Food Packaging Films Market Share, Size, Trends, Industry Analysis Report

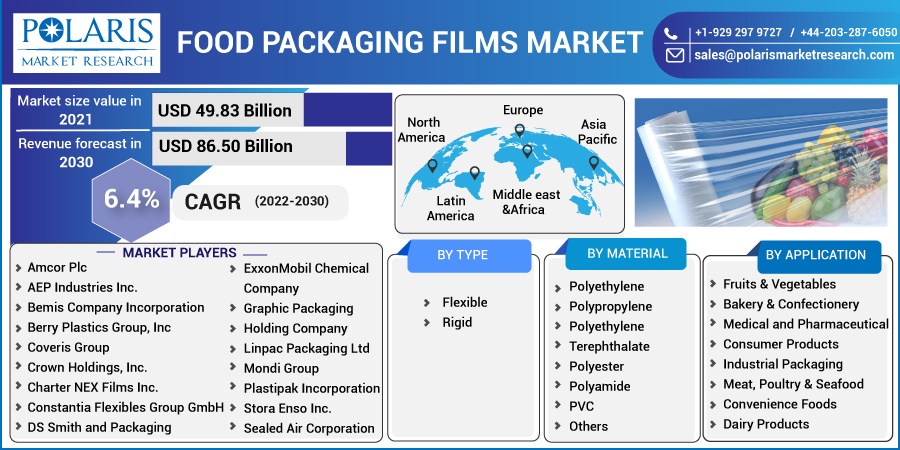

By Type (Flexible, Rigid); By Material (Polyamide, PE, PET, PP, Polyester, PVC, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 118

- Format: PDF

- Report ID: PM2693

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

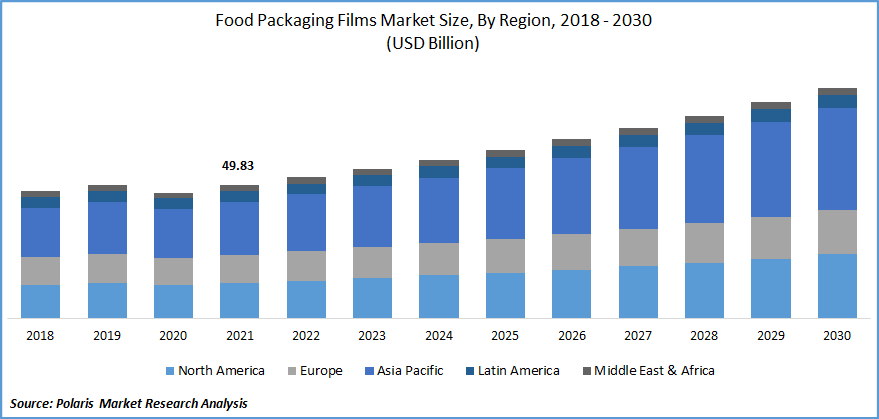

The global food packaging films market was valued at USD 49.83 billion in 2021 and is expected to grow at a CAGR of 6.4% during the forecast period. Increasing consumer demand for plastic-wrapped products due to changing eating behaviors and lifestyles may significantly impact the market.

Know more about this report: Request for sample pages

Because of the high physical properties, storage stability, and product safety, an increase in per-individual disposable income and an increasing population will aid in the market trend. Organic and high-quality foods consumed directly or unprocessed, do not contain additives, and have a longer shelf life are all in plentiful supply.

Packaged food serves various functions, including barrier and leakage protection, comfort, and portion control. Wasted food and loss decrease are addressed by sustainable packaging by reducing or preventing illnesses and contaminants and preserving food quality.

Convenience food is popular because it is easy to transport, has a long shelf life, and therefore is ready to eat. These products include snacks, finger food, chocolate, beverages, etc. These products are frequently hot in ready-to-eat vessels and necessitate less preparation time. Convenience food is expected to grow due to increasing demand for ready-to-eat snacks due to sedentary lifestyles.

Furthermore, growing individual capita disposable income combined with a rising working population is the primary market growth factor. Most people are shifting toward foods that can be easily digestible, which will drive the food packaging market forward. Fast food items are in high demand due to consumers' fast-paced lifestyles.

Because of the high demand, convenience food manufacturers have developed products with higher nutritional value and fewer harmful effects on the body. Because of the high demand for convenience foods, there is an increase in the need for food packaging, which supports the growth of this market.

Because the food industry is considered essential by all government agencies, the effect of COVID-19 on the global market is significantly smaller than in other manufacturing sectors. Flexible packaging businesses serving industries, including food products, are anticipated to do well during the continuing pandemic.

Shifting customer demand patterns, government policies, and amassing drive demand for packaged foods. Because of the higher food safety crisis during the pandemic, consumers in developing countries such as India have shifted their preference from unpackaged food to packaged food.

Additionally, the rise in e-commerce shopping during the outbreak assisted in expanding domestic convenience food sales and packing materials for packaged foods. However, import tariffs and supply chain disruptions restrict the global market growth. Packaged food suppliers' mitigation actions and different governmental relief packages to help economic growth recover are expected to increase market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Prominent packaging producers are advantageously investing in bolstering their positions to capitalize on potential opportunities in the increasing food packaging industry. For example, in May 2021, Coveris Group acquired Four04 Packaging, an innovative packaging manufacturer headquartered in the United Kingdom. Four04 Packaging was working on new ways to preserve the quality of fresh food and bakery products. Coveris intends to use the acquisition to support strategic growth across the United Kingdom by increasing production capacity and product offerings.

Further, in August 2022, H.I.G. Capital, the world's leading alternate solution investment firm with $50 billion in capital reserves under administration, is delighted to announce the completion of the purchases of Atlapac Corporation and the Inno-lok Division of Polyethylene Packaging by its portfolio company, Dazpak Flexible Packaging. Thus, these investments are boosting industry growth.

Also, Green Packaging is increasingly being used to achieve sustainability. They help to reduce environmental pollution and provide a wide range of benefits, such as reduced plastic use, increased recycling, energy conservation, and efficient transportation, resulting in increased industry growth.

Report Segmentation

The market is primarily segmented based on type, material, application, and region.

|

By Type |

By Material |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Rigid packaging films segment is expected to witness the fastest growth

Because of its enhanced use in vegetables, fruits, and other easily crushable packaged foods, rigid packaging has the highest market share among such packaged foods. Consumer lifestyle changes and increased consumption of bread, sausage rolls, and other snacks, primarily in China, India, and the United Kingdom, will drive industry growth.

The growing number of food retail locations with inventive product announcements may drive the overall market size. Furthermore, flexible packaging is becoming increasingly popular due to technological advances and innovative design solutions. Flexible packaging interprets less material than rigid containers and requires considerably less power during packaging product formation.

Furthermore, the production method of flexible packaging emits fewer greenhouse gas emissions, resulting in a cleaner environment. Increasing the adoption of packaging that ensures nutrient and flavor fortification will propel market revenue forward. Strict government regulations and rising consumer consciousness of hygiene and food safety will promote industry growth, boosting the market.

Bakery & confectionery segment industry accounted for the highest market share in 2021

Bakery & confectionery products are usually packed in higher water-protective packaging to maintain their shelf life. Flexible packaging is prevalently utilized in the aforementioned implementation because of benefits such as featherweight, processability, and cost-effectiveness over paper cardboard boxes and tins. Furthermore, the appealing packaging of confectioneries is expected to accelerate segment growth.

The bakery and confectionery segment is expected to expand during the forecast period. The comfort of prepared or ready-to-eat baked goods makes them a popular choice for dual families and students. As a result, the high acknowledgment of packaged food is expected to drive the expansion of the confectionery and bakery section.

The packaging industry is constantly adapting to meet the shifting requirements of consumers. Lifestyle changes, particularly among the working urban population, have played a significant role in the increase in demand for packaged food and beverage products.

The introduction of ready-to-cook and ready-to-eat food and beverages has resulted in ongoing demand growth. Such predictors have influenced the requirement. Increasing health issues and increased awareness about the nutritional value of meats are driving up demand for food wrapping in this segment. The growing public awareness of respiratory infections has increased the demand for safely packaged food.

Growing spending power and expanding middle inhabitants are two significant factors that drive the demand for high-barrier packaging applications in sectors such as food and beverage, consumer products, manufactured equipment, and many others.

Food & beverage packaging consumes the most packaging film, accompanied by pharmaceutical and medical packaging. However, the healthcare industry is expected to provide significant potential growth opportunities for the packaged food film market during and after the forecast period.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific region is predicted to remain the highest over the forecast period due to increasing urban population numbers and retail infrastructure building, which is expected to help China, Japan, and India's growing demand for packaged goods.

Expanding disposable income and consumer preferences for environmentally friendly packaging that is easy to handle and affordable may start driving demand in the region. Because of different manufacturers and rising demand for frozen food, China is a significant consumer of packaging. Furthermore, increased consumer spending on packaged foods and healthier lifestyles may drive regional product sales.

Increasing spending power and growing middle-class inhabitants are two significant factors driving the demand for packaging films throughout industries in the Asia Pacific. The rising demand for plastic-wrapped pharmaceutical and food products in developing economies is expected to drive the most rapid growth in the Asia Pacific market.

The current trade war between the United States and China is expected to affect market demand. The latest ban on the shipment of plastic waste in countries such as Singapore and China is also likely to affect the market during the forecast period.

Rising investment by the major players in the North American region in the food packaging industry is boosting market growth. Also, the increasing expansion of manufacturing facilities across the area by the major players is driving growth.

In July 2021, Direct Pack, a US manufacturing company of thermoplastic plastic wrapping for food applications, decided to expand its Rockingham, North Carolina infrastructure as part of its ongoing growth plan. The Rockingham facility manufactures a wide range of food packaging containers, such as salad baskets and personalized packaging for hot and cold fresh food application areas.

Competitive Insight

Some of the major players operating in the global market include Amcor Plc, AEP Industries Inc., Bemis Company Incorporation, Berry Plastics Group, Inc., Coveris Group, Crown Holdings, Inc., Charter NEX Films Inc., Constantia Flexibles Group GmbH, DS Smith and Packaging, ExxonMobil Chemical Company, Graphic Packaging Holding Company, Linpac Packaging Limited, Mondi Group, Plastipak Incorporation, Stora Enso Inc., Sealed Air Corporation, Sonoco Products Company, Tetra Oak International S.A., The Dow Chemical Company, and Wipak Walsrode GmbH & Co. KG

Recent Developments

In June 2022, RollStar EZ Open Produce Bags were introduced by Novolex. The reusable grocery bags are easy to open owing to a proprietary recipe. The bags are in various dimensions and gauges, such as compostable variants certified by the Biodegradable Products Institute (BPI).

In May 2022, Camvac will introduce two new products at Packaging Advancements in the UK: ExtraPET PCR, an elevated lidding film including over 30% PCR substance, and Camplus Extra MDO PE, an elevated metalized MDO PE in single internet form and laminate formation. ExtraPET PCR was created to meet the increasing consumer demand for more ecologically responsible lidding film solutions. The new film development aims to reduce the amount of plastic in landfills.

In May 2022, Innovia Films inaugurated a new 6.2-meter multi-layer co-extrusion segment at its Pock, Poland, facility. The cutting-edge line would be dedicated to producing low-density polyolefin compress film for shrink sleeve tags and tamper prevalent applications.

Food Packaging Films Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 52.78 billion |

|

Revenue forecast in 2030 |

USD 86.50 billion |

|

CAGR |

6.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Type, By Material, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Amcor Plc, AEP Industries Inc., Bemis Company Incorporation, Berry Plastics Group, Inc., Coveris Group, Crown Holdings, Inc., Charter NEX Films Inc., Constantia Flexibles Group GmbH, DS Smith and Packaging, ExxonMobil Chemical Company, Graphic Packaging Holding Company, Linpac Packaging Limited, Mondi Group, Plastipak Incorporation, Stora Enso Inc., Sealed Air Corporation, Sonoco Products Company, Tetra Oak International S.A., The Dow Chemical Company, and Wipak Walsrode GmbH & Co. KG |