D-dimer Testing Market Share, Size, Trends, Industry Analysis Report

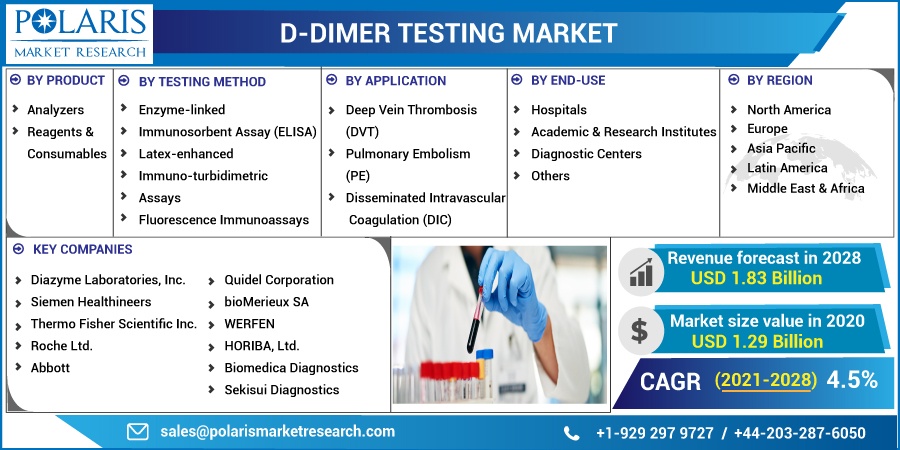

By Product (Analyzers, Reagents & Consumables); By Testing Method [Enzyme-linked Immunosorbent Assay (ELISA), Latex-enhanced Immuno-turbidimetric Assays, Fluorescence Immunoassays, Others]; By Application; By End-Use; By Regions; Segment Forecast, 2021 - 2028

- Published Date:Jan-2021

- Pages: 108

- Format: PDF

- Report ID: PM1788

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Outlook

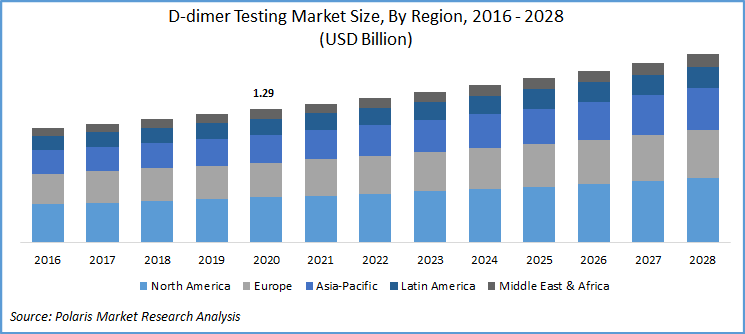

The global D-dimer testing market was valued at USD 1.29 billion in 2020 and is expected to grow at a CAGR of 4.5% during the forecast period. Increasing prevalence of blood clotting genetic disorders, a spike in Venous Thromboembolism (VTE), and the rising need for the next generation PoC D-dimer tests are the key factors responsible for the market growth.

The shift of testing services from traditional to the PoC D-dimer testing enables faster test results, rapid diagnosis, reduction in patient’s waiting time, and the improved patient journey. Such resounding benefits of PoC testing would boost its uptake among consumers. Moreover, the rising cardiovascular and pulmonary diseases, in severe cases, result in life threatening blood clot issues, thereby inducing market growth.

The normal range for the D-dimer is measured at less than 0.5 and positive is greater than 0.5. Under the abnormal medical case, D-dimer levels get decreased, which is measured by specific antibodies. The test is pretty useful in the diagnosis of intravascular fibrinolysis and coagulation.

Elevated levels of D-dimer are found in the cases of deep vein thrombosis, pulmonary embolism, bleeding, trauma, liver disease, malignancy, and chronic cases of a hypercoagulable state. In the blood, plasmin is specifically neutralized by the alpha 2 anti-plasmin, blocking fibrinogen lysis and localizes fibrinolysis on fibrin clots. This clot is further degraded by plasmin into several by-products such as D-dimers.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increase in the prevalence of VTE and blood-clot disorders creating a demand for the need for D-dimer testing. According to the estimates of the Centers for Disease Control and Prevention (CDC), each year in the U.S. alone, on average 75,000 die due to the VTE. The innovations in aptamers as a replacement of antibodies are considered as a cost-effective and highly efficient approach.

Know more about this report: request for sample pages

Aptamers are the short oligo-nucleotide, fold into well-defined architectures to bind with the specific proteins. In the binding process, they restrain protein and protein interactions and elicit therapeutic effects. Aptamers are stable, have a longer shelf life and affordable as compared to antibodies, and can be mass-produced for homogenous assays and other diagnostic tests. Several market research activities have shown that elevated levels of the D-dimer could serve as a valuable biomarker in many clinical indications, including, coronary artery disorders, atrial fibrillation, and HIV infections.

D-dimer Testing Market Report Scope

The market is primarily segmented on the basis of product, testing method, application, end-use, and region.

|

By Product |

By Testing Method |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

Based upon the product, the global D-dimer testing industry is categorized into analyzers, and reagents & consumables. In 2020, the consumables market segment accounted for the largest revenue share. This high share is attributed to the frequent availability of ready-to-use reagents and consumables in the D-dimer testing industry. Consumables are necessary for testing procedures. Moreover, the huge popularity of automated analyzers, which reduces the diagnosis time, and better patient journey, and enables better clinical decision making among physicians also favoring the segment’s future prospects.

This is evident with the launch of AQT90 FLEX analyzers, a PoC for D-dimer testing, introduced by Radiometer Limited, in February 2019. It is used for deep vein thrombosis cases in the lower limbs. With this PoC test, the results are provided within 21 minutes with a positive patient experience. Thus, the introduction of such novel products, expected to increase the market sale of reagents.

Insight by Testing Method

Based on the form, the global D-dimer testing market is bifurcated as enzyme-linked immunosorbent assay (ELISA), latex-enhanced immuno-turbidimetric assays, fluorescence immunoassays, and others. In 2020, ELISA market segment accounted for the largest market revenue share of over 35% in the global market because it is considered as the gold standard in the testing procedures, and the advent of automated ELISA systems also favoring the market growth. The fluorescence immunoassay segment is anticipated to register the highest market growth over the forecast period. Projected growth is due to the instrument’s high sensitivity, user-friendliness, and simpler assay procedures.

Geographic Overview

Geographically, the global D-dimer testing market is bifurcated into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA). North America market is the largest revenue contributor followed by Europe and the Asia Pacific region. In 2020, the North American market accounted for over 30% of the global market.

The presence of robust clinical infrastructure in the market with intellectual capability, proper regulatory guidelines for the companies, and the concerning innovations in the sector are key factors responsible for the region’s D-dimer testing industry growth. According to the article published in January 2020, stated the necessary proposal of D-dimer protocol for the identification of VTE in the patients suffering from neural disorders. Moreover, the favorable regulatory process also favors market growth, for instance, according to the guidelines of the American Society of Hematology 2018, is bound to support the professionals in the market.

Asia Pacific D-dimer testing industry is projected to exhibit the highest market growth over the study period. The factors such as improving healthcare infrastructure, the emergence of private pathology labs, and huge patient base with increased medical awareness and disposable income are the important factors driving the market growth. Moreover, the government’s role in laying down proper guidelines also shaping future D-dimer testing industry growth prospects of the region.

Competitive Insight

The prominent players operating in the D-dimer testing industry are Diazyme Laboratories, Inc., Siemen Healthineers, Thermo Fisher Scientific Inc., Roche Ltd., Abbott, Quidel Corporation, bioMerieux SA, WERFEN, HORIBA, Ltd., Biomedica Diagnostics, and Sekisui Diagnostics. The companies in the D-dimer testing industry are focusing on new D-dimer based assays. For instance, the U.S.-based Ortho Clinical Diagnostics in collaboration with Diazyme Laboratories introduced a new assay product “MicroTip Partnership Assay Program”.