Cloud Kitchen Market Size, Share, Trends, Industry Analysis Report

By Type (Independent Cloud Kitchen, Commissary/Shared Kitchen, Kitchen Pods), By Nature, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM2077

- Base Year: 2024

- Historical Data: 2020-2023

Overview

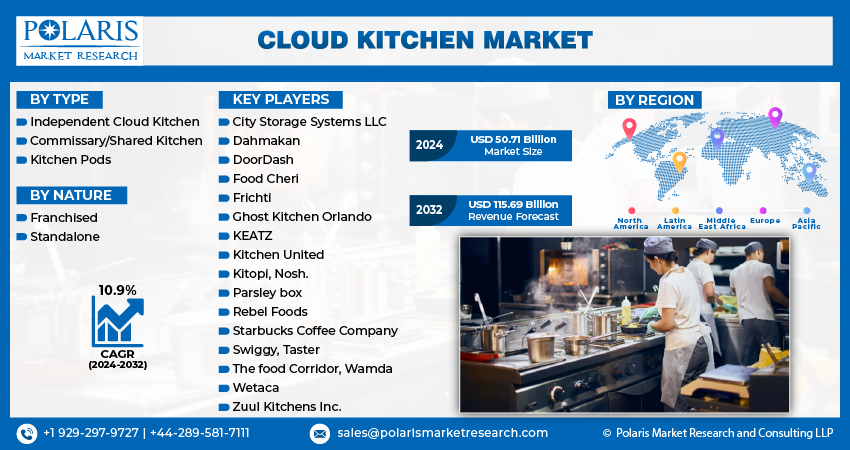

The global cloud kitchen market size was valued at USD 73.05 billion in 2024, growing at a CAGR of 11.58% from 2025 to 2034. Key factors driving popularity of cloud kitchens include the rising adoption of smartphones, growing internet usage, increasing disposable income, and expanding urbanization.

Key Insights

- The independent cloud kitchen segment held 63.32% of revenue share in 2024 due to its ability to personalize offerings without reliance on third-party operators.

- The franchised segment accounted for a major revenue share in 2024 due to its ability to access established operational frameworks.

- Asia Pacific dominated the global cloud kitchen market with 45.15% revenue share in 2024, owing to increasing smartphone penetration and a growing preference for food delivery.

- China held the largest revenue share in the Asia Pacific cloud kitchen landscape in 2024, due to growing disposable income.

- The industry in Europe is projected to grow at the fastest pace in the coming years, owing to increasing sustainability concerns and urbanization.

Industry Dynamics

- The increasing disposable income encourages consumers to frequently order food online instead of cooking at home, which is fueling the demand for cloud kitchens.

- The rising adoption of smartphones, coupled with growing usage of the internet, is driving the cloud kitchen market growth by making food delivery apps more accessible.

- The growing popularity of gourmet food options is expected to create a lucrative market opportunity during the forecast period.

- Limited customer interaction and difficulty in building brand loyalty in the cloud kitchen business hinder the market growth.

Artificial Intelligence (AI) Impact on Cloud Kitchen Market

- AI is optimizing cloud kitchen operations by automating order processing, inventory management, and demand forecasting, reducing costs and minimizing waste.

- AI is projected to analyze customer preferences and ordering patterns to create dynamic and personalized menus, enhancing customer satisfaction and retention.

- AI-powered tools monitor food preparation consistency and hygiene standards, ensuring uniform quality across multiple cloud kitchen locations.

- Artificial intelligence is also helping in adjusting menu prices in real-time based on demand, competition, and ingredient costs, maximizing profitability.

Market Statistics

- 2024 Market Size: USD 73.05 Billion

- 2034 Projected Market Size: USD 218.13 Billion

- CAGR (2025–2034): 11.58%

- Asia Pacific: Largest Market Share

A cloud kitchen, also known as a ghost kitchen or virtual kitchen, is a delivery-only restaurant that operates without a traditional dine-in space. These kitchens focus only on preparing food for online orders placed through food delivery apps or websites. Unlike conventional or quick service restaurants, cloud kitchens minimize overhead costs by eliminating the need for front-of-house staff, décor, or prime location rentals. They usually operate in shared or rented kitchen spaces and may host multiple brands under one roof, maximizing kitchen efficiency and resource use.

The primary benefits of cloud kitchens include lower startup and operational costs, faster setup, and increased flexibility in menu testing and brand expansion. Businesses can quickly adapt to consumer demand, launch multiple cuisines under different brand names, and scale with reduced financial risk. Cloud kitchens also enable data-driven decisions, as all orders are digitally managed, offering insights into customer behavior and preferences. The usage of cloud kitchens is particularly advantageous in urban areas with high food delivery demand, allowing entrepreneurs, existing restaurant chains, and food startups to reach broader audiences efficiently and profitably without heavy investments in real estate or staffing.

The global cloud kitchen market expansion is driven by the expanding urbanization. The world’s population living in cities is expected to rise to 80% by 2050, according to the World Economic Forum. This is driving demand for quick, affordable, and diverse meal options, especially among working professionals and young populations, which is encouraging individuals to open more cloud kitchens as they offer a delivery-focused food service without a dine-in area. Urbanization is also raising the cost of real estate, making traditional restaurants more expensive to run, pushing food businesses toward the cloud kitchen model. Additionally, the growing penetration of food delivery apps in urban centers makes it easier for cloud kitchens to reach a larger customer base efficiently. Therefore, as urbanization expands, the demand for cloud kitchens also surges.

Drivers & Opportunities

Increasing Disposable Income: Increasing disposable income is encouraging people to frequently order food online instead of cooking at home, seeking variety and quality meals. Cloud kitchens are catering to this demand by offering diverse cuisines at competitive prices, with faster delivery, leading to market growth. Bureau of Economic Analysis, in its report, stated that the disposable personal income in the U.S. increased by 0.6% in April 2025 from March 2025. Higher disposable income is also allowing customers to experiment with premium or niche food options, which cloud kitchens efficiently provide without the overhead costs of traditional restaurants. Additionally, busy professionals with greater spending power are prioritizing time-saving solutions, making cloud kitchens an attractive choice for regular meals.

Rising Adoption of Smartphones Coupled with Growing Usage of Internet: The rising adoption of smartphones and growing internet usage are making food delivery apps more accessible, directly boosting demand for cloud kitchens. Consumers are now increasingly relying on their phones to browse menus, place orders, and track deliveries seamlessly, creating a larger market for online food services. Cloud kitchens leverage this trend by partnering with food aggregator platforms, ensuring visibility and convenience for tech-savvy customers. Faster internet speeds also enable real-time updates and smoother transactions, enhancing the overall user experience. Therefore, as more people shift to digital ordering, cloud kitchens benefit from lower operational costs and the ability to scale quickly without physical dine-in spaces. The convenience of mobile ordering encourages frequent purchases, further driving the growth of cloud kitchens.

Segmental Insights

Type Analysis

Based on type, the segmentation includes independent cloud kitchen, commissary/shared kitchen, and kitchen pods. The independent cloud kitchen segment held 63.32% of revenue share in 2024 due to its operational flexibility, direct control over brand identity, and the ability to personalize offerings without reliance on third-party operators. Independent cloud kitchens often manage their own infrastructure, menu, and delivery operations, which allows them to maintain higher profit margins and better customer loyalty. The rising number of food entrepreneurs and established restaurant brands choosing to expand via this model further fueled its dominance. Urban centers with high online food delivery penetration particularly favored independent cloud kitchens, as they allowed operators to quickly adapt to local tastes and customer demands while maintaining cost efficiency by eliminating dine-in expenses.

The commissary/shared kitchen segment is projected to grow at a robust pace in the coming years, owing to its ability to enable multiple brands or chefs to operate from a centralized facility, reducing startup and operational costs. Startups and small-scale food ventures increasingly opt for shared kitchens due to lower capital investment and access to ready-to-use infrastructure. Moreover, the scalability of this model makes it attractive for regional or national food delivery platforms looking to expand into new areas without incurring high fixed costs. The rapid urbanization, growing demand for diverse food choices, and increasing investor interest in scalable foodtech ventures are expected to drive the adoption of commissary/shared kitchens across both developed and emerging economies.

Nature Analysis

In terms of nature, the segmentation includes franchised and standalone. The franchised segment accounted for a major revenue share in 2024 due to its ability to scale quickly, leverage brand recognition, and access established operational frameworks. Franchise operators benefit from centralized marketing, standardized recipes, and streamlined supply chains, which help maintain consistency and efficiency across multiple locations. Established food service brands expanded their delivery-only operations through this model to penetrate new markets with minimal risk. Additionally, franchisees found the model attractive due to lower initial investment compared to traditional dine-in restaurants and the growing demand for food delivery in urban areas.

The standalone segment is expected to grow at a rapid pace during the forecast period, owing to its flexibility, innovation potential, and appeal to niche consumer groups. Independent operators use this model to experiment with unique menus, localized flavors, and personalized branding without adhering to rigid franchise standards. The increasing consumer preference for artisanal, health-conscious, or fusion cuisines supports the expansion of standalone operations. Furthermore, the availability of restaurant management software and delivery aggregators enables individual entrepreneurs to manage end-to-end operations efficiently, thereby encouraging them to choose a standalone model.

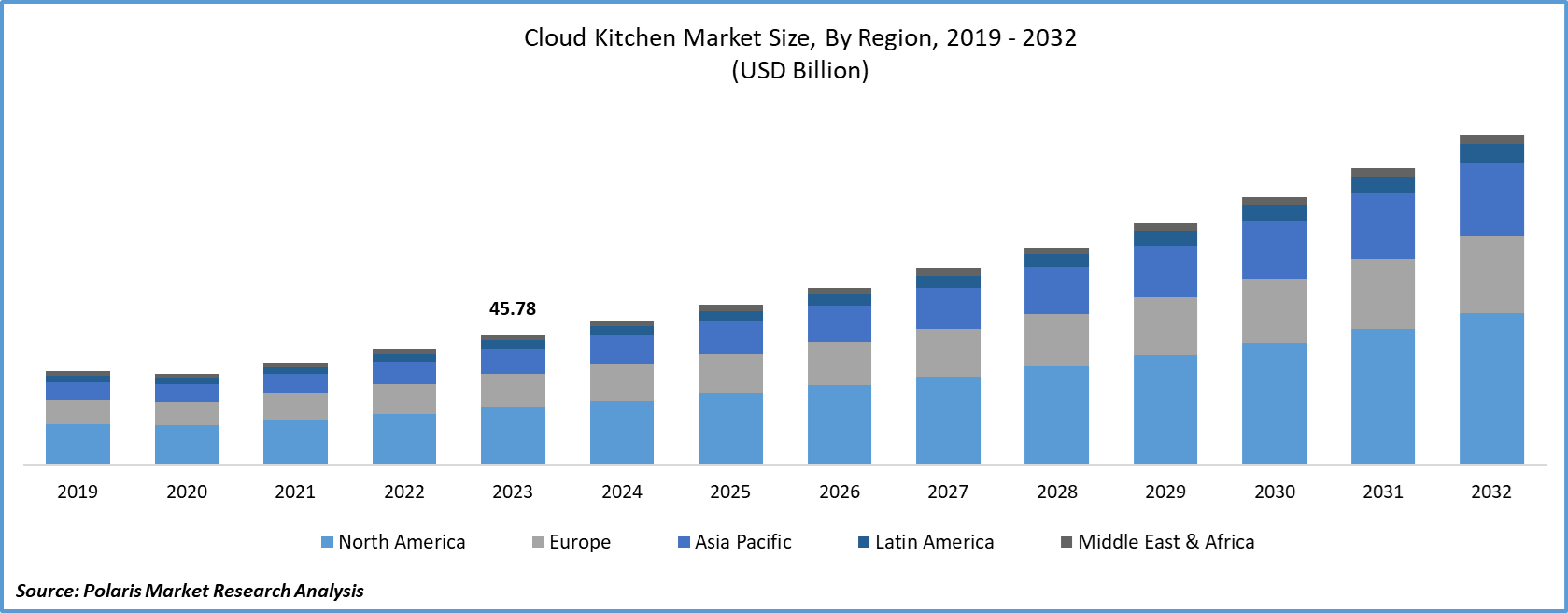

Regional Analysis

The Asia Pacific cloud kitchen market accounted for 45.15% of global revenue share in 2024. This dominance is attributed to rapid urbanization, increasing smartphone penetration, and a growing preference for food delivery. United Nations Human Settlements Programme, in its report, stated that the urban population in Asia is expected to grow by 50% by 2050. Countries, including India, Indonesia, and Japan, witnessed a surge in online food ordering due to the rising popularity of platforms such as Zomato, Swiggy, GrabFood, and Foodpanda. The region's young, tech-savvy population, rising disposable incomes, and busy lifestyles further fueled demand. Additionally, high real estate costs in cities made cloud kitchens a cost-effective alternative to traditional restaurants.

China Cloud Kitchen Market Insights

China held the largest revenue share in the Asia Pacific cloud kitchen landscape in 2024, due to growing food delivery platforms such as Meituan and Ele.me, which served millions of daily orders. The country's advanced digital infrastructure, high mobile payment adoption, and dense urban populations made it ideal for cloud kitchens. Consumers in the country prioritized convenience, speed, and affordability, driving demand for ghost kitchens.

North America Cloud Kitchen Market Trends

The market in North America is projected to hold a substantial revenue share in 2034 due to the rise of third-party delivery apps such as Uber Eats, DoorDash, and Grubhub. The U.S. and Canada have a strong culture of takeout and delivery, with consumers increasingly opting for cloud kitchens. Cloud kitchens offer lower startup costs, flexibility, and the ability to test multiple virtual brands simultaneously, which encourages people to open more cloud kitchens in the U.S.

U.S. Cloud Kitchen Market Overview

The demand for cloud kitchen in the U.S is being driven by high demand for food delivery, labor cost pressures, and the popularity of virtual restaurant brands. Major players such as Travis Kalanick’s CloudKitchens and Sweetgreen’s automated kitchens are scaling rapidly. The U.S. market benefits from a robust logistics network, tech-savvy consumers, and a preference for diverse cuisines. Rising real estate costs in cities such as New York and San Francisco are making cloud kitchens an attractive, asset-light model.

Europe Cloud Kitchen Market Outlook

The industry in Europe is projected to grow at the fastest pace in the coming years, owing to increasing delivery demand, urbanization, and sustainability concerns. The UK, Germany, and France are leading the market, with platforms such as Deliveroo, Just Eat, and Uber Eats driving demand. The rise of eco-friendly packaging and dark kitchen networks such as Keatz and Taster aligns with Europe’s sustainability trends, contributing to market growth. Additionally, regulatory support for food delivery startups and the growth of hybrid kitchen spaces are fueling the demand for cloud kitchens.

Key Players & Competitive Analysis

The Indian cloud kitchen market is rapidly evolving, driven by rising food delivery demand and capital-efficient business models. Rebel Foods leads the space with its tech-enabled multi-brand strategy, operating over 450 kitchens across 45+ cities. Established QSR players such as Box8 and Biryani By Kilo have successfully transitioned to asset-light cloud kitchen formats, while niche brands such as FreshMenu and The Food Lab cater to premium segments. Aggregator-backed kitchens like Swiggy Access and Zomato Infrastructure Services pose disruption risks with their delivery-algorithm advantages. Meanwhile, emerging players such as Yummy Corp and Kitchens@ are gaining traction through operational flexibility. Challenges include high customer acquisition costs, price wars with restaurants, and thin margins. Success hinges on menu innovation, kitchen cluster optimization, and leveraging AI for demand forecasting.

A few major companies operating in the cloud kitchen industry include Rebel Foods, Box8, Biryani By Kilo, FreshMenu, Curefoods, Yummy Corp, Kitchens@, Bigspoon, Kraver’s Canteen, and The Food Lab.

Key Players

- Bigspoon

- Biryani By Kilo

- Box8

- Curefoods

- FreshMenu

- Kitchens@

- Kraver’s Canteen

- Rebel Foods

- The Food Lab

- Yummy Corp

Cloud Kitchen Industry Developments

June 2024, Finnest, a London-based private equity firm, announced that it holds a majority stake in Bengaluru-based cloud kitchen startup, Kitchens@.

Cloud Kitchen Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

By Nature Outlook (Revenue, USD Billion, 2020–2034)

- Franchised

- Standalone

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cloud Kitchen Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 73.05 Billion |

|

Market Size in 2025 |

USD 81.37 Billion |

|

Revenue Forecast by 2034 |

USD 218.13 Billion |

|

CAGR |

11.58% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 73.05 billion in 2024 and is projected to grow to USD 218.13 billion by 2034.

The global market is projected to register a CAGR of 11.58% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Rebel Foods, Box8, Biryani By Kilo, FreshMenu, Curefoods, Yummy Corp, Kitchens@, Bigspoon, Kraver’s Canteen, and The Food Lab.

The independent cloud kitchen segment dominated the market revenue share in 2024.

The standalone segment is projected to witness the fastest growth during the forecast period.