DDoS Protection and Mitigation Security Market Share, Size, Trends, Industry Analysis Report

By Component (Hardware Solution, Software solutions, Services); By Application Area; By Deployment Mode (On-premise, Cloud, Hybrid); By Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 118

- Format: PDF

- Report ID: PM2344

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

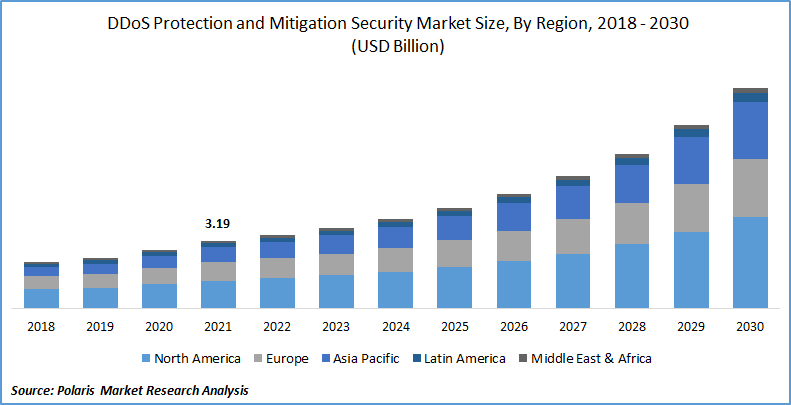

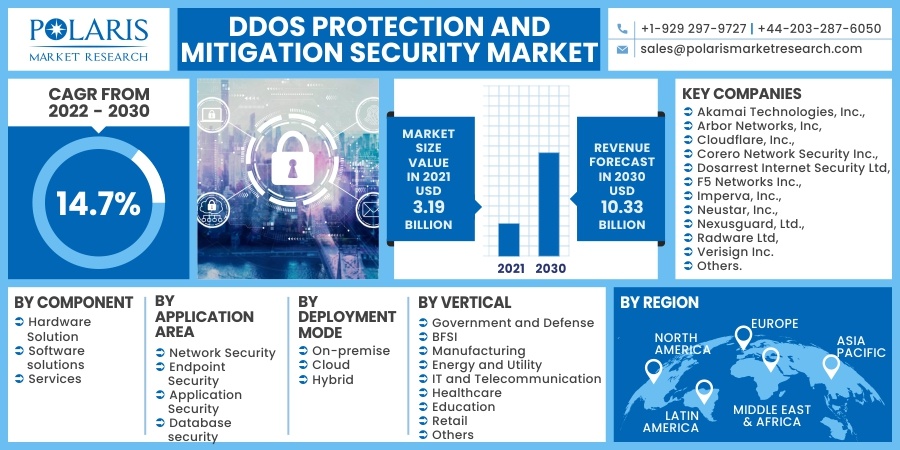

The global DDoS protection and mitigation security market was valued at USD 3.19 billion in 2021 and is expected to grow at a CAGR of 14.7% during the forecast period. Factors such as the increase in the number of DDoS threats on IoT platforms, and the rise in availability of IoT devices, are boosting the market growth.

Know more about this report: request for sample pages

With the rising use and availability of IoT devices and cryptocurrencies like Bitcoin (which is difficult to trace), there has been a surge in ransomware and blackmail attacks, with victims including Mexico's national lottery websites and Bitcoin.org, among others. The internet gaming vertical remains a very appealing target for attacks, as Respawn Entertainment has discovered over the last two months after experiencing severe disruptions to Titanfall's gameplay.

More markets are being targeted, including higher education, healthcare, telecommunications, and government. In May 2021, a DDoS attack on Belnet, Belgium's public-sector internet provider, wiped out the websites of over 200 institutions, including the British authorities, parliament, universities, and research facilities.

However, the high cost of adopting this protection and mitigation solution and budget constraints among small enterprises are restraining the DDoS protection and mitigation security market growth. It is difficult for SMEs to invest large sums of money in cybersecurity because they must also engage in other IT infrastructure. SMEs may not opt to purchase DDoS protection from prominent protection providers who offer protection and mitigation solutions with cutting-edge capabilities.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

An increase in the number of attacks has led to a rise in the market demand for protection and mitigation safety solutions, driving the DDoS protection and mitigation security market growth during the forecast period. Massive attacks are becoming more common all around the world. The attackers use sophisticated tools to launch attacks, which may go unnoticed early. Domain Name System (DNS) augmentation attacks, NTP attacks, and Chargen-focused attacks are examples of powerful attacks.

Individuals, businesses, and governments are suffering significant financial losses due to the various attack strategies utilized by hacktivist groups. The primary motivations for launching these multi-vector DDoS attacks include financial gain, political rivalry, international rivalry, extremist religious group goals, and cyberterrorism.

Further, the Microsoft Report saw a substantial increase in attacks per day for the first quarter of 2021. In the first half of 2021, the average daily threat mitigations grew by 25% compared to the fourth quarter of 2020. They prevented an average of 1,392 attacks per day, with the highest total of 2,043 attacks on May 24, 2021.

During the first half of 2021, they prevented up to 251,944 unique threats to their global infrastructure. Multi-vector attacks typically employ multiple attack routes to distract IT safety response teams. Following an attack, IT reaction teams take rapid action by rebooting systems, resulting in significant disruption.

Report Segmentation

The market is primarily segmented based on component, application area, deployment mode, vertical, and region.

|

By Component |

By Application Area |

By Deployment Mode |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

Based on the component segment, the services segment is the largest market revenue contributor in 2021 and is expected to retain its dominance in the foreseen period. With the rise in protection solutions among organizations and service providers, the market demand for various services is projected to rise. DDoS protection and mitigation suppliers help protect websites, networks, layer 3 and 7 attacks. DDoS protection services secure websites while reducing downtime and business hazards. These services guard against NTP multiplication, DNS signal, HTTP flood, SYN flood, spoofing, and volumetric attacks.

Geographic Overview

In terms of geography, North America had the highest market share in 2021. As major North American IT corporations roll out new protection and mitigation solutions and active partnerships in the region, it is recognized as an innovation center. Organizations have widely adopted pCs in the region to streamline their work operations.

Furthermore, the rising proliferation of mobile devices and the critical requirement to protect information within businesses push the adoption of DDoS protection and mitigation solutions in the North American market. The broad commitment to data compliance rules by all companies and rapid cloud implementation are the primary growth drivers of the North American DDoS prevention and mitigation industry.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. There are a variety of rich economies in the region with well-developed cyber ecosystems. India, China, Australia, and New Zealand are among the economies. These economies are rapidly adopting DDoS prevention and mitigation technologies to obtain transparency into their networks. Large organizations and SMEs recognize the importance of data safety in Countries in Asia pacific. They are now more open to implementing dedicated DDoS protection and mitigation solutions to safeguard their essential and sensitive corporate data against commercial espionage, cyber-attacks, and computer hackers.

Furthermore, the region's enterprises have been pushed to embrace DDoS prevention and mitigation solutions due to increased improvements in mobility and expanding cloud adoption, and necessary adherence with specific government rules for handling data security issues. Additionally, as cyber-attack severity and complexity have increased, the region's firms' data security concerns have grown.

Competitive Insight

Some of the major market players operating in the global DDoS protection and mitigation security market include Akamai Technologies, Inc., Arbor Networks, Inc, Cloudflare, Inc., Corero Network Security Inc., Dosarrest Internet Security Ltd, F5 Networks Inc., Imperva, Inc., Neustar, Inc., Nexusguard, Ltd., Radware Ltd, and Verisign Inc. among others.

DDoS Protection and Mitigation Security Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3.19 Billion |

|

Revenue forecast in 2030 |

USD 10.33 Billion |

|

CAGR |

14.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Application Area, By Deployment Mode, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Akamai Technologies, Inc., Arbor Networks, Inc, Cloudflare, Inc., Corero Network Security Inc., Dosarrest Internet Security Ltd, F5 Networks Inc., Imperva, Inc., Neustar, Inc., Nexusguard, Ltd., Radware Ltd, and Verisign Inc. among others. |