Recycled Plastics Market Size, Share, Trends, & Industry Analysis Report

By Type (Polyethylene (PE), Polyvinyl Chloride (PVC)), By Source, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2609

- Base Year: 2024

- Historical Data: 2020 - 2023

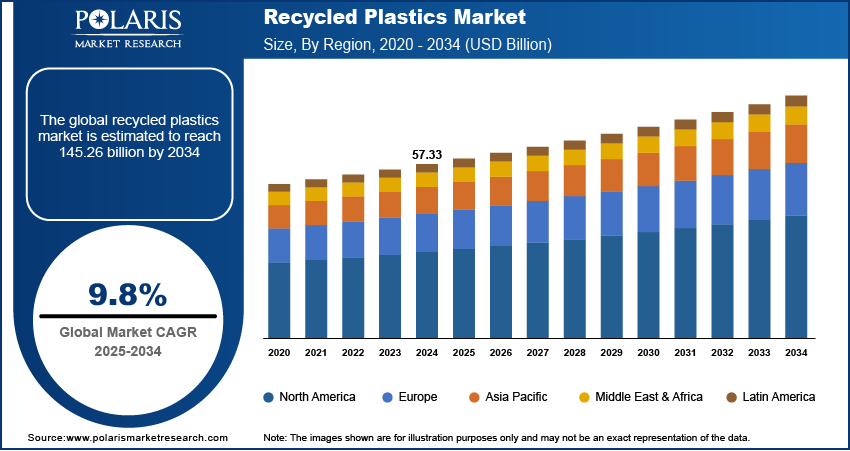

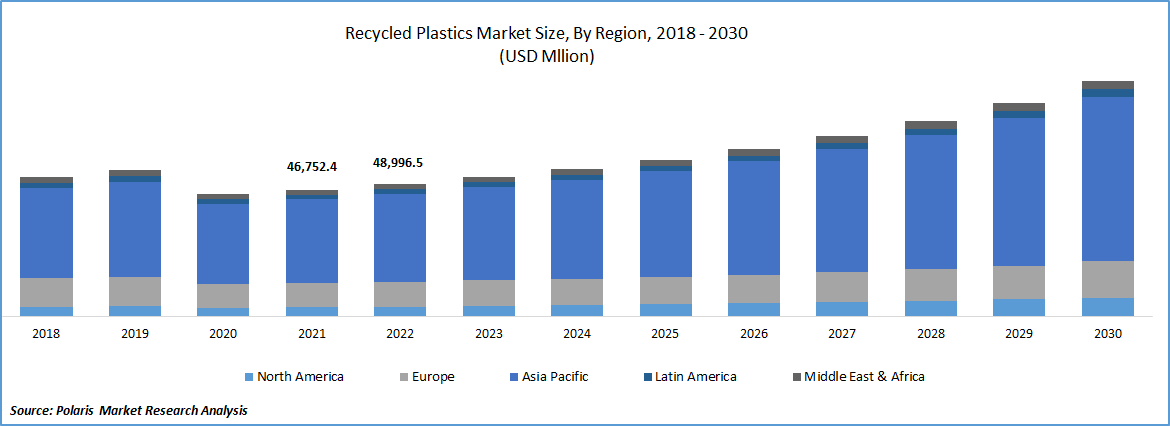

The global recycled plastics market was valued at USD 57.33 billion in 2024 and is expected to grow at a CAGR of 9.8% during the forecast period. The growth is driven by rising government incentive for recycled plastic adoption, rising demand from end use industries, and technological advancment in recycling technology.

Key Insights

- The polyethylene terephthalate segment is expected to witness significant growth due to rising demand for PET in food packaging and bottles.

- The bottles segment accounted for the largest share in 2024 driven by its easy availability and efficient collection network.

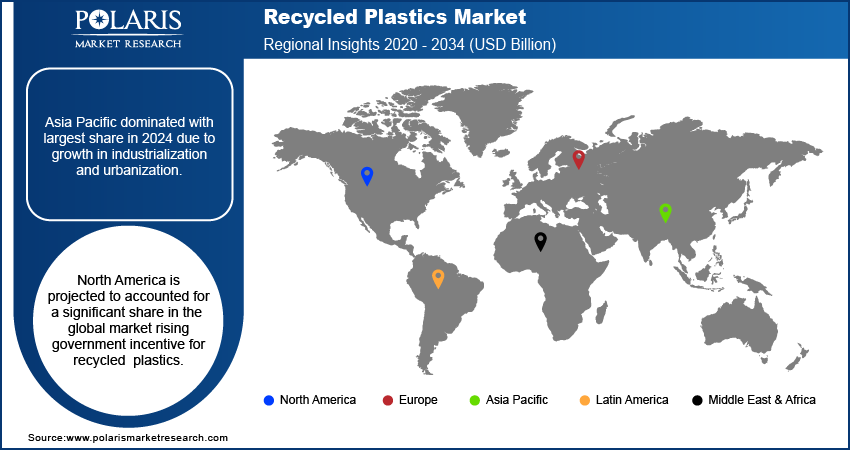

- Asia Pacific dominated with largest share in 2024 due to growth in industrialization and urbanization.

- North America is projected to accounted for a significant share in the global market rising government incentive for recycled plastics.

Industry Dynamics

- The government regulation to promote adoption is fueling the industry growth.

- The growing demand from packaging, automotive, and construction is boosting the industry growth.

- The technological advancement in recycling technology is driving the growth.

- High cost and complexity of plastic sorting and processing, which affects the quality and economic viability of recycled materials.

Market Statistics

- 2024 Market Size: USD 57.33 Billion

- 2034 Projected Market Size: USD 145.26 Billion

- CAGR (2025-2034): 9.8%

- Largest Market: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

Recycled plastics involve reusing and recovering plastic waste to develop functional and valuable products. They are obtained through sorting and cleaning plastic waste, followed by identifying, extruding, and reprocessing. The application of the industry has increased in the packaging, textiles, automotive, and construction sectors.

Several countries across the globe are introducing incentives to promote the adoption of the recycled plastics. In January 2021, a plastic tax associated with plastic packaging, which has not been recycled, was announced by E.U. The U.K. also introduced a charge on plastic packaging not comprising 30% recycled content by April 2022. Similar regulations have been introduced in the U.S., with California driving the adoption of recycled plastic. California announced a minimum recycled plastic content of 15% in PET bottles to be applied from 2022.

Industry Dynamics

Growth Drivers

Recycled plastics are used in packaging, automotive, construction, textile, electrical & electronics, and others major application. Expansion of these end use industries globally is fueling the demand for the recycled plastics. This demand is driven by company's sustainability and circular economy goals, and cost efficiency. Several companies are aiming to reduce their carbon footprint and adopt eco-friendly materials by 2050. This in turn is driving the demand for the recycled plastics. Moreover, greater environmental concerns, strict regulations regarding packaging waste, and implementation of new recycling techniques further support the growth. Technological advancements, supportive government initiatives, and rising investments in R&D have further increased the demand.

Report Segmentation

The market is primarily segmented based on type, source, end-use, and region.

|

By Type |

By Source |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Polyethylene Terephthalate segment is expected to account for the largest market share

Based on type, the recycled plastics market has been segmented into polyethylene (PE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), and others. The polyethylene terephthalate segment is expected to witness significant growth during the forecast period due to its use in food packaging and bottles. PET is transparent, durable, light, and completely recyclable. Due to its non-toxicity, lightweight, and ease of recycling, it is in high demand for use in the packaging of food and beverage goods. Bottled water and beverage manufacturers have switched from using virgin PET to recycled PET for manufacturing packaging bottles as a result of regulations implemented by governments worldwide.

Bottles accounted for a major share in 2024

The different sources of recycled plastics include foams, films, bottles, fibers, and others. The bottles segment accounts for a major market share owing to its easy availability and efficient collection network. Bottles are widely used in the packaging of water, carbonated drinks, medicines, and pharmaceuticals, among others, making it easier to sort and recycle. Morever, bottle collection is relatively cost effectivce which makes them major source of recycled plastic, thereby driving the segment growth.

Foam is used as a lightweight core material across several industries, such as wind energy and power, marine, industrial, and transportation, among others. PET foam is also used in the building and construction sector owing to its fire resistance, thermal insulation, and corrosion resistance.

Packaging segment expected to dominate the global market

On the basis of the end-use industry, the global recycled plastics market is segmented into packaging, automotive, construction, textile, electrical & electronics, and others. The packaging segment accounted for a significant market share in 2021. It is increasingly being used in packaging solutions for food and beverages, consumer goods, and electronic devices. Greater environmental concerns combined with a rise in consumer awareness regarding recycling and packaging waste disposal support the growth of this segment. Market players are taking initiatives to develop recycled packaging solutions to reduce the environmental impact associated with packaging. In May 2022, Trioworld collaborated with Lidl Sweden for the introduction of post-consumer recycled (PCR) plastic film for application in frozen food packaging. This collaborative efforts by major playes is driving the segment growth.

Asia Pacific accounted for a major share in 2024

Asia Pacific dominated the global recycled plastics market in 2024 driven by economic growth, industrialization, and urbanization support. Greater use of plastics in the manufacturing sector, growth in automotive penetration, and wider application in construction and development activities boost the adoption of the industry in Asia Pacific. Construction of residential & commercial projects and significant investments in infrastructure development further contribute to the growth. Increasing environmental concerns and initiatives to adopt sustainable solutions have increased the adoption of the industry in the region. In September 2021, India developed a plastics pact, which is an initiative to encourage businesses to support a circular system for plastics.

North America is expected to experience significant growth during the forecast period, driven by increasing government incentives and initiatives. The government in the region has implemented laws such as Extended Producer Responsibility (EPR) in some states in the US. This law offers incentives for the recycling of plastics. Moreover, there is a rise in investment in recycling facilities. This investment is majorly through government bodies and private capitalists, which further fuels the growth in the region. Furthermore, the region has one of the most mature industrial bases for the automotive, packaging, and construction sectors. This large industrial base fuels demand for recycled plastics for a wide range of applications, thereby driving growth in the region.

Competitive Insight

Major players in the recycled plastics market are Alpek S.A.B. de C.V., Biffa plc, Custom Polymers, Envision Plastics Industries, Far Eastern New Century, Green Line Polymers, Indorama Ventures, Jayplas, KW Plastics, Plastipak Holdings, Republic Services, Stericycle, Suez, Ultra Poly Corporation, and Veolia Polymers. These prominent market players are launching new products to address growing environmental concerns. Collaboration with private and public organizations enable entering new markets and exploring advanced technologies.

Recent Developments

June 2025, Ineos Olefins & Polymers Europe launched recycled plastic production at its Lavera site after receiving pyrolysis oil from plastic waste, enabling the manufacture of virgin-quality recycled polymers to meet stringent EU packaging and sustainability requirements.

In November 2021, the commercialization of Honeywell's "UpCycle Process Technology" plastic recycling method was announced.

In October, 2021, ExxonMobil announced the construction of its facility for advanced recycling of plastic trash at its Baytown, Texas plant. By the end of 2022, the plastic recycling facility is anticipated to be operational. With an initial planned capacity to recycle 30,000 metric tonnes of plastic trash per year, the plant is expected be one of the biggest plastic waste recycling facilities in North America.

In September 2021, Sumitomo Chemical introduced Meguri, which is a new brand incorporating plastic products that are developed using recycling technology. The brand includes several recycled plastic products, such as acrylic resin, polyethylene and polypropylene. The new launch enabled the company to cater to the growing industry need for sustainable solutions and reduce of greenhouse gas emissions.

Recycled Plastics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 57.33 billion |

| Market size value in 2025 | USD 62.80 billion |

|

Revenue forecast in 2034 |

USD 145.26 billion |

|

CAGR |

9.8% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Source, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Alpek S.A.B. de C.V., Biffa plc, Custom Polymers, Envision Plastics Industries, Far Eastern New Century, Green Line Polymers, Indorama Ventures, Jayplas, KW Plastics, Plastipak Holdings, Republic Services, Stericycle, Suez, Ultra Poly Corporation, and Veolia Polymers. |

FAQ's

• The market size was valued at USD 57.33 Billion in 2024 and is projected to grow to USD 145.26 Billion by 2034.

• The market is projected to register a CAGR of 9.8% during the forecast period.

• A few of the key players in the market are Alpek S.A.B. de C.V., Biffa plc, Custom Polymers, Envision Plastics Industries, Far Eastern New Century, Green Line Polymers, Indorama Ventures, Jayplas, KW Plastics, Plastipak Holdings, Republic Services, Stericycle, Suez, Ultra Poly Corporation, and Veolia Polymers.

• The bottle accounted for the largest market share in 2024.

• The polyethylene terephthalate segment is expected to record significant growth.