Drone Analytics Market Share, Size, Trends, Industry Analysis Report

By Industry; By Application; By Type (Service, Software As A Service); By Solution; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 115

- Format: PDF

- Report ID: PM2717

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

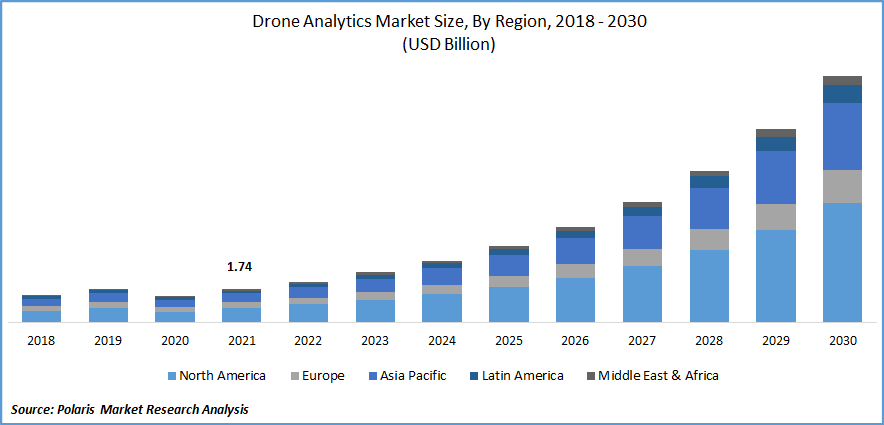

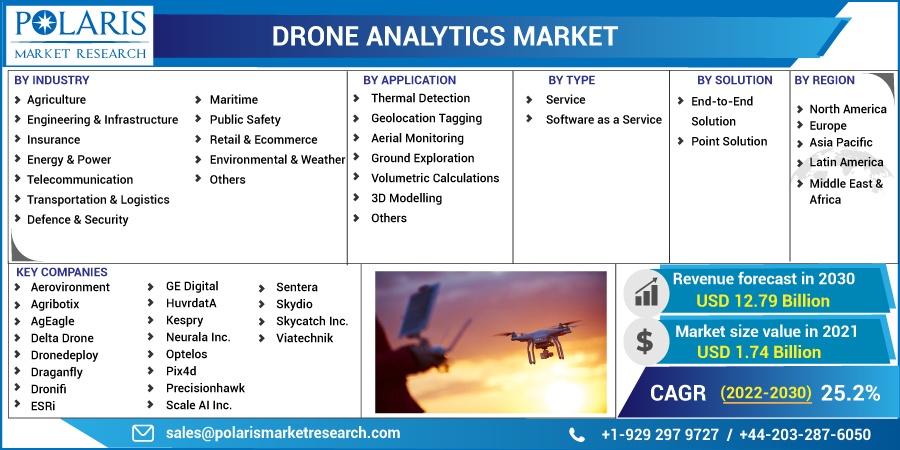

The drone analytics market was valued at USD 1.74 billion in 2021 and is expected to grow at a CAGR of 25.2% during the forecast period. The growth of the drone analytics market can be ascribed to the increased demand for drones, which are being utilized by an increasing number of sectors, including agriculture, logistics, mining, oil and gas, and real estate, as it shows applications including timeliness and cost-effective data collecting.

Know more about this report: Request for sample pages

Drone analytics is frequently used to gather, examine, and control the data required to make critical decisions. The data is also used in various industries, such as mining and construction, to calculate the stockpile and raw material quantities in inventories, providing accurate inventory analysis considerably more quickly than conventional methods.

Numerous applications use data analytics, including geolocation tagging, ground investigation, 3D modeling, and volumetric computations. To provide more information, some drone analytics technologies can be utilized with other analytics tools, including business intelligence platforms.

Drones are becoming more and more likely to be used in various industries. These winged machines quickly give comprehensive and valuable findings due to their speed and agility.

Nowadays, drones with sensors and cameras are proving their value in obtaining real-time video that can be saved for later analysis. Unlike conventional approaches, unmanned aerial systems can find malfunctioning structures and equipment more easily.

Innovative technologies such as machine learning and lasers expand the range of these inspection drones by equipping them with the technology necessary to perform specific tasks during inspections. This new feature provides drone manufacturers with growth prospects in the market.

Global culture, economics, financial markets, and business practices are all negatively affected by the COVID-19 pandemic. A lot of small market participants are struggling to make a profit. Some have even had financial difficulties and operational closures while trying to stay afloat. The nationwide lockdown in many countries, which led to border restrictions, impacted the supply of raw materials. To reorganize production patterns and boost customer demand, industry leaders and authorities are increasingly seeking efficient strategies and laws.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market is expanding due to the strong demand for drone analytics in industries such as agriculture and forestry, construction, insurance, mining and quarrying, utility, telecommunication, and oil and gas, as well as transportation and scientific research. Drone analytics can map inaccessible areas and save time and money on surveys and data collection.

Increasing demand for complete drone packages has witnessed drastic growth. The amount of data produced by drones have greatly expanded due to high-resolution cameras used for image mapping, video recording, and equipment tracking. However, drone-generated data is frequently unstructured. Drone analytics is crucial in structuring unstructured data to be analyzed.

Improving risk management through better data collection, analysis, and actionable insights, lower operational costs through improved efficiency and effectiveness in claims adjudication claims processing, and customer experience, insurance is one of the industries already deploying and expanding the potential of commercial drones.

Aerial site inspections can identify property characteristics that give the owner the option of pursuing a reduced risk profile or engaging in appropriate actions to reduce overall risk and support premium savings which is anticipated to drive the market.

Several governments have authorized BVLOS operations for drones in the commercial sector. They have given drone analytics companies permission for some commercial operations witnessing the industry’s growth in the coming years.

Report Segmentation

The market is primarily segmented based on industry, application, type, solution, and region.

|

By Industry |

By Application |

By Type |

By Solution |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Agriculture industry is expected to grow fastest in 2021

The agriculture industry is expected to witness the fastest growth over the forecast period as drone analytics is prominently used for crop spraying, seed planting, soil analysis, crop monitoring, and livestock inspection.

According to studies on the benefits of precision agriculture and drone platforms, farmers can boost their crop production by up to 5% while lowering their input expenses by 5%. By enabling closer, more frequent, and more timely inspections of their crops, drone analytics may help farmers better understand their crops.

Low-cost drone platforms enable farmers to regularly monitor and economically care for crops while lowering the expense of chemical and inspection treatments. These factors are attributed to the segment’s growth.

Aerial monitoring accounted for the largest market share

The aerial monitoring segment accounted for the largest market share in 2021. It is also estimated to be the fastest-growing segment during the forecast period.

The increased utilization of drone analytics for real-time aerial monitoring allows for measuring construction sites and correcting errors quickly. By using the drone construction site, it is made possible to reduce dangerous accidents significantly. Furthermore, 3D Robotics (3DR) uses Autodesk's Forge platform to provide a UAV-to-cloud solution. Developments like these are expected to impact the growth of this segment positively. These factors are expected to aid the growth of this market.

Thermal detection is expected for the second largest market share due to the rising need for high-resolution photos and the widespread use of thermal cameras integrated into drones for body temperature detection and emergency supplies delivery.

Software as a service witnessed fastest growth over the forecast period

Based on type, the market is segmented into service and software as a service. Software as a service is expected to grow fastest during the forecast period. This is attributed to the growing focus on drone-based mapping and inspection services, growing emphasis on leveraging advanced software tools and platforms technologies, increasing demand for on-site data collection, and a strong focus on sharing the results with stakeholders.

End-to-end solution is expected for significant growth in 2021

Based on the solution, the market is categorized as end-to-end and point solutions. The end-to-end solution is expected to grow considerably during the forecast due to the split of end-to-end solutions.

These all-inclusive packaged solutions satisfy all operational needs, from data gathering to visualization and analysis. Due to their growing demand, market players offer processing, analysis, and management capabilities in a single solution.

North America is projected to grow at the highest during the forecast period

Due to the presence of numerous companies and the increasing demand for drones in the region, North America is identified as the region with the largest market revenue share, and this trend is anticipated to continue.

The rapidly growing demand for improved drone-based surveillance and inspection, the incorporation of advanced technologies such as the internet of things (IoT), machine learning (ML), and computer vision in drone software, and the growing demand for such solutions from sectors like agriculture, oil & gas, energy & utilities, is projected to drive the market in this region.

Competitive Insight

Some of the major players operating in the global market include Aerovironment, Agribotix, AgEagle, Delta Drone, Dronedeploy, Draganfly, Dronifi, ESRi, GE Digital, HuvrdatA, Kespry, Neurala Inc., Optelos, Pix4d, Precisionhawk, Scale AI Inc., Sentera, Skydio, Skycatch Inc., Viatechnik.

Recent Development

In May 2021, AeroVironment Inc. acquired Telerob to expand the former’s company portfolio of intelligent, multi-domain robotic systems, from small and medium unmanned aerial systems to tactical missile systems and unmanned ground vehicles.

Drone Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.12 billion |

|

Revenue forecast in 2030 |

USD 12.79 billion |

|

CAGR |

25.2% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Industry, By Application, By Type, By Solution, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aerovironment, Agribotix, AgEagle, Delta Drone, Dronedeploy, Draganfly, Dronifi, ESRi, GE Digital, HuvrdatA, Kespry, Neurala Inc., Optelos, Pix4d, Precisionhawk, Scale AI Inc., Sentera, Skydio, Skycatch Inc., Viatechnik |