Composite Railing and Decking Market Size, Share, Trends, & Industry Analysis Report

By Product (Capped Composite Railing & Decking and Uncapped Composite Railing & Decking), By Material, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5785

- Base Year: 2024

- Historical Data: 2020-2023

Overview

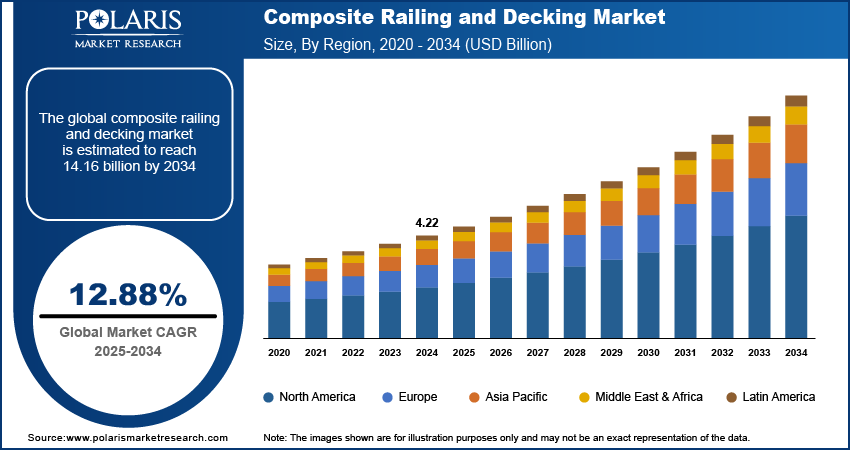

The global composite railing and decking market size was valued at USD 4.22 billion in 2024, growing at a CAGR of 12.88 % during 2025–2034. Key factors driving demand for composite railing and decking include rising urbanization globally, increasing disposable income worldwide, growing demand for sustainable construction materials, and innovation in composite decking and railing.

Composite railing and decking refer to building materials made by combining bonding agents, wood fibers, and recycled plastics to create a durable, low-maintenance alternative to traditional wood. Manufacturers mold these materials into planks, boards, and railings that replicate the appearance of natural wood while offering enhanced resistance to weather, moisture, pests, and decay. Composite railing and decking eliminate the need for frequent sealing, staining, or painting, which makes it highly attractive to homeowners, builders, and commercial property developers seeking long-lasting performance with minimal cost. People use composite decking primarily in outdoor applications such as backyard patios, garden pathways, rooftop terraces, pool surrounds, and commercial boardwalks to create aesthetic outdoor living spaces.

The rising urbanization globally is driving the market growth. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050. This rise in urbanization is increasing the development of residential and commercial spaces along with recreational facilities. Architects and developers are widely using composite material decking and railing solutions in these spaces as they offer durability, low maintenance, and aesthetic versatility. Additionally, urban homeowners and property managers are prioritizing composite materials as they resist moisture, mold, and termites, leading to high demand for composite railing and decking solutions. Therefore, as more people move into cities, demand rises for multi-family housing, rooftop decks, balconies, parks, and public gathering spaces, all of which require composite railing and decking, contributing to market expansion.

The composite railing and decking demand is driven by the increasing disposable income worldwide. Bureau of Economic Analysis, in its report, stated that disposable personal income in the US increased by 0.7% in April 2025 compared to March 2024. This increase in disposable income is driving homeowners to choose composite decking and railing over traditional wood as they offer long-term cost savings through minimal maintenance and greater durability. Increasing income level is also influencing the lifestyle preferences of homeowners, leading to the construction of outdoor entertainment areas, patios, and balconies that rely on composite railing and decking. Therefore, the demand for railing and decking made from composite material is rising with the increasing disposable income globally.

Industry Dynamics

Growing Demand for Sustainable Construction Materials

Consumers and builders are increasingly prioritizing environmentally friendly composite materials to reduce deforestation and landfill waste and meet green building standards such as LEED. This increasing focus on sustainability is driving demand for composite railing and decking, as they are made from recycled plastics and reclaimed wood fibers, which helps reduce environmental impact and conserve natural resources. Hence, as demand for sustainable construction materials increases, the adoption of composite railing and decking also rises.

Innovation in Composite Decking and Railing

Innovation, such as hidden fastening systems, multi-tone color options, and realistic wood grain textures, is elevating the visual appeal and user experience of composite railing and decking. These innovations are attracting homeowners who are seeking low-maintenance, long-lasting outdoor solutions that do not compromise on style. Additionally, smart integration features such as built-in lighting or modular railing systems is providing an added convenience and safety, appealing to modern lifestyle needs. Therefore, as companies invest in R&D to create eco-friendly, customizable, and high-performance composite railing and decking, the market continues to witness rising consumer interest and broader adoption across residential and commercial applications.

Segmental Insights

By Product Analysis

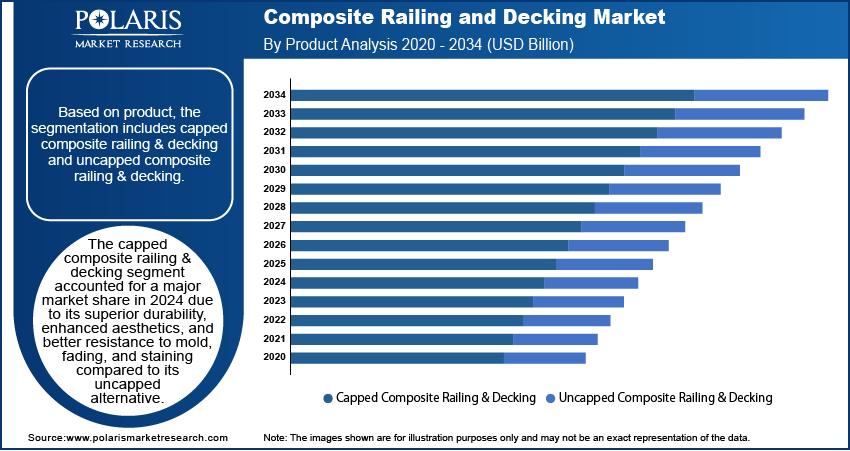

Based on product, the segmentation includes capped composite railing & decking and uncapped composite railing & decking. The capped composite railing & decking segment accounted for a major market share in 2024 due to its superior durability, enhanced aesthetics, and better resistance to mold, fading, and staining compared to its uncapped alternative. Manufacturers invested heavily in co-extrusion technologies, enabling the production of capped boards that offer long-lasting performance with minimal maintenance. Homeowners and commercial property developers favored these products as they deliver the appearance of natural wood while eliminating the recurring cost and effort associated with traditional materials. The rising demand for eco-friendly construction materials further fueled the segment’s growth, as capped variants typically use recycled materials and demonstrate long service life, reducing overall adverse environmental impact.

By Material Analysis

In terms of material, the segmentation includes polyethylene composite decking & composite railing, polypropylene composite decking & composite railing, polyvinyl chloride composite decking & composite railing, PVC & recycled wood composite decking & composite railing, and others. The polyethylene composite decking & composite railing segment accounted for a 33.05% revenue market share in 2024 due to its cost-effectiveness, ease of processing, and wide availability. Manufacturers preferred polyethylene as it offers a good balance of durability, flexibility, and affordability, making it an ideal choice for residential applications. Consumers in both developed and emerging economies increasingly selected PE-based products as they mimic the appearance of natural wood and require less maintenance. The material’s resistance to splintering, rotting, and insect damage also contributed to its growing popularity, especially among DIY homeowners and budget-conscious contractors.

The polyvinyl chloride (PVC) and recycled wood composite decking & composite railing segment is projected to grow at a robust pace in the coming years, owing to its superior resistance to moisture, UV radiation, and temperature fluctuations, which makes it particularly suitable for harsh outdoor environments. Builders are now turning to PVC and recycled wood composites for commercial and coastal installations due to their structural stability and long service life. Innovations in surface texturing and color blending are also making these materials more visually appealing, helping them gain market share among high-end residential customers.

Regional Analysis

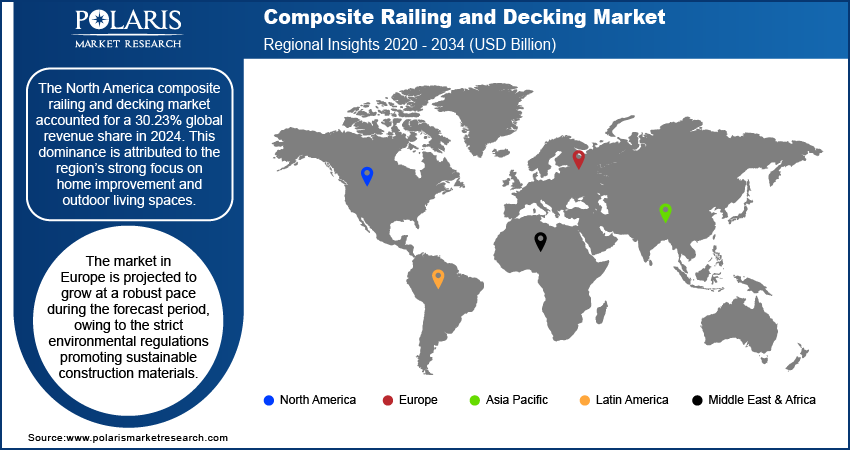

The North America composite railing and decking market accounted for a 30.23% global revenue share in 2024. This dominance is attributed to the region’s strong focus on home improvement and outdoor living spaces. Homeowners in the region heavily opted for low-maintenance, durable, and aesthetically pleasing alternatives to traditional wood, which fueled the adoption of composite railing and decking. The harsh weather conditions in many parts of North America also contributed to the preference for composite materials, which resist to rot, mold, and UV damage. Additionally, stringent building codes and environmental regulations also encouraged the use of sustainable materials, further boosted demand for composite railing and decking in North America.

US Composite Railing and Decking Market Insight

The US dominated the regional revenue share in 2024, due to increased residential construction and remodeling activities. The trend toward outdoor entertainment spaces post-pandemic has also fueled the demand for composite railing and decking in the country. The presence of a strong eco-conscious consumer base in the US further propelled the market growth in 2024. Additionally, major manufacturers in the US invested heavily in innovating enhanced textures and colors, which fueled the adoption of composite railing and decking.

Europe Composite Railing and Decking Market

The market in Europe is projected to grow at a robust pace during the forecast period, owing to the strict environmental regulations promoting sustainable construction materials. Countries such as the UK, France, and Scandinavia are witnessing increased adoption of composite railing and decking due to its durability and low maintenance in wet and cold climates. The expanding urbanization and growing multi-family housing are also projected to contribute to market growth. Additionally, the ban on certain wood preservatives, such as creosote, in the EU is pushing consumers toward composite alternatives.

Germany Composite Railing and Decking Market Overview

In Germany, the demand is driven by the country’s strong emphasis on sustainability and high-quality construction standards. Consumers in the country prefer eco-friendly, low-maintenance materials, making composite decking a popular choice for both residential and commercial projects. The growth in green building certifications, such as Deutsche Gesellschaft für Nachhaltiges Bauen, is further supporting the demand for composite railing and decking. Additionally, Germany’s high disposable income levels are also allowing homeowners to invest in composite decking solutions that offer longevity and aesthetic appeal. For instance, disposable personal income in Germany increased to USD 699.58 Billion in the first quarter of 2025 from USD 696.10 Billion in the fourth quarter of 2024.

Asia Pacific Composite Railing and Decking Market

Asia Pacific is witnessing rapid growth in composite railing and decking demand, due to rising urbanization and infrastructure development. Countries such as Australia, Japan, and China are witnessing increasing adoption of composite railing and decking in both residential and commercial sectors. The tropical climates in Southeast Asia are also driving demand for weather-resistant materials, fueling the popularity of composite decking and railing solutions. Additionally, the growing middle-class population with higher disposable income in the region is propelling market demand as this population is investing heavily in modern, low-maintenance outdoor living solutions. According to data published in a report of India Brand Equity Foundation, a Trust established by the Government of India, the size of India's middle class is projected to nearly double to 61% of its total population by 2047, up from 31% in 2020–2021.

Key Players and Competitive Analysis

The composite railing and decking market is highly competitive, driven by increasing demand for low-maintenance, durable, and aesthetic outdoor living solutions. Key players such as Trex Company, Fiberon, and TimberTech dominate the industry, leveraging advanced material technologies, strong brand recognition, and extensive distribution networks. Regional and private-label brands also challenge these leaders by offering lower-priced options, though often with reduced durability and warranties. The industry is further shaped by increasing competition from PVC and aluminum railing alternatives. Distribution channels play a critical role, with major players securing partnerships with big-box retailers and specialty dealers, while smaller brands rely on online sales and regional distributors. Innovation remains a key differentiator, with companies investing in scratch-resistant coatings, enhanced color retention, and sustainable materials to attract environmentally conscious buyers. Additionally, mergers and acquisitions are reshaping the market, allowing larger firms to expand product portfolios and geographic reach.

A few major companies operating in the composite railing and decking market include Barrette Outdoor Living; Cladco; DuxxBak Composite Decking; Envision Building Products LLC; Eva-Last; Fiberon, LLC; MoistureShield; NewTechWood; TimberTech; and Trex Company, Inc.

Key Players

- Barette Outdoor Living

- Cladco

- DuxxBak Composite Decking

- Envision Building Products LLC

- Eva-Last

- Fiberon, LLC

- MoistureShield

- NewTechWood

- TimberTech

- Trex Company, Inc.

Composite Railing and Decking Industry Developments

February 2025: Trex announced the expansion of its mid-tier composite decking options with the launch of new performance-engineered boards.

February 2025: DuxxBak Composite Decking announced that it had appointed AmeriLux International as its exclusive master distributor for North America.

June 2023: Trex Company, one of the world’s largest manufacturers of high-performance wood-alternative decking and railing, introduced Trex Select T-Rail, a new style-centric, entry-level composite railing system.

Composite Railing and Decking Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Capped Composite Railing & Decking

- Uncapped Composite Railing & Decking

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Polyethylene Composite Decking & Composite Railing

- Polypropylene Composite Decking & Composite Railing

- Polyvinyl Chloride Composite Decking & Composite Railing

- PVC & Recycled Wood Composite Decking & Composite Railing

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Composite Railing and Decking Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.22 Billion |

|

Market Size in 2025 |

USD 4.76 Billion |

|

Revenue Forecast by 2034 |

USD 14.16 Billion |

|

CAGR |

12.88% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.22 billion in 2024 and is projected to grow to USD 14.16 billion by 2034.

The global market is projected to register a CAGR of 12.88% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Barrette Outdoor Living; Cladco; DuxxBak Composite Decking; Envision Building Products LLC; Eva-Last; Fiberon, LLC; MoistureShield; NewTechWood; TimberTech; and Trex Company, Inc.

The capped composite railing & decking segment dominated the market share in 2024.

The polyvinyl chloride (PVC) and recycled wood composite decking & composite railing segment is expected to witness the fastest growth during the forecast period.