Chondroitin Sulfate Market Size, Share, Trends, Industry Analysis Report

By Source (Bovine, Swine, Poultry, Shark, Synthetic), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6109

- Base Year: 2024

- Historical Data: 2020-2023

Overview

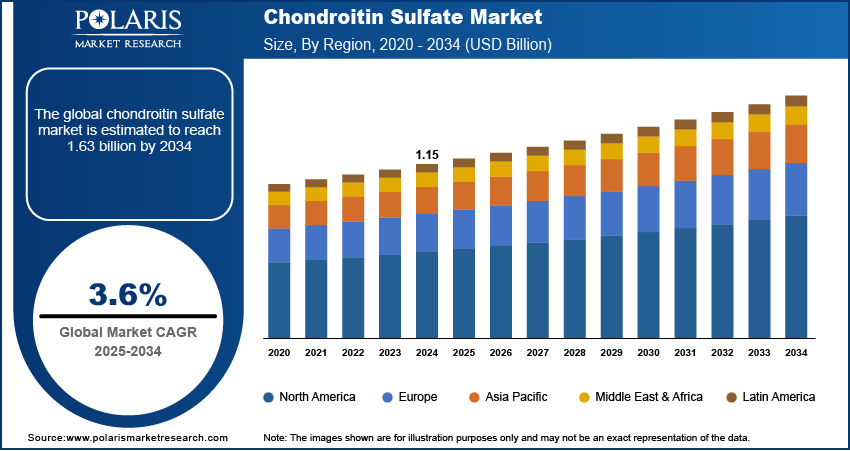

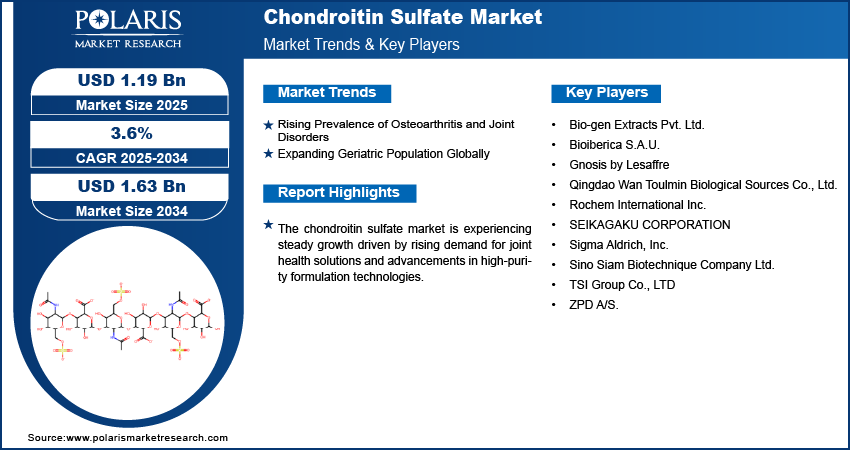

The global chondroitin sulfate market size was valued at USD 1.15 billion in 2024, growing at a CAGR of 3.6% from 2025 to 2034. The demand is primarily fueled by increasing cases of osteoarthritis and joint disorders, a rapidly expanding aging population requiring joint support, and significant advancements in extraction and purification technologies that enhance product quality and efficiency.

Key Insights

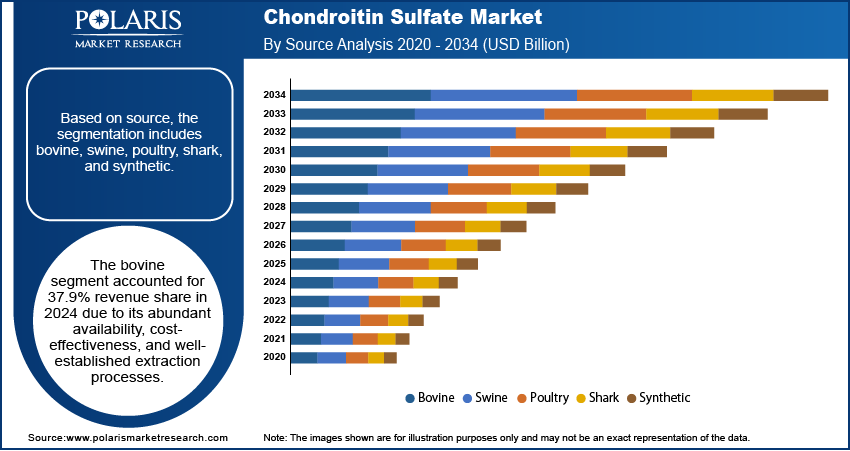

- The bovine segment accounted for 37.9% revenue share in 2024 due to its abundant availability, cost-effectiveness, and well-established extraction processes.

- The pharmaceuticals segment is expected to witness a significant CAGR of 4.0% during the forecast period, driven by the increasing clinical adoption in the treatment of osteoarthritis and other joint-related disorders.

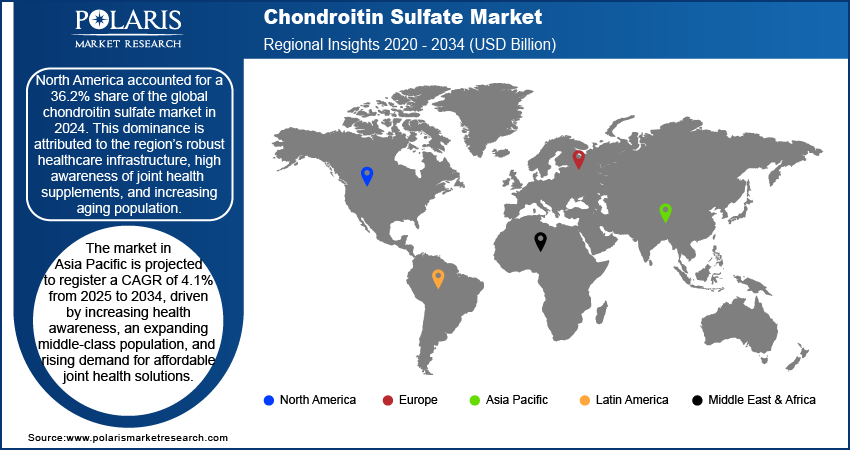

- North America accounted for 36.2 % of global market share in 2024 due to the region’s robust healthcare infrastructure, high awareness of joint health supplements, and increasing aging population.

- In 2024, the U.S. dominated North America's market, supported by advanced healthcare infrastructure, high joint health awareness, and major nutraceutical manufacturers.

- The market in Asia Pacific is projected to register a CAGR of 4.1% from 2025 to 2034, driven by increasing health awareness, an expanding middle-class population, and rising demand for affordable joint health solutions.

- The market in India is expanding due to increasing healthcare expenditure, growing awareness of joint health supplements, and a rising prevalence of age-related musculoskeletal conditions.

Industry Dynamics

- Growing demand for joint health supplements in aging populations and pet care markets creates significant revenue potential for manufacturers.

- Stricter regulations and quality standards for animal-derived ingredients may increase production costs and limit supply chain flexibility.

- Rising cases of osteoarthritis and joint disorders are boosting demand, as it effectively reduces joint pain and enhances mobility.

- Aging leads to declining joint function and a higher risk of osteoarthritis, leading to mobility and joint health issues. Therefore, the rising elderly population propels the use of chondroitin sulfate for proactive care.

Market Statistics

- 2024 Market Size: USD 1.15 billion

- 2034 Projected Market Size: USD 1.63 billion

- CAGR (2025–2034): 3.6%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Chondroitin sulfate is a naturally occurring compound found in connective tissues, commonly used as a dietary supplement to support joint health and manage osteoarthritis. The market for chondroitin sulfate is witnessing growth, driven by advancements in extraction and purification technologies that have improved both the efficiency and quality of production. Modern biotechnological methods and enhanced purification techniques are enabling manufacturers to obtain higher-purity sulfate from both animal and marine sources, with reduced levels of contaminants. In April 2025, Gnosis by Lesaffre rebranded its fermentation-derived chondroitin sulfate as MyCondro, offering a sustainable, high-purity version with a purity level of over 99% as an alternative to animal-sourced versions. Clinical studies show 45% higher bioavailability than bovine-derived chondroitin, with potential benefits for joint health due to its human-like structure. These innovations ensure better product consistency and also support regulatory compliance, strengthening the credibility across pharmaceutical and nutraceutical applications.

Increased consumer awareness surrounding joint health and preventive healthcare is further driving demand for these products. People are seeking effective and natural ways to maintain mobility and joint function as lifestyles become more stagnant. This rising awareness is further supported by growing interest in non-prescription supplements, particularly among middle-aged and elderly demographics. The proactive shift toward preventive health practices is creating sustained demand for joint health formulations, positioning this sulfate as a preferred ingredient in both standalone supplements and combination products with glucosamine and MSM.

Drivers and Opportunities

Rising Prevalence of Osteoarthritis and Joint Disorders: The rising prevalence of osteoarthritis and joint disorders is driving the growth opportunities, as the compound is widely recognized for its role in alleviating joint pain and improving mobility. According to an NCBI article published in February 2025, osteoarthritis of the knee accounted for 30.85 million new cases, 374.74 million existing cases, and 12.02 million disability-adjusted life years (DALYs). There is growing demand for effective, noninvasive treatment options, with degenerative joint conditions becoming increasingly common due to factors such as lethargic lifestyles, obesity, and physical strain. It is a core ingredient in joint health supplements and osteoarthritis therapies, which helps slow cartilage degradation and reduce inflammation. Therefore, as the global burden of musculoskeletal disorders escalates, healthcare professionals and consumers are increasingly turning to chondroitin-based products to manage symptoms and improve quality of life.

Expanding Geriatric Population Globally: The expanding geriatric population worldwide is driving the expansion opportunities. According to a February 2025 World Health Organization report, the global population aged 60 and above is expected to grow, rising from 1.1 billion in 2023 to 1.4 billion by 2030, highlighting the increasing importance of addressing age-related health concerns, such as osteoarthritis. Aging naturally leads to a decline in joint function and cartilage integrity, making elderly individuals more susceptible to conditions such as osteoarthritis and chronic joint pain. There is increasing emphasis on maintaining mobility, independence, and overall well-being through proactive joint care as this demographic continues to grow. It is valued for its cartilage-supportive and anti-inflammatory properties, is gaining importance in geriatric healthcare regimens. The growing aging population thus fuels a consistent demand for chondroitin-based supplements and therapeutics aimed at preserving joint health and improving quality of life in later years.

Segmental Insights

Source Analysis

Based on source, the segmentation includes bovine, swine, poultry, shark, and synthetic. The bovine segment accounted for 37.9% revenue share in 2024 due to its abundant availability, cost-effectiveness, and well-established extraction processes. Bovine cartilage, primarily sourced from cattle, offers a reliable and scalable raw material base, making it a preferred choice among manufacturers. Additionally, bovine-derived chondroitin is widely accepted in both nutraceutical and pharmaceutical applications due to its consistent quality and high bioavailability. The established regulatory framework for bovine sourcing in several regions further supports its dominance.

Application Analysis

In terms of application, the segmentation includes nutraceuticals, pharmaceuticals, animal feed, personal care & cosmetics, and other applications. The pharmaceuticals segment is expected to witness a significant CAGR of 4.0% during the forecast period, driven by the increasing clinical adoption in the treatment of osteoarthritis and other joint-related disorders. Its anti-inflammatory and cartilage-protective properties make it a valuable active ingredient in prescription and over-the-counter medications. Growing preference for non-surgical and symptom-relieving treatment options is also boosting demand within this segment. Furthermore, regulatory approvals and inclusion in therapeutic guidelines enhance its credibility in the pharmaceutical space.

Regional Analysis

The North America chondroitin sulfate market accounted for 36.2 % of global market share in 2024. This dominance is attributed to the region’s robust healthcare infrastructure, high awareness of joint health supplements, and increasing aging population. According to a June 2024 government Census report, the U.S. population aged 65 and above reached ~59.2 million by 2023, reflecting a significant 9.4% increase, highlighting the nation's accelerating aging. The widespread use of dietary supplements, combined with the presence of major nutraceutical and pharmaceutical companies, contributes to robust product availability and increased consumer access. Additionally, the region's regulatory support and advanced extraction technologies facilitate high-quality production and commercialization. These dynamics position North America as a leading market, reflecting strong demand across multiple end-use sectors.

U.S. Chondroitin Sulfate Market Insights

The U.S. held the largest regional share in North America chondroitin sulfate landscape in 2024 due to its advanced healthcare infrastructure, high consumer awareness regarding joint health, and the strong presence of major nutraceutical and pharmaceutical manufacturers. The widespread use of dietary supplements, combined with well-regulated product formulations, contributes to a steady demand. Additionally, a well-established distribution network and rising trends in preventive healthcare continue to reinforce the U.S. market’s leading position.

Asia Pacific Chondroitin Sulfate Market Trends

The market in Asia Pacific is projected to register a CAGR of 4.1% from 2025 to 2034, driven by increasing health awareness, an expanding middle-class population, and rising demand for affordable joint health solutions. The region presents substantial opportunities for these sulfate products, with a growing focus on preventive healthcare and a rising incidence of age-related joint conditions. Advancements in manufacturing capabilities and increased adoption of nutraceuticals are also supporting expansion opportunities. Additionally, local production and favorable regulatory developments are enabling greater accessibility and consumption, contributing to consistent regional growth.

India Chondroitin Sulfate Market Overview

The market in India is expanding due to increasing healthcare expenditure, growing awareness of joint health supplements, and a rising prevalence of age-related musculoskeletal conditions. Consumers are becoming more health-conscious and are adopting affordable nutraceuticals to support long-term mobility. Moreover, domestic manufacturing capabilities and improving access to nutritional products are enhancing overall market penetration across urban and semi-urban areas.

Europe Chondroitin Sulfate Market Trends

The chondroitin sulfate landscape in Europe is projected to hold a substantial share by 2034, supported by a well-developed healthcare system, a growing geriatric population, and rising demand for natural joint care solutions. European consumers are increasingly inclined toward clinically backed supplements and pharmaceutical-grade formulations that support long-term joint health. Additionally, strict quality standards and sustainability practices are encouraging the use of traceable, ethically sourced chondroitin. The region’s focus on innovation, product safety, and regulatory compliance continues to attract investments, reinforcing its position in the global chondroitin sulfate industry.

Germany Chondroitin Sulfate Market Assessment

The growth of the Germany landscape is driven by the country’s strong focus on evidence-based supplementation, aging demographics, and demand for high-quality, ethically sourced ingredients. German consumers place a significant focus on product quality and clinical efficacy, which supports the demand for pharmaceutical-grade chondroitin sulfate. The country’s well-regulated healthcare market and commitment to sustainable sourcing further contribute to its market advancement.

Key Players and Competitive Analysis

Competitive intelligence and strategy reveal that key players are focusing on strategic investments and expansion opportunities to capitalize on latent demand and opportunities. Industry trends indicate a shift toward sustainable value chains, influenced by economic and geopolitical shifts, as well as supply chain disruptions. Growth projections highlight strong potential in emerging market segments, supported by technological advancements in production. Vendor strategies highlight competitive positioning through revenue growth analysis and pricing insights, while small and medium-sized businesses explore future development strategies to enhance market presence. Experts' insights suggest that disruptions and trends in the pharmaceutical and nutraceutical sectors will further shape the industry's trajectory, creating new revenue opportunities for stakeholders.

A few major companies operating in the chondroitin sulfate industry include Bio-gen Extracts Pvt. Ltd.; Bioiberica S.A.U.; Gnosis by Lesaffre; Qingdao Wan Toulmin Biological Sources Co., Ltd.; Rochem International Inc.; SEIKAGAKU CORPORATION; Sigma Aldrich, Inc.; Sino Siam Biotechnique Company Ltd.; TSI Group Co., LTD; and ZPD A/S.

Key Players

- Bio-gen Extracts Pvt. Ltd.

- Bioiberica S.A.U.

- Gnosis by Lesaffre

- Qingdao Wan Toulmin Biological Sources Co., Ltd.

- Rochem International Inc.

- SEIKAGAKU CORPORATION

- Sigma Aldrich, Inc.

- Sino Siam Biotechnique Company Ltd.

- TSI Group Co., LTD

- ZPD A/S.

Industry Developments

- April 2025: Eurofins Nutrition Analysis Center in Des Moines introduced advanced testing methods for glucosamine and chondroitin sulfate in pet food, overcoming analytical challenges to ensure precise measurement in joint health products. This supports quality control in pet supplements and formulations.

- January 2025, Tractor Supply launched 4health Shreds, a new dog food blending kibble with protein shreds. Formulated for adult dogs, it includes joint-supporting glucosamine, skin-nourishing omegas, and digestive probiotics with glucosamine and chondroitin sulfate.

Chondroitin Sulfate Market Segmentation

By Source Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Bovine

- Swine

- Poultry

- Shark

- Synthetic

By Application Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- Nutraceuticals

- Pharmaceuticals

- Animal Feed

- Personal Care & Cosmetics

- Other Applications

By Regional Outlook (Volume, Tons; Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Chondroitin Sulfate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.15 Billion |

|

Market Size in 2025 |

USD 1.19 Billion |

|

Revenue Forecast by 2034 |

USD 1.63 Billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Tons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.15 billion in 2024 and is projected to grow to USD 1.63 billion by 2034.

The global market is projected to register a CAGR of 3.6% during the forecast period.

North America accounted for 36.2% of global chondroitin sulfate market share in 2024.

A few of the key players in the market are Bio-gen Extracts Pvt. Ltd.; Bioiberica S.A.U.; Gnosis by Lesaffre; Qingdao Wan Toulmin Biological Sources Co., Ltd.; Rochem International Inc.; SEIKAGAKU CORPORATION; Sigma Aldrich, Inc.; Sino Siam Biotechnique Company Ltd.; TSI Group Co., LTD; and ZPD A/S.

The bovine segment accounted for 37.9% revenue share in 2024.

The pharmaceuticals segment is expected to witness a significant CAGR of 4.0% during the forecast period.