Direct Energy Conversion Device Market Share, Size, Trends, Industry Analysis Report

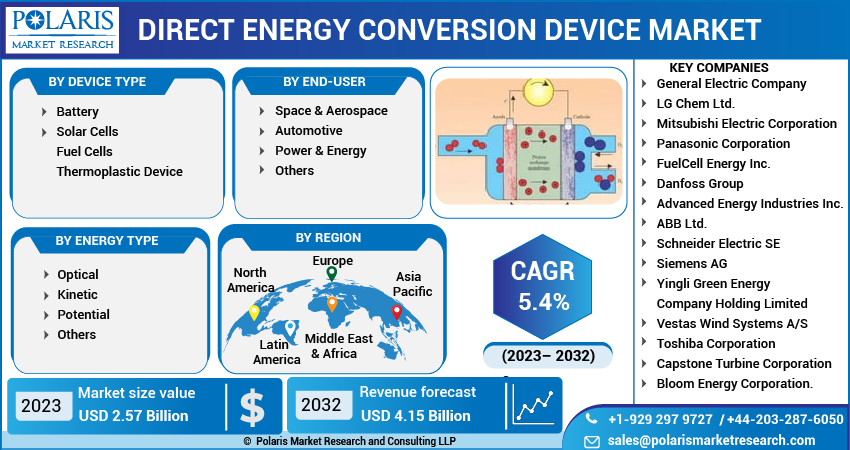

By Device Type (Battery, Solar Cells, Fuel Cells, and Thermoelectric Device); By Energy Type; By End-User; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 116

- Format: PDF

- Report ID: PM3519

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

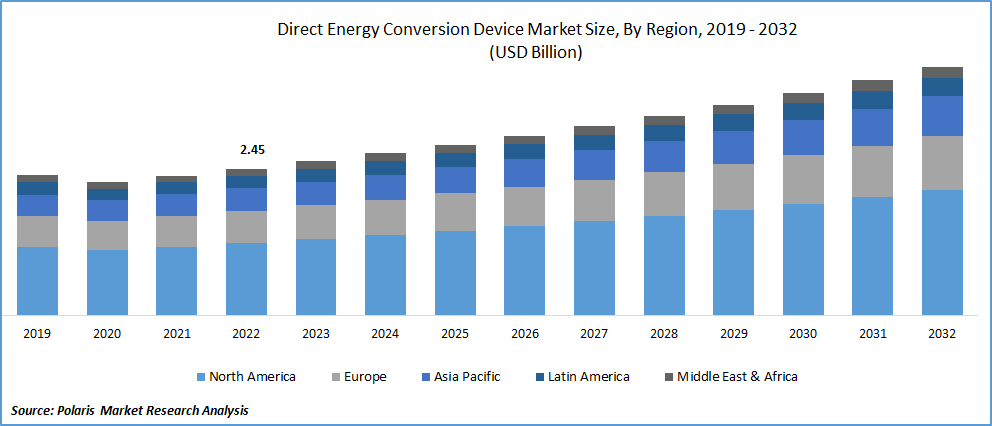

The global direct energy conversion device market was valued at USD 2.45 billion in 2022 and is expected to grow at a CAGR of 5.4% during the forecast period. Growing power consumption and rising usage of various types of renewable energy sources like solar energy and wind turbines, coupled with the surge in technological advancements targeting reducing production costs and enhancing overall performance effectiveness, are driving the market growth. Besides this, the significant increase in the number of regulations and various incentives or benefits offered by governments for the use of solar cells as well as solar energy, along with the introduction to automobiles using hydrogen fuel cell technology by key companies, is also likely to bode well for the market growth.

To Understand More About this Research: Request a Free Sample Report

For instance, in January 2023, MG Motors introduced their new vehicles integrated with 3rd generation hydrogen fuel technology exhibited at Auto Expo 2023. The technology presents the future of transportation in the country with a greater focus on sustainability, which would be using fuel cells as direct energy converters.

Moreover, the emergence of thermo-electrics worldwide as a direct energy conversion between heat and electric power has numerous advantages, including the ability to cool materials without an exchange media. It can also get some electric energy back from the waste heat. This technology has gained immense popularity recently, especially from the growing need for new environment-friendly energy sources. It has encouraged researchers to develop new thermoelectric materials with improved properties.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the direct energy conversion device market. The significant emergence of the deadly coronavirus has caused disruptions in global supply chains, making it difficult for manufacturers to obtain the necessary components and materials to produce direct energy conversion devices, which also led to delays in production and delivery times. Construction and installation of devices like solar and wind farms were also closed due to labor shortages and trade restrictions.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rapid advancement of technology, which resulted in improvements in the efficiency and cost-effectiveness of these devices, such as advances in materials science and engineering, has led to the development of more efficient solar panels and wind turbines coupled with the rising popularity for installing solar panels homeowners and businesses, as it can reduce their energy bills by generating their own electricity, are among the primary factors influencing the direct energy conversion device market growth.

Furthermore, the rapidly increasing popularity of photovoltaic electric generating stations across the globe, as they can easily or efficiently operate at the near-ambient temperature and also qualify as low-temperature power plants, which makes them highly preferable to be installed or deployed at residences, which is further likely to boost the demand and growth of the global market.

Report Segmentation

The market is primarily segmented based on device type, energy type, end-user, and region.

|

By Device Type |

By Energy Type |

By End-User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The fuel cells segment will hold a substantial market share in 2022.

The fuel cells segment is expected to hold a substantial market share in 2022 with a healthy growth rate over the coming years, which is mainly driven by rising demand and need for hydrogen power plants across the globe due to encouraging legislation by the major governing bodies of developed nations to reduce the carbon emission rates. Additionally, the rapid expansion in research and development towards creating more hydrogen-powered cars and the high focus on electric grid replacements by governments across the globe will also create huge demand and growth for the segment market.

For instance, in March 2022, Toyota, a leading automobile manufacturer, unveiled India’s 1st hydrogen-based EV as a part of their pilot project by the Toyota Kirloskar Motor & International Center for Automotive Technology. It is completely environment-friendly with almost no emissions other than water, which will help the company to achieve a net-zero carbon emission goal throughout the lifecycle.

The optical segment accounted for the largest market share in 2022.

The optical segment accounted for the largest market share in 2022, which can be largely attributed to the growing focus on sustainability and reducing carbon emissions, which fuels the demand for renewable energy sources like solar power coupled with the increasing advances in materials science, device design, and manufacturing processes to improve the efficiency and performance of optoelectronic devices.

The kinetic energy segment is projected to exhibit a significant growth rate during the forecast period, mainly due to a rapid increase in the usage of wireless sensors across various applications such as IoT devices, which require a reliable and efficient source of power, as kinetic energy harvesting technologies provide a more convenient solution for powering such kind of devices owing to their abilities to be used in various remote or hard-to-reach locations.

The automotive segment is expected to witness the highest growth over the forecast period

The automotive segment is projected to grow at a healthy CAGR throughout the anticipated period, which is highly attributable to an increased number of consumers who are becoming more conscious regarding the impact of petrol and diesel-based vehicles on their environment, which enforces them to opt for electric and hybrid vehicles to reduce their carbon footprint, which has led to an increased demand for direct energy conversion devices in the automotive industry.

The cost of electric vehicles and their components has continuously decreased over the years due to advancements in technology and scaling economies, which have made electric vehicles more affordable and accessible to customers. Besides this, significant advancements in direct energy conversion technology have led to more efficient and reliable devices, including power electronics and electric motors, boosting product demand in the automotive industry.

North America dominated the global market in 2022

North America dominated the global market with considerable market share in 2022 and is expected to continue its dominance over the study period. The extensively rising concerns regarding climate change which fuels the demand and penetration for clean and renewable energy sources, along with the growing implementation of several government policies and initiatives like tax credits for homeowners who install solar panels at their houses, are the factors propelling the regional market growth at a rapid pace.

Asia Pacific is projected to register the highest growth rate during the forecast period, which can be highly accelerated to exponential growth in the demand for the product across the automobile sector, as thermoelectric devices like generators are being used to convert heat into electricity in engines since the rise in the production of automobiles is resulting in higher demand for these devices. For instance, according to a report published in 2023, total vehicle products and sales of automobiles amounted to 2.032 million units and 1.976 million units, with a rise of 11.9% and 13.5% from the previous year.

Competitive Insight

Some of the major players operating in the global market include General Electric Company, LG Chem Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, FuelCell Energy Inc., Danfoss Group, Advanced Energy Industries Inc., ABB Ltd., Schneider Electric SE, Siemens AG, Yingli Green Energy Company Holding Limited, Vestas Wind Systems A/S, Toshiba Corporation, Capstone Turbine Corporation, and Bloom Energy Corporation.

Recent Developments

- In September 2022, Powin acquired EKS Energy. This acquisition will ensure that the new and existing customers of the company receive updated technology offerings and also delivers integrated grid energy storage capabilities.

- In May 2022, U.S. Department of Energy announced the launch of its new USD 3.5 Bn program with an aim to capture & store C02 from air. This program is supported by the four large hubs that comprise a wide network of C02 removal projects to address the growing impacts of climate change and prioritize community engagement & environmental justice.

Direct Energy Conversion Device Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.57 billion |

|

Revenue forecast in 2032 |

USD 4.15 billion |

|

CAGR |

5.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Device Type, By Energy Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

General Electric Company, LG Chem Ltd., Mitsubishi Electric Corporation, Panasonic Corporation, FuelCell Energy Inc., Danfoss Group, Advanced Energy Industries Inc., ABB Ltd., Schneider Electric SE, Siemens AG, Yingli Green Energy Company Holding Limited, Vestas Wind Systems A/S, Toshiba Corporation, Capstone Turbine Corporation, and Bloom Energy Corporation. |

FAQ's

The direct energy conversion device market report covering key segments are device type, energy type, end-user, and region.

Direct Energy Conversion Device Market Size Worth $4.15 Billion By 2032.

The global direct energy conversion device market is expected to grow at a CAGR of 5.4% during the forecast period.

North America is leading the global market.

key driving factors in direct energy conversion device market are increasing focus on renewable energy.