Communication Based Train Control System Market Share, Size, Trends, Industry Analysis Report

By Train Type (Metros and high-Speed Trains); By Type; By Automation Grade; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3629

- Base Year: 2022

- Historical Data: 2019-2921

Report Outlook

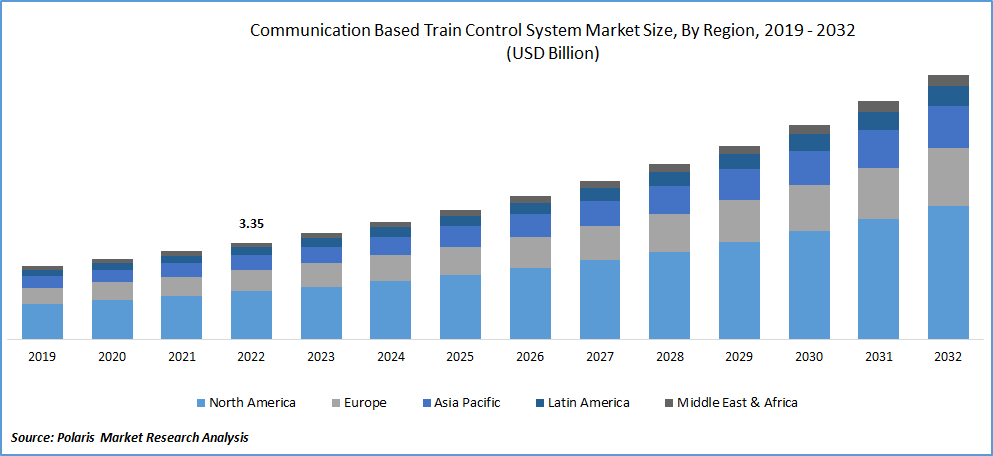

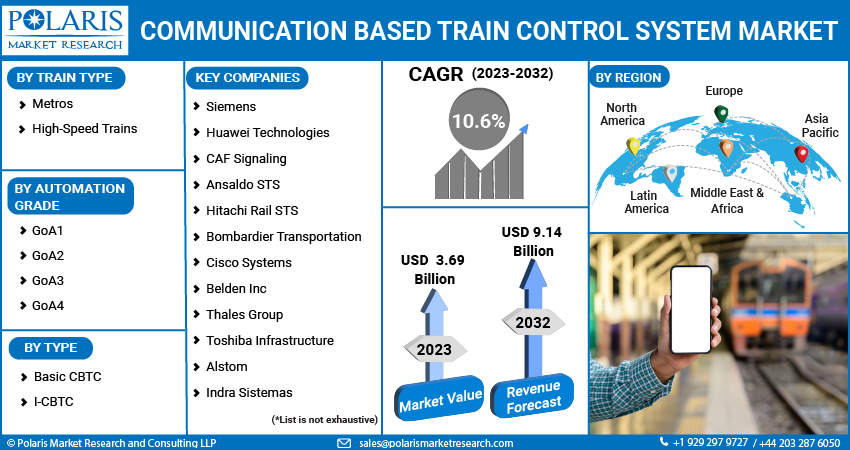

The global communication-based train control system market was valued at USD 3.35 billion in 2022 and is expected to grow at a CAGR of 10.6% during the forecast period. The Communication Based Train Control (CBTC) System Market is for advanced train control systems that utilize communication-based technologies for efficient and safe train operations. CBTC systems enable real-time communication between trains and the control center, facilitating precise train tracking, automated train control, and enhanced safety features.

To Understand More About this Research: Request a Free Sample Report

CBTC systems are designed to replace traditional fixed-block signaling systems, which rely on physical trackside signals and fixed-block sections. In contrast, CBTC systems use wireless communication, positioning technology, and onboard train control units to provide continuous, dynamic train control and monitoring.

The growing demand for enhanced railway safety, increased transportation efficiency, and improved passenger experience drive the adoption of CBTC systems worldwide. These systems offer benefits such as reduced headways between trains, optimized train operations, improved punctuality, and enhanced passenger safety.

The increasing demand and adoption of these systems worldwide, as it enables more efficient train operations, reduce energy consumption and environmental impact compared to conventional signaling systems, and increase government investments towards infrastructure development in modern rail infrastructure, are among the major factors fostering the market growth. Additionally, the constant emergence of wireless communication, the Internet of Things, data analytics, and artificial intelligence worldwide, which has enabled more advanced and sophisticated CBTC solutions and digitalization of rail systems which allows for remote monitoring and improved system performance, is pushing the communication-based train control system market forward.

For instance, in May 2023, Alstom announced they had been awarded a contract of €54 million to design, manufacture, supply, and install advanced train control and signaling solutions for two corridors of Delhi MRTS in India. The new corridors will be equipped with the company's scalable communication-based train control solutions, which improve capacity, efficiency, safety, and reliability and also reduce operating costs.

Moreover, with the increasing reliance on digital communication and data transmission, cybersecurity has become a critical aspect of CBTC systems, as advanced encryption and authentication mechanisms are being widely employed to protect the integrity and confidentiality of data transmitted over wireless networks, ensuring the system's resilience against cyber threats, that is gaining significant traction and will contribute positively towards the market growth. The rapid emergence of deadly coronavirus across the globe resulted in heavy delays in infrastructure projects, including railway upgrades and expansions, and has also disrupted the global supply chains, which led to a negative influence on the manufacturing and delivery of various CBTC system components.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

- Increasing proliferation regarding the system adoption

The growing proliferation regarding the system adoption across the globe due to its several advantageous characteristics, including enhanced efficiency, improved capacity, improved passenger experience, and greater safety features, among others, coupled with the rising prevalence of incorporating various types of advanced cutting-edge technologies, that made the transportation more simple, comfortable, and safe, are the primary factors influencing the demand and growth of the communication-based train control system market.

Furthermore, the rapid increase in desire across the globe to enhance the rail transit capacity and speed to relieve the pressure of extremely busy roads, along with the growing need to evolve and adapt innovative train signaling systems across both developed and developing regions, is further likely to create lucrative growth opportunities in the forecast period.

Report Segmentation

The market is primarily segmented based on train type, type, automation grade, and region.

|

By Train Type |

By Type |

By Automation Grade |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Metros segment held the highest market share in 2022

In 2022, the metros segment held the highest market share due to rapid growth in urbanization and population, mainly in the urban cities due to higher demand for reliable and efficient transportation systems along with the capabilities of CBTC systems to enable efficient train operations, optimized scheduling, and improved traffic management congestion.

Additionally, an increased number of governments and transit authorities worldwide investing heavily in the development and expansion of metro rail networks and introducing favorable initiatives, subsidies, and funding programs supporting the adoption of CBTC systems is likely to impact the market positively. For instance, in January 2023, the Asian Development Bank & the Government of India signed a loan of around USD 350 Mn to improve the metro rail system's connectivity and build 3 metro lines in Chennai city.

The basic CBTC segment accounted for the largest market share in 2022

In 2022, the basic CBTC segment accounted for the largest market share 2022, mainly driven by its numerous beneficial characteristics, including real-time tracking, precise location information, and automated solutions that reduce the risk of accidents and collisions. In addition, increasing investments regarding the modernization and upgradation of existing rain networks due to increased adoption of basic CBTC solutions, as it offers a cost-effective and highly efficient solution to enhance the functionality of rail infrastructure, thereby propelling the segment market growth.

The I-CBTC segment is likely to expand significantly over the coming years, mainly due to the growing adoption of advanced train control systems to provide better safety and reliability to passengers. I-CBTC systems are specifically designed to improve safety levels by providing precise train positioning, automatic train protection, and collision avoidance features, which makes them a preferred choice to be incorporated into rail networks.

The GoA4 segment is anticipated to witness significant growth over the forecast period.

The GoA4 segment is anticipated to witness significant growth over the forecast period, largely attributable to its ability to provide the maximum level of automation and reduce human error by automating the entire train movement. It can also lower operational expenses by eliminating the need for several workers like drivers and dispatchers. Besides this, these kinds of systems could also boost the capacity by allowing the trains to run more closely, increasing the number of trains that can run on the single or same track, and reducing the headways, which in turn, fuels the adoption of the system across the globe at a rapid pace.

North America dominated the global market in 2022

In 2022, North America dominated the global market. The regional market growth can be mainly accelerated by significant investments in rail infrastructure, increasing federal and state financing schemes or programs, and quick adoption of advanced and innovative technologies across the region. In addition, the push for standardization and interoperability among rail systems across major countries like the US and Canada and the establishment of common protocols and communication standards allow for easier integration and interoperability of CBTC systems, further enhancing the growth of communication-based train control systems.

The Asia Pacific region is projected to be a significant growing region during the study period, owing to extensive growth in the burden on the region's transportation infrastructure due to the continuous rise in the population and people shifting to urban areas, which is putting extra pressure of urban transportation sector and boost the need for developments and improvements in rail networks. For instance, according to the United Nations, the urban population in India is estimated to reach 675 million by 2035, with a significant increase from 483 million in 2020, which will account for about 43.2% of the country's total population. And the overall urban population in Asia will be around 2.99 billion in 2035.

Competitive Insight

Some of the major players operating in the global market include Siemens, Thales Group, Huawei Technologies, CAF Signaling, Ansaldo STS, Hitachi Rail STS, Bombardier Transportation, Mitsubishi Electric, Toshiba Infrastructure, Wabtec Corporation, Alstom, Indra Sistemas, Nokia Corporation, ZTE Corporation, Cisco Systems, Teleste Corporation, and Belden Inc.

Recent Developments

- In March 2021, Thales Group announced the launch of its new eight-generation CBTC train control system called SelTracTM G8, which has a completely new digital architecture. With the 8th generation of the system, operations can easily and better anticipate future passenger growth, fleet expansions, and network expansions, along with improved services and better monitoring activities.

- In August 2021, Hitachi Rail STS agreed to acquire the Thales Group Ground Transportation System division for an enterprise value of around EUR 1,660 Mn. With this acquisition, the company will likely boost its growth by expanding its rail signaling system business and fare collection solutions. The joint strength of these twos will also help Hitachi to accelerate its Mobility-as-a-Service offerings.

Communication Based Train Control System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.69 billion |

|

Revenue forecast in 2032 |

USD 9.14 billion |

|

CAGR |

10.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2021 – 2022 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Train Type, By Type, By Automation Grade, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Siemens, Thales Group, Huawei Technologies, CAF Signaling, Ansaldo STS, Hitachi Rail STS, Bombardier Transportation, Mitsubishi Electric, Toshiba Infrastructure, Wabtec Corporation, Alstom, Indra Sistemas, Nokia Corporation, ZTE Corporation, Cisco Systems, Teleste Corporation, and Belden Inc |

FAQ's

key companies in Communication Based Train Control System Market are Siemens, Thales Group, Huawei Technologies, CAF Signaling, Ansaldo STS, Hitachi Rail STS, Bombardier Transportation.

The global communication-based train control system market expected to grow at a CAGR of 10.6% during the forecast period.

The Communication Based Train Control System Market report covering key are train type, type, automation grade, and region.

key driving factors in Communication Based Train Control System Market are 1. Increasing proliferation regarding the system adoption.

The global communication-based train control system market size is expected to reach USD 9.14 billion by 2032.