CV Depot Charging Market Share, Size, Trends, Industry Analysis Report

By Charger Type (DC Chargers, AC Chargers); By Vehicle Type; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4631

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

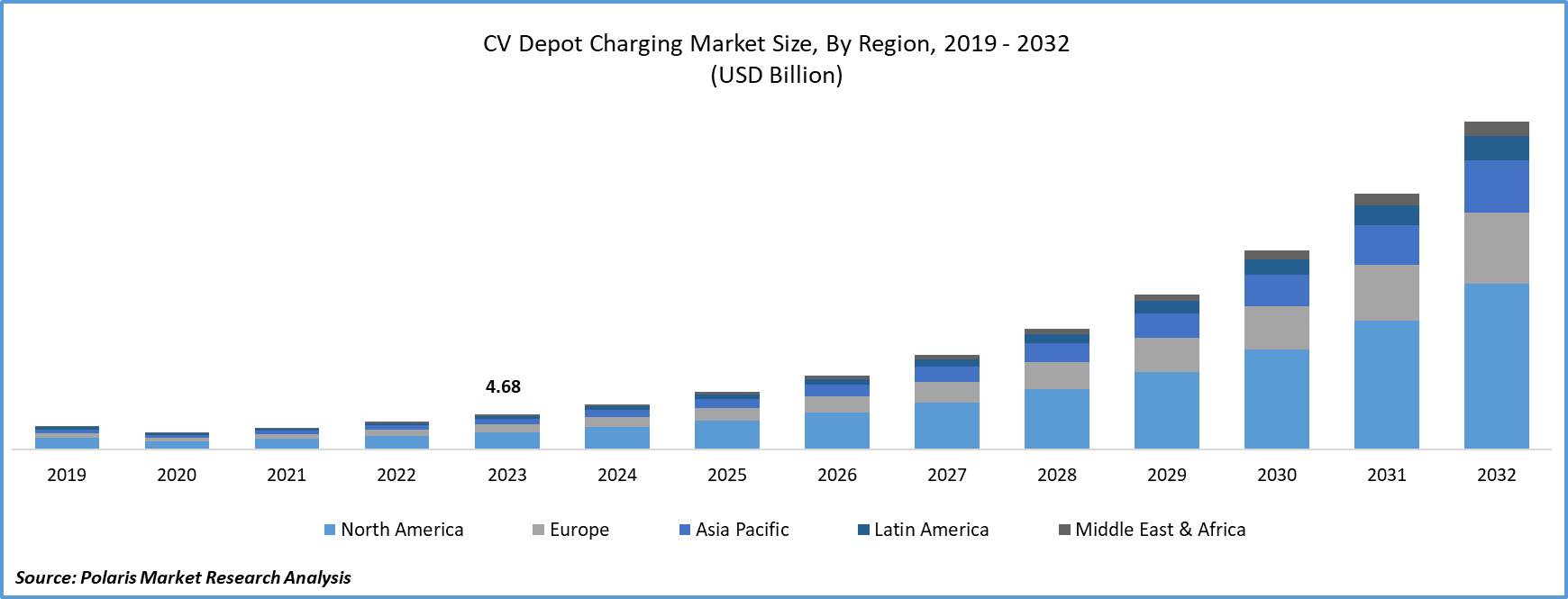

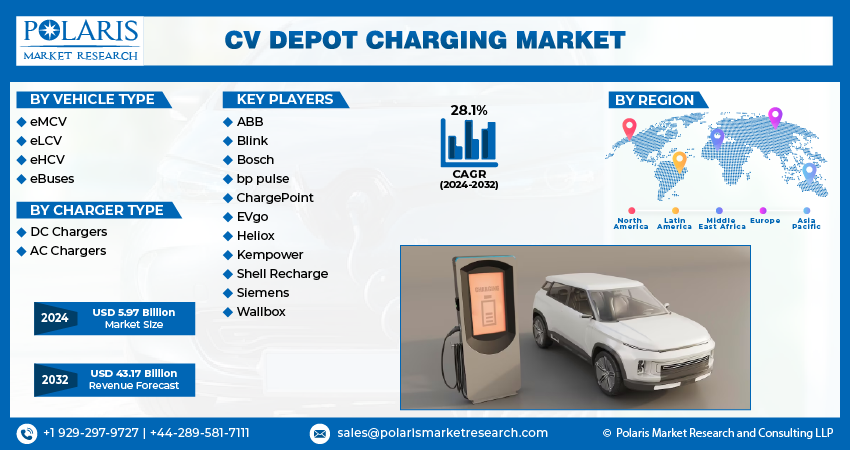

Global CV depot charging market size was valued at USD 4.68 billion in 2023. The market is anticipated to grow from USD 5.97 billion in 2024 to USD 43.17 billion by 2032, exhibiting a CAGR of 28.1% during the forecast period

CV Depot Charging Market Overview

Commercial Vehicle (CV) depot charging refers to the installation of infrastructure of electric charging tailored to meet the requirements of charging at their facilities or depots for commercial vehicles facilities or depots. Commercial vehicles, including electric buses, electric light commercial vehicles (eLCVs), electric medium commercial vehicles (eMCVs), electric heavy commercial vehicles (eHCVs), are encompassed within this context. The primary objective of CV depot charging offers fleet operators convenient and dedicated option for charging their electric vehicles during downtime, typically between shifts or overnight.

This specialized CV depot charging architecture is meticulously designed to address the demand of commercial vehicles, considering factors such as the operative patterns for many types of vehicles, fleet management systems, and scalability. CV depot charging facilitates the change to electric vehicles by catering the demand for reliable and tailored charging solutions, thereby attributing to the efficiency and sustainability of operations for commercial vehicles.

To Understand More About this Research: Request a Free Sample Report

The Commercial Vehicle (CV) Depot Charging sector is experiencing swift transformations propelled by several significant factors. A key catalyst is the increasing global focus on durability and the transition to electric commercial vehicles. Businesses and government are realigning their policies to align with environmental goals, and the pursuit of greener mobility solutions is boosting the need for CV depot charging stations. This CV depot charging market trend becomes particularly pronounced when regulatory bodies enforce stringent limits in emission and provide incentives to promote the adoption of electric commercial vehicles.

The aggregation of vehicle management systems with smart charging solutions presents a substantial opportunity for industry advancement, with the integration of smart charging technologies and robust vehicle management capabilities enabling real-time monitoring, heightened operational efficiency, and optimal charging schedules. Collaborative initiatives and partnerships involving energy companies, automakers, and charging infrastructure providers provide comprehensive solutions addressing both vehicle management requirements and charging infrastructure.

CV Depot Charging Market Dynamics

Market Drivers

Swift embrace of electric vehicles for public transportation bolstering the growth of the CV Depot Charging market share.

The electric vehicle (EV) segment experienced robust growth of 30-40% in 2023, driven by an increasing preference for clean transportation and government support through incentives. Notably, countries like India, the US, Germany, China, Norway, the UK, and others have set ambitious goals to transition their public transportation bus fleets from internal combustion engines (ICE) to electric. Additionally, commercial vehicle fleet operators are increasingly adopting electric commercial vehicles (ECV), leading to the global expansion of the ECV depot charging market. However, the electrification of commercial vehicles faces challenges such as insufficient charging infrastructure, vehicle downtime, range limitations.

The EV charging infrastructure has witnessed significant expansion to meet consumer needs. In 2023, over a million new EV charging points were installed globally, comprising both slow and fast chargers. For instance, In 2023, the installation of charging points in the UK reached almost 16,000, contributing to a total of over 53,000, with more than 4,500 dedicated to fast charging. Successful pilot projects for wireless charging were implemented in Japan, China, Germany, the US, and various European countries. Governments and providers of EV charging solutions committed a combined total of over $50 billion in 2023, progressively investing the sum to deploy charging infrastructure globally.

The years 2022 and 2023 witnessed a shift in car charging technology, with the introduction of ultra-fast chargers to expedite the charging of electric vehicles. Original Equipment Manufacturers (OEMs) like Tesla and Ford have collaborated with charging infrastructure solution providers to address the demand for ultra-fast charging. Furthermore, hardware and software manufacturers have developed various business models to monetize the commercial electric vehicle depot charging market.

Market Restraints

Limited speed of AC chargers likely to hamper the growth of the market.

Depot charging stations feature a range of chargers, including both DC and AC, each offering different charging levels. While AC chargers are more economical, they necessitate extended charging durations for EV batteries. In contrast, DC chargers enable rapid charging but come with a higher cost. Depot charging setups typically incorporate a combination of both DC and AC chargers. Light commercial vehicles, such as cars, benefit from fast charging setups to minimize downtime. Heavy commercial vehicles, like trucks and buses, with large batteries, also require substantial charging speed even during overnight charging. Consequently, the presence of slow chargers in depot charging stations increases vehicle downtime, serving as a constraint on the CV depot charging market growth.

Report Segmentation

The market is primarily segmented based on vehicle type, charger type, and region

|

By Vehicle Type |

By Charger Type |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

CV Depot Charging Market Segmental Analysis

By Vehicle Type Analysis

- In 2023, the market was predominantly led by electric light commercial vehicles (eLCVs), primarily owing to their extensive utilization in urban settings for local transportation and long miles deliveries. The compact size and maneuverability of eLCVs render them well-suited for vehicle operations situated at their depots, where the available infrastructure of charging can efficiently accommodate their daily their schedules and routes. This prominence aligns with the global inclination towards increasing focus on reducing emissions in heavily populated areas sustainable urban mobility solutions.

- Electric buses (eBuses) segment is positioned as a formidable contender for the fastest CV depot charging market share. Playing a crucial role in public transportation, eBuses are gaining traction driven by a growing demand for sustainable transit options, environmental regulations, and government incentives. The rising requirement for charging architecture to support electric bus at depots underscores the pivotal role of eBuses in the increasing CV depot charging market.

By Charger Type Analysis

- AC, chargers holds the largest CV depot charging market share during forecast period. AC charging infrastructure is commonly utilized in CV depot charging environments, offering a cost-effective and practical option for overnight charging or extended vehicle downtime. It is well-suited for smaller fleets with less time-sensitive charging needs.

- On the other hand, DC charging infrastructure, especially high-power DC rapid charging, plays a crucial role for fleets operating larger commercial vehicles or those with a need for rapid turnaround times. DC charging is often employed in heavy-duty applications and environments where minimizing charging delays is essential.

CV Depot Charging Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share in 2023

The Asia-Pacific region, spearheaded by China, holds a pivotal role in the electric vehicle market. China, in particular, has ambitious plans for widespread electric vehicle adoption and the development of associated infrastructure. The CV depot charging market trend of swift growth of e-commerce and urbanization, especially in countries like India, is further fueling interest in electric commercial vehicles and the corresponding charging solutions.

Europe has been at the forefront of embracing electric car technology, with numerous nations implementing stringent pollution regulations and offering incentives to promote sustainable mobility. The European Union's commitment to achieving carbon neutrality is expediting the CV depot charging market size growth. Countries such as Germany, the Netherlands, and the United Kingdom have made substantial investments in charging infrastructure, creating an optimal environment for the advancement of CV depot charging solutions.

Competitive Landscape

The CV Depot Charging market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ABB

- Blink

- Bosch

- bp pulse

- ChargePoint

- EVgo

- Heliox

- Kempower

- Shell Recharge

- Siemens

- Wallbox

Recent Developments

- In December 2023, Ford collaborated with Xcel Energy to deploy 30,000 charging points for home, public, and depot use across the United States by 2030.

- In November 2023, Total Energies introduced an electric truck charging service within depots at the SOLUTRANS road and urban transportation trade show. This novel solution aims to facilitate the setup and monitoring of charging infrastructure tailored to meet the requirements of transporters.

- In September 2022, Tritium secured $150 million in a Series D funding round, intending to utilize the capital to expand its worldwide presence and enhance research and development efforts for the creation of innovative products in the depot charging market.

- In March 2022, ABB collaborated with New Flyer to create and provide zero-emission bus charging solutions for cities throughout North America.

Report Coverage

The CV Depot Charging market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive vehicle type, charger type and futuristic growth opportunities.

CV Depot Charging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.97 billion |

|

Revenue Forecast in 2032 |

USD 43.17 billion |

|

CAGR |

28.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Vehicle Type, By Charger Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The CV Depot Charging Market report covering key segments are vehicle type, charger type, and region

CV Depot Charging Market Size Worth $43.17 Billion By 2032

Global cv depot charging market exhibiting a CAGR of 28.1% during the forecast period

Asia Pacific is leading the global market

key driving factors in CV Depot Charging Market are swift embrace of electric vehicles for public transportation