Desktop Virtualization Market Share, Size, Trends, Industry Analysis Report

By Type (Desktop-as-a-service (DaaS), Virtual Desktop Infrastructure (VDI), Remote Desktop Services (RDS); By Offering; By Organization Size; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 114

- Format: PDF

- Report ID: PM2616

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

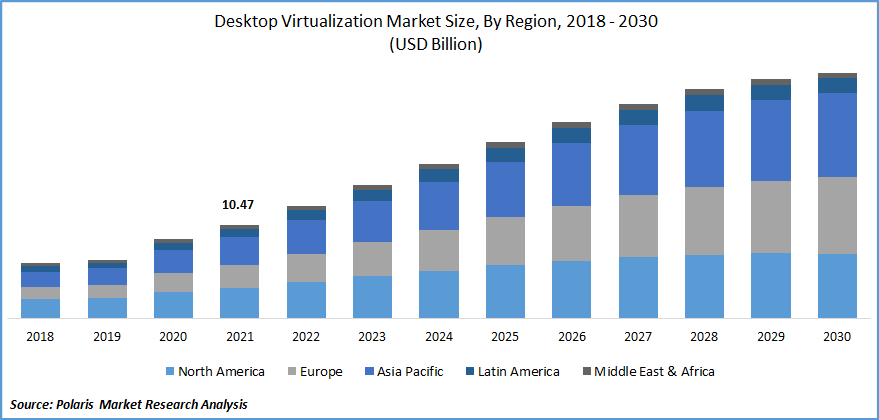

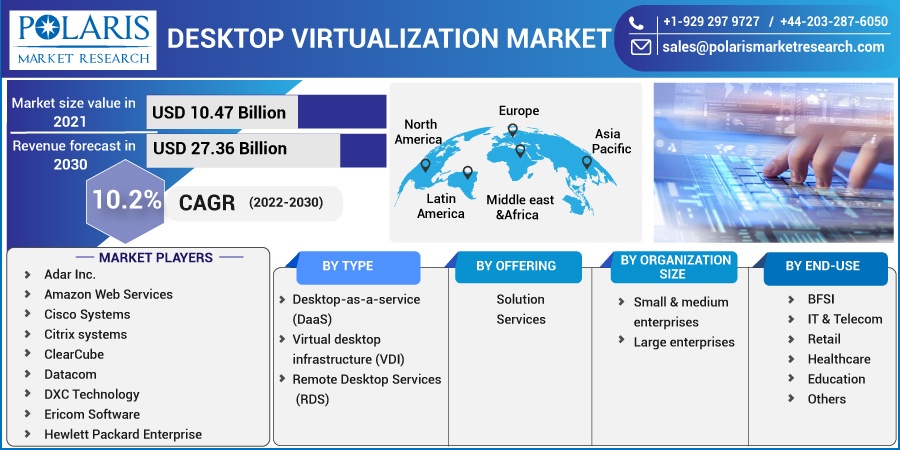

The global desktop virtualization market was valued at USD 10.47 billion in 2021 and is expected to grow at a CAGR 10.2% during the forecast period. There has been an increased implementation of desktop virtualization by IT usage for better efficiency of the data center.

Know more about this report: Request for sample pages

Due to technological advancements, any applications on a laptop or smartphone, the desktop can be accessed through desktop virtualization, unlike the traditional method of pushing operation systems and applications to use devices. Therefore, there has been a huge cost reduction for organizations, wherein they can install inexpensive and less influential customer devices.

The market has been observed according to the patents filed in the U.S., Japan, and Europe. The U.S. has the largest number of patent filings due to its highly developed technological sector, which highly contributes to the growth of the number of patent applications filed in these regions.

The COVID-19 pandemic has positively impacted the overall economy of the market, as corporates and businesses had to adopt remote working and monitoring tools, which in turn encouraged large investments in the desktop virtualization space.

According to an article published by Search Virtual Desktop Blogs, in March 2020, the global spending on virtual desktop infrastructure was $4.91 billion in the year 2019, which is anticipated to grow with an average of 14.4% post the outbreak of the COVID-19 pandemic. Moreover, virtual desktop plays a crucial role in facilitating remote working during the period, as desktop virtualization tools provide cost-effective management and working solutions for employees.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Many corporate businesses are investing in technologies to offer remote operational capabilities post the outbreak of the COVID-19 pandemic. In addition, the growing adoption of digital technologies has made it necessary for many small businesses to speed up their digital transformation. According to a report published by Organisation for Economic Co-operation and Development (OECD), from the months of February to April of 2020, E-Commerce retailers saw an increase of almost 15% in the U.S. alone.

Furthermore, in European countries, online retail sales witnessed a rise of over 30% as compared to the previous of 2019. Such factors further drive the adoption of desktop virtualization solutions during the forecast period.

Furthermore, according to an article published by TechTarget, in May 2021, more than 50-70% of the overall total cost of ownership of an individual personal computer comes from managing and maintaining its hardware and software. Desktop virtualization tools can help companies decrease or even avoid maintenance and management costs and free up time for the internal IT team, which is a major factor anticipated to drive the growth of the industry in the upcoming years.

Report Segmentation

The market is primarily segmented based on type, offering, organization size, end-use, and region.

|

By Type |

By Offering |

By Organization Size |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Virtual desktop infrastructure type accounted for the largest market share

By type, the desktop virtualization market is segmented into desktop-as-a-service (DaaS), virtual desktop infrastructure (VDI), and remote desktop services (RDS). The industry for the virtual desktop infrastructure segment is expected to hold a significant share in 2021.

Virtual desktop infrastructure (VDI) can help businesses become agile with their IT operations. They can instantly spin up new virtual machines for development and testing, seasonal labor, and contractors/consultants. VDI also allows employees to work in a more modular fashion. Employees can access VDI using their preferred devices over the internet.

According to an article published by TechJury.net, in June 2022, more than 67% of employees are using personal devices at work, proving beneficial to companies allowing BYOD (Bring Your Own Device). The user experience is the same for every employee with VDI solutions, irrespective of whether the user uses a smartphone, laptop, Apple, Windows, or thin-client device.

Solution segment accounted for the largest market share

By offering, the desktop virtualization market is segmented into solutions and services. Among these solutions, the segment is expected to be the largest market in the desktop virtualization industry. Desktop virtualization tools offer various application-specific solutions such as security management, data management, remote monitoring system, and network management.

These solutions help organizations to leverage the best return from their IT and digital infrastructure and save on operational and management costs. Moreover, critical business sectors have been utilizing desktop virtualization solutions to offer improved security, easier access, greater control over various systems, and enhanced overall operational productivity. Desktop virtualization solutions have proven advantageous to various industries, boosting operational efficiency and productivity of its IT infrastructure and resources.

Small & medium enterprises segment is expected to be the fastest growing segment during the forecast period

By organization size, the market is categorized into large enterprises and small & medium enterprises. Among these, the small & medium business segment is expected to be the fastest growing segment during the forecast period. Small & medium enterprises are those having revenue between $10 and $200 million and have employee sizes of up to 1,000 employees. SMBs often struggle to survive in the modern competitive markets.

Deployment and management of employee desktop computers, including managing patches of the operating system every week while keeping the software updated, is a difficult and complex task for an SME. Such factors are motivating SMBs to move toward desktop virtualization to cater computing needs of their workforce and reduce costs.

IT & telecom segment accounted for the largest market share

By end-user industry, the desktop virtualization market is categorized into BFSI, IT & Telecom, Retail, Healthcare, Education, and Others. The IT & Telecom segment is expected to account for the largest share during the forecast period. Desktop virtualization solutions can help telecom organizations accomplish their objectives of sustainability and growth by creating an agile IT infrastructure system that matches their business requirements.

By implementing desktop virtualization and VDI solutions, telecoms can expand their customer base and strengthen their presence via retail expansion without having to worry about excessive IT investment and maintenance costs.

Moreover, all virtual desktops can be centrally managed by the IT team, which helps simplify efforts connected with backup and storage, security, and updates. In addition, desktop virtualization can help businesses achieve significant cost savings with the ability to manage IT assets easily and reduce the need for new devices.

North America region will lead the global market by 2030

The North American region is expected to account for a larger share in the market owing to its advancements in cloud and digital technologies. Moreover, the presence of major providers and increased government support for regulatory compliance are the major factors that boost the industry's growth. The rising adoption of desktop virtualization solutions across end-user industries, such as BFSI, IT & telecom, manufacturing, and others, further boosts the market growth in the region.

Competitive Insight

The prominent players in the global market include Adar Inc., Amazon Web Services, Cisco Systems, Citrix systems, ClearCube, Datacom, DXC Technology, Ericom Software, Hewlett Packard Enterprise, Huawei Technologies Co., Ltd., IBM Corporation, Kyndryl Holdings, Microsoft Corporation, NTT DATA, and Oracle Corporation.

The major players operating in the market are investing in advanced technologies to develop innovative solutions to cater to the growing demand from consumers. Collaboration and acquisition also enables companies to strengthen their presence in the global desktop virtualization market.

Recent Developments

In March 2021, Amazon Web Services launched an AWS Solution Consulting offer, Virtual Desktop Accelerator. It is supported by consulting engagement from RedNight Consulting. Virtual Desktop Accelerator will speed up Amazon WorkSpaces deployment.

In December 2020, NComputing collaborated with Microsoft for integration of Microsoft Windows Virtual Desktop Linux client into the RX420(RDP) and RX-RDP+ thin clients powered by Raspberry Pi to decrease total cost of ownership and deliver superior performance and efficiency.

Desktop Virtualization Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 10.47 billion |

|

Revenue forecast in 2030 |

USD 27.36 billion |

|

CAGR |

10.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Offering, By Organization Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Adar Inc., Amazon Web Services, Cisco Systems, Citrix systems, ClearCube, Datacom, DXC Technology, Ericom Software, Hewlett Packard Enterprise, Huawei Technologies Co., Ltd., IBM Corporation, Kyndryl Holdings, Microsoft Corporation, NTT DATA, and Oracle Corporation. |