Dental Laboratories Market Share, Size, Trends, Industry Analysis Report

By Product (Endodontic, Implant, Oral Care, Orthodontic, Restorative); By Material; By Equipment; By Prosthetic Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 118

- Format: PDF

- Report ID: PM4837

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

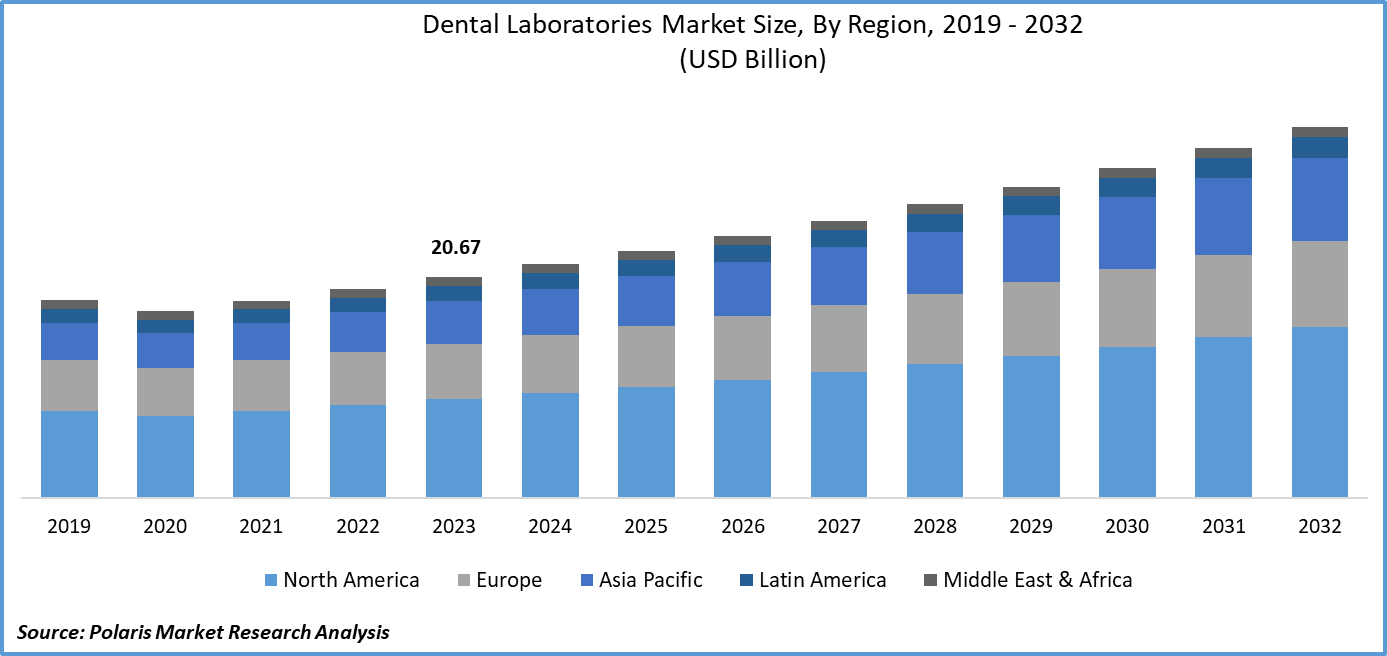

Global dental laboratories market size was valued at USD 20.67 billion in 2023. The market is anticipated to grow from USD 21.87 billion in 2024 to USD 34.77 billion by 2032, exhibiting the CAGR of 6.0% during the forecast period

Industry Trends

Dental laboratories are specialized facilities where dental prostheses, appliances, and restorations are fabricated to meet the specific needs of dental patients. These laboratories play a crucial role in the dental industry by working closely with dentists and dental professionals to create custom-made dental products such as crowns, bridges, dentures, implants, and orthodontic appliances.

The dental laboratories market is playing a pivotal role in providing customized dental prostheses, appliances, and restorations to meet the diverse needs of patients. As advancements in dental technology continue to evolve, dental laboratories are witnessing significant growth, driven by factors such as increasing demand for cosmetic dentistry, rising prevalence of dental disorders, and the growing aging population worldwide. The market is characterized by innovation, quality, and precision, with dental laboratories focusing on delivering high-quality, patient-specific solutions to meet the exacting standards of dental professionals and patients.

To Understand More About this Research:Request a Free Sample Report

The market trends toward growing demand for digital dentistry solutions, including computer-aided design and computer-aided manufacturing (CAD/CAM) technologies, intraoral scanning, and 3D printing, is enabling faster production times, greater precision, and enhanced customization of dental prostheses, driving efficiency and quality in laboratory operations. Also, there is a rising preference for aesthetic dentistry procedures, driven by increasing consumer awareness and demand for cosmetic enhancements. This trend is fueling the demand for aesthetically pleasing dental restorations and prostheses, prompting dental laboratories to offer a wide range of materials and design options to meet patient preferences.

The increasing prevalence of dental disorders such as dental caries, periodontal disease, and tooth loss is driving demand for restorative and prosthetic dental solutions. Additionally, the growing aging population, coupled with rising disposable incomes and a greater emphasis on oral health and aesthetics, is fueling demand for cosmetic and reconstructive dental procedures. Moreover, advancements in dental technology, including digital dentistry solutions, are driving efficiency, accuracy, and customization in laboratory workflows, leading to increased adoption and investment in dental laboratory services and equipment.

Despite the positive growth trajectory, the market faces certain challenges, such as the high cost associated with advanced dental technology equipment and materials, which limit adoption, particularly among smaller laboratories with limited financial resources.

Key Takeaways

- North America dominated the market and contributed over 39% market share of the dental laboratories market size in 2023

- By product category, the oral care segment dominated the global dental laboratories market size in 2023

- By material category, the CAD/CAM materials segment is projected to grow with a significant CAGR over the dental laboratories market forecast period

What are the market drivers driving the demand for the market?

The increasing prevalence of dental disorders is driving dental laboratories' market growth.

The increasing prevalence of dental disorders serves as a significant driver for the growth of the dental laboratories market. With dental conditions such as dental caries, periodontal disease, and tooth loss becoming more prevalent globally, there is a growing demand for restorative and prosthetic dental solutions to address these issues.

Dental laboratories play a crucial role in meeting this demand by fabricating custom-made dental prostheses, appliances, and restorations tailored to patients' specific needs. As the number of individuals requiring dental treatment continues to rise, driven by factors such as aging populations and lifestyle changes, the demand for dental laboratory services is expected to increase correspondingly. This trend not only drives revenue growth for dental laboratories but also underscores their essential role in providing high-quality dental care and improving oral health outcomes for patients worldwide.

Which factor is restraining the demand for Dental Laboratories?

The high cost of advanced dental technology equipment is hindering the dental laboratories market growth.

The high cost of advanced dental technology equipment indeed presents a significant barrier to the growth of the dental laboratories market. Investing in state-of-the-art equipment such as CAD/CAM systems, intraoral scanners, and 3D printers requires substantial financial resources, which can be challenging for many dental laboratories, particularly smaller ones or those operating in regions with limited financial means. These high upfront costs not only deter some laboratories from adopting advanced technologies but also pose ongoing operational expenses for maintenance, upgrades, and training.

As a result, dental laboratories may need help remaining competitive and meeting the evolving demands of dental professionals and patients, who increasingly expect faster turnaround times, higher precision, and greater customization in dental prostheses and restorations.

Report Segmentation

The market is primarily segmented based on product, material, equipment, prosthetic type, and region.

|

By Product |

By Material |

By Equipment |

By Prosthetic Type |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on product category analysis, the market has been segmented on the basis of endodontic, implant, oral care, orthodontic, and restorative. In 2023, the oral care segment emerged as the dominant segment in the global market, exerting a significant influence on market size and growth. This dominance can be attributed to the increasing emphasis on oral health and hygiene worldwide, which has led to rising demand for preventive and restorative dental services, driving the need for dental prostheses, appliances, and restorations fabricated by dental laboratories. Also, advancements in oral care technologies and treatment modalities have expanded the scope of dental procedures, leading to a greater variety of dental devices and products requiring fabrication in laboratories.

Demographic market trends such as aging populations and lifestyle changes have contributed to the growing prevalence of oral health conditions, further fueling demand for dental laboratory services within the oral care segment. As oral health continues to gain prominence on the global healthcare agenda, the oral care segment is expected to maintain its dominance in the dental laboratories market.

By Material Insights

Based on material category analysis, the market has been segmented into CAD/CAM materials, metal ceramics, metals, plastic, and traditional all ceramics. The CAD/CAM materials segment is poised for substantial growth with a significant compound annual growth rate (CAGR) over the forecast period within the market, as this technology offers dental laboratories unparalleled precision, efficiency, and customization in fabricating dental prostheses and restorations.

As dental professionals increasingly adopt digital workflows and intraoral scanning technologies, the demand for CAD/CAM materials compatible with these systems rises accordingly. Also, these materials offer advantages such as enhanced aesthetics, durability, and biocompatibility that meet the evolving needs and expectations of patients and dental professionals.

Regional Insights

North America

In 2023, North America emerged as the dominant region in the global market since the region boasts a well-established healthcare infrastructure and a high level of awareness regarding oral health, leading to a strong demand for dental prostheses, appliances, and restorations fabricated by dental laboratories. Also, North America is at the forefront of technological innovation, with widespread adoption of advanced dental technologies such as CAD/CAM systems and 3D printing, driving efficiency and precision in laboratory operations. Favorable reimbursement policies, robust regulatory frameworks, and a large pool of skilled dental professionals further support market growth in the region.

Asia Pacific

The Asia Pacific region is poised to experience substantial growth in the market due to the region's greater awareness and demand for oral health services and cosmetic dentistry procedures. This growing demand is fueling the need for dental prostheses, appliances, and restorations fabricated by dental laboratories. Also, advancements in dental technology and increasing adoption of digital dentistry solutions, particularly in countries like Japan, South Korea, and China, are driving efficiency and innovation in dental laboratory operations. The region's large population, particularly in countries with emerging healthcare markets, presents significant growth opportunities for dental laboratories.

Competitive Landscape

The competitive landscape of the dental laboratories market is characterized by intense rivalry among key players striving to differentiate themselves and capture market share in a rapidly evolving industry. Established dental laboratories compete alongside emerging startups and niche players, offering a wide range of products and services, including crowns, bridges, dentures, implants, and orthodontic appliances. Key competitive factors include technological capabilities, precision, customization, turnaround times, and quality assurance standards. Market leaders continually invest in research and development to stay at the forefront of dental technology advancements while also focusing on strategic partnerships, mergers, and acquisitions to expand their market presence and enhance their competitive position.

Some of the major players operating in the global market include:

- 3M

- A-dec Inc.

- Champlain Dental Laboratory, Inc.

- Dentsply Sirona

- Envista Holdings Corporation

- Henry Schein, Inc.

- Knight dental design

- National Dentex Corporation

- Straumann AG

- ZimVie Inc.

Recent Developments

- In February 2024, Carbon, a company focused on developing and manufacturing advanced technologies, launched its Automatic Operation (AO) suite of solutions, which are tailored to revolutionize the dental lab automation landscape. The AO suite is an innovative set of automation solutions specifically designed to address the unique requirements of dental labs and is expected to set a new benchmark in terms of lab automation and efficiency.

- In October 2023, ZimVie Inc., a global life sciences company specializing in dental and spine markets, introduced a comprehensive range of restorative components called Azure Multi-Platform Product Solutions, specifically designed for the dental laboratory market.

- In June 2022, Cayster, a technology company headquartered in New York, introduced an open marketplace to tackle the dental industry's inefficiencies. This platform is designed to connect dentists, large practice groups, dental laboratories, and other service providers in the industry.

Report Coverage

The dental laboratories market report emphasizes key regions across the globe to help users better understand the product. It also provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis of various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, material, equipment, prosthetic type, and their futuristic growth opportunities.

Dental Laboratories Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.87 billion |

|

Revenue Forecast in 2032 |

USD 34.77 billion |

|

CAGR |

6.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Material, By Equipment, By Prosthetic Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

key companies in Dental Laboratories Market are 3M, A-dec Inc., Champlain Dental Laboratory, Inc., Dentsply Sirona, Envista Holdings Corporation

Dental Laboratories Market exhibiting the CAGR of 6.0% during the forecast period

The Dental Laboratories Market report covering key segments are product, material, equipment, prosthetic type, and region.

key driving factors in Dental Laboratories Market are increasing prevalence of dental disorders

The global dental laboratories market size is expected to reach USD 34.77 Billion by 2032