Core Banking Software Market Share, Size, Trends, Industry Analysis Report

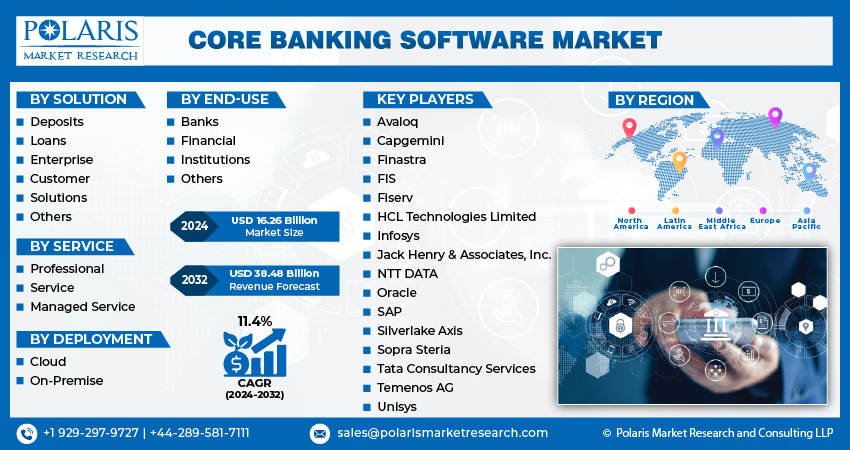

By Solution (Deposits, Loans, Enterprise Customer Solutions, Others), By Service, By Deployment (Cloud, On-Premises), By End Use, By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM2068

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

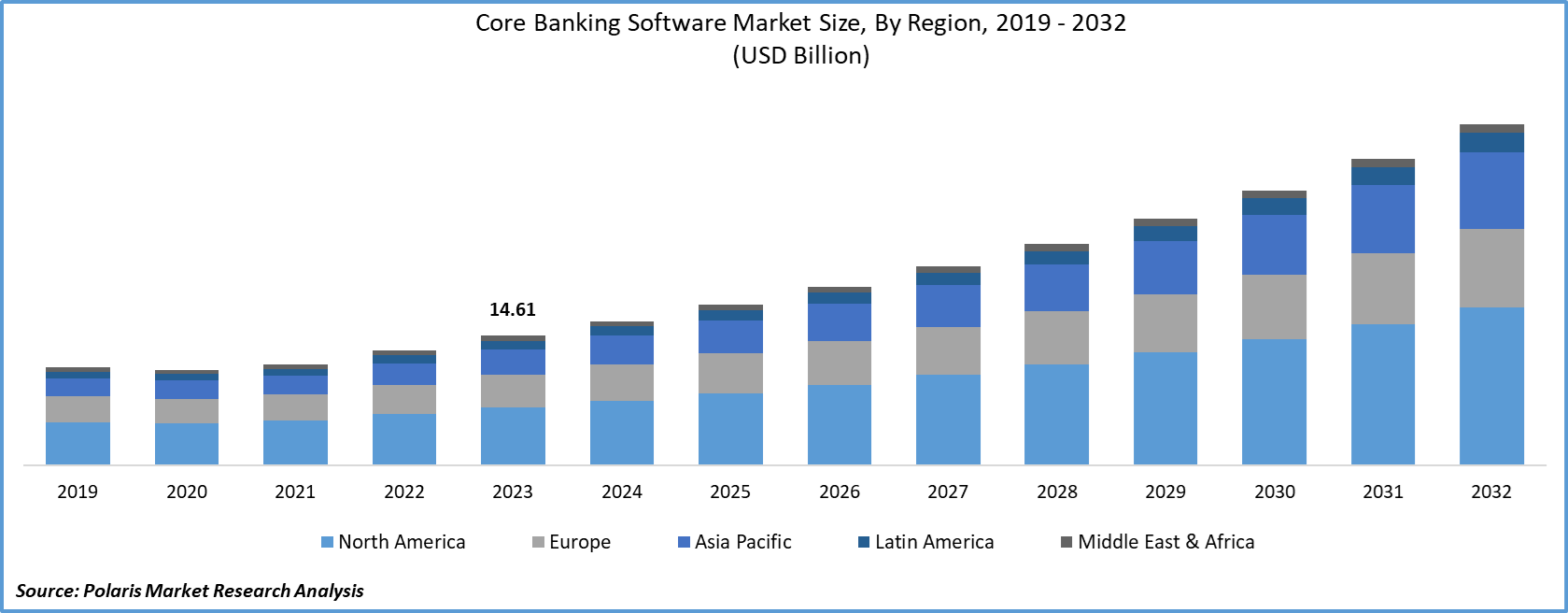

The global core banking software market size was valued at USD 14.61 billion in 2023. The market is anticipated to grow from USD 16.26 billion in 2024 to USD 38.48 billion by 2032, exhibiting the CAGR of 11.4% during the forecast period.

The adoption of the core banking software offers customers access to core banking services from any subdivision of the banks across the region and transfer data through delivery channels. Also, core banking software solutions facilitate banks to process withdrawals & deposits, improve transactions services, and enhance the management of customer’s activities. Thus, these factors act as a catalyzing factor for core banking software market growth around the world.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Furthermore, emerging economies such as China, India, South Korea, Singapore, and others present various opportunities for the core banking software solution providers to expand their business operations. This may also accelerate the adoption of the core banking software industry in the estimated period. The widespread of the COVID-19 exhibits a negative impact on the global core banking software industry.

This pandemic forced financial institutions and banks to allow their workforce to carry on their tasks under work from home (WFH) policy. This move leads to experiencing sudden struggling variations in the rates of interest as well as a delayed lease payment in the financial market. Therefore, it is a major challenge for financial institutions and banks to re-establish variations in their credit and loan management situations. To conquer this scenario, various vendors are introducing developed core banking software solutions in the market, which further strengthens the market development.

Industry Dynamics

Growth Drivers

The increasing penetration of the core banking technologies in the financing industry drives the global core banking software market growth. The banks and financial institutes turn out as the highest adopters of the technologies such as AI, chatbots, machine learning, cloud, RPA, API, and blockchain. Also, by executing the core banking software solutions, banks and financial institutes are proficient in working highly advanced tasks & customer analysis. This also facilitates their consumers to perform their transactions on software effectively.

Thereby, numerous banks are picking core banking software solutions for offering more value-added as well as integrated services to their end-user, which fuels the core banking software market growth across the globe. In addition, the proliferation of SaaS-based and cloud-based software platforms presented by various software companies acts as a catalyzing factor for core banking software industry growth.

It facilitates banks and financial institutes to monitor transactions, payments, and other operations. Thereby, increasing demand for advanced and enhancing productivity across enterprises will accelerate the market demand. Accordingly, market vendors are introducing new products to gain a huge consumer base in the core banking software industry. For instance, Temenos AG unveiled its cloud-based agnostic products- Temenos Transact and Temenos Infinity to increase penetration of cloud-based technologies in the forecasting period.

Report Segmentation

The market is primarily segmented on the basis of solution, service, deployment, end-use, and region.

|

By Solution |

By Service |

By Deployment |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Solution

The enterprise customer solution segment is the leading in terms of revenue generation in the global market. The market easily integrates with the ERP & CRP as well as customer information and administrative management tools with the help of the central database of the banks. Therefore, core banking software solutions aid in enhancing performance and expanding their working limits while presenting a sole interface and decreasing the working costs of banks.

Hence, these may contribute towards the market growth across the globe for managing effective operations. The core banking solutions segment is likely to show substantial growth in the foreseen period. The market facilitates inter-connectivity among all branches of the equivalent banks and financial institutes. Besides, it also assists the management of credit processing and loans & deposits.

Core banking solutions efficiently process numerous transactions among various subdivisions of banks because it is incorporated with the back-end system. Moreover, core banking solutions also aids in enhancing multiple financing activities such as opening new floating accounts, servicing loans, processing deposits and withdrawals, and calculating interests.

Insight by Deployment

The on-premises segment is recorded with the largest revenue shares in the global market based on the deployment segment. Factors like setting up an on-premises system in organizations lead to complete responsibilities regarding the integration of IT-related software solutions along with security problems. Moreover, enterprises with legacy platforms are collaborating with IT professionals for decreases concerns about security & operational costs and the data recovery process. Therefore, these emerging factors create a lucrative growth of the market across the globe.

The cloud segment is expected to register the highest CAGR over the forecasting period. Various companies are introducing digital innovative products & services for gaining huge traction among end-user. The adoption of cloud-based technologies offers benefits such as increasing working productivity, automating operations, secure & flexibility, and it is a very cost-effective solution.

For instance, in May 2020, several chief banks declared their partnerships with the new cloud-based core banking system providers. Various small and midcap banks in Latin America and the U.S. are few examples of these partnerships. As a result, it leads the market growth in the forecasting period.

Geographic Overview

Geographically, North America is the largest contributor in terms of revenue and dominates the overall global market because this region has the highest adoption rate of opting for developed core banking software by the major banks and financial institution. Besides, various small and medium banks are deploying these software solutions for the efficient working of financial activities. Thus, the segment is dominating in the region with the increasing application limit of these software solutions.

Moreover, Asia Pacific is expected to emerge as the fastest-growing region across the globe in the upcoming years. The rising penetration of smartphones and web-based applications in the financial industry primarily fuels the market growth. Furthermore, the increasing economies in the region such as China, India, South Korea, and others are likely to foster the implementation of the market.

Competitive Landscape

Some of the Major Players operating the global market include Avaloq, Capgemini, Finastra, FIS, Fiserv, HCL Technologies Limited, Infosys, Jack Henry & Associates, Inc., NTT DATA, Oracle, SAP, Silverlake Axis, Sopra Steria, Tata Consultancy Services, Temenos AG, and Unisys.

Breast Implants Industry Developments

- July 2023: FIS was selected for three XCelent Awards by the research and advisory firm Celent in the categories of ""Advanced Technology,"" ""Customer Base,"" and ""Breadth of Functionality."" These awards recognize the cloud-native, computerized architecture of FIS Banking Platform.

- April 2023: Temenos and HCL Technologies Limited expanded their partnership to accelerate the digital transformation of banks and other financial institutions. This partnership combines HCL Tech's extensive cloud hosting, implementation, and integration capabilities with Temenos' open platform for composable banking and its state-of-the-art enterprise solutions.

Core Banking Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 16.26 billion |

|

Revenue forecast in 2032 |

USD 38.48 billion |

|

CAGR |

11.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Solution, By Service, By Deployment, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Avaloq, Capgemini, Finastra, FIS, Fiserv, HCL Technologies Limited, Infosys, Jack Henry & Associates, Inc., NTT DATA, Oracle, SAP, Silverlake Axis, Sopra Steria, Tata Consultancy Services, Temenos AG, and Unisys |