China Anti-Aging Products Market Size, Share, Industry Analysis Report

By Product (Facial Cream & Lotion, Eye Cream & Lotion), By Distribution Channel, By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6172

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

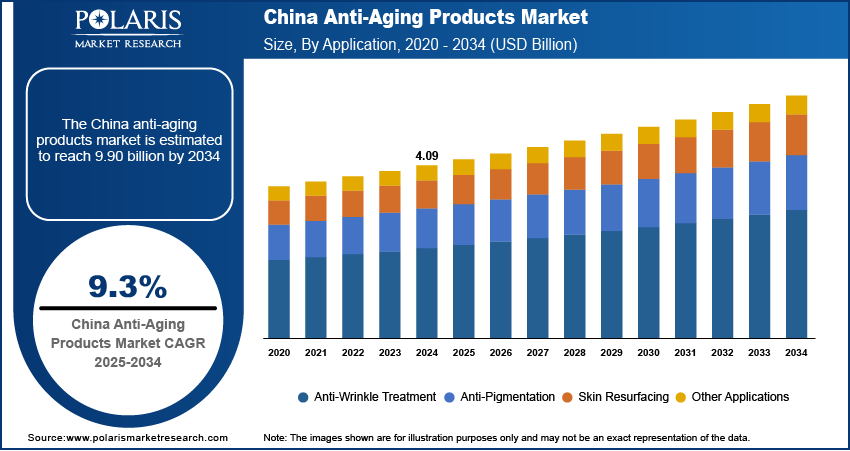

The China anti-aging products market size was valued at USD 4.09 billion in 2024, growing at a CAGR of 9.3% from 2025 to 2034. The China market is witnessing growth due to growing middle-class population with rising disposable income, advanced skincare technologies, and increasing demand for sustainable and clean beauty.

Key Insights

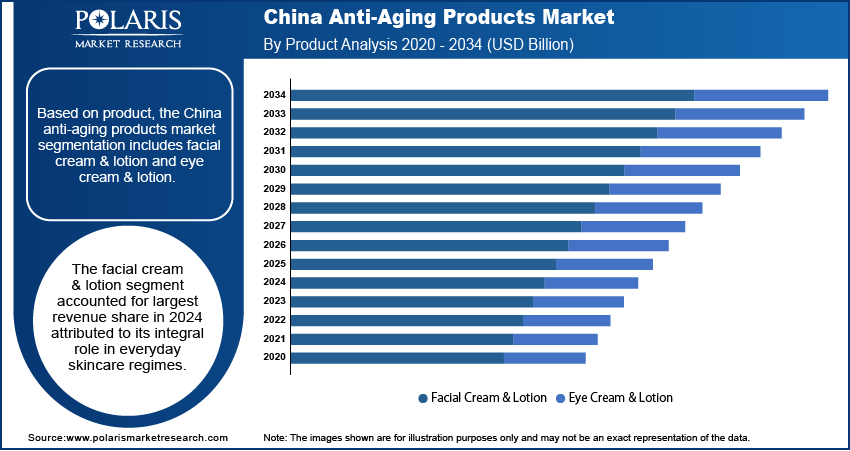

- The facial cream & lotion segment accounted for the largest revenue share in 2024, attributed to its integral role in everyday skincare regimes.

- The anti-pigmentation segment is expected to witness the fastest growth during the forecast period, driven by increasing awareness of hyperpigmentation, sunspots, and uneven skin tone, particularly in urban areas exposed to high pollution and UV levels.

Industry Dynamics

- Breakthroughs in biotech and nanotech enable deeper, targeted anti-aging solutions, boosting efficacy and personalization.

- Eco-conscious consumers in China drive growth for sustainable, toxin-free anti-aging products with ethical sourcing.

- The imposition of strict regulations on novel ingredients, such as retinoids and peptides, delays product launches, increasing R&D costs for brands.

- Rising demand for "pre-aging" skincare among Gen Z offers growth potential, especially for science-backed, affordable serums and wearable tech.

Market Statistics

- 2024 Market Size: USD 4.09 billion

- 2034 Projected Market Size: USD 9.90 billion

- CAGR (2025–2034): 9.3%

To Understand More About this Research: Request a Free Sample Report

Anti-aging products are formulations designed to reduce, prevent, or reverse visible signs of skin aging, such as wrinkles, fine lines, and loss of elasticity. In China, the market is experiencing robust growth, driven by increasing consumer awareness of skin health and the desire for a youthful appearance. A growing middle-class population with rising disposable income is driving demand for premium skincare products, particularly among younger consumers who are now entering the market earlier and adopting preventive skincare routines. Alongside traditional anti-aging solutions, there is an increasing preference for multifunctional products that offer hydration, UV protection, and natural antioxidant benefits, thereby boosting product innovation across the sector.

Drivers & Opportunities

Advanced Skincare Technologies: Advanced skincare technologies are driving the growth opportunities, as they enable the development of highly targeted, effective, and personalized solutions. Manufacturers are developing products that deliver active ingredients more efficiently and penetrate deeper into skin layers through the integration of biotechnology, nanotechnology, and dermatological research. In April 2025, Cosmax China partnered with Xinhai Bio for the use of biosynthetic retinol. The collaboration aims to develop eco-friendly anti-aging cosmetics with reduced irritation, leveraging Xinhai’s synthetic biology tech to meet global demand for effective, sustainable wrinkle solutions. These innovations enhance product performance, serving to consumers' demand for visible and lasting results. Consumers' expectations for efficacy and science-backed formulations continue to rise as they become more informed and discerning, making technologically advanced skincare a critical factor in shaping market growth and brand differentiation.

Rising Preventive Skincare Culture: The growing demand for sustainable and clean beauty is fueling the market expansion in China. Modern Chinese consumers, particularly Millennials and Gen Z, are increasingly aware of ingredient transparency, environmental impact, and ethical sourcing. This has led to a shift in purchasing behavior, where consumers are actively seeking anti-aging products that are free from harmful chemicals and cruelty, and packaged in a sustainable manner. In February 2024, Evonik partnered with China's Jland Biotech to commercialize vegan collagen for skincare, including anti-aging products. Backed by Evonik’s investment, the collaboration launched new vegan collagen offerings, complementing its existing Vecollage Fortify L line. Brands are adapting to this shift by reformulating their products with plant-based actives, utilizing biodegradable packaging, and implementing eco-conscious production practices. Therefore, as clean beauty becomes interchangeable with trust and efficacy in skincare, its alignment with anti-aging goals is expected to influence the product landscape in China.

Segmental Insights

Product Analysis

Based on product, the China anti-aging product market segmentation includes facial cream & lotion and eye cream & lotion. The facial cream & lotion segment accounted for the largest revenue share in 2024, attributed to its integral role in everyday skincare regimes. These formulations are widely adopted for their ability to provide deep hydration, reinforce skin defenses, and deliver anti-aging benefits, including enhanced firmness and reduced wrinkles. Their adaptability across diverse skin concerns, ranging from texture irregularities to moisture loss, makes them indispensable in personal care routines. The frequent application, availability in various formulations suited for different skin types, and inclusion of efficacious anti-aging compounds, such as peptides, retinoids, and botanical extracts, solidify their leading position in the Chinese market.

By Application Outlook

The segmentation, based on application, includes anti-wrinkle treatment, anti-pigmentation, skin resurfacing, UV protection & repair, hydration & barrier repair, collagen stimulation, elasticity improvement, and dark circle reduction (Under-Eye Treatments). The anti-pigmentation segment is expected to witness the fastest growth during the forecast period, driven by increasing awareness of hyperpigmentation, sunspots, and uneven skin tone, particularly in urban areas exposed to high pollution and UV levels. This awareness is fueling consumer interest in brightening and tone-balancing skincare. The growing refinement in formulations, incorporating active ingredients such as niacinamide, arbutin, and vitamin C derivatives, has enhanced the efficacy and appeal of these products. This rising demand aligns with the broader cultural emphasis on achieving a luminous, even complexion, reinforcing the segment’s accelerated expansion.

Key Players and Competitive Analysis

The China anti-aging market thrives on revenue growth opportunities fueled by emerging market segments such as bio-retinol and TCM-infused skincare. Brands such as Pechoin and Proya dominate through competitive intelligence and strategy, blending traditional herbs with biotech. Disruptions and trends in clean beauty and personalized skincare are reshaping demand. Strategic investments in synthetic biology highlight a shift toward sustainable value chains. Meanwhile, small and medium-sized businesses leverage e-commerce and KOL marketing to challenge giants. Economic and geopolitical shifts, such as stricter ingredient regulations, push brands to adopt future development strategies focused on efficacy and safety. Expansion opportunities lie in tier-2/3 cities, where latent demand and opportunities for premium anti-aging products remain untapped.

A few major companies operating in the China anti-aging products market include BlackBird Skincare; Bloomage Biotech Co., Ltd; Elov Cosmetics; Kolmar Cosmetics (Wuxi) Co., Ltd.; PECHOIN; PROYA COSMETICS CO., LTD; Shanghai CHANDO Group Co., Ltd (Jala Group); Shanghai Shangmei Cosmetics Co., LTD (KANS); Shanghai Xiangyi Bencao Cosmetics Co., Ltd.; and XiangxiangDaily.

Key Players

- BlackBird Skincare

- Bloomage Biotech Co., Ltd

- Elov Cosmetics

- Kolmar Cosmetics (Wuxi) Co., Ltd.

- PECHOIN

- PROYA COSMETICS CO., LTD

- Shanghai CHANDO Group Co., Ltd (Jala Group)

- Shanghai Shangmei Cosmetics Co., LTD (KANS)

- Shanghai Xiangyi Bencao Cosmetics Co., Ltd.

- XiangxiangDaily

China Anti-Aging Products Industry Developments

- April 2025: Galderma launched Sculptra in China, the first PLLA-SCA biostimulator approved to restore facial volume. This anti-aging treatment stimulates natural collagen for youthful skin, tapping into China's booming aesthetics market.

- August 2024: Pechoin launched its upgraded Anti-Aging Face Cream 2.0, featuring an herbal collagen booster (ginseng + snow lotus) and 100% human-type Type III collagen. The formula ensures deep absorption, delivering a 37% wrinkle reduction in just an hour.

China Anti-Aging Products Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Facial Cream & Lotion

- Eye Cream & Lotion

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hypermarket & Supermarket

- Specialty Store

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Anti-Wrinkle Treatment

- Anti-Pigmentation

- Skin Resurfacing

- Other Applications

China Anti-Aging Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.09 Billion |

|

Market Size in 2025 |

USD 4.46 Billion |

|

Revenue Forecast by 2034 |

USD 9.90 Billion |

|

CAGR |

9.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.09 billion in 2024 and is projected to grow to USD 9.90 billion by 2034.

The market is projected to register a CAGR of 9.3% during the forecast period.

A few of the key players in the market are BlackBird Skincare; Bloomage Biotech Co., Ltd; Elov Cosmetics; Kolmar Cosmetics (Wuxi) Co., Ltd.; PECHOIN; PROYA COSMETICS CO., LTD; Shanghai CHANDO Group Co., Ltd (Jala Group); Shanghai Shangmei Cosmetics Co., LTD (KANS); Shanghai Xiangyi Bencao Cosmetics Co., Ltd.; and XiangxiangDaily.

The facial cream & lotion segment accounted for the largest revenue share in 2024.

The anti-pigmentation segment is expected to witness fastest growth during the forecast period.