Cone Crushers Market Share, Size, Trends, Industry Analysis Report

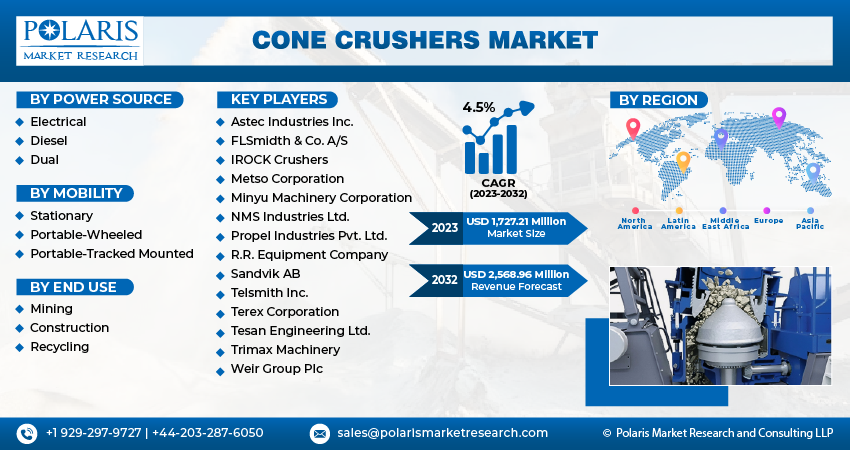

By Power Source (Electrical, Diesel, and Dual); By Mobility; By End Use; By Region; Segment Forecast, 2023 – 2032

- Published Date:Dec-2023

- Pages: 119

- Format: PDF

- Report ID: PM4078

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

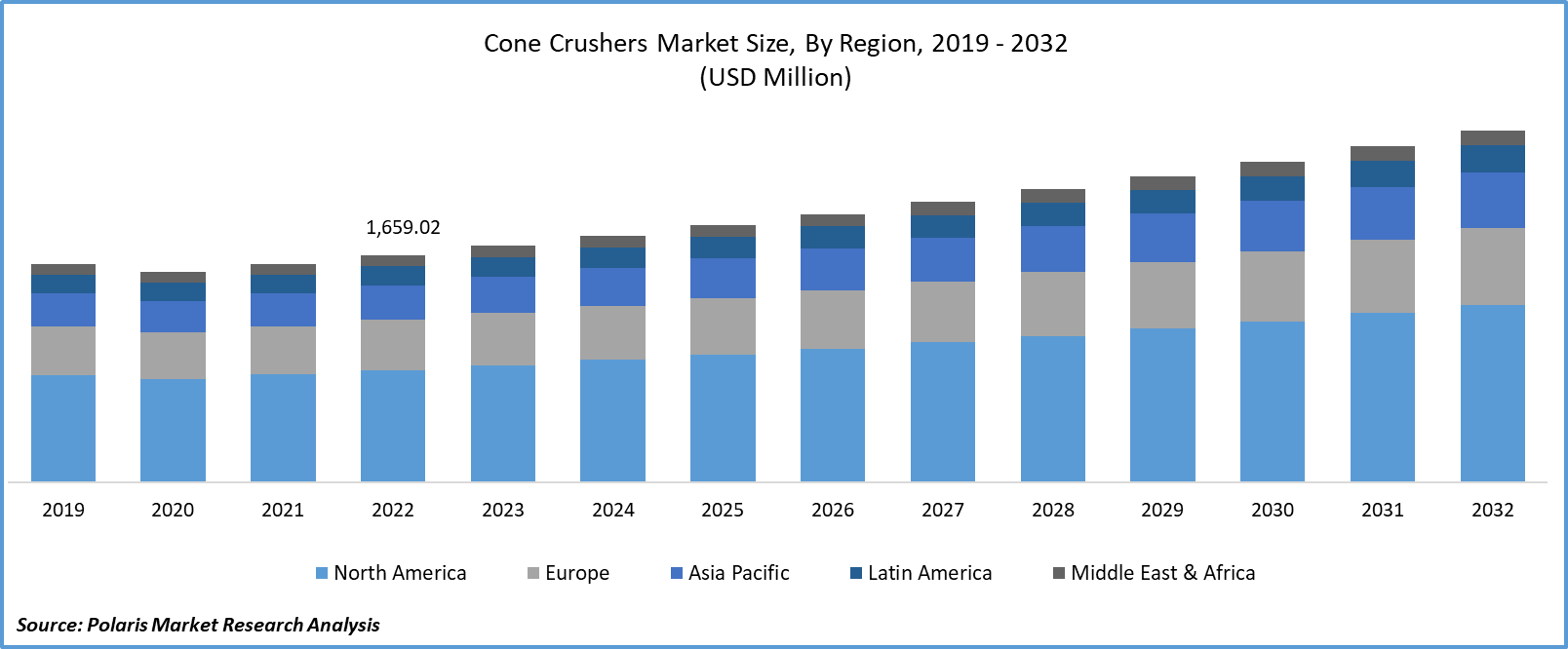

The global cone crushers market was valued at USD 1,659.02 million in 2022 and is expected to grow at a CAGR of 4.5% during the forecast period.

The continuous upsurge in the number of commercial construction activities and growing adoption of automation in mining operations that led to increased production, better energy efficiency, environmental benefits, and cost reduction in overall processes are among the prime factors propelling the demand for cone crushers worldwide. Apart from this, the expansion of quarrying activities across the world, which is driven by the demand for construction materials, also contributes to the need and adoption of cone crushers as they are vital for crushing and processing extracted materials efficiently.

To Understand More About this Research: Request a Free Sample Report

- For instance, as per a recent report published, the total construction spending in the United States reached approx. USD 1.79 trillion in 2022 and commercial construction spending was estimated at USD 128 billion as of July 2023, which is an increase of around 11% from the previous year.

The ongoing advancements and improvements in cone crusher technology by key market companies, such as remote monitoring, automation, and enhanced crusher chamber design, which improves the overall efficiency and performance and focus on expanding their product portfolio and market reach with new product launches across various regions, are further anticipated to create lucrative growth opportunities for the market.

For instance, in June 2021, Kleemann introduced its new mobile cone crusher named the MOBICONE MCO 90(i) EVO2, which is specially designed for intelligent control engineering, quality crushing, and high economy. The newly launched crusher can be used as a supplement for the company jaw’s crushing plant and offers users a range of benefits and advantages.

Moreover, the increasing environmental concerns and growing stringent government regulations around the world have encouraged or prompted the organization]to seek energy-efficient and environment-friendly equipment solutions, which have also fueled the market demand for cone crushers meeting these government standards and needs.

However, the high cost associated with the installation of technologically advanced and enhanced models and the high maintenance and operating costs of crushers are among the key factors hampering the growth of the market.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

- Increasing emphasis on cost reduction and production enhancement of the mining industry boosting the market

As mining industry operations consume a substantially larger amount of energy to mine minerals and other materials, which amounts to significant costs to them, companies in the mining industry are seeking advanced and innovative cone-crushing equipment solutions in order to reduce their overall operation costs, improve productivity, and achieve higher energy efficiency. Thus, with the emergence of the mining sector worldwide, the need and demand for cone crushers also rises.

For instance, as per a study conducted by Deloitte, energy is among the biggest expenses for mining companies, constituting about 30% of total operating costs. Also, according to the report, companies could reduce their energy consumption and cost by 15-20% with an effective energy management system.

The mining and quarrying industry is a significant user of cone crushers for crushing large rocks and minerals. With the increasing demand for minerals and metals in various industries, such as manufacturing and energy, the mining and quarrying sector is expected to drive the demand for cone crushers. Cone crushers are also used in recycling applications to crush and process recycled materials, including concrete and asphalt. As environmental concerns and recycling initiatives grow, the cone crushers market may benefit from increased adoption in recycling operations.

Report Segmentation

The market is primarily segmented based on power source, mobility, end use, and region.

|

By Power Source |

By Mobility |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Power Source Analysis

- The diesel segment held the largest market share in 2022

In 2022, the diesel segment held the largest market share, which is mainly driven by numerous advantages associated with diesel engine cone crushers, such as mobility and portability and easy transportation to different job sites, which makes it a suitable option for construction, quarrying, and mining applications.

The cone crushers segment is projected to grow at a significant growth rate during the projected period on account of increasing demand for energy-efficient and cost-effective cone crushers in different industries, including mining, construction, and aggregates production. Also, electric cone crushers generally have lower maintenance costs because of their fewer moving parts and less requirement for frequent servicing as compared to diesel-powered crushers, which helps companies to increase their revenue opportunities.

By End-Use Analysis

- The mining segment is expected to witness the fastest CAGR during the forecast period.

The mining segment is expected to witness the fastest CAGR during the forecast period on account of substantial growth in the mining sector with increasing demand for minerals and metals such as iron ore, copper, and gold, among others, because of the rising industrialization and infrastructure development in major emerging economies.

The construction segment led the industry market with substantial revenue share in 2022, which is majorly driven by the surge in the number of construction projects of roads, bridges, airports, highways, and commercial buildings and the need for the maintenance and repair of existing infrastructure particularly in developed economies like United States, Canada, Germany, and France, among others.

Regional Insights

- North America region held the largest market in 2022

In 2022, the North American region held the largest market. The regional market growth can be largely attributed to the rapid adoption of technological advancements in cone crusher technology and the surge in the number of government initiatives promoting infrastructure development and mining operations across the region. Additionally, the robust presence of major manufacturers and their competitive strategies, such as new product offerings, marketing, and pricing, is further escalating the region’s market growth.

For instance, in May 2022, McCloskey International unveiled its new C2C cone crusher, which brings the power of a 200 HP cone to a compact footprint while offering high maneuverability. It is likely to deliver high production from the material feed to the product stockpile.

The Asia Pacific region is anticipated to exhibit the fastest growth rate throughout the study period, owing to the emergence of some of the major APAC countries as prominent players in the construction market and the constant increase in investments by both government and private organizations towards the development of mining sector to meet the growing need for various minerals including iron ore across the region.

For instance, as per a report by Invest India, the construction market in India is projected to reach USD 1.4 trillion by 2025, which will make the country the third-largest construction market globally by that period.

Key Market Players & Competitive Insights

The cone crushers market is moderately competitive, with the robust presence of regional and global players worldwide. Companies are significantly focusing on research & development activities to develop new products with more enhanced capabilities. Also, they are opting for some business expansion strategies, including collaborations, partnerships, and acquisitions & mergers, to expand their geographical presence and customer base.

Some of the major players operating in the global market include:

- Astec Industries Inc.

- FLSmidth & Co. A/S

- IROCK Crushers

- Metso Corporation

- Minyu Machinery Corporation

- NMS Industries Ltd.

- Propel Industries Pvt. Ltd.

- R.R. Equipment Company

- Sandvik AB

- Telsmith Inc.

- Terex Corporation

- Tesan Engineering Ltd.

- Trimax Machinery

- Weir Group Plc

Recent Developments

- In March 2023, Metso Outotec announced the launch of its new Nordberg HP200e cone crusher range, which provides a more improved performance and uptime sustainably.

- In November 2022, Terex MPS introduced its Cedarapids CRC1350 Portable Cone Plant, which features a new TC1300X cone crusher, delivering higher productivity at an economical price. It uses high-efficiency roller bearings that lead to several notable advancements which enhance the overall performance and functionality.

Cone Crushers Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,727.21 million |

|

Revenue forecast in 2032 |

USD 2,568.96 million |

|

CAGR |

4.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Power Source, By Mobility, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |