Drug Discount Card Market Share, Size, Trends, Industry Analysis Report

By Type (Generic Card, Branded Card); By Sales Channel; By Application; By Region; Segment Forecast, 2023- 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM4033

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

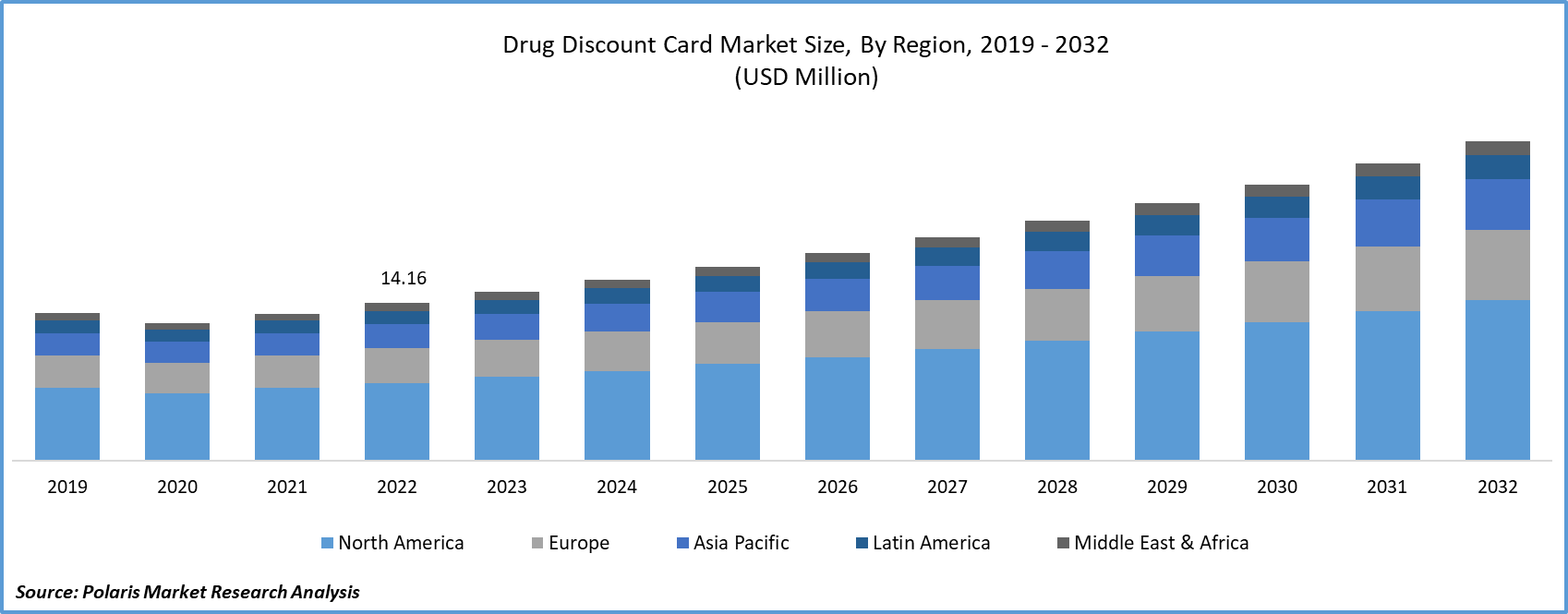

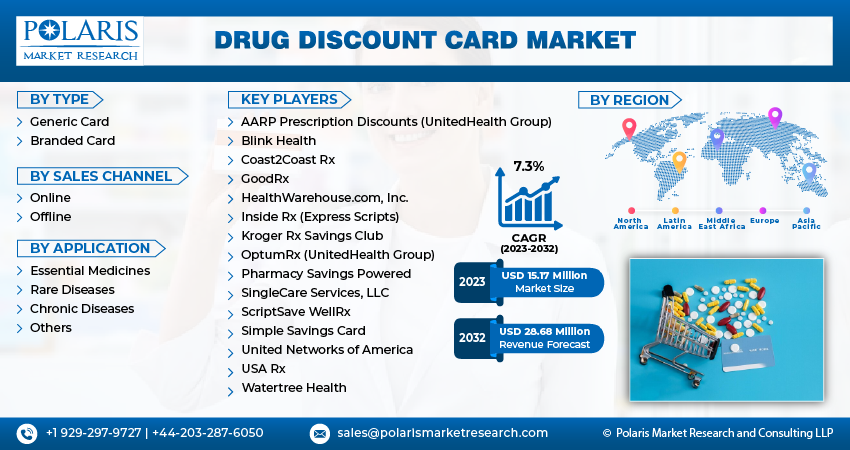

The global drug discount card market was valued at USD 14.16 million in 2022 and is expected to grow at a CAGR of 7.3% during the forecast period.

In today’s scenario, where healthcare expenses are rising, obtaining essential medications poses a formidable challenge for numerous individuals and families. The introduction of drug discount cards stands as a beacon of hope, extending a crucial lifeline to those in dire need. Often overshadowed in the broader healthcare discourse, these cards assume a pivotal role in ensuring accessible and affordable avenues to vital medications. This exposition scrutinizes the intricacies of drug discount cards, exploring their profound significance, operational mechanics, and their far-reaching impact on the healthcare landscape.

To Understand More About this Research: Request a Free Sample Report

Drug discount cards, also recognized as prescription savings cards, exemplify the potential of collective negotiation and inventive healthcare interventions. They furnish consumers with the capacity to acquire prescription medications at markedly reduced costs. This economic respite holds particular urgency for individuals lacking comprehensive insurance coverage, those enrolled in high-deductible plans, or those with medications falling outside the purview of their existing policies.

- For instance, in September 2023, Connecticut has announced to provide drug discount card, which will have potential to yield substantial savings, and 98% of pharmacies will have to accept the same.

The pressing need for affordable healthcare solutions propels forward the drug discount card market. However, challenges in standardization, sustainability, and regulatory compliance present notable hurdles. Striking a balance between these drivers and restraints will be instrumental in shaping the future of this vital facet of the healthcare industry.

Collaborations between card issuers and pharmaceutical companies are instrumental in driving the market. These partnerships often leverage bulk purchasing power to secure reduced prices, passing on the benefits to the end consumers.

For Specific Research Requirements: Request for Customized Report

Although drug discount cards prove effective for a wide range of common medications, their impact on specialty drugs, often pricier, may be less substantial. This limitation could dissuade individuals grappling with intricate medical conditions from reaping significant benefits.

Growth Drivers

- Increasing healthcare expenditure is projected to spur the product demand.

As healthcare expenses continue to escalate, the demand for cost-effective solutions, such as drug discount cards, intensifies. These cards provide a practical means for individuals to access essential medications without enduring exorbitant out-of-pocket expenses.

Moreover, drug discount cards offer a lifeline to individuals without comprehensive insurance coverage. They bridge the gap, ensuring that a wider demographic can afford and acquire necessary prescription medications, regardless of their financial standing.

Furthermore, the integration of digital platforms and mobile applications has streamlined the distribution and utilization of drug discount cards. This technological advancement enhances accessibility and convenience for cardholders, further propelling market growth.

Report Segmentation

The market is primarily segmented based on type, sales channel, application, and region.

|

By Type |

By Sales Channel |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Generic card segment is expected to witness highest growth during forecast period

The generic card segment is projected to grow at a CAGR during the projected period. The generic card segment within the drug discount card market has witnessed remarkable growth in recent years. This surge can be attributed to several key factors. The growing inclination towards economical options has spurred the need for generic medications, known for their generally lower costs compared to brand-name equivalents. Generic drug discount cards cater specifically to this burgeoning market, offering substantial savings on a wide array of generic prescription drugs.

Moreover, regulatory initiatives and policies favoring the promotion and use of generic drugs have provided a conducive environment for the expansion of this segment. Healthcare providers and pharmacies, recognizing the economic benefits of generic medications, have actively participated in these programs, further fueling the growth of the generic card segment.

Additionally, heightened awareness among consumers regarding the efficacy and safety of generic drugs has bolstered their acceptance and utilization, creating a fertile ground for the proliferation of generic drug discount cards. As a result, this segment is poised for continued growth, playing an increasingly pivotal role in providing accessible and affordable healthcare solutions.

By Sales Channel Analysis

- Offline segment accounted for the largest market share in 2022

The offline segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. This segment includes hospitals, retail stores, clinics, and others. In spite of the digital advancements in healthcare, a notable segment of the population maintains a preference for conventional, face-to-face interactions when tending to their pharmaceutical requirements. Physical pharmacies, often referred to as brick-and-mortar establishments, remain pivotal in the process of dispensing medications and providing essential patient counseling.

This preference for offline interactions has led to an upswing in the utilization of drug discount cards in physical pharmacies. Many local and chain pharmacies have partnered with card issuers to offer discounts to their customers, driving the growth of the offline segment. Additionally, some individuals may not have access to online resources or are more comfortable seeking assistance in person, further bolstering the importance of the offline segment.

Moreover, community outreach programs and healthcare events often utilize drug discount cards as a means of providing tangible assistance to underserved populations. This has amplified the impact and visibility of the offline segment, solidifying its position as a significant player in the drug discount card market.

By Application Analysis

- Essential medicines segment held the significant market revenue share in 2022

The essential medicines segment in the drug discount card market has experienced remarkable expansion. These crucial medications, fundamental to basic healthcare, have seen increased demand driven by aging populations and rising chronic illnesses. Tailored drug discount cards targeting essential medicines provide substantial cost savings, aligning with global health goals for universal access. Pharmaceutical companies have joined forces to make these vital medicines more affordable, further propelling the growth of this segment. As accessibility to healthcare gains importance, the essential medicine segment is poised for sustained growth, playing a pivotal role in ensuring equitable healthcare provision.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The growth of the segment market can be largely attributed to escalating healthcare costs. As medical expenses surge, individuals seek affordable access to prescription medications, driving the demand for drug discount cards. Additionally, the region's well-established pharmaceutical industry and advanced healthcare infrastructure provide a fertile ground for market expansion. Collaborations between card issuers and pharmaceutical companies further enhance the market's growth, ensuring reduced prices for medications. Government support through favorable policies and initiatives also propels the market forward. With a high level of awareness and acceptance, the drug discount card market in North America is poised for sustained growth, meeting the pressing need for accessible healthcare solutions.

The Asia-Pacific region is expected to be the fastest-growing region. The growing middle-class population, coupled with increasing healthcare awareness, has amplified the adoption of drug discount cards in the Asia-Pacific region. The presence of a thriving pharmaceutical industry and a rapidly expanding healthcare infrastructure further supports this growth. Moreover, government initiatives to enhance healthcare accessibility and affordability have provided a conducive environment for the market's expansion. With these factors at play, the drug discount card market in Asia-Pacific is poised for continued and substantial growth in the coming years.

Key Market Players & Competitive Insights

The drug discount card market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AARP Prescription Discounts (UnitedHealth Group)

- Blink Health

- Coast2Coast Rx

- GoodRx

- HealthWarehouse.com, Inc.

- Inside Rx (Express Scripts)

- Kroger Rx Savings Club

- OptumRx (UnitedHealth Group)

- Pharmacy Savings Powered

- SingleCare Services, LLC

- ScriptSave WellRx

- Simple Savings Card

- United Networks of America

- USA Rx

- Watertree Health

Recent Developments

- In September 202, GoodRx unveiled its Gold subscription plan, offering subscribers access to reduced prescription costs, complimentary delivery, and around-the-clock virtual doctor consultations, all in exchange for a monthly fee. This strategic move marked an expansion of GoodRx's revenue streams, extending their offerings beyond discounted medications.

Drug Discount Card Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 15.17 million |

|

Revenue forecast in 2032 |

USD 28.68 million |

|

CAGR |

7.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Sales Channel, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |