Diabetic Ketoacidosis Treatment Market Size, Share, Trends, & Industry Analysis Report

By Treatment Type, By Application (Pediatric and Adults), By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM6065

- Base Year: 2024

- Historical Data: 2020-2023

Overview

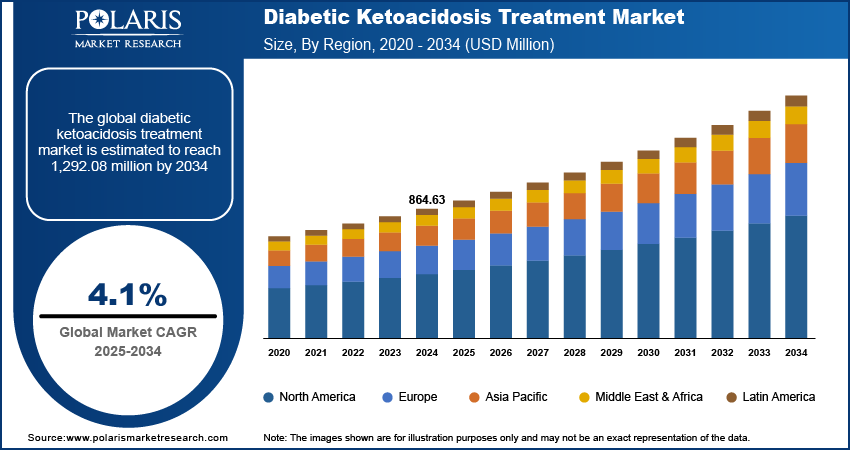

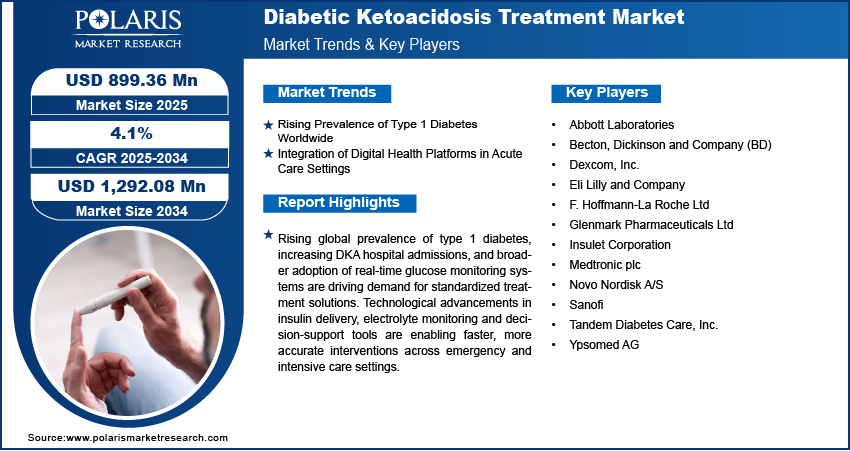

The global diabetic ketoacidosis treatment market size was valued at USD 864.63 million in 2024, growing at a CAGR of 4.1% from 2025–2034. Rising prevalence of type 1 diabetes worldwide and the integration of digital health platforms in acute care settings are collectively driving demand for timely diagnosis, continuous monitoring, and standardized treatment of diabetic ketoacidosis.

Key Insights

- The insulin therapy segment accounted for largest market share in 2024.

- The electrolyte replacement segment is projected to grow at the fastest rate over the forecast period, driven by increasing clinical focus on correcting potassium and bicarbonate imbalances to prevent life-threatening complications.

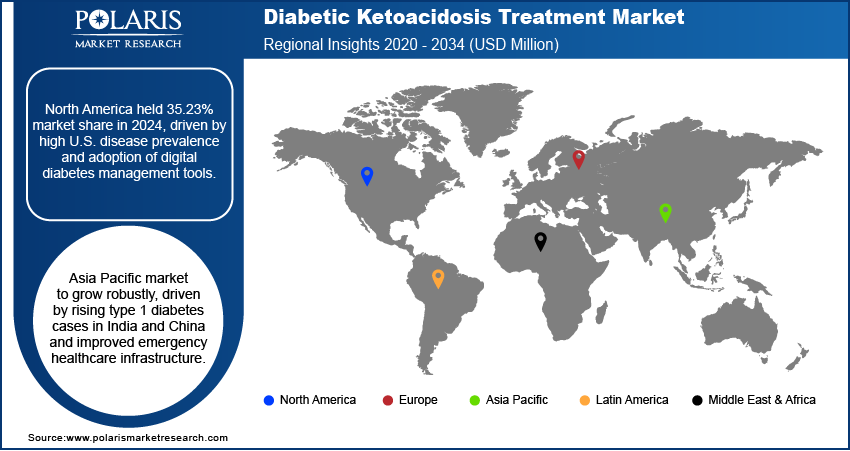

- The North America diabetic ketoacidosis treatment market accounted for 35.23% of the global market share in 2024.

- The US diabetic ketoacidosis treatment market held largest regional share of the North America market in 2024, fueled by widespread adoption of continuous glucose monitoring systems and integration of algorithm-based insulin delivery in hospitals and emergency care settings.

- The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034, owing to fueled by rising type 1 diabetes incidence and expanding access to structured DKA treatment.

- China market is expanding steadily, fueled by due to growing public hospital investment in emergency care infrastructure and increasing availability of point-of-care glucose and ketone testing tools in urban and rural regions.

Industry Dynamics

- Rising prevalence of type 1 diabetes worldwide is increasing the frequency of acute DKA cases, thereby driving the need for rapid-response treatment protocols across hospitals and emergency care settings.

- Integration of digital health platforms in acute care settings is enabling real-time glycemic monitoring and treatment optimization, driving faster clinical decisions and improved patient outcomes in DKA management.

- Rising adoption of AI-enabled clinical decision support systems presents an opportunity for DKA treatment to enhance early diagnosis, automate insulin dosing adjustments and improve treatment precision in emergency settings.

- High cost burden of acute care infrastructure and intensive insulin therapies remains a limiting factor for widespread adoption in low-income and middle-income countries.

Market Statistics

- 2024 Market Size: 864.63 million

- 2034 Projected Market Size: 899.36 million

- CAGR (2025-2034): 4.1%

- North America: Largest market in 2024

Diabetic ketoacidosis (DKA) treatment involves fluid resuscitation, insulin therapy and electrolyte replacement to stabilize blood glucose and reverse metabolic acidosis. Hospitals and emergency departments are the primary users of DKA treatment protocols due to the condition’s acute onset and life-threatening nature. Intravenous insulin infusions and rapid fluid administration are widely adopted to restore metabolic balance in patients presenting with severe hyperglycemia and ketonemia. The demand for point-of-care ketone testing and continuous glucose monitoring is rising in intensive care and emergency settings to enable faster diagnosis and reduce treatment delays. For instance, in April 2025, Medtronic announced the expansion of its real-time CGM systems across acute care settings in the US to support better glycemic control in DKA management.

The DKA treatment market is expanding due to the increasing global prevalence of type 1 diabetes and the rising incidence of insulin non-compliance among younger populations. Growth in emergency hospital admissions linked to uncontrolled diabetes is driving the adoption of advanced insulin delivery and monitoring solutions. Growing focus on guidelines from health authorities such as the American Diabetes Association (ADA) and the European Society of Endocrinology highlight early intervention protocols, which are accelerating the demand for standardized treatment kits and algorithm-based care. Market players are focusing on R&D investments to develop fast-acting insulin analogs and smart insulin infusion systems. The adoption of integrated treatment approaches combining digital diagnostics, automated dosing and remote monitoring is driving the adoption of DKA treatment across developed healthcare systems. In May 2025, Sequel Med Tech announced to integrate its Twiist automated insulin delivery (AID) system with Abbott’s upcoming dual glucose-ketone sensor to create a closed-loop diabetes management solution. This integration is expected to enhance early detection and intervention for diabetic ketoacidosis (DKA) by enabling real-time monitoring of glucose and ketone levels, thereby reducing the risk of severe DKA episodes.

The growing focus on decentralized acute care delivery is pushing hospitals to adopt mobile treatment units and modular intensive care setups for diabetic emergencies. Healthcare providers are rapidly relying on flexible care models to manage surges in DKA admissions linked to seasonal or regional fluctuations in diabetes-related complications. Manufacturers of insulin delivery systems and infusion kits are expanding their contract manufacturing operations and third-party logistics partnerships to streamline supply across geographically dispersed facilities. In addition, the rising focus on reducing turnaround time, improving on-demand availability and enabling faster treatment cycles is boosting operational efficiencies across the DKA treatment ecosystem.

Drivers & Opportunities/Trends

Rising Prevalence of Type 1 Diabetes Worldwide: The rising prevalence of type 1 diabetes globally is contributing to increasing incidence of diabetic ketoacidosis, particularly among children and young adults. As per the International Diabetes Federation, more than 1.8 million individuals under the age of 20 are currently living with type 1 diabetes worldwide. The growing insulin dependency combined with delays in diagnosis, therapy initiation, or treatment adherence is contributing to rising emergency admissions for diabetic ketoacidosis. This trend is accelerating the demand for acute care resources, including intravenous insulin, fluid replacement and electrolyte correction. Health systems are expanding capacity to manage acute diabetic crises, while manufacturers are scaling production of insulin analogs and emergency-use treatment kits. The increasing disease burden is boosting public health agencies to strengthen early screening and prevention efforts.

Integration of Digital Health Platforms in Acute Care Settings: The integration of digital health platforms into acute care settings is transforming diabetic ketoacidosis management by improving diagnostic speed, treatment accuracy and real-time monitoring. The increasing adoption of continuous glucose monitoring systems, smart insulin pumps and hospital-based analytics are enabling faster clinical decisions and reducing delays in intervention. These technologies support data-driven care by alerting providers to critical changes in patient condition and guiding precise insulin dosing. Moreover, the integration with electronic health records enhances treatment continuity during emergency admissions. The growing adoption of connected care systems in hospitals is driving demand for interoperable devices and algorithm-based treatment tools to standardize DKA management across intensive care and emergency departments.

Segmental Insights

Treatment Type Analysis

Based on treatment type, the segmentation includes insulin therapy, fluid replacement, and electrolyte replacement. The insulin therapy segment accounted for largest revenue share in 2024, due to its central role in stabilizing hyperglycemia and reversing ketogenesis. Insulin is the first-line intervention in DKA treatment protocols and administered intravenously to rapidly normalize blood glucose levels. For instance, in June 2024, Insulet launched SECURE-T2D pivotal trial showed that the Omnipod 5 automated insulin delivery system significantly improved glycemic control and quality of life in adults with type 2 diabetes. These findings support the potential of wearable insulin technologies including Omnipod 5 to enhance diabetic ketoacidosis (DKA) prevention by maintaining stable glucose levels in high-risk patients. Moreover, the rising hospitals reliance on standardized insulin infusion regimens for pediatric and adult cases to support consistent clinical use. This segment benefits from the widespread availability of analog insulins along with adherence to clinical guidelines and integration into emergency care workflows. The rising advancements in ultra-rapid insulin formulations and the adoption of smart pump technologies continue to improve the segment's effectiveness in acute care settings.

The electrolyte replacement segment is projected to grow at the fastest pace during the forecast period. This growth is attributed to the increasing clinical recognition of electrolyte imbalances such as hypokalemia and bicarbonate deficits that frequently accompany DKA episodes. Healthcare facilities are adopting tailored potassium and bicarbonate replacement strategies to mitigate complications such as cardiac arrhythmias and cerebral edema. The demand for electrolyte replacement is also driven by the use of real-time electrolyte analyzers and pre-mixed hospital-grade formulations. The rising complexity in DKA cases and institutional preference for complete metabolic correction protocols are expected to drive growth in this segment across emergency and critical care settings.

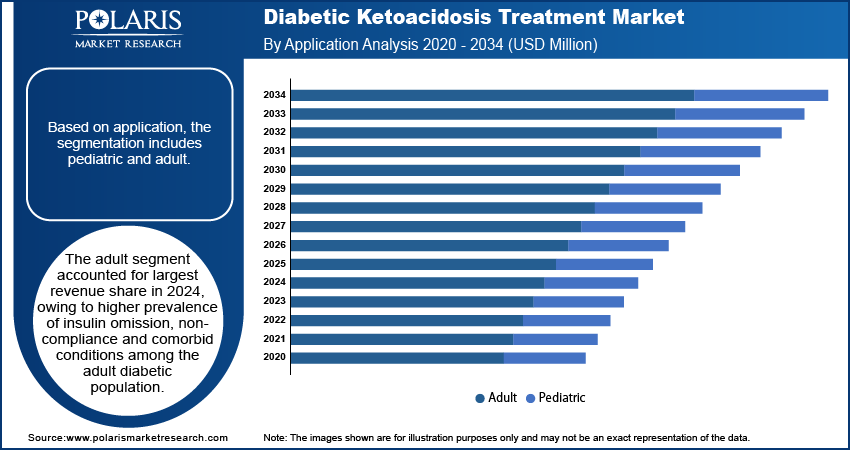

Application Analysis

Based on application, the segmentation includes pediatric and adult. The adult segment accounted for largest revenue share in 2024, owing to higher prevalence of insulin omission, non-compliance and comorbid conditions among the adult diabetic population. Adults with poorly managed type 1 diabetes are expected to experience repeated DKA episodes, with the increasing reliance on structured hospital-based interventions. Hospitals and emergency departments prioritize adult care protocols that include glucose monitoring, electrolyte correction and intravenous insulin therapy. The availability of advanced diagnostic infrastructure and growing awareness of adult-onset autoimmune diabetes are further contributing to the segment’s dominance.

The pediatric segment is projected to grow at the fastest pace during the forecast period, driven by rising incidence of type 1 diabetes in children and adolescents. In this age group, delayed diagnosis and early-stage misidentification of the disease frequently result in critical presentations of diabetic ketoacidosis (DKA). Pediatric care units are integrating age-appropriate insulin dosing algorithms, fluid resuscitation guidelines, and non-invasive monitoring solutions to enhance clinical management and improve patient outcomes. The rising technological advancements such as wearable glucose sensors and pediatric-focused insulin pumps are improving treatment outcomes. Additionally, increased screening initiatives, targeted educational programs and early intervention campaigns led by public health authorities are facilitating the faster adoption of DKA treatment protocols within the pediatric population.

End User Analysis

By end user, the market includes hospitals, ambulatory care centers, and specialty clinics. The hospitals segment held the largest revenue share in 2024, due to their ability to provide full-spectrum acute care services for severe DKA cases. Hospitals are equipped with the infrastructure necessary for continuous patient monitoring, intravenous therapies and laboratory diagnostics. Emergency departments and intensive care units (ICUs) frequently manage diabetic ketoacidosis (DKA) cases that require intensive insulin therapy and fluid administration. The strong reimbursement support, integration of electronic health records and institutional compliance with diabetes management guidelines are contributing to hospital dominance in this market.

The ambulatory care centers segment is anticipated to grow at the fastest rate. The shift toward outpatient-based care models and decentralized emergency response is increasing the relevance of ambulatory centers in managing mild-to-moderate DKA cases. These centers are equipped with point-of-care glucose and ketone testing along with ready-to-administer insulin and electrolyte kits. The features including cost efficiency, faster triage and lower hospitalization rates are making ambulatory care centers an attractive option for payers and healthcare providers in the management of diabetic ketoacidosis (DKA). Additionally, manufacturers are forming distribution partnerships to ensure timely availability of DKA treatment solutions in outpatient settings, driving further segment expansion.

Regional Analysis

North America diabetic ketoacidosis treatment market accounted for 35.23% of global market share in 2024. The high prevalence of type 1 diabetes coupled with a well-established emergency care infrastructure is driving the demand for DKA treatment across the region. As per the Breakthrough T1D report, approximately 300,000 individuals in Canada are currently living with type 1 diabetes (T1D), with the national prevalence increasing at an annual rate of 4.4%, significantly outpacing the population growth rate of 1%. Based on current trends, the total number of T1D cases is projected to reach 455,580 by 2040. Each year, an estimated 12,000 new cases are reported across all age groups, with adults accounting for nearly 71% of diagnoses. Additionally, the standardized DKA management protocols followed by hospitals in the US and Canada support early screening and improve insulin accessibility, thereby accelerating market growth. In addition, the presence of major healthcare companies along with high investments in advanced insulin therapies and diagnostic technologies, continues to boost North America diabetic ketoacidosis treatment market.

The US Diabetic Ketoacidosis Treatment Market Insight

The US held largest market share in North America diabetic ketoacidosis treatment landscape in 2024, due to rising prevalence of type 1 diabetes across all age groups is contributing to increasing emergency admissions for diabetic ketoacidosis, pushing hospitals to maintain continuous readiness with standardized treatment protocols. Additionally, the adoption of real-time digital monitoring platforms and EHR-linked insulin infusion systems is enhancing clinical decision-making and enabling faster guideline-based interventions for pediatric and adult DKA cases in high-volume healthcare settings.

Asia Pacific Diabetic Ketoacidosis Treatment Market

The market in Asia Pacific is projected to grow at a significant CAGR from 2025-2034. This growth is driven by the rising number of diabetes cases, limited early diagnosis and improving access to healthcare. In countries such as India and China, the growing incidence of type 1 diabetes in children and young adults is leading to more emergency admissions for diabetic ketoacidosis (DKA). Also, government efforts to strengthen emergency care in rural and urban areas are helping improve access to insulin and fluid therapies. In addition, increasing awareness programs are helping patients and caregivers recognize symptoms and seek timely treatment.

China Diabetic Ketoacidosis Treatment Market Overview

The market in China is expanding due to growing number of type 1 diabetes cases among younger populations is resulting in a higher frequency of DKA-related hospitalizations, boosting government efforts to strengthen acute care capacity in provincial health systems. According to the World Health Organization (WHO), diabetes-related healthcare costs in China are projected to rise from USD 250.2 million in 2020 to USD 460.4 million by 2030, with per-capita spending increasing from USD 231 to USD 414. This growing economic burden is expected to drive greater investment in early diagnosis, insulin access, and acute care infrastructure, driving the expansion of diabetic ketoacidosis (DKA) treatment services across the country. At the same time, national initiatives to digitize emergency care and introduce automated glucose monitoring tools are enabling faster diagnosis and more effective metabolic correction in high-risk patients.

Europe Diabetic Ketoacidosis Treatment Market

The diabetic ketoacidosis treatment landscape in Europe is projected to hold a substantial share in 2034, fueled by the presence of universal healthcare systems, early-stage diabetes screening programs and adherence to international clinical guidelines. Also, countries such as Germany, the UK, and France are improving DKA management through the integration of electronic health records and clinical decision support systems. Furthermore, the presence of key companies in this region is extensively engaged in delivering DKA treatment through various business strategies such as acquisition and expansion of product portfolio, which in turn contributes to the growth of DKA treatment in this region. As an example, in March 2023, Sanofi acquired Provention Bio, adding TZIELD to its portfolio, the first approved therapy designed to delay the onset of Stage 3 type 1 diabetes. By slowing disease progression, TZIELD is expected to lower the likelihood of diabetic ketoacidosis (DKA). This acquisition fuels Sanofi’s commitment to advancing innovative, disease-modifying therapies that address critical gaps in diabetes management.

Key Players & Competitive Analysis Report

The diabetic ketoacidosis treatment industry is moderately competitive, with key players focusing on technology integration, product innovation and strategic collaborations to strengthen their market position. Companies are investing in rapid-acting insulin formulations, point-of-care diagnostics and digital health tools to improve treatment outcomes. In addition, rising partnerships with healthcare providers and public health agencies are enhancing protocol adoption and expanding regional reach.

Major companies operating in the diabetic ketoacidosis treatment industry include Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Becton, Dickinson and Company (BD), Dexcom, Inc., Medtronic plc, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Insulet Corporation, Tandem Diabetes Care, Inc., Ypsomed AG, and Glenmark Pharmaceuticals Ltd.

Key Players

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- Dexcom, Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Glenmark Pharmaceuticals Ltd

- Insulet Corporation

- Medtronic plc

- Novo Nordisk A/S

- Sanofi

- Tandem Diabetes Care, Inc.

- Ypsomed AG

Industry Developments

- June 2025: Ypsomed announced plans to integrate Abbott’s upcoming dual glucose-ketone sensor into its mylife Loop system, which combines the mylife YpsoPump and mylife CamAPS FX. This integration is expected to enhance diabetic ketoacidosis (DKA) management by enabling continuous monitoring of glucose and ketone levels, supporting timely intervention in high-risk patients.

- June 2024: Tandem Diabetes Care partnered with Abbott to integrate their insulin pump technology with Abbott’s continuous glucose monitoring (CGM) systems. This collaboration is expected to enhance glycemic monitoring and insulin delivery for individuals with diabetes, supporting improved management of diabetic ketoacidosis (DKA) through more precise and timely intervention.

Diabetic Ketoacidosis Treatment Market Segmentation

By Treatment Type Outlook (Revenue, USD Million, 2020–2034)

- Insulin Therapy

- Fluid Replacement

- Electrolyte Replacement

By Application Outlook (Revenue, USD Million, 2020–2034)

- Pediatric

- Adults

By End User Outlook (Revenue, USD Million, 2020–2034)

- Specialty Clinics

- Ambulatory Care Center

- Hospitals

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Diabetic Ketoacidosis Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 864.63 Million |

|

Market Size in 2025 |

USD 899.36 Million |

|

Revenue Forecast by 2034 |

USD 1,292.08 Million |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 864.63 million in 2024 and is projected to grow to USD 1,292.08 million by 2034.

The global market is projected to register a CAGR of 4.1% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Becton, Dickinson and Company (BD), Dexcom, Inc., Medtronic plc, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Insulet Corporation, Tandem Diabetes Care, Inc., Ypsomed AG, and Glenmark Pharmaceuticals Ltd.

The adult segment dominated the market in 2024. This dominance is attributed to larger patient base, higher hospitalization rates due to insulin omission or non-compliance and established treatment infrastructure in hospitals managing adult DKA cases.

The ambulatory care centers segment is expected to witness the fastest growth during the forecast period, driven by increasing adoption of decentralized DKA management models and growing demand for cost-effective emergency stabilization services driven by digital monitoring tools.