Ductile Iron Pipes Market Size, Share, & Industry Analysis Report

: By Application (Water Distribution, Sewage & Wastewater Systems, Irrigation Systems, Fire Protection Networks, Industrial Utilities, Desalination & Marine Outfalls, Hydropower & Dams, and Others) and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5743

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

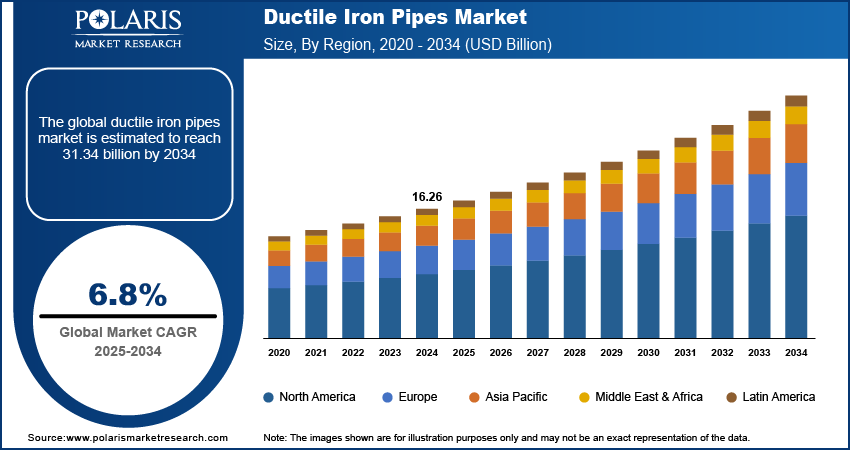

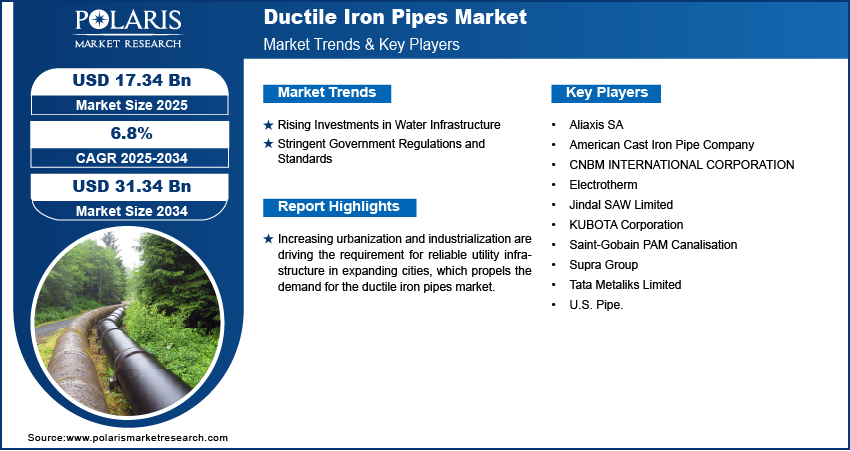

The global ductile iron pipes market size was valued at USD 16.26 billion in 2024 and is projected to grow at a CAGR of 6.8% during 2025–2034. Increasing urbanization and industrialization are driving the requirement for reliable utility infrastructure in expanding cities, which propels the demand for ductile iron pipes.

The ductile iron pipes market refers to the global industry focused on the production, distribution, and installation of pipes made from ductile cast iron, a material known for its high strength, toughness, and corrosion resistance. These pipes are widely used in water and wastewater transportation systems, industrial applications, and infrastructure projects due to their durability and ability to withstand high pressure. The market ecosystem encompasses raw material suppliers, pipe manufacturers, coating and lining technology providers, and end-use industries. Technological advancements in internal linings and external coatings, improving performance in aggressive soil and fluid conditions, are driving overall growth.

To Understand More About this Research: Request a Free Sample Report

Expansion of smart water management systems, encouraging utilities to upgrade to high-strength, leak-resistant pipe networks drives the market revenue. Additionally, growing emphasis on sustainable and resilient infrastructure, aligning with global climate adaptation strategies, is driving overall growth.

Market Dynamics

Rising Investments in Water Infrastructure

Rising investments in water infrastructure development are significantly contributing to the growth of the ductile iron pipes market. The Bipartisan Infrastructure Law designates over USD 50 billion to the EPA to enhance the nation’s drinking water, wastewater, and stormwater infrastructure. Governments and utilities worldwide are allocating substantial budgets to upgrade aging water distribution systems, many of which suffer from leakage, corrosion, and inefficiency due to outdated materials. Ductile iron pipes offer a robust solution with high tensile strength, longevity, and superior hydraulic performance, making them ideal for long-term water conveyance. Urban expansion and the need for a reliable water supply in rural regions are further driving large-scale pipeline installations and replacements. These infrastructure investments enhance service delivery and water conservation and also create long-term demand for high-quality, pressure-resistant piping solutions, cementing the relevance of ductile iron pipes in modern water networks.

Stringent Government Regulations and Standards

Regulatory bodies are increasingly mandating the use of safe, nontoxic, and corrosion-resistant materials to ensure water quality and public health. For instance, the European Union has implemented a definitive anti-dumping duty on certain corrosion-resistant steel imports from the People's Republic of China, following an expiry review under Article 11(2) of Regulation (EU) 2016/1036. Ductile iron pipes, often lined with cement mortar or other protective coatings, meet these requirements effectively, offering excellent durability under varied environmental conditions. The ability to withstand high internal pressures and external loads makes them compliant with the rigorous performance standards set for municipal and industrial water systems. As policy frameworks evolve to emphasize sustainability and infrastructure resilience, compliance with these standards is becoming essential for project approvals. This regulatory environment reinforces the demand for certified, long-lasting pipe materials such as ductile iron in new and retrofitted water networks. Hence, stringent government regulations and standards are accelerating the adoption of ductile iron pipes for potable water distribution.

Segment Insights

Market Assessment by Application

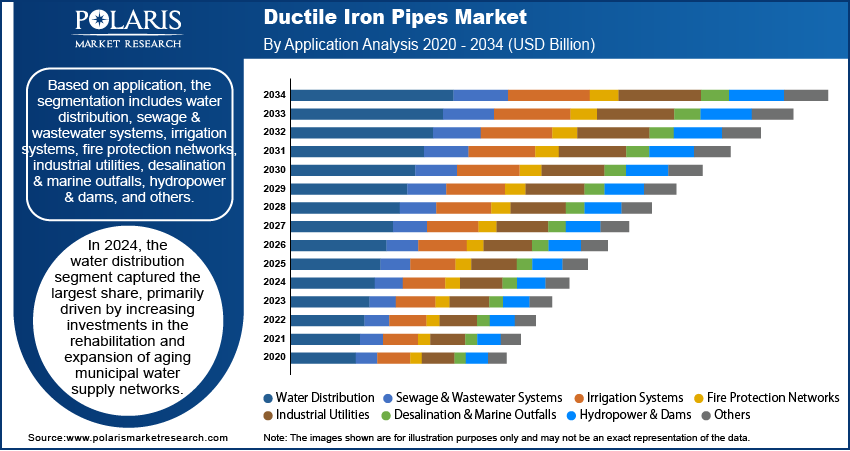

Based on application, the segmentation includes water distribution, sewage & wastewater systems, irrigation systems, fire protection networks, industrial utilities, desalination & marine outfalls, hydropower & dams, and others. In 2024, the water distribution segment captured the largest share, primarily driven by increasing investments in the rehabilitation and expansion of aging municipal water supply networks. Many urban centers are facing rising demand for potable water, prompting utilities to replace deteriorating pipelines that suffer from leakage, contamination risks, and hydraulic inefficiencies. Ductile iron pipes offer unmatched structural integrity, pressure-bearing capacity, and long operational lifespan, making them ideal for long-distance water transportation and high-pressure urban networks. Their compatibility with modern trenchless installation techniques and resistance to ground movement has made them the preferred choice for dense urban environments. Government-backed smart water grid initiatives and leakage reduction programs have further accelerated the adoption of durable piping systems that offer low total lifecycle cost. This surge in replacement and greenfield infrastructure projects, coupled with stringent water quality regulations, has reinforced the dominance of the water distribution segment.

The sewage & wastewater systems segment is projected to register the highest CAGR during the forecast period due to the escalating demand for resilient underground infrastructure capable of managing rising volumes of municipal and industrial effluent. Increasing urban population density and the expansion of centralized sewage networks are prompting the use of corrosion-resistant, pressure-capable piping materials. Ductile iron pipes, often lined with specialized coatings, offer robust resistance to the aggressive chemical environments typical of wastewater conveyance systems. These pipes are particularly suited to gravity-fed and pressurized sewer systems that require high structural stability in both stable and unstable soils. Technological innovations in jointing systems, enabling flexible and leak-proof connections, further enhance the reliability of these pipes in complex underground networks. Many governments are investing in advanced wastewater treatment and collection systems to align with evolving environmental compliance mandates. This has intensified the focus on long-term infrastructure performance, driving accelerated adoption of ductile iron pipes in modern sewage and wastewater engineering projects.

Regional Analysis

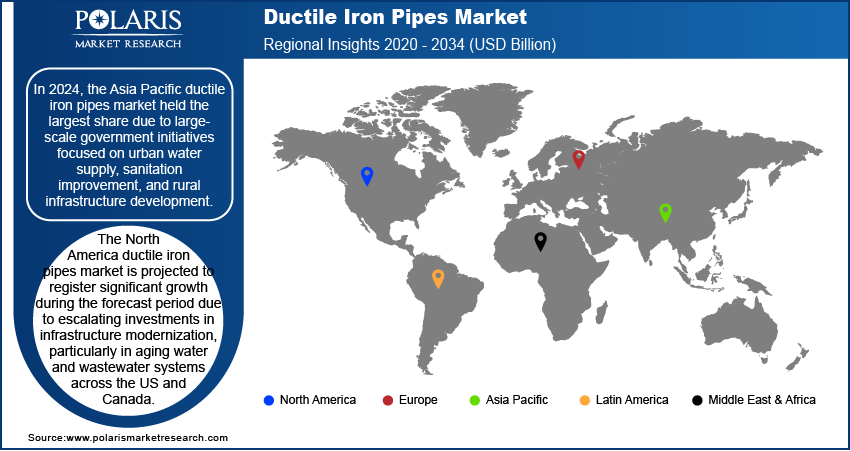

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific ductile iron pipes market held the largest share due to large-scale government initiatives focused on urban water supply, sanitation improvement, and rural infrastructure development. Rapid industrialization and urbanization across emerging economies in the region have intensified the need for reliable utility networks, particularly for potable water and wastewater treatment. According to the Asian Development Bank projections, by 2030, over 55% of Asia's population will reside in urban areas. National programs promoting smart cities and sustainable urban planning have prioritized the replacement of inefficient pipeline systems with robust alternatives such as ductile iron pipes. The region’s susceptibility to seismic activity and shifting soil conditions has further highlighted the need for structurally resilient materials that endure ground movements without compromising pipeline integrity. Moreover, the expansion of industrial corridors and water-intensive manufacturing hubs has catalyzed demand for high-strength, long-life piping systems that minimize operational disruptions. Favorable financing models for infrastructure development, coupled with strong public sector procurement, have strengthened the dominance of ductile iron pipes across a wide spectrum of utility applications in the Asia Pacific market.

The China ductile iron pipes market demonstrates strong momentum, driven by an aggressive national agenda to modernize municipal infrastructure and meet stringent water management goals. Strategic investments in upgrading outdated urban water distribution networks, alongside the expansion of rural drinking water access programs, are fueling steady demand for durable pipe systems. Ductile iron’s high pressure-handling capacity and longevity make it a preferred material for China’s long-distance and high-demand transmission lines. In addition, ongoing industrial park developments and smart city projects are integrating advanced utility systems that require high-performance materials capable of enduring mechanical stress and environmental exposure. China’s emphasis on controlling non-revenue water and improving overall network efficiency has further elevated the adoption of ductile iron pipes. Local manufacturing capabilities, supported by government-backed incentives, allow for cost-effective scaling and regional availability, contributing to their widespread use. This favorable alignment of infrastructure planning, policy direction, and material suitability continues to position ductile iron pipes at the center of China's utility network modernization.

The North America ductile iron pipes market is projected to register significant growth during the forecast period due to escalating investments in infrastructure modernization, particularly in aging water and wastewater systems across the US and Canada. Municipalities are under mounting pressure to replace deteriorating legacy pipelines that are prone to leakage, contamination, and frequent maintenance. Ductile iron pipes, known for their strength, durability, and resistance to internal pressure and external loads, are being adopted as a reliable long-term solution. Additionally, the rise in federal and state funding initiatives targeting water infrastructure development and maintenance, such as the US Bipartisan Infrastructure Law, is creating a favorable environment for pipeline replacement projects. Growth is also supported by heightened awareness of water quality and public health, driving regulatory compliance and the use of certified materials. Increased resilience to seismic activity and ground movement further makes ductile iron an optimal choice in diverse environmental conditions prevalent across North America.

The Europe ductile iron pipes market is experiencing steady growth driven by the region’s commitment to upgrading water infrastructure, compliance with stringent environmental regulations, and growing focus on sustainable utility networks. Countries across Europe are undertaking modernization of aging municipal water and wastewater systems to reduce non-revenue water, improve supply efficiency, and meet EU water quality directives. Ductile iron pipes are favored due to their long operational lifespan, recyclability, and resistance to internal and external stressors. Adoption of these pipes is further supported by advanced installation methods that reduce construction time and environmental disruption. Growing investments in climate-resilient infrastructure, especially in flood-prone and seismically active areas, are also boosting the demand for robust, high-pressure-capable piping systems. Furthermore, increasing urbanization and the development of smart cities are driving the integration of intelligent pipeline monitoring technologies, which align well with the structural and operational capabilities of ductile iron systems.

Key Players and Competitive Analysis

The competitive landscape of the ductile iron pipes market is characterized by strategic industry movements focused on technological advancement, capacity expansion, and geographic penetration. Market players are actively engaging in mergers and acquisitions to consolidate expertise, optimize production efficiency, and strengthen distribution networks across high-growth regions. Joint ventures and strategic alliances are facilitating access to advanced materials, enhancing product customization, and supporting R&D into corrosion-resistant linings and eco-friendly coatings. Industry analysis highlights a strong focus on product launches aimed at improving hydraulic performance and simplifying joint installation. Post-merger integration is being leveraged to streamline supply chains and reduce operational redundancies. Market expansion strategies emphasize local manufacturing footprints and digital integration, aligning with sustainability goals and infrastructure resilience mandates.

List of Key Companies

- Aliaxis SA

- American Cast Iron Pipe Company

- CNBM INTERNATIONAL CORPORATION

- Electrotherm

- Jindal SAW Limited

- KUBOTA Corporation

- Saint-Gobain PAM Canalisation

- Supra Group

- Tata Metaliks Limited

- U.S. Pipe

Ductile Iron Pipes Industry Developments

In November 2024, China’s Xinxing invested around USD 150 million to set up a ductile iron pipe manufacturing unit in Egypt’s Suez Canal Economic Zone, located in the TEDA-Egypt industrial area. The plant, spanning 270,500 square meters, was designed to produce up to 250,000 tonnes of ductile iron pipes annually, with sizes reaching up to 2,600 mm, supporting various infrastructure projects.

In February 2024, Rungta Steel, a TMT bar and steel manufacturer in India, expanded into the infrastructure segment by starting production of Ductile Iron Pipes at its Chaliyama Steel Plant in Chaibasa, Jharkhand.

Ductile Iron Pipes Market Segmentation

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Water Distribution

- Sewage & Wastewater Systems

- Irrigation Systems

- Fire Protection Networks

- Industrial Utilities

- Desalination & Marine Outfalls

- Hydropower & Dams

- Others

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ductile Iron Pipes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 16.26 billion |

|

Market Size Value in 2025 |

USD 17.34 billion |

|

Revenue Forecast by 2034 |

USD 31.34 billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.26 billion in 2024 and is projected to grow to USD 31.34 billion by 2034.

The global market is projected to register a CAGR of 6.8% during the forecast period.

In 2024, the Asia Pacific ductile iron pipes market held the largest share due to large-scale government initiatives focused on urban water supply, sanitation improvement, and rural infrastructure development.

A few of the key players include Aliaxis SA, American Cast Iron Pipe Company, CNBM INTERNATIONAL CORPORATION, Electrotherm, Jindal SAW Limited, KUBOTA Corporation, Saint-Gobain PAM Canalisation, Supra Group, Tata Metaliks Limited, and U.S. Pipe.

In 2024, the water distribution segment captured the largest share, primarily driven by increasing investments in the rehabilitation and expansion of aging municipal water supply networks.