DNA & RNA Banking Services Market Share, Size, Trends, Industry Analysis Report

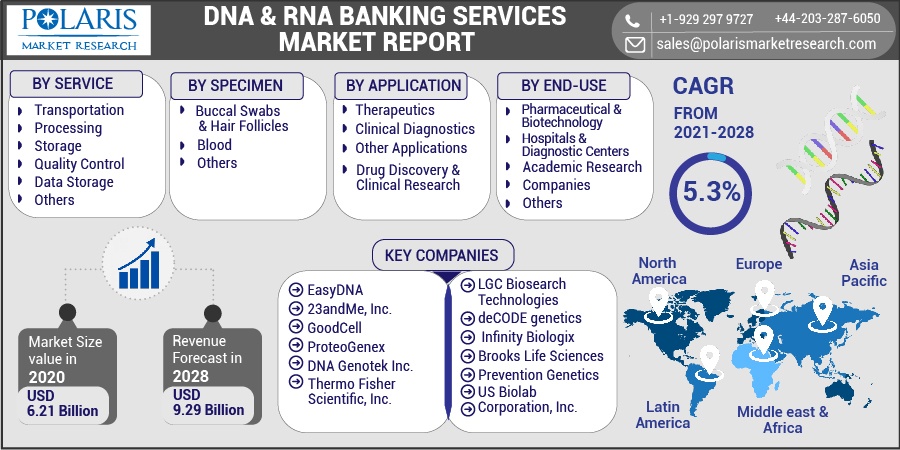

By Service (Transportation, Processing, Storage, Quality Control, Data Storage, Others); By Specimen (Blood, Buccal Swabs & Hair Follicles, Others); By Application; By End-Use, By Regions; Segment Forecast, 2021 - 2028

- Published Date:Apr-2021

- Pages: 117

- Format: PDF

- Report ID: PM1856

- Base Year: 2020

- Historical Data: 2016-2019

Report Outlook

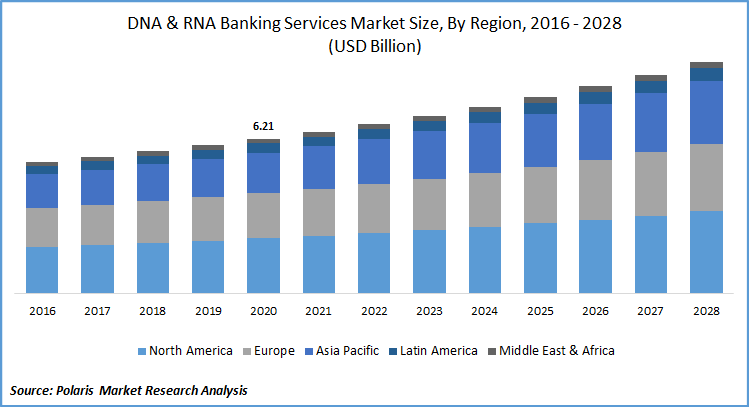

The global DNA & RNA banking services market was valued at USD 6.21 billion in 2020 and is expected to grow at a CAGR of 5.3% during the forecast period. Bio-banking services are identified as one of the key areas in accelerating drug discovery to develop new therapeutic approaches, particularly in oncology indications.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Such a multi-disciplinary approach is applied for therapy monitoring, disease prediction, preventive measures, drug discovery, and optimization. As a result, the market for DNA & RNA banking services is expected witness significant market growth over the forecast period.

Hence, the rise in cancer cases worldwide is anticipated to drive the DNA & RNA banking services industry growth. Cancer is the second largest death cause in the U.S. alone, after heart diseases. As per the estimates of the American Cancer Society, there are more than 1.8 million new cases of cancer, by 2020, in the U.S. alone. It is being estimated that around 606,520 people in the U.S., die after contracting cancer. High cancer prevalence, resulted in demand for cancer research, which further propels DNA & RNA banking services demand.

Know more about this report: Request for sample pages

DNA & RNA Banking Services Market Report Scope

The market is primarily segmented on the basis of service, specimen, application, end-use, and geographic region.

|

By Service |

By Specimen |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Service

The storage device segment of DNA & RNA banking services market accounted for the largest revenue share, in 2020. This is high market share is attributed to the availability of high-quality biospecimens for research purposes. Reliable long-term stabilization and storage solutions are critical to the development of biobanks. Biological samples need to be stored in temperature-controlled storage facilities of up to -496oCelsius.

The easy availability of these systems, such as compound and arktic systems manufactured by SPT Labtech, could be easily configured to have -80oCelsius of temperature. The platforms are well suited for 2D barcoded tubes to fulfill storage volumes from micro-liters to 1.2 mL. Hence, the presence of ambient storage facilities positively impacts the market segment’s demand.

The quality control market segment is expected to witness the highest growth rate over the study period. The presence of several guidelines to improve the quality of specimens. Bio-specimen Reporting for Improved Study Quality strengthens the publication related to the bio-specimen research. France on the other hand has already introduced specific region-specific guidelines to regulate DNA & RNA banking services.

Insight by Specimen

In 2020, the blood market segment of DNA & RNA banking services market held the largest share. It is the most used sample type by clinicians for routine lab tests. It is the most common non-invasive biomarker specimen type for cancer studies. Moreover, blood sample collection time does not interfere with the count of DNA and RNA.

Blood collection is one type of certified primary skill for front-line medical workers. It requires special collection tubes and venipuncture. Additional specimen collection to store them in biobanks does not burden the patient, which complicates blood collection. Moreover, serum and plasma are mostly preferred over cell-free DNA, protein, or hormone for sample collection.

The buccal swaps market segment is projected to witness a lucrative growth rate over the study period. The collection of buccal swabs samples is one of the fastest methods, which does not require any medically trained professional. Mostly, hair samples are used in forensic studies. Moreover, the rise in COVID cases has increased exponentially, owing to the increase in market demand for swabbing testing.

Insight by End Use

In 2020, the academic market segment held the largest revenue share. A huge pool of researchers in research institutions involved in any kind of research is largely responsible for such growth. A paradigm shift towards biomarker therapy, personalized medicine, and tailored therapies offered by biomarkers also attributed to the growth of the segment and market for DNA & RNA banking services.

Academic institutions are involved to understand differences between several treatment types and their response type. Colorado Center for Personalized Medicine (CCPM) is one such type of institute which is involved in personalized medicine. This biobank collects and stores different biological samples.

Hospitals market segments of DNA & RNA banking services industry are projected to witness a lucrative growth rate over the assessment period. This is primarily due to strong relations and collaborations with associations, for instance, more than 80,000 have already consented to transfer rights of their biological sample to Partners Biobank to the Spaulding Rehabilitation Hospital, Massachusetts General Hospital, and McLean Hospital.

Geographic Overview

In 2020, the North America market for DNA & RNA banking services accounted for over 30% of the global market. This high share is attributed to the presence of a wide network of biobanks and the efforts taken by them in the country. The Canadian Tumor Repository Network is a non-profit bio-bank network financed by the Government of Canada. It collects and stores blood, tissue, and saliva samples of cancer patients for further research purposes.

The U.S. government also supports a comprehensive network of biobanks in the country. The Cooperative Human Tissue Network is one such organization that is supported and funded by the National Cancer Institute. It usually provides blood and tissue microarrays for existing specimens from cancer patients for varied research themes.

Asia Pacific market for DNA & RNA banking services is projected to witness the highest growth rate over the study period. Demand in the region is primarily due to awareness among stakeholders about the concept of bio-banking through conferences and industry consortiums. For instance, in September 2020, Japan hosted the International Conference on Advanced Bio-banking and Biotechnology to spread awareness in Asian countries.

Competitive Insight

The prominent market players operating in the DNA & RNA banking services industry are EasyDNA, 23andMe, Inc., GoodCell, ProteoGenex, LGC Biosearch Technologies, DNA Genotek Inc., US Biolab Corporation, Inc., Thermo Fisher Scientific, Inc., deCODE genetics, Infinity Biologix, Brooks Life Sciences, and PreventionGenetics.

The companies operating in the DNA & RNA banking services industry have adopted several innovative techniques for transportation, processing, storage, and quality control. Furthermore, the companies are using strategies to gain edge over their competitors increasing the competition in the DNA & RNA banking services industry.