Conveying Equipment Market Share, Size, Trends, Industry Analysis Report

By Type (Belt, Roller, Pallet, Overhead, Chain Conveyors, Others), By Product (Unit Handling, Bulk Handling, Parts & Attachments), By Application, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4094

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

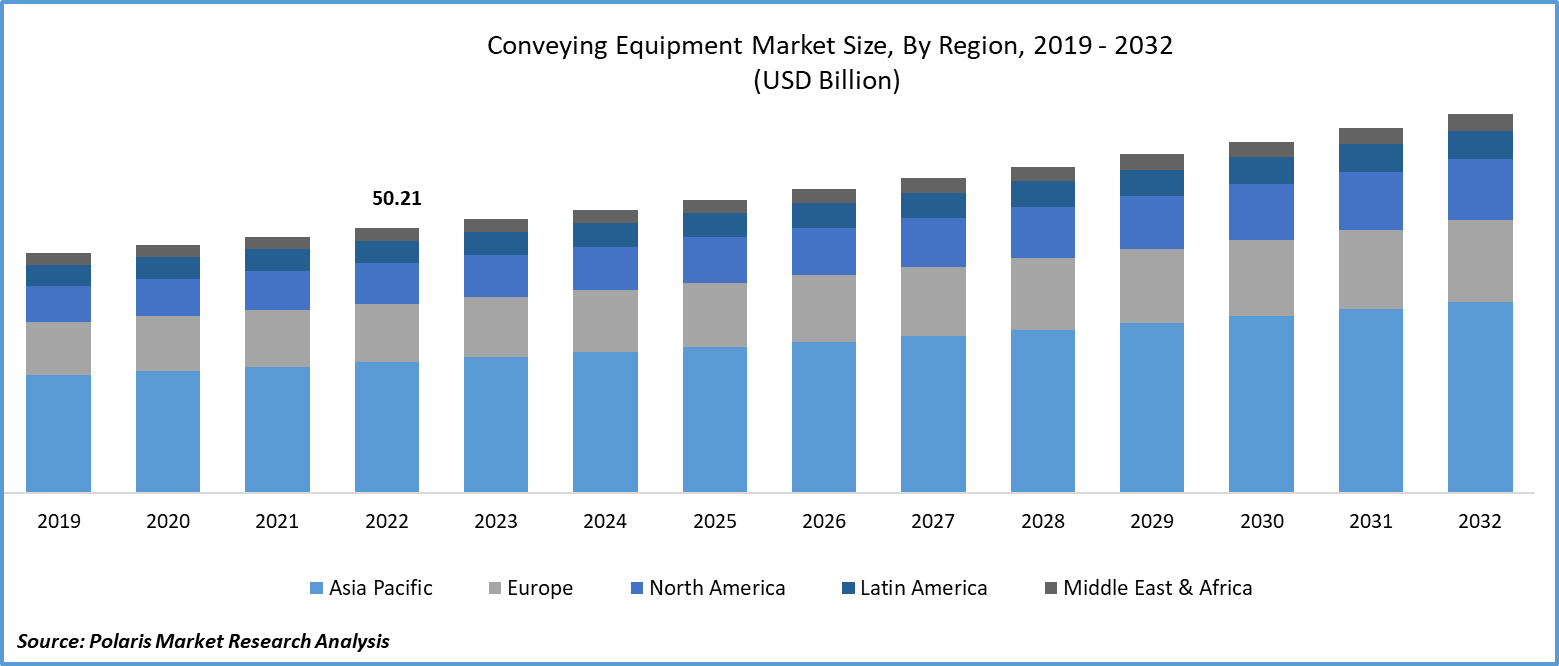

The global conveying equipment market was valued at USD 51.93 billion in 2023 and is expected to grow at a CAGR of 3.70% during the forecast period.

The burgeoning reliance on automated systems in various industries is set to benefit the conveying equipment sector significantly. Conveying equipment plays a crucial role as a carrier of goods across diverse industries such as mining, coal, food & beverages, automotive, airports, and ports. In industrial and commercial facilities, conveyors serve as indispensable tools for the continuous transportation of materials from one location to another. By automating this transportation process, conveying equipment not only ensures a seamless flow of materials but also optimizes production time and enhances overall efficiency. This results in heightened operational efficiency and increased productivity for businesses, making conveying equipment a vital component in modern industrial setups.

To Understand More About this Research: Request a Free Sample Report

Conveyor systems serve as the lifeline of numerous manufacturing and distribution networks. The market's growth is significantly propelled by advancements in smart conveying equipment, making them integral to the Industry 4.0 revolution. Leading companies are focusing on developing conveyors that integrate smart devices and embedded intelligence, making them more efficient and versatile. The rise of e-commerce and evolving changes in distribution channels, from sellers to end customers, are driving this trend. Additionally, the expanding food and beverage sector, which demands both seamless horizontal production and efficient delivery of goods, is opening new avenues for the conveying equipment industry. These factors collectively indicate a promising future for conveyor systems, enhancing their role in modern industries.

The COVID-19 pandemic had a profound impact on the manufacturing sector, leading to widespread disruptions and shutdowns of businesses worldwide. Many manufacturing operations came to a standstill due to safety measures and lockdowns imposed to curb the spread of the virus. When businesses eventually resumed their operations, they encountered challenges in the form of scaled-down production for conveying equipment materials. This reduction in production capacity was primarily a result of the pandemic-induced disruptions in the global supply chain.

Industry Dynamics

Growth Drivers

- Automation Advancements Fueling Conveying Equipment

Developed nations stand out as a significant market for conveying equipment due to their advanced technology sectors, skilled workforce, robust research and development efforts, and sophisticated processing capabilities. The growth of the industry in these nations is fueled by increasing demands from warehouse and distribution, automotive, and food and beverage sectors. The push for automation in manufacturing is a key driving force, aiming to achieve mass production while reducing capital investments.

Moreover, escalating infrastructure investments, particularly in emerging economies, are further contributing to the positive trajectory of the conveying equipment market. These factors combined underscore a thriving landscape for conveying equipment, driven by technological advancements and strategic industry demands.

Report Segmentation

The market is primarily segmented based on type, product, application, and region.

|

By Type |

By Product |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Belt segment accounted for the largest market share in 2022

The belt segment held the largest revenue share. Segment’s growth is driven by increased demand for belt conveyors in sectors like food and beverage, pharmaceuticals, airports, and mining. Belt conveyors are widely used in diverse industries due to their versatility. They can operate at different speeds, adjusted according to the desired throughput, utilizing variable speed drives.

The rollers segment is expected to grow at a rapid pace. This surge in demand for roller conveyors can be attributed to their widespread adoption in material handling tasks, such as baggage handling, loading docks, and assembly lines, among others. Roller conveyors utilize parallel-mounted rollers within frames to move products, employing gravity, manual, or power systems.

By Application Analysis

- Warehouse & distribution segment held the significant market share in 2022

The warehouse & distribution segment held the majority of the market share. This trend is attributed to the rapid expansion of the e-commerce sector, coupled with substantial growth in supermarkets, online retail outlets, & distribution centers.

The automotive segment will grow at a rapid pace. Conveying equipment plays a pivotal role in various applications within the automotive industry. These applications include indexing, processing, integrating vision systems, welding processes, and moving parts along assembly lines. These conveyors facilitate the smooth movement and handling of automotive components during the manufacturing processes, ensuring efficiency and precision in automotive production.

By Product Analysis

- Unit handling segment held the largest share

The unit handling segment held the largest share. Unit handling equipment is predominantly utilized for managing small batches of products and finds widespread application in various industries, including food and beverage processing, warehouse and distribution, and the manufacturing of automotive and other durable goods. Unit handling and conveying equipment contributes to sustainability efforts by reducing energy consumption and optimizing production output. These systems lower maintenance costs by employing reliable equipment that needs minimal servicing and boasts a long lifespan. They are essential for both manufacturing and shipping materials, making them fundamental requirements for various industries.

The bulk handling segment will grow rapidly. This equipment is widely utilized for tasks like loading and unloading. The increasing industrialization is anticipated to boost the demand for bulk equipment in the upcoming years. This category includes various equipment such as conveyor belts for coal, fuel handling equipment, conveyor belts, coal handling systems, coal & ash handling systems, rotary air-locks, rotary air valves, truck loaders, rotary feeders, & belt conveyors.

Regional Insights

- Asia Pacific dominated the global market

Asia Pacific emerged as the largest region. The region is witnessing a surge in industrialization, with numerous industries emerging rapidly. These industries, ranging from manufacturing to e-commerce, demand efficient and rapid material handling systems to streamline their operations. As these industries expand and diversify, the need for cutting-edge conveying equipment becomes paramount. Additionally, the region's economic growth, coupled with increased international trade, propels the demand for seamless and agile transportation of goods within and across borders. These factors collectively drive the growth, making it the leading hub for market expansion.

North America region is anticipated to grow rapidly throughout the forecast period. By focusing on innovation, companies in the conveying equipment sector can develop solutions that not only adhere to regulatory requirements but also offer unique features and capabilities. Customization is becoming increasingly important for industries that require tailored solutions to optimize their operations. For instance, industries like automotive manufacturing, e-commerce, and food processing often have specific requirements for material handling. Conveying equipment that can be fine-tuned to meet these specific demands provides a competitive advantage.

Key Market Players & Competitive Insights

The sector emphasizes research and development efforts to create innovative technologies for product manufacturing and integration at different points in the value chain, aiming to establish a competitive advantage in the market. Businesses are embracing tactics like collaborations, mergers, and acquisitions to broaden their geographic presence.

Some of the major players operating in the global market include:

- BEUMER GROUP

- Continental AG

- Daifuku Co., Ltd.

- Emerson Electric Co.

- Fives Group

- FlexLink

- Jungheinrich AG

- Kardex

- Kion Group AG

- KUKA AG

- Murata Machinery, Ltd

- Phoenix Conveyor Belt Systems

- Siemens

- TGW Logistics Group

Recent Developments

- In July 2023, Jungheinrich announced plans to construct a new logistics warehouse in Freilassing for Hawle Armaturen by October 2024. The project will include a comprehensive conveyor system, order-picking workstations, five stacker cranes with SPS, and silo steel rack constructions with roof and wall cladding.

- In April 2023, TGW Logistics introduced an innovative system designed to help food service professionals, grocery producers, and retailers effectively tackle future challenges. With FullPick, both pallets & roll cages can be easily loaded entirely automatically.

Conveying Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 53.73 billion |

|

Revenue forecast in 2032 |

USD 71.83 billion |

|

CAGR |

3.70% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Sample, By Product, By Application, By Usage, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |