Drone Inspection and Monitoring Market Share, Size, Trends, Industry Analysis Report

By Application (Construction & Infrastructure, Agriculture, Utilities, Oil & Gas, Mining, Others); By Solution; By Type; By Mode of Operation; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 113

- Format: PDF

- Report ID: PM2226

- Base Year: 2024

- Historical Data: 2020 - 2023

What is the Drone Inspection and Monitoring Market Size?

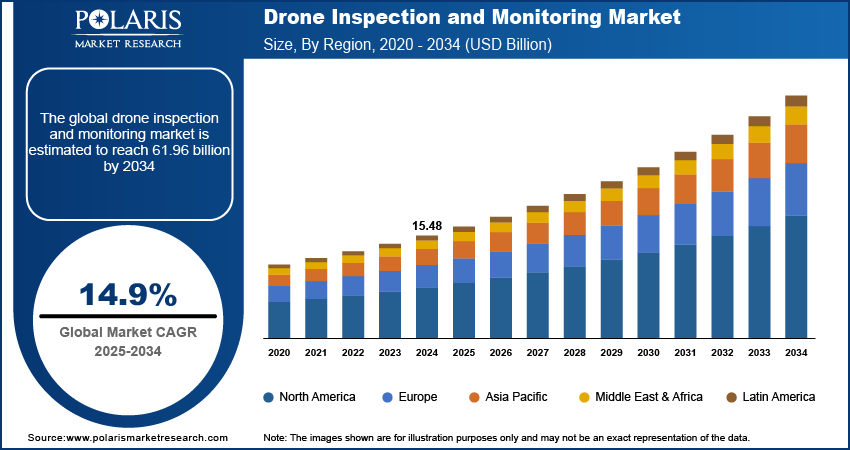

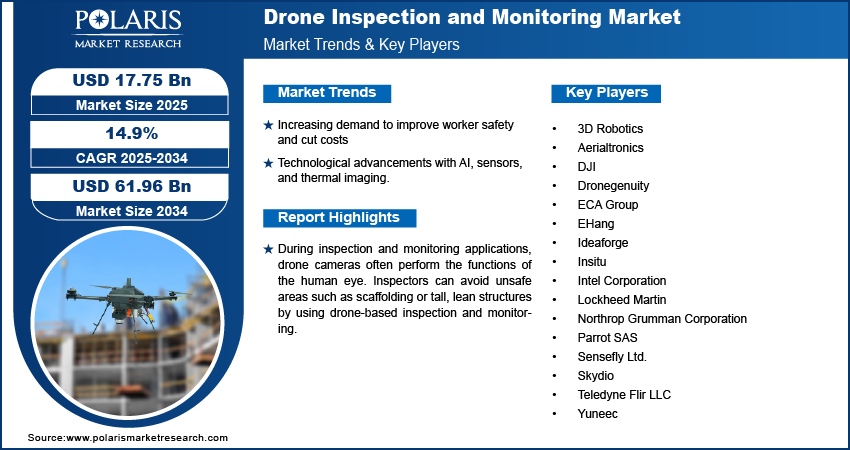

The global drone inspection and monitoring market was valued at USD 15.48 billion in 2024 and is expected to grow at a CAGR of 14.9% during the forecast period. Almost all industries that require a visual assessment of facilities as part of their maintenance operations use drones for inspection and monitoring. Visual inspection and monitoring are necessary to verify that a company's resources are properly maintained.

Key Insights

- By solution, the software subsegment held the largest share in 2024 due to the rising need for advanced capabilities like data management, image processing, and analytics.

- By application, the construction & infrastructure subsegment held the largest share in 2024. The large-scale use of drones in this sector is transforming construction processes.

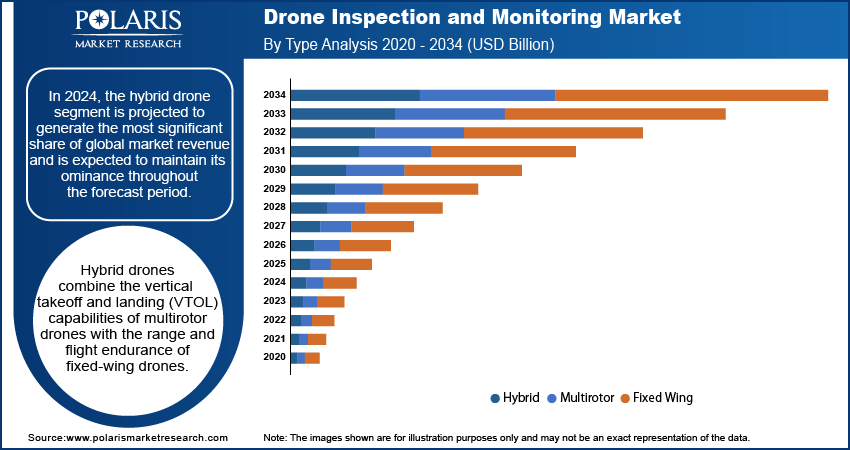

- By type, the hybrid drone subsegment held the largest share in 2024 due to its versatility and operational benefits.

- By mode of operation, the fully autonomous mode held the largest share in 2024 as this mode eliminates the risk of human error by removing the need for manual control.

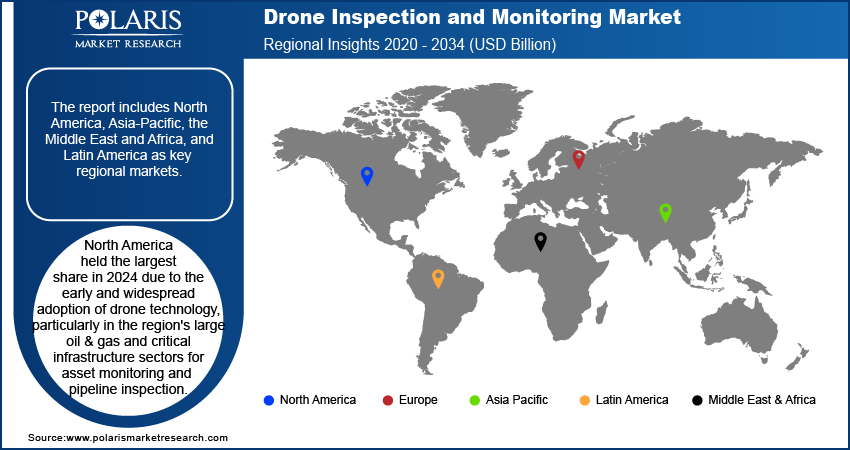

- By region, North America held the largest share in 2024 due to the early and widespread adoption of drone technology, particularly in the region's large oil & gas and critical infrastructure sectors for asset monitoring and pipeline inspection.

Industry Dynamics

- The growing need to enhance worker safety and reduce operational costs is a major driving force.

- Rapid advancements in technology, particularly the integration of high-resolution sensors, thermal imaging, and artificial intelligence (AI), are significantly fueling adoption across various industries.

- The increasing industry demand for real-time data acquisition and remote monitoring capabilities is propelling the use of unmanned aerial vehicles (UAVs) for consistent asset oversight.

Market Statistics

- 2024 Market Size: USD 15.48 billion

- 2034 Projected Market Size: USD 61.96 billion

- CAGR (2025-2034): 14.9%

- North America: Largest market in 2024

Impact of AI on Market

- AI allows drones to fly and operate with greater autonomy. Features like autonomous navigation, obstacle avoidance, and path planning, often powered by computer vision and machine learning, reduce the need for constant human control.

- AI is key to processing the large amounts of data collected by drone sensors (such as thermal or high-resolution cameras) in real time.

- AI drastically reduces the risk exposure for human workers. The improved safety and precision offered by AI-powered systems are driving their adoption across high-risk industries, including defense and utilities.

To Understand More About this Research: Request a Free Sample Report

During inspection and monitoring applications, drone cameras often perform the functions of the human eye. Inspectors can avoid unsafe areas such as scaffolding or tall, lean structures by using drone-based inspection and monitoring. The major factor supporting the drone inspection and monitoring market growth includes its increasing use in critical infrastructure applications as a Remote Visual Inspection (RVI) tool.

They are also being used for internet provision in rural areas, aerial photography and video recording, animal surveying, documentation, and public service missions. Several businesses use this technology for agricultural, aerial images, and data gathering applications. Home deliveries using the equipment are becoming a reality due to the efforts of transportation and retail corporations like Amazon and UPS to roll out the technology.

Further, advanced technology adoption, such as installing artificial intelligence by the major players, augment the drone inspection and monitoring market growth during the forecast period. Artificial intelligence in drones has improved their capabilities while allowing them to do the takeoff, data capture, data transfer, navigation, and data analysis without human interaction.

However, the market's growth would be hindered by low flight duration and payload capacity over the forecast period. They can now only fly for 15 to 30 minutes before needing to be replaced or recharged. It is available with payloads of nearly twenty pounds, but those weighing five pounds or less are more popular. Payload weight and flight endurance to make matters even more complicated: as payload increases, flying time decreases. This means, in demanding tasks, such as inspection and monitoring bridges and major catastrophes, there are frequent intervals. Due to this limitation, they are unable to perform larger tasks.

Industry Dynamics

Which are the major factors driving Drone Inspection and Monitoring Market Growth?

Growth Drivers

Over the last few decades, the drone inspection and monitoring market has observed extensive developments supported by several factors such as the increased cost-saving and human safety and the emergence of advanced technology for various applications. Organizations now benefit from previously inaccessible levels of visibility and acceptable cost by deploying this equipment for inspection and monitoring reasons rather than traditional human, airplane, or helicopter techniques. They are used to increase worker safety and offer access to asset information in various dynamic and complex sectors.

Inspections and monitoring will, on average, identify no problem that has to be fixed 80% of the time, as has been seen. When a human inspector is dispatched to begin the work, this makes inspections and monitoring a waste of time. Inspectors benefit from drone inspections and monitoring because they put themselves in dangerous situations. They can help companies save money on liability insurance by lowering the length of time employees are exposed to hazardous situations.

Further, in recent years, the successful design of small remote-controlled aircraft has become the most popular commercial industry. The market is a major contributor to the economic development of several countries. Their payloads and software systems have become less expensive as a result of these improvements. As a result, it's been successful in a variety of industries, including surveying, aerial mapping, aerial photos, and precision farming. The need for real-time data analysis on the ground to determine the true potential of projects that would help the industry expand.

Report Segmentation

The market is primarily segmented based on solution, application, type, mode of operation, and region.

|

By Solution |

By Application |

By Type |

By Mode of Operation |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

Which type segment dominated the Drone Inspection and Monitoring Market?

The drone inspection and monitoring market is experiencing rapid growth, with the hybrid drone segment emerging as a key revenue contributor. In 2024, the hybrid drone segment is projected to generate the most significant share of global market revenue and is expected to maintain its dominance throughout the forecast period. This growth is largely attributed to the superior capabilities of hybrid drones when compared to their fixed-wing and multirotor counterparts.

Hybrid drones combine the vertical takeoff and landing (VTOL) capabilities of multirotor drones with the range and flight endurance of fixed-wing drones. This unique combination allows them to perform complex inspection tasks across vast areas without the need for extensive launch or recovery infrastructure. These capabilities are particularly valuable in sectors such as oil and gas, energy, agriculture, infrastructure, and mining, where inspections are often carried out in remote or difficult-to-access environments.

One of the major advantages of hybrid drones is their increased payload capacity, enabling them to carry more advanced sensors, high-resolution cameras, LiDAR systems, and thermal imaging equipment. This allows for more detailed and accurate data collection in a single flight, improving efficiency and reducing operational costs. Additionally, their extended flight endurance translates to longer mission durations, minimizing downtime and the need for frequent battery changes or landings.

As industries continue to prioritize safety, efficiency, and cost-effectiveness, the demand for high-performance drone solutions like hybrid models is expected to rise. With continued advancements in drone technology and automation, the hybrid segment is well-positioned to lead the drone inspection and monitoring market in the coming years.

Geographic Overview

Why North America held the largest revenue share in Drone Inspection and Monitoring Market?

In terms of geography, North America had the largest revenue share in 2024. The market for the North American region is anticipated to grow significantly as a result of the presence of major players and increased demand for the market in various industries. For instance, in May 2021, FLIR Systems, Inc. has been received USD 15.4 Mn contract to supply FLIR Black 3 Personal Reconnaissance Systems. Within the Army's Soldier Borne Sensor (SBS) program, advanced nano-unmanned aerial vehicles (UAVs) are used for small-level surveillance, inspection, and monitoring capabilities. Thus, the major players focus on the funding for the drone supply to boost the region's growth.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2024. The increased demand for the market in developing economies like China and India, where the equipment is frequently used for inspection and monitoring jobs in the agriculture and utility sectors, can be credited to the rise of this regional market. According to the IBEF, drones are increasingly being used in India for non-commercial purposes such as aerial cinematography, mining activities, disaster management, and mapping of the national highways and railway routes.

The market has witnessed popularity over the last few years due to its diverse capabilities, ranging from simple photography to surveillance, road, and railway line monitoring, and even delivering essentials/food items to clients. Drones also performed a critical part in various tasks across the country, from surveillance and sanitization to temperature checks and public broadcasting, even during the current COVID-19 outbreak. This reduced the chance of viral spread and helped authorities protect medical and law enforcement workers.

Competitive Insight

Who are the key player in Drone Inspection and Monitoring Market?

Some of the major players operating in the global market include 3D Robotics, Aerialtronics, DJI, Dronegenuity, ECA Group, EHang, Ideaforge, Insitu, Intel Corporation, Lockheed Martin, Northrop Grumman Corporation, Parrot SAS, Sensefly Ltd., Skydio, Teledyne Flir LLC, and Yunnec.

Drone Inspection and Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.48 billion |

| Market size value in 2025 | USD 17.75 billion |

|

Revenue forecast in 2034 |

USD 61.96 billion |

|

CAGR |

14.9% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Solution, By Application, By Type, By Mode of Operation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

3D Robotics, Aerialtronics, DJI, Dronegenuity, ECA Group, EHang, Ideaforge, Insitu, Intel Corporation, Lockheed Martin, Northrop Grumman Corporation, Parrot SAS, Sensefly Ltd., Skydio, Teledyne Flir LLC, and Yunnec. |

FAQ's

? The global market size was valued at USD 15.48 billion in 2024 and is projected to grow to USD 61.96 billion by 2034.

? The global market is projected to register a CAGR of 14.9% during the forecast period.

? North America dominated the market share in 2024.

? The software segment accounted for the largest share of the market in 2024.