Coagulation Analyzer Market Size, Share, Trends, & Industry Analysis Report

By Product (Clinical Laboratory Analyzers, Consumables, Reagents, Systems), By Test, By Technology, By End-User, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5796

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

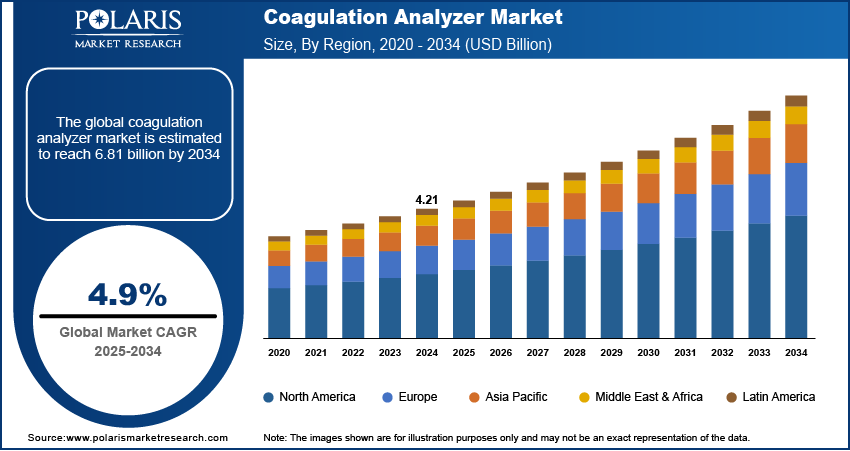

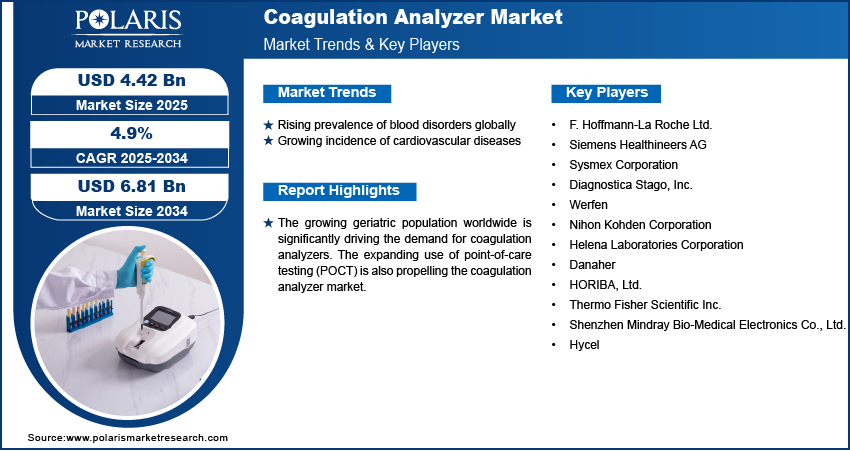

The global coagulation analyzer market size was valued at USD 4.21 billion in 2024, growing at a CAGR of 4.9% during 2025–2034. Rising prevalence of blood disorders globally are boosting the coagulation analyzer market. Growing incidence of cardiovascular diseases is further expanding coagulation analyzer demand.

Coagulation analyzers are diagnostic devices designed to evaluate the blood’s ability to clot, serving as critical tools in the detection, diagnosis, and management of bleeding disorders and thrombotic conditions. These systems analyze various parameters such as prothrombin time (PT), activated partial thromboplastin time (aPTT), and fibrinogen levels, offering precise insights into coagulation pathways. Coagulation analyzers integrate optical, mechanical, and electrochemical technologies to ensure accurate measurement and real-time monitoring of hemostatic processes. They are essential for guiding treatment decisions in patients receiving anticoagulant therapy, undergoing surgeries, or presenting symptoms of coagulation abnormalities. The use of coagulation analyzers significantly improves diagnostic efficiency, minimizes manual error, and enhances patient outcomes through rapid turnaround times and data-driven decision-making.

The growing shift toward healthcare system automation and centralized laboratory operations, the demand for integrated, high-throughput coagulation analyzer systems is significantly surging. Additionally, the use of coagulation analyzers in monitoring patients with conditions such as atrial fibrillation, deep vein thrombosis, and liver disease highlights the importance across a wide range of clinical diagnostic applications.

The growing geriatric population worldwide is significantly driving the demand for coagulation analyzers. Elderly individuals are more prone to developing coagulation disorders and cardiovascular conditions, necessitating frequent monitoring of blood clotting parameters for early detection and effective management. According to a 2023 report by the United Nations, the global population aged 65 years and older is projected to rise significantly, reaching approximately 2.2 billion by the late 2070s. This demographic shift is increasing the demand for geriatric healthcare services, with coagulation testing forming a vital component of clinical assessments. Thus, hospitals and diagnostic labs are investing in high-throughput, automated analyzers to meet the rising volume of coagulation tests, enhancing diagnostic accuracy while reducing operational burden.

The growing adoption of point-of-care testing (POCT) is further propelling the coagulation analyzer market. The need for rapid, on-site diagnostic results is driving the adoption of portable and user-friendly coagulation analyzers in emergency rooms, intensive care units (ICUs), and outpatient clinics. These compact systems allow clinicians to assess coagulation parameters within minutes, enabling quicker decision-making for critical interventions such as surgery preparation or anticoagulant management. The shift toward decentralized care models particularly in rural and underserved regions further supports the importance of point-of-care coagulation solutions, as these analyzers eliminate delays associated with centralized laboratory testing.

Industry Dynamics

Rising Prevalence of Blood Disorders Globally

The increasing global incidence of blood-related disorders is fueling the coagulation analyzer market. Conditions such as hemophilia, thrombophilia, and von Willebrand disease require frequent coagulation monitoring and diagnostics to ensure patient safety and guide effective treatment strategies. Coagulation analyzers support accurate assessment of clotting factors and bleeding tendencies, serving as an essential tool for both diagnosing and managing disorders over the long term. According to the 2023 World Federation of Hemophilia (WFH) WBDR Data Report, data collection on von Willebrand disease was initiated in February 2023. By the end of the year, a total of 999 individuals were enrolled from 45 Hemophilia Treatment Centers located across 22 countries. This highlights a significant step in global blood disorder surveillance and emphasizes the urgent need for effective diagnostic tools such as coagulation analyzers. Expanding patient registries and the wider adoption of standardized protocols across treatment centers are driving increased reliance on automated analyzers to deliver accurate, rapid, and consistent results. This trend is boosting the adoption of coagulation analyzers in specialized care settings and public health initiatives worldwide.

Growing Incidence of Cardiovascular Diseases

The growing burden of cardiovascular diseases (CVDs), including atrial fibrillation, deep vein thrombosis, and stroke, is substantially increasing the need for reliable coagulation monitoring. These conditions often require patients to be on long-term anticoagulant therapy, necessitating precise and regular monitoring of blood clotting parameters to manage bleeding risks and optimize therapeutic outcomes. Coagulation analyzers emerged as critical tools in this domain, helping clinicians tailor treatments based on real-time data while minimizing adverse effects.

According to the World Health Organization, cardiovascular diseases are the leading cause of death globally, accounting for approximately 17.9 million deaths every year. This underscores the scale of CVD-related healthcare challenges and highlights the importance of advanced diagnostic technologies. Healthcare systems aiming to minimize cardiovascular complications are increasingly adopting coagulation analyzers for integration into cardiac care protocols, pre-surgical assessments, and regular patient monitoring routines. Hospitals and specialty clinics are increasingly integrating compact and high-performance analyzers into their workflows to improve accuracy, reduce turnaround times, and enhance patient safety in cardiovascular care.

Segmental Insights

By Product Analysis

The global segmentation, based on product includes, clinical laboratory analyzers, consumables, reagents, systems. The reagents segment is projected to grow during the forecast period. Reagents are indispensable components in coagulation testing procedures and are required consistently with every test run, thereby ensuring recurring demand. The growing global incidence of clotting disorders such as hemophilia, thrombosis, and cardiovascular complications has heightened the demand for accurate and fast-acting reagents. As per data from the US Centers for Disease Control and Prevention, approximately 900,000 people in the US are diagnosed with venous thromboembolism (VTE), or blood clots, each year. Manufacturers are investing in high-quality, stable, and long-shelf-life reagents that offer superior sensitivity and specificity, which has further contributed to the segment’s dominance. The rise in regulatory approvals and standardization of reagent kits for global use is propelling the growth of the market.

The systems segment is projected to witness the fastest growth during the forecast period. This is attributed to the growing technological innovations such as miniaturized platforms, enhanced data visualization, and touchscreen interfaces are improving system usability in both centralized and decentralized environments. For instance, in November 2024, Mindray launched the CX-6000, a fully automated coagulation analyzer system equipped with dual optical and magnetic detection technology, offering high throughput of up to 400 PT tests per hour. The system supports continuous loading, auto re-run, and STAT testing, designed to meet the demands of mid-to-large volume laboratories. These systems are increasingly being integrated with hospital information systems (HIS) and laboratory information management systems (LIMS) for seamless diagnostic workflows.

By Test Analysis

The global segmentation, based on test includes, PT Test, APT Test, and D-Dimer Test. The prothrombin time (PT) test segment accounted for fourth largest market share in 2024 due to its widespread use in monitoring anticoagulant therapy and evaluating clotting disorders. The PT test are crucial in assessing the extrinsic and common coagulation pathways, making it one of the first-line diagnostics for patients on warfarin and other blood thinners. Also, the rising burden of cardiovascular diseases and stroke, along with aging populations in developed and developing regions, continues to drive PT test utilization. According to a report by the American Heart Association, the global age-standardized incidence rate of ischemic stroke is projected to reach 89.32 cases per 100,000 population by 2030. Healthcare providers’ preference for fast, accurate, and cost-effective clotting assessments has made PT testing a staple in hospital labs and diagnostic facilities, thereby sustaining its leadership in the market.

The D-Dimer test segment is projected to grow at a significant pace during the assessment phase. D-Dimer testing is critical for the diagnosis of thrombotic disorders such as deep vein thrombosis (DVT), pulmonary embolism (PE), and disseminated intravascular coagulation (DIC). The test gained significant momentum during the COVID-19 pandemic due to its use as a prognostic marker for disease severity. Even in the post-pandemic era, its relevance in emergency medicine, intensive care units, and oncology settings remains high. Innovations in rapid and point-of-care D-Dimer assays are expanding accessibility, fueling faster adoption across global markets.

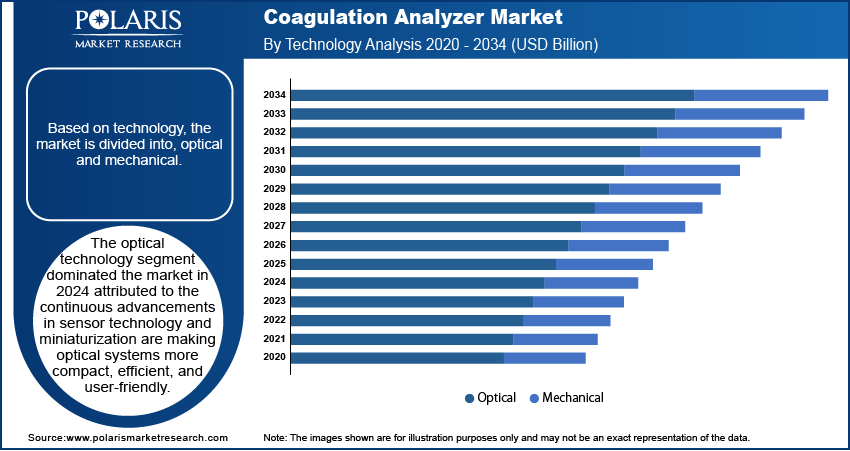

By Technology Analysis

The global segmentation, based on technology includes, optical and mechanical. The optical technology segment dominated the market in 2024 attributed to the continuous advancements in sensor technology and miniaturization are making optical systems more compact, efficient, and user-friendly. Optical coagulation analyzers measure changes in light transmission or absorbance to detect clot formation, offering precise and reproducible results. This method is highly compatible with fully automated systems, making it ideal for high-throughput laboratories and centralized testing facilities.

The mechanical segment is estimated to hold a substantial market share in 2034 driven by its reliability in handling challenging sample conditions and its suitability for resource-limited settings. Mechanical coagulation analyzers are less affected by interferences such as lipemia or icterus, which enhances testing accuracy in diverse clinical environments. Additionally, their simplicity, durability, and minimal maintenance requirements make them highly favorable in low- and middle-income countries where advanced infrastructure may be limited. The rising demand for cost-effective and dependable diagnostic tools, coupled with increasing interest in hybrid technologies that integrate mechanical and optical methods, is further accelerating the expansion across global healthcare systems.

By End User Analysis

The global segmentation, based on end user includes, hospitals and clinical laboratory. The hospitals segment held third largest share in 2024. Hospitals handle a wide spectrum of patient cases requiring coagulation testing, from routine preoperative checks to emergency diagnostics and chronic disease monitoring. The presence of in-house laboratories, skilled personnel, and sophisticated infrastructure enables hospitals to perform a high volume of tests daily. Increasing surgical volumes and the rising prevalence of clotting-related conditions such as hemophilia and thrombophilia are boosting the demand for coagulation analyzers across hospital environments. Moreover, hospital laboratories are increasingly adopting advanced analyzer systems that process complex test panels with minimal turnaround time, thus, boosting the market growth.

The clinical laboratory segment is estimated to hold a significant market share during forecast period, due to the surge in testing volume driven by rising public awareness of preventive healthcare and early diagnostics. These labs often serve a diverse customer base, including physicians’ offices, specialty clinics, and wellness centers. The increasing outsourcing of diagnostic services by smaller hospitals and clinics is also boosting this segment. Furthermore, the emergence of large diagnostic chains and the adoption of automated, scalable analyzer systems are enabling clinical laboratories to offer efficient, cost-effective coagulation testing services.

Regional Analysis

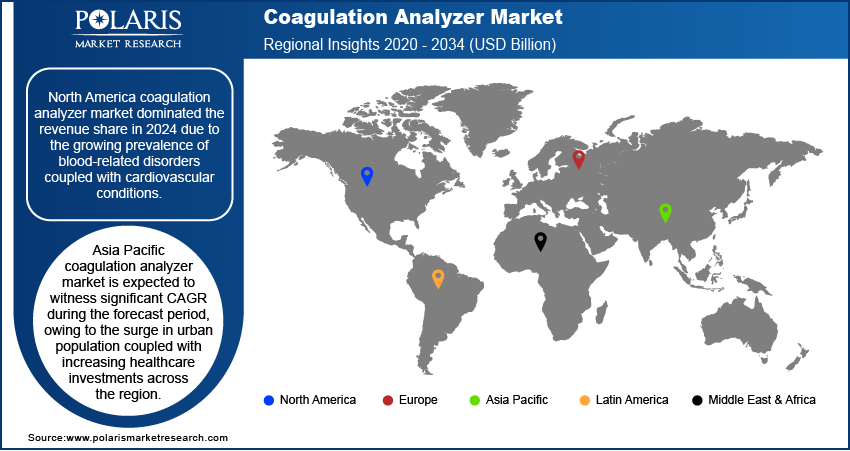

North America coagulation analyzer market dominated the revenue share in 2024 due to the growing prevalence of blood-related disorders coupled with cardiovascular conditions. The region’s well-established healthcare infrastructure, combined with strong adoption of point-of-care testing and centralized laboratory automation, contributed to the widespread use of coagulation analyzers. Furthermore, favorable reimbursement policies and government funding for research into hematological diseases are accelerating the integration of advanced coagulation testing platforms in hospitals and diagnostic laboratories across the region.

US coagulation analyzer market Insight

The US, in particular, dominated the regional market due to the growing technological innovations in the country’s healthcare landscape. The nation’s focus on advancing diagnostic capabilities through digital transformation and automation is significantly accelerating the adoption of next-generation coagulation analyzers. For instance, in March 2025 to develop autonomous diagnostic imaging systems, focusing on AI-driven X-ray and ultrasound solutions. This collaboration is focused on integrating AI-driven digital X-ray and ultrasound solutions with physical AI, robotic automation, and advanced simulation platforms to enhance imaging precision, streamline clinical workflows, and address staffing shortages. Such advancements in diagnostic technology are paving the way for broader implementation of smart, automated coagulation analyzers in hospitals and laboratories across the US, reinforcing the country’s leadership in the regional market.

Europe Coagulation Analyzer Market

The Europe coagulation analyzer market growth is owing to increase in hemophilia diagnosis, implementation of national screening programs, and advancements in laboratory testing protocols. Governments across countries such as Germany, France, and the UK are actively supporting early diagnosis initiatives, which is leading to wider adoption of coagulation analyzers. For example, public health policies in Germany now emphasize early detection of hereditary bleeding disorders, supporting the integration of high-throughput testing equipment in healthcare institutions.

Hospitals and diagnostic centers in Western and Northern Europe are also emphasizing the use of smart diagnostic tools to meet quality and performance benchmarks. The region's focus on sustainability in healthcare delivery and the digitization of patient records are paving the way for next-generation coagulation systems. These advancements are further supported by the growing interest in personalized medicine, where precise coagulation profiling plays a important role in therapy customization and risk mitigation.

Asia Pacific coagulation analyzer market Overview

Asia Pacific coagulation analyzer market is expected to witness significant CAGR during the forecast period, owing to the surge in urban population coupled with increasing healthcare investments across the region. Rapid urbanization is growing pressure on public health infrastructure, pushing governments and private stakeholders to expand diagnostic capabilities and invest in modern medical technologies. According to a report from the United Nations Human Settlements Programme, Asia’s urban population is projected to increase by 50% by 2050, adding approximately 1.2 billion people. This demographic transition is accelerating the need for accessible, efficient, and decentralized diagnostic solutions including coagulation analyzers to serve expanding urban and peri-urban communities.

The rising healthcare investments are enabling the deployment of advanced diagnostic tools across a broader spectrum of healthcare facilities, from tertiary hospitals in metropolitan centers to regional clinics and community health hubs. Countries such as China, India, and Japan are witnessing significant growth in demand for coagulation analyzers as part of their broader push to enhance chronic disease management and preventative care. National health screening programs targeting cardiovascular and hematologic conditions, along with the introduction of cost-effective, automated analyzers, are further boosting the market growth in the region.

Key Players & Competitive Analysis Report

The coagulation analyzer market is highly competitive, marked by intense rivalry among leading companies that are actively focusing on expanding their product lines, increasing manufacturing capabilities, forging strategic alliances, and engaging in mergers and acquisitions (M&A) to solidify their market positions. Key players are making significant investments in the development of advanced diagnostic platforms to meet the growing demand for precision and speed in coagulation testing across hospitals, clinics, and laboratories. The competitive landscape is further shaped by the integration of cutting-edge technologies such as artificial intelligence (AI), deep learning, cloud-based diagnostics, and automated data analytics, which are transforming traditional laboratory workflows and enhancing diagnostic accuracy.

Prominent companies in the coagulation analyzer market include F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Sysmex Corporation, Diagnostica Stago, Inc., Werfen, Nihon Kohden Corporation, Helena Laboratories Corporation, Danaher, HORIBA, Ltd., Thermo Fisher Scientific Inc., Shenzhen Mindray Bio-Medical Electronics Co., Ltd., and Hycel.

Key Players

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

- Diagnostica Stago, Inc.

- Werfen

- Nihon Kohden Corporation

- Helena Laboratories Corporation

- Danaher

- HORIBA, Ltd.

- Thermo Fisher Scientific Inc.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Hycel

Industry Developments

September 2024: Sysmex launched the HISCL HIT IgG assay kit for its CN‑6500/CN‑3500 coagulation analysers in Japan, enabling high-sensitivity detection of heparin-induced thrombocytopenia antibodies.

October 2021: Trivitron Healthcare, in partnership with Diagon‑Vanguard Diagnostics, launched Diagon’s COAG rangeautomated, semi‑automated, and POC coagulation analysers in India.

Coagulation Analyzer Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Clinical Laboratory Analyzers

- Consumables

- Reagents

- Systems

By Test Outlook (Revenue, USD Billion, 2020–2034)

- PT Test

- APT Test

- D-Dimer Test

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Optical

- Mechanical

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Clinical Laboratory

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Coagulation analyzer market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.21 Billion |

|

Market Size in 2025 |

USD 4.42 Billion |

|

Revenue Forecast by 2034 |

USD 6.81 Billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.21 billion in 2024 and is projected to grow to USD 6.81 billion by 2034.

The global market is projected to register a CAGR of 4.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Sysmex Corporation, Diagnostica Stago, Inc., Werfen, Nihon Kohden Corporation.

The optical technology segment dominated the market share in 2024.

The systems segment is expected to witness the fastest growth during the forecast period.