Data Warehouse as a Service Market Size, Share, Trends, Industry Analysis Report

By Usage (Data Mining, Reporting, Analytics), By Deployment, By Application, By Vertical, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM2215

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

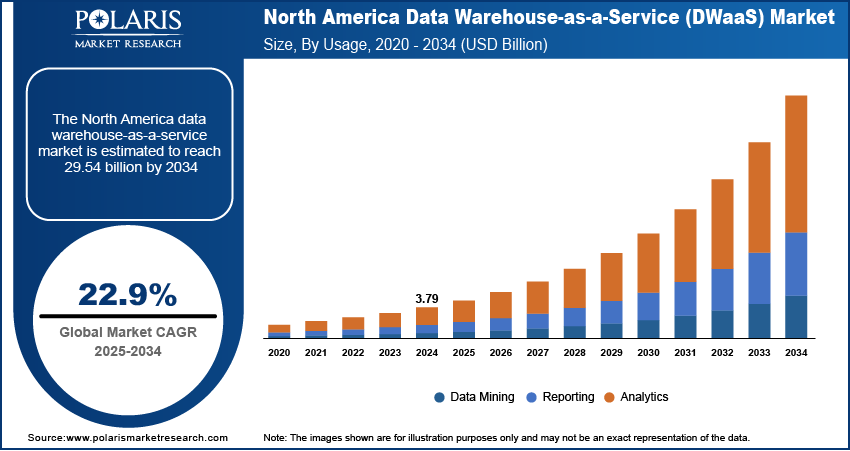

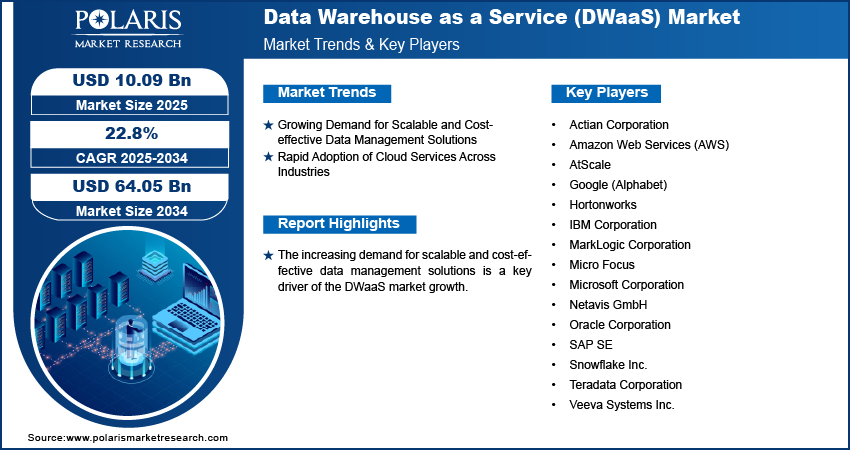

The global data warehouse as a service (DWaaS) market size was valued at USD 8.27 billion in 2024 and is expected to register a CAGR of 22.8% from 2025 to 2034. Rising demand for real-time data processing and enhanced decision-making capabilities propels the industry growth. In addition, increasing demand for scalable and cost-effective data management solutions are expected to boost the market demand during the forecast period.

Key Insights

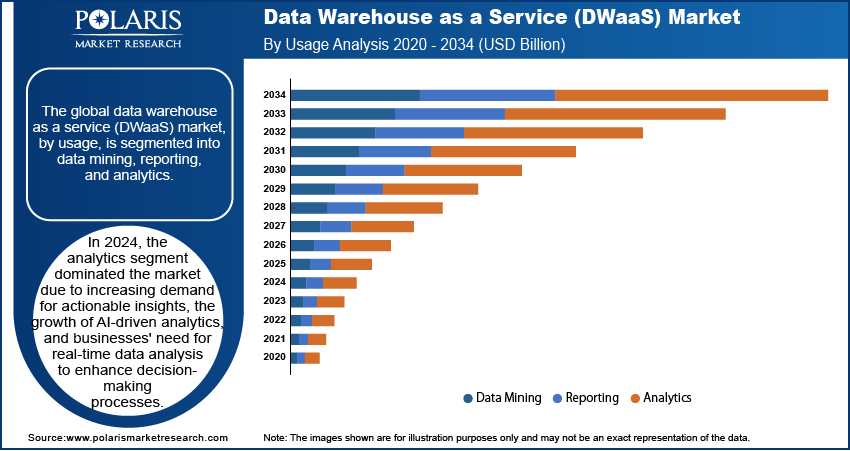

- In 2024, the analytics segment held the largest share. The increasing demand for real-time data analysis and decision-making in various industries contributed to the segment dominance.

- In 2024, the hybrid cloud segment held a significant share due to its flexible, scalable, and cost-effective nature.

- The manufacturing & automotive segment is projected to register the highest growth rate during 2025–2034. The increasing adoption of data-driven decision-making in vehicle manufacturing and the integration of connected car technologies drive this growth.

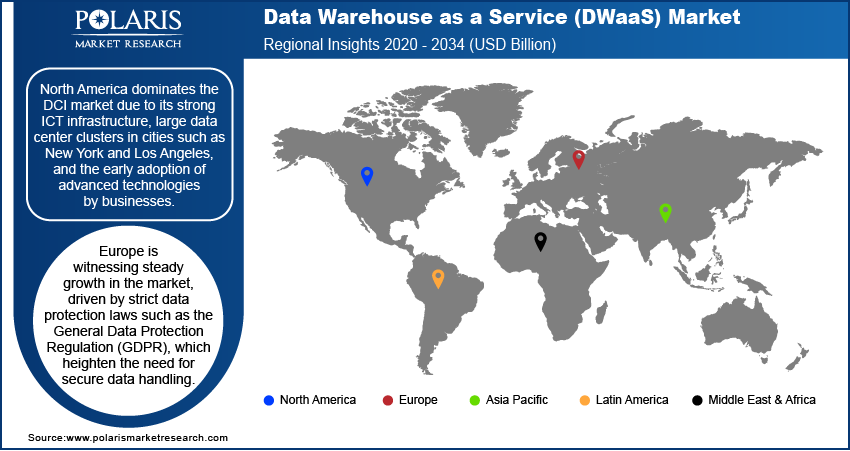

- North America held a dominant share of the global DWaaS market in 2024. This regional dominance is driven by a highly developed IT infrastructure, increased adoption of cloud technologies, and the presence of major players.

- The Asia Pacific market is expected to witness the fastest growth during the forecast period. The growth is attributed to rapid digital transformation, especially in countries such as China, India, and Japan.

Industry Dynamics

- Increasing adoption of digital solutions in industries across the world drives the industry demand.

- The rapid adoption of cloud services across industries is accelerating the market expansion.

- Rising focus on advancements in autonomous driving systems is expected to offer lucrative opportunities for the market players during the forecast period.

- Growing concerns regarding data security and complex regulatory compliance processes hinder the industry growth.

Market Statistics

2024 Market Size: USD 8.27 billion

2034 Projected Market Size: USD 64.05 billion

CAGR (2025–2034): 22.8%

North America: Largest market in 2024

AI Impact on Data Warehouse as a Service (DWaaS) Market

- Artificial intelligence (AI)-powered DWaaS platforms are used for real-time analytics and predictive modeling. It helps businesses make smarter and faster decisions.

- The technology helps enforce compliance, detect anomalies, and ensure data accuracy, which is critical for industries dealing with stringent regulatory requirements.

- AI enables intuitive data access through natural language processing (NLP). It makes analytics more accessible to non-technical users.

- AI-enabled DWaaS platforms are increasingly cloud-native. They offer elastic scalability and cost-effective infrastructure.

To Understand More About this Research: Request a Free Sample Report

The data warehouse as a service (DWaaS) market is growing due to the increasing demand for scalable, cost-effective, and efficient data storage solutions. Organizations are shifting toward cloud-based services to manage and analyze large volumes of data to reduce the need for on-premise infrastructure. The rising demand for technologies such as big data analytics, machine learning, and AI-driven insights further accelerates the adoption of DWaaS. Additionally, the growing emphasis on real-time data processing and enhanced decision-making capabilities is propelling market growth.

A key significant driver that is fuelling the adoption of cloud-based solutions and services is the progressive shift of organizations from traditional on-premises infrastructure to more flexible and scalable cloud solutions. Cloud data warehouse offers several advantages, including reduced operational costs, improved data accessibility, and enhanced disaster recovery capabilities. Major cloud service providers, such as Amazon Web Services, Google Cloud, Microsoft Azure, and others, are continually enhancing their offerings, which is bolstering market growth. For instance, in September 2022, India-based Adani Group announced an investment of USD 100 billion over the next ten years in new energy and digital space that includes data centers.

The benefits of DWaaS include scalability, cost-effectiveness, and the ability to handle large volumes of data efficiently. Key applications span across various industries, including finance, healthcare, retail, manufacturing, and more. A notable trend is the shift toward hybrid cloud solutions, where organizations combine public and private cloud services to optimize performance and meet various compliance needs. Moreover, the hybrid model provides the flexibility to store sensitive data on secure private servers while leveraging the scalability of public cloud services for less sensitive operations, thus promoting the industry growth for data warehouse as a service.

Market Dynamics

Growing Demand for Scalable and Cost-effective Data Management Solutions

The increasing demand for scalable and cost-effective data management solutions is a key driver of the DWaaS market growth. Moreover, with the growing volume of information, businesses are unable to manage vast amounts of data without incurring high costs. DWaaS enables companies to scale their infrastructure based on demand, reducing upfront investments in hardware. For instance, in 2023, Walmart adopted a hybrid cloud strategy, significantly reducing costs while improving data processing speeds. This growing trend of operational efficiency through cloud-based data solutions is fueling market growth.

Rapid Adoption of Cloud Services Across Industries

The rapid adoption of cloud services across industries is accelerating the cloud data warehouse market expansion. Organizations in sectors such as BFSI, healthcare, and retail are transitioning their data management and analytics to cloud-based platforms to enhance efficiency, flexibility, and accessibility. For instance, Netflix's strategic partnership with Amazon Web Services (AWS) has enabled the company to deploy thousands of servers and terabytes of storage within minutes, facilitating seamless global streaming services. This shift toward cloud-based data warehouses is a significant driving force behind the market, as businesses increasingly leverage cloud technologies to gain insights and meet real-time demands.

Segment Insights

Market Assessment by Usage

The global DWaaS market segmentation, by usage, includes data mining, reporting, and analytics. In 2024, the analytics segment held the largest share due to the increasing demand for real-time data analysis and decision-making in various industries. The growing reliance on big data analytics, coupled with the integration of machine learning and AI-driven insights, is accelerating market expansion. As organizations seek to enhance operational efficiency and gain competitive advantages, the analytics segment continues to witness substantial growth and increasing adoption in cloud environments.

Market Evaluation by Deployment

The global market, by deployment, is segmented into private cloud, public cloud, and hybrid cloud. In 2024, the hybrid cloud segment held a significant share due to its flexible, scalable, and cost-effective nature. Hybrid cloud deployments allow businesses to combine the cloud security of private clouds with the flexibility of public clouds, making it an attractive option for companies looking to scale their data infrastructure without compromising security or performance. This deployment model is beneficial for businesses managing large volumes of data, as it ensures both efficiency and compliance with data governance requirements.

Market Outlook by Vertical

Based on vertical, the global data warehouse as a service (DWaaS) market is segmented into BFSI, retail & e-commerce, telecommunications & IT, healthcare & life sciences, manufacturing & automotive, government & public sector, travel & hospitality, media & entertainment, and others. The manufacturing & automotive segment is projected to experience the highest growth rate during the forecast period. This surge is attributed to the increasing adoption of data-driven decision-making in vehicle manufacturing, the integration of connected car technologies, and advancements in autonomous driving systems. These developments necessitate robust data warehousing solutions to manage and analyze the vast amounts of data generated, thereby driving the demand for DWaaS in the automotive industry.

Regional Analysis

North America held a dominant share of the global DWaaS market in 2024. This regional dominance is driven by a highly developed IT infrastructure, increased adoption of cloud technologies, and the presence of major players such as Amazon Web Services (AWS) and Microsoft Azure. The growing demand for big data analytics and AI-driven decision-making is propelling the market's expansion, with a steady increase in regional revenue share expected during the forecast period.

In the US, the DWaaS industry is growing due to the widespread adoption of cloud solutions across various industries. The increasing need for real-time data analysis, cost-effective storage, and scalable cloud infrastructure is driving industry growth. Furthermore, major tech hubs in Silicon Valley and strong governmental support for digital transformation contribute to accelerating the adoption of data warehouse as a service, enhancing the regional revenue share and industry growth outlook.

In Canada, the market is gaining popularity due to the country’s strong digital economy and increasing investments in cloud infrastructure. Factors such as growing emphasis on data-driven decision-making across sectors, including healthcare, retail, and financial services, businesses are adopting DWaaS solutions for their flexibility, scalability, and efficiency. The government’s focus on promoting innovation and data management is further fueling the market's growth, leading to a notable increase in regional revenue share.

Europe held the second-largest position in the global data warehouse-as-a-service market, driven by the increasing adoption of digital solutions across industries. The region’s focus on data privacy regulations, such as General Data Protection Regulation (GDPR), is encouraging businesses to adopt secure cloud-based data storage solutions. The growing demand for real-time analytics and business intelligence tools, particularly in countries such as the UK, Germany, and France, is contributing to the regional market growth.

Asia Pacific is expected to emerge as the fastest-growing region in the global market due to rapid digital transformation, especially in countries such as China, India, and Japan. The increasing adoption of cloud-based solutions, coupled with the region's expanding IT infrastructure, is driving significant growth in the market. Moreover, the rise in e-commerce, fintech, and the manufacturing sector is expected to contribute to substantial revenue growth and market expansion in Asia Pacific.

Key Players and Competitive Analysis Report

The data warehouse as a service (DWaaS) market presents a dynamic and competitive environment, with both established and emerging players striving to expand their market presence. Leading companies are focusing on research and development investments, deployment innovation, and strategic partnerships to enhance the performance and adaptability of DWaaS solutions across various industries. Additionally, driven by increasing demand from sectors such as automotive, oil & gas, and construction, market players are concentrating on developing cost-effective, high-performance solutions to capture greater revenue share.

Oracle Corporation is a global company engaged in cloud computing and enterprise software. Oracle’s business segments include cloud services, database solutions, and enterprise resource planning (ERP). In the market, Oracle’s offerings are categorized under cloud services, providing scalable data warehousing solutions for businesses. Key pointers of the company are strong R&D focus, high-performance analytics, and integration with Oracle Cloud.

IBM Corporation is a multinational technology company with business segments in cloud & cognitive software, global business services, and systems. In the market, IBM’s solutions are categorized under cloud & cognitive software, focusing on data management and analytics. Key pointers of the company are advanced AI integration, hybrid cloud deployment, and a strong portfolio of data warehouse solutions.

List of Key Companies

- Actian Corporation

- Amazon Web Services (AWS)

- AtScale

- Google (Alphabet)

- Hortonworks

- IBM Corporation

- MarkLogic Corporation

- Micro Focus

- Microsoft Corporation

- Netavis GmbH

- Oracle Corporation

- SAP SE

- Snowflake Inc.

- Teradata Corporation

- Veeva Systems Inc.

Data Warehouse as a Service Industry Developments

May 2023: Oracle introduced new innovations to its autonomous data warehouse, the industry's first and only autonomous database powered by machine learning and optimized for analytics workloads. These advancements aim to break through the proprietary and closed nature of traditional data warehouses and data lakes, enhancing performance and scalability for users.

March 2023: SAP SE launched SAP Datasphere, a cloud-based data warehouse service designed to harmonize strategic data and facilitate decision-making. This solution enables organizations to manage metadata, ensure data quality, and perform data lineage and impact analysis, providing a comprehensive framework for governing information assets.

Data Warehouse as a Service Market Segmentation

By Usage Outlook (Revenue, USD Billion, 2020–2034)

- Data Mining

- Reporting

- Analytics

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- Private Cloud

- Public Cloud

- Hybrid Cloud

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Fraud Detection and Threat Management

- Supply Chain Management

- Asset Management

- Risk and Compliance Management

- Customer Analytics

- Others

By Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Retail & Ecommerce

- Telecommunication and IT

- Healthcare and Life Sciences

- Manufacturing and Automotive

- Government and Public Sector

- Travel and Hospitality

- Media and Entertainment

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Data Warehouse as a Service (DWaaS) Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.27 billion |

|

Market Size Value in 2025 |

USD 10.09 billion |

|

Revenue Forecast by 2034 |

USD 64.05 billion |

|

CAGR |

22.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.27 billion in 2024 and is projected to grow to USD 64.05 billion by 2034.

The global market is projected to register a CAGR of 22.8% during the forecast period.

In 2024, North America accounted for the largest market share, driven by increased demand for data warehouse as a service in industries such as healthcare and life sciences, manufacturing and automotive, government, and public sector.

A few of the key players in the market are Actian Corporation, Amazon Web Services (AWS), AtScale, Google (Alphabet), Hortonworks, IBM Corporation, MarkLogic Corporation, Micro Focus, Microsoft Corporation, Netavis GmbH, Oracle Corporation, SAP SE, Snowflake Inc., Teradata Corporation, and Veeva Systems Inc.

In 2024, the analytics segment held the largest market share due to increasing demand for real-time data analysis, business intelligence, and AI-driven insights across various industries.

The hybrid cloud segment is expected to witness significant market growth during 2025–2034 due to its ability to combine the scalability of public clouds with the security and control of private clouds, offering flexibility to businesses.