Customized Premixes Market Share, Size, Trends & Industry Analysis Report

By Form (Liquid, Powder); By Nutrient; By Function; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 119

- Format: PDF

- Report ID: PM1875

- Base Year: 2024

- Historical Data: 2020-2023

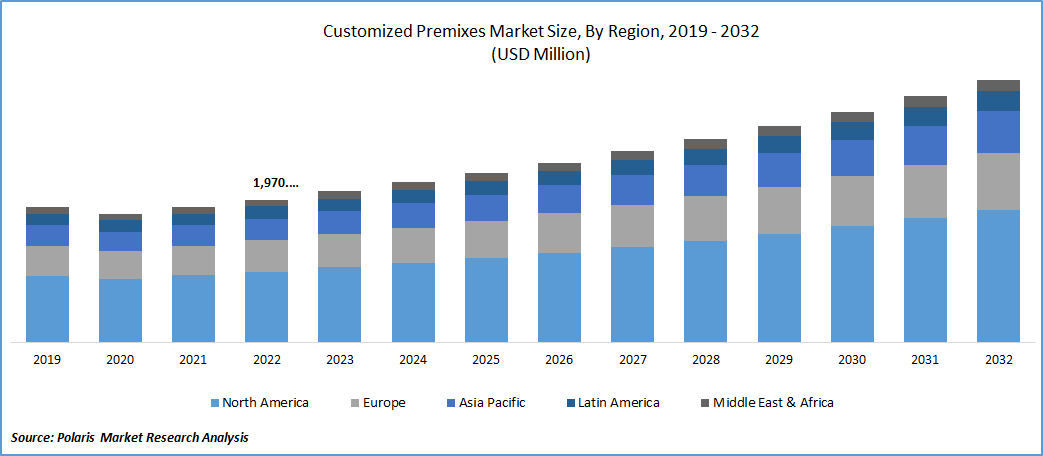

The global customized premixes market was valued at USD 1920.05 million in 2024 and is projected to grow at a CAGR of 7.20% from 2025 to 2034. Growth is supported by increasing demand for tailored nutritional formulations in food and beverage industries.

Increasing consumer interest in vitamin- and mineral-fortified foods, coupled with a growing health-consciousness, is anticipated to drive industry expansion. Customized premixes, comprising tailored blends of various nutrients like minerals, amino acids, vitamins, fibers, nutraceuticals, and nucleotides, have witnessed heightened demand. This surge is attributed to the rising popularity of fortified beverages, especially among sports enthusiasts and athletes, who have a notable preference for sports drinks and energy drinks worldwide.

Health-aware individuals in the United States are fueling an increased desire for functional drinks imbued with a variety of nutrients such as vitamins, minerals, amino acids, and nucleotides. Notably, energy and sports beverages have gained significant popularity in the nation within the category of functional drinks.

To Understand More About this Research: Request a Free Sample Report

The uptick in the use of dietary supplements, prompted by the surge in chronic illnesses and the mounting expenses of healthcare, has resulted in a growing demand for premixes. Of particular interest are vitamins and minerals, renowned for their exceptional health advantages, as they play a vital role in sustaining a resilient immune system, hormonal equilibrium, backing tissue growth and bone health, and overseeing metabolism.

Furthermore, the desire for a personalized mix of nutrients tailored to individual needs has heightened due to variations in nutritional deficiencies among individuals. Additionally, consumers have grown accustomed to having on-demand and personalized services. With the surge in on-demand personalization, the industry is expected to experience substantial growth throughout the forecast period.

However, the substantial investment in research and development endeavors aimed at creating products with specific requirements, ensuring precise fortification without compromising taste and texture, has led to elevated product costs, thereby impeding industry growth. Moreover, challenges such as inaccurate labeling of food products and issues related to alterations in color, texture, and flavor are likely to pose hurdles for market players, ultimately impacting product demand.

Industry Dynamics

- Growth Drivers

- Increasing Consumer Health Awareness Propelling Market Expansion

The rising demand for nutrient-enriched foods and increasing health awareness among consumers are anticipated to drive industry growth. The global use of customized premixes is boosted by the popularity of ready-to-eat (RTE) foods fortified with active nutrients and chemicals. The demand for nutritional bars is fueled by busy lifestyles and the growing trend of on-the-go food consumption. Additionally, the utilization of customized premixes for animal feed production contributes to market expansion. The significant growth in the consumption of fortified beverages, especially sports and energy drinks, among sports enthusiasts and athletes worldwide has led to a substantial increase in the demand for customized premixes. Leading players are introducing innovative liquid premixes for fortifying various products such as salad dressings, infant milk formulas, cereals, and dietary supplements. These products, often made with vegan-friendly botanicals, offer diverse colors, tastes, and flavors tailored to meet individual nutritional needs. Furthermore, increased investments in advertising and promotional activities by key players are expected to further propel Customized Premixe market growth.

Report Segmentation

The market is primarily segmented based on form, nutrient, function, application, and region.

|

By Nutrient |

By Form |

By Function |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Form Analysis

- The Powder segment held the largest revenue share in 2024

The use of powdered premixes is widespread due to its numerous advantages, including convenient packaging, cost-effectiveness, stability, and flexibility, making it the preferred choice over liquid premixes. This form is particularly favored for supplements consumed in larger quantities.

End-use industries like food and beverage and dietary supplements prefer powdered premixes because of their ease of packing and handling. Among the processes used to create powder premixes, spray drying is a popular choice among companies due to its shorter cycle time, scalability, and cost-effectiveness compared to freeze-drying.

Liquid premixes offer flexibility in dosing and faster absorption. Their high water content facilitates easy mixing in various formulations, making them popular in the food and beverage industry, especially for products like smoothies, yogurt, and energy drinks.

However, handling and storage of liquid premixes become inconvenient with bulk packaging, as they occupy more space. Additionally, liquid premixes tend to be more expensive than powder premixes, have a shorter shelf life, and often require refrigeration. These factors contribute to the preference for powder premixes over liquid premixes.

By Function Analysis

- The Energy segment accounted for the highest market share during the forecast period

Energy derived from fortified food and beverages supports physical tasks and essential bodily functions, including cell growth, repair, blood transport, and respiration. Dietary supplements containing vitamin B12, iron, calcium, chromium, and magnesium are widely consumed to enhance and sustain energy levels.

Micronutrients play a vital role in maintaining a robust immune system. Commonly used micronutrients for immune system functionality include vitamins, selenium, zinc, and iron. Vitamin C and vitamin D are particularly essential for immune system enhancement. The COVID-19 pandemic has led to a significant rise in the consumption of nutrition-rich products to bolster immunity.

The widespread consumption of functional foods enriched with minerals and vitamins is contributing to enhanced bone and joint health. Increasing consumer preference for bone health supplements from an early age to mitigate potential complications in later stages is expected to drive product demand.

The rising popularity of functional beverages offering health benefits such as improved immunity, increased energy, and enhanced digestive health is poised to boost overall market growth. Moreover, the increasing use of dietary supplements to address concerns related to digestive health, weight management, and vitality is anticipated to further propel the growth of this segment in the forecast period.

Regional Insights

- North America dominated the largest market in 2024

The robust expansion of customized premixes in North America is linked to the emerging trend of functional food and beverages. The rise in the aging population has generated an augmented need for micronutrient supplements among consumers to uphold health and well-being. The U.S. Food & Drug Administration recommends the inclusion of vitamin supplements in the daily routines of individuals aged 50 and above. Such governmental guidance motivates manufacturers to innovate new supplements and capitalize on their growing demand, thereby positively influencing market growth. The escalating interest in herbal supplements and functional food and beverages further contributes to the heightened demand for botanical extracts and phytochemicals premixes in the region.

Asia Pacific is expected to demonstrate substantial growth due to the rising demand for customized dietary supplements formulated with personalized micronutrient premixes. Developing countries exhibit a significant demand for dietary supplements, particularly to enhance overall health among children, pregnant women, and the elderly. The inclination to invest more in nutritional products for preventive measures against conditions like obesity, diabetes, and cardiovascular diseases acts as a catalyst for market growth. The fast-evolving food and beverage sector, marked by new product innovations in the functional food and beverage space, further propels the market's expansion in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- ADM Animal Nutrition

- BI Nutraceuticals

- Corbion N.V.

- Farbest Brands

- Glanbia plc

- Jubilant Life Sciences Limited

- Koninklijke DSM N.V.

- Piramal Group

- Prinova Group LLC

- Pristine premixes

- Provimi Animal Nutrition India Pvt. Ltd.

- SternVitamin GmbH & Co. KG

- Utrix S.A.L

- Vitablend Netherland B.V.

- Wright Enrichment Inc.

Recent Developments

- In March 2022, SternVitamin has launched a series of micronutrient premix concepts, including SternMind, SternFocus, PureVITalizer, SternDe-Stress, and Relax, aimed at supporting cognitive performance and mental well-being. These premix concepts are designed to help producers of food supplements, foods, and beverages tap into the growing market demand for products in these categories.

- In December 2021, Prinova has completed the acquisition of Lakeshore Technologies, a contract manufacturer specializing in various toll processing services, including micronizing, repackaging, blending, sifting, and metal detection and removal. This strategic move is expected to enhance Prinova's capabilities, bring skilled personnel on board, and provide increased flexibility for its customers in the industry.

- In September 2021, ADM has acquired the commercial team and premix client list of Mixscience Polskain in Poland, a division of BNA Nutrition Animale sp. z o.o. This strategic move is expected to expedite Wisium's growth in Poland and central Europe, bolstering the global brand's position in the premix and services business of ADM.

Customized Premixes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2041.41 million |

|

Revenue forecast in 2034 |

USD 3805.32 million |

|

CAGR |

7.20% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

By Form, By Nutrient, By Function, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Customized Premixes Market report covering key segments are form, nutrient, function, application, and region.

Customized Premixes Market Size Worth $3805.32 Billion By 2034.

The global Customized Premixes market is expected to grow at a CAGR of 7.20% during the forecast period.

North America is leading the global market.

The key driving factors in Customized Premixes Market are Increasing Consumer Health Awareness Propelling Market Expansion