Chocolate Syrup Market Share, Size, Trends, Industry Analysis Report

By Type (Conventional and Organic); By Distribution Channel By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 115

- Format: PDF

- Report ID: PM2916

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

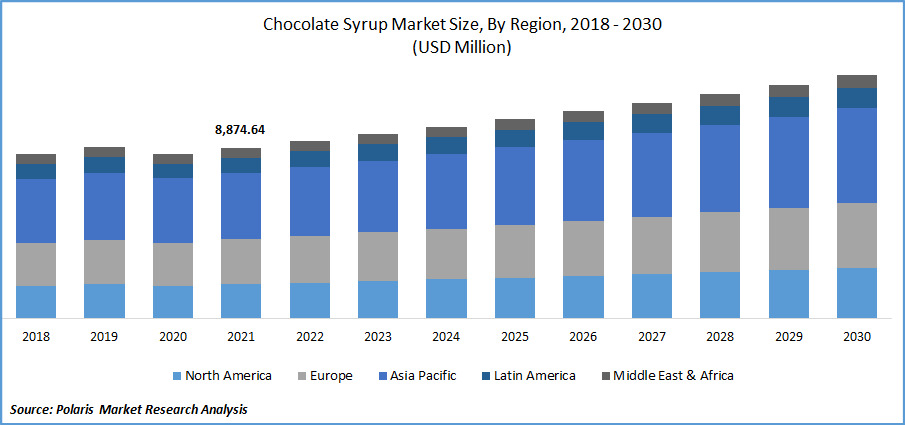

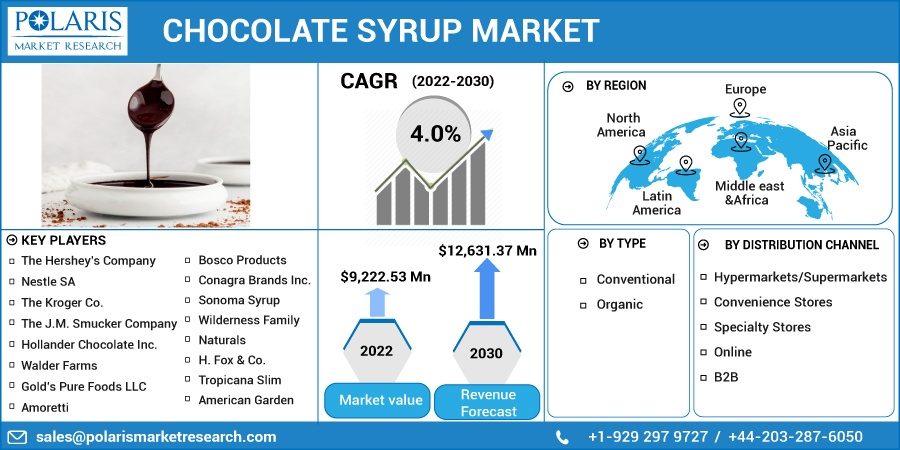

The global chocolate syrup market was valued at USD 8,874.64 million in 2021 and is expected to grow at a CAGR of 4.0% during the forecast period.

The extensive rise in the demand for chocolate syrup as a flavor enhancer and topping in a variety of food recipes such as cakes, pastries, and pancakes among consumers worldwide are major factors propelling the global market growth. Moreover, change in consumer eating patterns, and the rising popularity of ready-to-eat and packaged foods are likely to boost the growth and demand of the market in the coming years.

Know more about this report: Request for sample pages

In recent years, the high demand for plant-based & organic syrups, which contain naturally sourced ingredients such as allulose & organic cocoa powder, has created a lucrative market, especially from developed countries, including the United States and Japan. Various manufacturers of these products are focusing on expanding their offerings in low and no-sugar options in syrup to fulfill the growth for healthier products from consumers worldwide. These factors are expected to positively impact market growth over the coming years.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the chocolate syrup market. The rapid emergence of deadly coronavirus worldwide has forced many countries to impose lockdowns and various other restrictions on movement. Therefore, all manufacturing units were temporarily closed, coupled with the high disruptions in the global supply chain. Due to this, many large market companies have seen a decline in their sales and revenue generation during the pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing adoption of chocolate syrup in various restaurants and hotels as a major ingredient in multiple deserts and the extensively growing popularity of these types of syrups among kids and children around the world are key factors expected to drive the growth of the global market during the projected period. Chocolate syrups have gained immense popularity as a sauce and topping to prepare a wide range of food recipes, including coffee shakes, ice creams, frappes, puddings, pancakes, etc.

Furthermore, rapid growth in urbanization, especially in emerging economies like India, China, and Indonesia, coupled with the rising prevalence of ready-to-eat food products among consumers, are other factors projected to fuel the global market growth over the coming years. In addition, the growing consumer health concerns about the high glycemic index in conventional syrups have forced manufacturers to launch organic product variants, significantly augmenting the market growth.

Report Segmentation

The market is primarily segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

Conventional segment accounted for largest market share in 2021

The conventional segment accounted for the largest revenue share in 2021 and is likely to maintain its position throughout the forecast period. The growth of the segment market is mainly attributable to an increase in consumer interest in ready-to-eat food products, sweeteners, and flavorful syrups, coupled with the easy availability in several types of variants, including almonds and hazelnuts. In addition, the product is gaining immense popularity in countries like India and China due to changes in consumer taste preferences. Also, the evolving demand for innovative packaged food products will likely augment the segment market in the coming years.

Furthermore, the organic segment is anticipated to grow significantly during the projected period owing to increasing consumer inclination towards various health-oriented syrups and sweeteners across the globe. Moreover, a rapid surge in consumer awareness towards health and wellness associated with gluten-free, zero-sugar, and organically sourced syrups is gaining huge popularity and is expected to drive the market growth forward in the near future.

For instance, in June 2021, Hershey’s Company acquired Lily’s confectionery, a high maker of low-sugar & better for your confectionery products with a value of USD 425 Mn. With this acquisition, the company will strengthen its product portfolio & get to work with its innovative and talented team.

Supermarkets/hypermarkets segment held the significant market revenue share

The supermarkets/hypermarkets segment held the highest revenue share in 2021. The growth of this segment can be attributed to the wide range of product variety from various global brands, the ability to check products physically, and the growing investment in expanding their supply chain. Moreover, factors such as growing consumer preference for personalization, extensive availability of product discounts, and easy access to global consumers are further expected to drive the segment market during the anticipated period.

Furthermore, the B2B segment will likely expand at a high CAGR over the forecast period. The growth of the segment market can be attributed to massive product adoption, like experiencing various flavors of the product, including confectioneries, puddings, cakes, donuts, pastries, and desserts. Additionally, food service outlets across the globe, such as Cruisin Coffee, Handle’s Ice Cream, and The Cone of West Chester, have enhanced their b2b business segment in recent years, creating growth opportunities for the market.

Asia Pacific region dominated the chocolate syrup market in 2021

The Asia Pacific region dominated the global market in 2021 with a significant market share. The regional market's growth is mainly driven by urbanization, rapid technological development in manufacturing processes, structural adjustment, and high industrial upgrading in the region. Moreover, the increasing consumer interest regarding sweet dishes and gourmet confectioneries coupled with the growing penetration of new product launches and high accessibility to products are likely to boost the growth of the segment market during the forecast period.

Furthermore, the Middle East & Africa region is expected to witness the fastest growth at a high CAGR over the anticipated period. Availability of a wide range of products in various authentic flavors and rising consumer willingness to try new flavors are major factors expected to drive the segment market growth. In addition, companies such as The Hershey Company and Nestle are highly engaged in extending their portfolio in gourmet products across the region, which is projected to bodes well for the market's growth in the coming years.

Competitive Insight

Key players in the market include Hershey’s Company, Nestle, The Kroger, J.M. Smucker Company, Hollander Chocolate, Walder Farms, Gold’s Pure Foods, Amoretti, Bosco Products, Conagra Brands, Kraft Heinz Company, Sonoma Syrup, Wilderness Family Naturals, Tropicana Slim, and American Garden.

Recent Developments

In December 2021, Enlightened, announced the launch of its new lineup of sugar-free chocolate syrup. The syrup is sweetened with erythritol & monk fruit and made up of solution corn fiber, cocoa, water, salt, citric acid, and natural flavor. One tablespoon of this syrup contains 20 calories, 9 g of fiber, 1 g of new carbs, & no-sugar, while the traditional chocolate syrups contain up to 10 g of sugar & 12 g of then net carbs.

Furthermore, in August 2021, Nestle, announced the completion of the acquisition of core brands of Bountiful Company including Natures bounty, Solgar, Ester-C, Sundown, Puritan’s Pride, and Osteo Bi-Flex. With this acquisition, the company will strengthen its position as an industry leader in supplements, vitamins, minerals, specialty retail, eCommerce, and D2C in the United States.

Chocolate Syrup Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 9,222.53 million |

|

Revenue forecast in 2030 |

USD 12,631.37 million |

|

CAGR |

4.0% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

The Hershey’s Company, Nestle SA, The Kroger Co., The J.M. Smucker Company, Hollander Chocolate Inc., Walder Farms, Gold’s Pure Foods LLC, Amoretti, Bosco Products, Conagra Brands Inc., The Kraft Heinz Company, Sonoma Syrup, Wilderness Family Naturals, H. Fox & Co., Tropicana Slim, and American Garden. |