Cybersecurity Insurance Market Share, Size, Trends, Industry Analysis Report

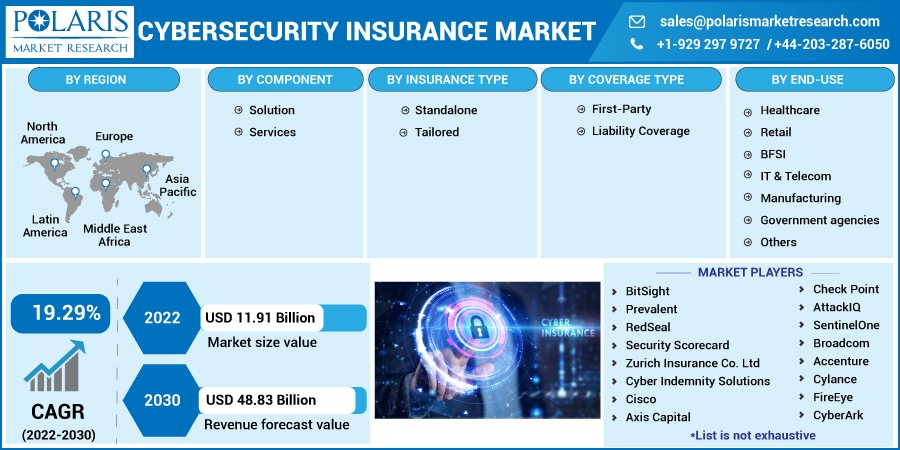

By Components; By Insurance Type (Standalone and Tailored); By Coverage type (First-Party, Liability Coverage); By End-Use; By Region; Segment others Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2751

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

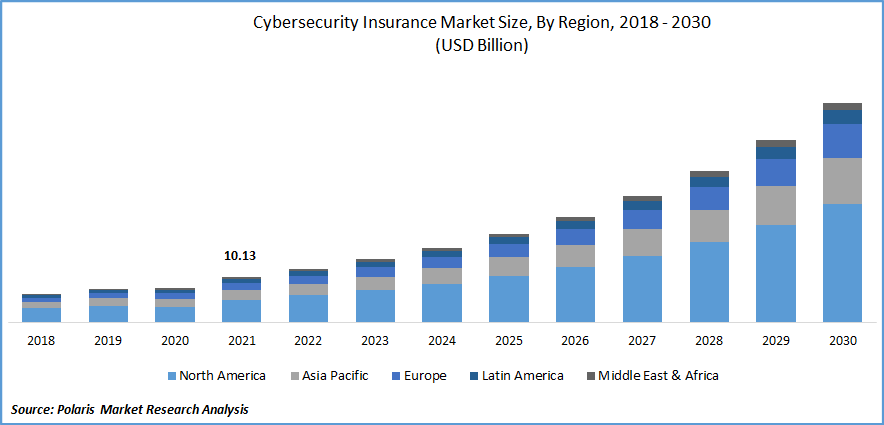

The global cybersecurity insurance market was valued at USD 10.13 billion in 2021 and is expected to grow at a CAGR of 19.29% during the forecast period.

To strengthen data security and protection, governmental regulatory authorities and law enforcement organizations from around the world have taken several actions. With the introduction of COVID-19, policyholders, brokers, insurers, and agents have understood the importance of having cybersecurity insurance coverage. To enhance the data security procedures that financial institutions must implement to safeguard their clients' financial information, the Federal Trade Commission changed its rule in October 2021.

Know more about this report: Request for sample pages

Data breaches and the onset of cyber-attacks in recent years have made consumers to suffer greatly, including financial loss, identity theft, and other forms of financial hardship. The revised Safeguards Rule from the Federal Trade Commission requires non-banking financial firms to maintain a robust security system to protect the data of their clients.

Governmental policies would have a significant impact on the marketplace. Because so many more aspects of everyday life are digital, cyber dangers are rising. U.S. exporters of cyber technologies and software can meet the rising demand for cyber security solutions in Canada. The Canadian federal government heavily mandates the use of cybersecurity technology.

Multiple governments and regulatory bodies have required that public and commercial enterprises adopt effective strategies for adopting remote work and social separation as the COVID-19 pandemic catastrophe looms. Since then, different firms have depended more and more on market-available digital business continuity planning techniques.

The main problem affecting the market was the supply of hardware. Work-from-home arrangements increased in popularity after the pandemic, putting employers in danger of sophisticated cyber-attacks. Markets have shifted to digitization due to the prevalence of BYOD devices, the WFH phenomena, and the widespread usage of the internet, driving the demand for cyber insurance plans to protect against cyber-attacks.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Due to technology advancements, cybersecurity insurance is becoming more and more common in small, medium, and large-scale enterprises. Additionally, since commercial attacks were covered more frequently in the media, more companies wanted to buy cyber insurance. Cyber hazards are being more strictly regulated, with stricter underwriting and risk management requirements.

Further rules related to cybersecurity are anticipated in the upcoming years. This is because an increasing number of regulatory organizations will call for more data to be gathered and reported on cybercrimes. Specific market data gathering needs will be required for a reporting system that is simple to use and uniform across the board. In the upcoming years, this will lead to implementation of adaptive cyber policies in many firms.

Report Segmentation

The market is primarily segmented based on component, Insurance type, coverage type, end-use, and region.

|

By Component |

By Insurance Type |

By Coverage Type |

By End-use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Solution Segment is Expected to Witness the Fastest Growth

In 2021, The solution sub-segment was anticipated to grow quickly throughout the projected period and to capture the largest market share for cyber insurance. Axis Cyber Insurance, Berkshire Hathaway Specialty Insurance, AXA XL Cyber Liability Insurance, and other prominent insurance products are available on the market. The insurance options address problems, including lost credit cards, network extortion, business interruption, phone toll fraud, digital data recovery, and others. There is an increasing need for insurance solutions as cyber risk is quantified and diminished.

Standalone Accounted for the Second-Largest Market Share in 2021

Standalone policies offer media liability insurance, which includes allegations of libel or slander, invasion of privacy, and other wrongdoings. Additional property exposures covered by the Standalone insurance include business interruption, data loss and destruction, and money transfer loss. By offsetting the costs associated with recovery from a cyber-related security breach or similar event, it helps an organization mitigate its risk exposure. Businesses are being compelled by current cyber security to employ more complex insurance arrangements in order to protect sensitive data on the cloud. The market for cyber insurance is expanding due to all of these issues.

The First-Party Segment is Expected to Witness the Fastest Growth

First-party insurance provides coverage for those victims who were directly involved in the accident. First-party coverage types are likely fueled by rising extortion, hacker operations, data destruction, internet theft, and more. It is anticipated that the first party will grow considerably during the predicted period. First-party insurance is becoming more popular due to its coverage of the insurer's duty to make amends to impacted partners and clients. It covers losses due to, among other things, privacy lawsuits, compliance fines, claims, and settlements. Therefore, first-party coverage is becoming increasingly popular among businesses that deal with customers' private and confidential information.

The BFSI Segment is Expected to Witness the Fastest Growth

In 2021, BFSI had the largest share. The BFSI segment is expected to grow the most during the projection period. The rising digitalization of enterprises, the growth of customer-sensitive data, the adoption of mobile applications, and online banking are all likely to raise cybersecurity concerns. Because the financial industry retains such a large amount of client data, it is likely to be a desirable target for hackers. This will probably increase demand for cybersecurity insurance in the BFSI sector. The retail industry is anticipated to increase its market share significantly throughout the forecast period.

Retailers are increasing their revenue and gaining the trust of their customers by implementing insurance coverage. Healthcare will expand quickly as a result of the rise in cyberattacks on patient data. According to the Healthcare Breach Report, the rate of healthcare breaches in the United States rose by 55.1% in 2020. One stolen healthcare record can be sold for 50 times more, according to the FBI's Cyber Division. The need for insurance in the healthcare industry is expected to increase.

The Demand in North America is Expected to Witness Significant Growth

The market share will be dominated by North America during the anticipated period. The region's need for cybersecurity insurance is probably driven by the rising number of cyberattacks and the high danger of data loss. Due to the country's stringent cybersecurity policies and severe government control, the U.S. is predicted to experience rapid development. Additionally, the country's considerable presence of important cyber insurance providers is anticipated to support its expansion.

Additionally, the National Association of Insurance Commissioners (NAIC) estimated that the U.S. cybersecurity insurance industry, encompassing both domestic insurers and international insurers, produced direct premiums of nearly USD 4.1 billion in 2020, according to research released in October 2021. The sum is up 29.1% over the previous year, and once the data for 2021 are confirmed, it is anticipated to rise significantly.

Throughout the forecast period, Europe will probably obtain a sizable market share. Cyber insurance premiums are projected to rise because of changing insurance regulatory laws, such as the imposition of fines on businesses that experience data breaches. All around Europe, different insurance brokers, and insurance firms are growing. For instance, the Chubb Corporation introduced Personal Insurance products and services in the UK in October 2020 to protect the individual and their family.

Competitive Insight

There are several major players in the global market, such as BitSight, Prevalent, RedSeal, Security Scorecard, Zurich Insurance, Cyber Indemnity Solutions, Cisco, Axis Capital, UpGuard, Microsoft, Check Point, AttackIQ, Broadcom, Accenture, CyberArk, CYE, SecurIT360, Founder Shield, AIG, Arthur, Travelers Insurance, Cylance, FireEye, CNA Financial, Fairfax Financial, Liberty Mutual, Lloyd’s of London, and others.

Recent Developments

- July 2024: Global insurer QBE Insurance, which operates in 27 countries, unveiled QCyberProtect. According to QBE Insurance, QCyberProtect is an all-inclusive cyber policy made to improve cyber resilience for a variety of clients across the globe. It provides customized protection against losses brought on by both established and new cyber threats.

- January 2024: Worldwide brokerage company WTW unveiled a cyber solution that is specially tailored for small and medium-sized businesses (SMEs) in North America. This product is intended for companies with yearly sales under USD 50 million, including startups and pre-revenue entities.

- In May 2022, At-new Bay's cyber insurance is backed by Trisura Specialty Insurance Company and The Hartford Steam Boiler, two of the industry's top players (HSB). HSB has increased its capital commitment for 2022 compared to last year. Trisura is now responsible for underwriting the cyber and technology errors and omissions (E&O) program. At-recently, Bay's established captive reinsurance firm and reinsurance partners are making contributions to the new program, giving the corporation a network of businesses that are cooperating to promote long-term growth plans.

- In September 2021, BOXX Insurance worked with Zurich Insurance Group. The company hopes to enhance its customer-focused cyber protection solution for its clients and business partners by working with BOXX.

Cybersecurity Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 11.91 billion |

|

Revenue forecast in 2030 |

USD 48.83 billion |

|

CAGR |

19.29% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Insurance type, By Coverage type, By End-use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

BitSight, Prevalent, RedSeal, Security Scorecard, Zurich Insurance Co. Ltd, Cyber Indemnity Solutions, Cisco, Axis Capital, UpGuard, Microsoft, Check Point, AttackIQ, SentinelOne, Broadcom, Accenture, Cylance, FireEye, CyberArk, CYE, SecurIT360, Founder Shield, AIG, Aon, Arthur J. Gallagher & Co, Travelers Insurance, AXA XL, AXIS Capital, Beazley, Chubb, CNA Financial, Fairfax Financial, Liberty Mutual, Lloyd’s of London. |