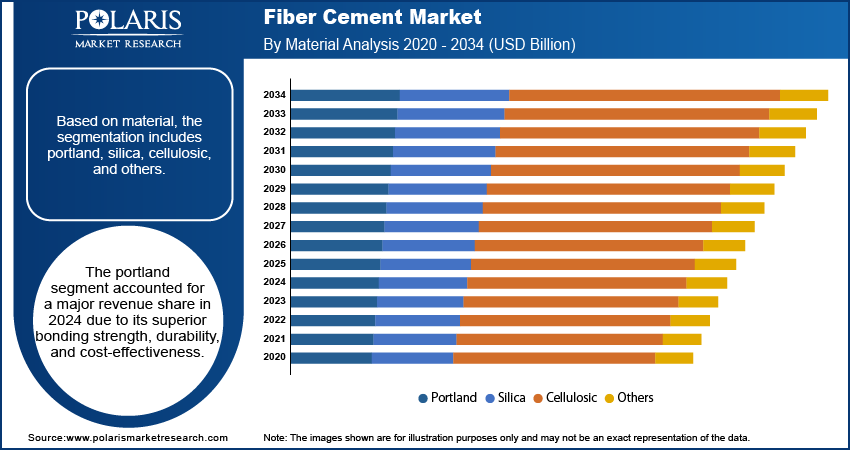

Based on material, the segmentation includes portland, silica, cellulosic, and others. The portland segment accounted for a major revenue share in 2024 due to its superior bonding strength, durability, and cost-effectiveness. Manufacturers preferred portland-based formulations for producing siding boards, roofing sheets, and backer boards as they offer excellent mechanical performance and compatibility with cellulose fibers. The widespread availability of portland cement and its established supply chain also supported the segment’s dominance. Additionally, increasing construction activities across emerging countries and the renovation of aging infrastructure in developed regions contributed to the high demand for portland cement-based composite products.

The cellulosic segment is projected to grow at a robust pace in the coming years, owing to the rising need for eco-friendly and sustainable materials, and cellulose fibers, derived from natural sources such as wood pulp, meet these demands. Growing awareness about green building certifications and regulatory shifts toward sustainable construction practices are driving the adoption of cellulosic. Furthermore, advancements in processing technology are enhancing the compatibility of cellulose fibers with cement, making them a preferred material in modern construction.

Product Analysis

In terms of product, the segmentation includes cladding, siding/weatherboard, roofing, molding & trim, and others. The siding/weatherboard segment dominated the revenue share in 2024 due to its durability, resistance to termites and rot, and ability to withstand extreme weather conditions. The product also offers a wood-like aesthetic with minimal maintenance, making it an ideal choice for residential exteriors. Rapid urbanization, rising investments in housing projects, and the growing trend of replacing traditional wood or vinyl siding with more resilient alternatives further fueled its adoption. North America and Europe, in particular, witnessed significant demand for weatherboard solutions in both new constructions and renovation activities.

Application Analysis

In terms of application, the segmentation includes residential, commercial, industrial, education/institutional, agricultural, and others. The residential segment held the largest revenue share in 2024 due to rising global demand for durable, low-maintenance, and cost-effective building materials in housing construction. Homeowners preferred this solution for siding, roofing, and backer boards, owing to resistance to moisture, fire, and pests. Rapid urbanization, population growth, and government-backed affordable housing initiatives in emerging economies further boosted demand. Additionally, homeowners increasingly preferred fiber cement for home renovation and remodeling, especially in regions prone to extreme climate conditions.

The commercial segment is expected to grow during the forecast period, owing to the increasing volume of office spaces, retail centers, and mixed-use developments worldwide. Architects and developers are prioritizing strong, lightweight, and aesthetically versatile materials for large-scale commercial projects, particularly for exterior cladding and partition walls. Furthermore, the rising adoption of green building certifications such as LEED and BREEAM is encouraging the use of fiber cement in commercial buildings.

Regional Analysis

The Asia Pacific fiber cement market accounted for 41.15% of global revenue share in 2024. This dominance is attributed to rapid urbanization, infrastructure development, and increasing construction activities in emerging economies such as India, Indonesia, and Vietnam. The urban population in Asia is expected to grow by 50% by 2050, according to the United Nations Human Settlements Programme. Governments in the region also invested in affordable housing projects, commercial buildings, and industrial facilities, where fiber cement is favored for its durability, fire resistance, and low maintenance. Additionally, stricter building codes promoted non-combustible materials such as fiber cement in disaster-prone areas. Rising awareness of sustainable construction materials also contributed to market growth, as fiber cement is considered more eco-friendly than traditional alternatives such as wood or vinyl siding.

China Fiber Cement Market Insights

China held the largest revenue share in the Asia Pacific fiber cement landscape in 2024. The industry growth in the country is attributed to large-scale urbanization, government-led infrastructure projects, and the push for green building materials under policies such as the "14th Five-Year Plan." The construction of high-rise buildings, public facilities, and energy-efficient homes in China has increased the need for durable, fire-resistant, and weatherproof materials such as fiber cement. Additionally, China’s focus on reducing carbon emissions has led to stricter regulations on traditional construction materials, making fiber cement a preferred alternative. The renovation of aging buildings and the expansion of smart cities further drove market growth in China.

North America Fiber Cement Market Trends

The market in North America is projected to hold a substantial revenue share in 2034 due to rising demand for sustainable and resilient construction materials, particularly in residential and commercial sectors. Homeowners and builders in the region are opting for fiber cement siding for its resistance to fire, moisture, termites, and extreme weather conditions. The trend toward energy-efficient and low-maintenance housing, along with stringent building codes in the U.S. and Canada, is supporting market expansion.

U.S. Fiber Cement Market Overview

The demand for fiber cement in the U.S is being driven by the strong housing sector, increasing natural disasters such as wildfires and hurricanes, and the shift away from wood and vinyl siding due to durability concerns. Fiber cement’s fire-resistant properties are making it particularly popular in wildfire-prone states such as California. Government incentives for energy-efficient buildings and the trend toward modern, sustainable architecture are also boosting demand. Additionally, the rise in DIY home improvement projects and the growing preference for low-maintenance exteriors are propelling market growth.

Europe Fiber Cement Market Outlook

The industry in Europe is projected to grow at the fastest pace in the coming years, owing to stringent environmental regulations, energy efficiency standards, and the growing adoption of sustainable construction materials. Countries such as Germany, France, and the UK are leading the market, with increasing use of fiber cement in residential, commercial, and industrial applications. The material’s resistance to mold, moisture, and fire makes it ideal for Europe’s varied climate conditions. Additionally, renovation projects under EU energy efficiency directives and the shift toward lightweight, durable building materials are supporting market expansion. The ban on certain hazardous construction materials in some European countries further accelerated the adoption of fiber cement.

Key Players & Competitive Analysis

The global fiber cement market is highly competitive, with key players such as James Hardie Building Products Inc., Etex Group, and Everest Industries Limited dominating the industry. James Hardie leads in North America and Australia, leveraging its strong brand reputation and advanced manufacturing technologies. Etex Group focuses on sustainability and high-performance fiber cement solutions in Europe and emerging markets. NICHIHA Co., Ltd. and SHERA are prominent in Asia Pacific, offering innovative, weather-resistant products for residential and commercial applications. Meanwhile, Visaka Industries Limited and BirlaNu Limited strengthen their presence in India with cost-effective and eco-friendly alternatives. CSR Limited and ELEMENTIA MATERIALES also contribute to market growth through strategic expansions and mergers. The competition is driven by product durability, fire resistance, and sustainability, with companies investing in R&D to develop lightweight, low-maintenance fiber cement boards.

A few major companies operating in the fiber cement industry include BirlaNu Limited; CSR; ELEMENTIA MATERIALES; Etex Group; Everest Industries Limited; HVG Facades; James Hardie Building Products Inc.; NICHIHA Co., Ltd; SHERA; Swisspearl Group AG; and Visaka Industries Limited.

Key Players

- BirlaNu Limited

- CSR

- ELEMENTIA MATERIALES

- Etex Group

- Everest Industries Limited

- HVG Facades

- James Hardie Building Products Inc.

- NICHIHA Co., Ltd

- SHERA

- Swisspearl Group AG

- Visaka Industries Limited

Fiber Cement Industry Developments

In November 2024, SHERA, at its 50th anniversary, announced the launch of SHERA Board Pro and high-quality products such as SHERA Door & Door Frame, SHERA Gypsum, and SHERA SPC Flooring in the Philippines.

In February 2024, HVG Facades announced the release of a new high-density, fibre cement exterior and interior cladding product called Vetérro.

In December 2023, Etex, a building material manufacturer, enhanced its architectural design with the acquisition of SCALAMID, a manufacturer of fiber cement panels.

Fiber Cement Market Segmentation

By Material Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Portland

- Silica

- Cellulosic

- Others

By Product Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Cladding

- Rainscreen/Ventilated

- Direct‑fix/Non‑ventilated

- Siding/Weatherboard

- Roofing

- Molding & Trim

- Other

By Application Outlook (Revenue, USD Billion, Volume Kiloton, 2020–2034)

- Residential

- Commercial

- Industrial

- Education/Institutional

- Agricultural

- Others

By Regional Outlook (Revenue, USD Billion, Volume, Kiloton, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fiber Cement Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 13.62 Billion |

|

Market Size in 2025 |

USD 14.15 Billion |

|

Revenue Forecast by 2034 |

USD 20.27 Billion |

|

CAGR |

4.08% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 13.62 billion in 2024 and is projected to grow to USD 20.27 billion by 2034.

The global market is projected to register a CAGR of 4.08% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are BirlaNu Limited; CSR; ELEMENTIA MATERIALES; Etex Group; Everest Industries Limited; HVG Facades; James Hardie Building Products Inc.; NICHIHA Co., Ltd; SHERA; Swisspearl Group AG; and Visaka Industries Limited.

The portland segment dominated the market revenue share in 2024.

The commercial segment is projected to witness the fastest growth during the forecast period.