Smart Water Management Market Size, Share, Trends, Industry Analysis Report

: Water Meter (AMR and AMI), Solution, Service, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM2256

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

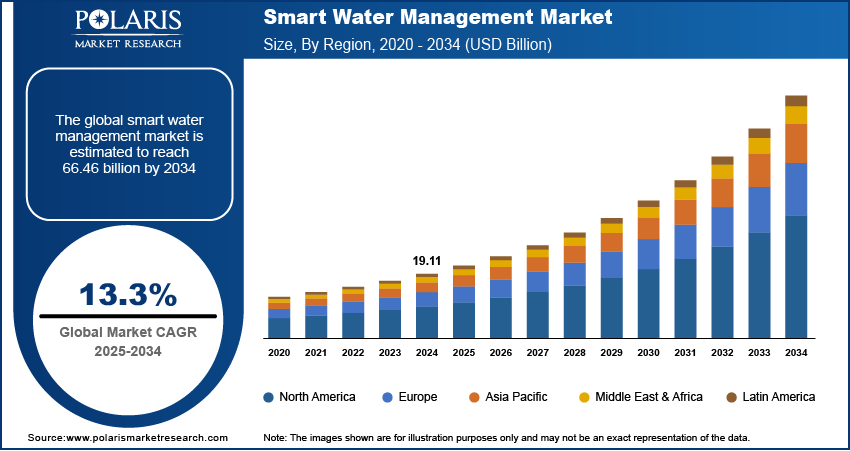

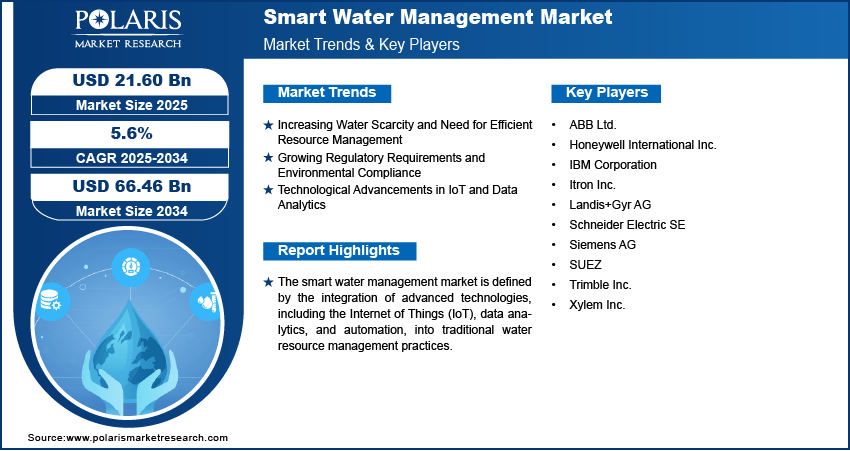

The smart water management market size was valued at USD 19.11 billion in 2024, growing at a CAGR of 13.3% during 2025–2034. The rising implementation of Internet of Things (IoT) analytics and devices, and the growing number of smart city projects globally, are a few of the key factors driving market growth.

Key Insights

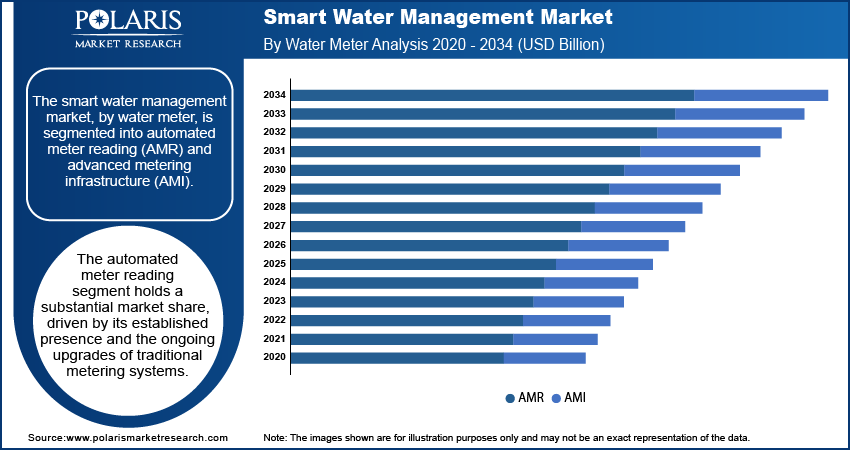

- The automatic meter reading (AMR) segment accounts for a substantial market share. The established presence of AMR water meters contributes to their leading market position.

- The analytics & data segment is registering the highest growth rate. The growing need for data-driven decision-making in water management drives the segment’s growth.

- The professional segment accounts for a significant market share, primarily due to the growing need for expert consultation and implementation support.

- The residential segment is registering the highest growth rate. Increased adoption of smart home technologies and growing awareness of water conservation are driving the segment’s growth.

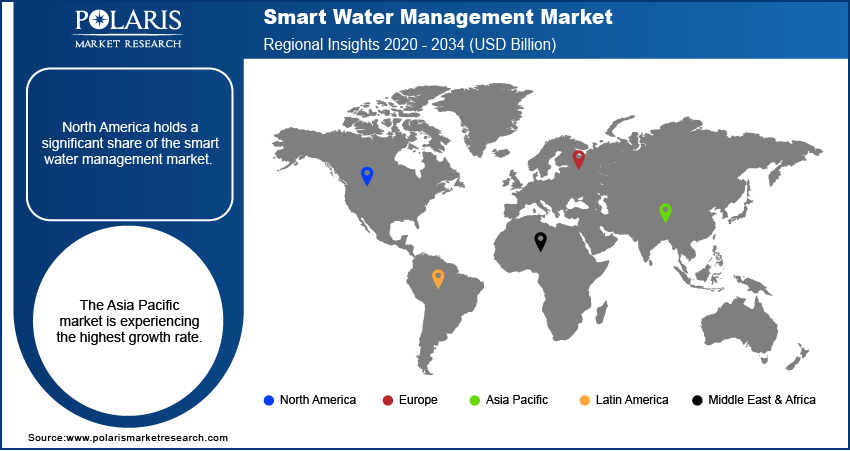

- North America holds a significant share of the market revenue, owing to the region’s stringent regulatory frameworks and presence of advanced technological infrastructure.

- Asia Pacific is witnessing the highest growth rate. The regional market growth is fueled by rising water scarcity and the introduction of government initiatives promoting smart water solutions.

Industry Dynamics

- Rising water scarcity globally, driven by population growth and climate change, is a key factor fueling the need for smart water management.

- The implementation of stringent environmental regulations and rising compliance requirements has prompted water utilities and industries to adopt smart water management solutions, driving market growth.

- The growing emphasis on sustainable water management is projected to provide significant market opportunities in the coming years.

- The market may experience challenges due to high initial investment costs associated with smart water management systems.

Market Statistics

2024 Market Size: USD 19.11 billion

2034 Projected Market Size: USD 66.46 billion

CAGR (2025-2034): 13.3%

North America: Largest Market in 2024

AI Impact on Smart Water Management Market

- AI analyzes sensor and IoT data to monitor water quality, consumption, and distribution in real time.

- Machine learning models predict leaks, contamination risks, and infrastructure failures before they occur.

- AI-powered platforms optimize water allocation and treatment processes. This optimization improves efficiency and sustainability.

- Continuous AI learning enhances system adaptability, enabling better responses to changing demand patterns and environmental conditions.

To Understand More About this Research: Request a Free Sample Report

The smart water management market encompasses the deployment of advanced technologies to monitor, analyze, and optimize water resources and infrastructure. This market is driven by increasing global concerns regarding water scarcity, the need for efficient water distribution, and the rising demand for sustainable urban development. Key drivers include the growing implementation of Internet of Things (IoT) analytics and devices, which enable real-time data collection and analysis. Furthermore, the necessity to reduce water loss through leak detection and improve water quality monitoring is significantly impacting market dynamics. The rising number of smart city projects worldwide also contributes to the increased adoption of smart water management solutions. This is causing a significant shift in market demand trends.

Qualitative analysis indicates that the smart water management market is experiencing substantial growth due to the heightened focus on environmental sustainability and regulatory compliance. The need to optimize water consumption in industrial and agricultural sectors is a significant market drive. Additionally, the development of sophisticated data analytics platforms allows for predictive maintenance and improved decision-making within water utilities. The market potential is also being expanded by the increasing availability of cloud-based solutions and the integration of Artificial Intelligence (AI) to enhance system efficiency, along with heat pump water heaters. In essence, the market outlook shows a strong correlation between technological advancement and the imperative for responsible water resource management. This is leading to positive market development.

Market Dynamics

Increasing Water Scarcity and Need for Efficient Resource Management

Global water scarcity, exacerbated by climate change and population growth, is a critical driver for the smart water management market demand. Governments worldwide are increasingly focusing on implementing technologies that optimize water usage. Approximately 2.3 billion people live in water-stressed countries, and this number is projected to increase significantly by 2050 due to population growth, urbanization, and climate change, as per UN Water.

A research paper published in the National Center for Biotechnology Information (NCBI) in 2023 highlighted the implementation of advanced sensor networks for real-time monitoring of water resources in arid regions, noting the significant reduction in water loss and improved efficiency in distribution. The United Nations Environment Programme (UNEP), in a 2022 report, emphasized the urgency of adopting smart water solutions to mitigate the impacts of water stress on vulnerable communities. The United States Environmental Protection Agency (EPA) in 2021 released guidance on the use of smart metering and data analytics to improve water conservation in urban areas. The growing necessity to conserve and efficiently manage dwindling water resources is significantly driving the smart water management market expansion.

Growing Regulatory Requirements and Environmental Compliance

Stricter environmental regulations and increasing compliance requirements are pushing water utilities and industries to adopt smart water management solutions. Governments are implementing stringent standards for water quality monitoring and wastewater treatment, necessitating the use of advanced technologies. The European Environment Agency (EEA), in a 2022 policy brief, detailed the implementation of digital water management systems to ensure compliance with the EU’s Water Framework Directive. A study published in the Journal of Environmental Management on ScienceDirect in 2023 discussed the use of AI-driven water quality monitoring systems to meet the stringent regulatory demands for industrial wastewater discharge. The National Oceanic and Atmospheric Administration (NOAA) in 2021 released a report on the adoption of sensor-based monitoring to ensure compliance with coastal water quality standards. These regulatory pressures are compelling stakeholders to invest in smart water solutions, thereby fueling the growth of the smart water management market.

Technological Advancements in IoT and Data Analytics

The rapid advancements in Internet of Things (IoT) technologies and data analytics are revolutionizing water management practices. The integration of sensors, smart water meters, and cloud-based platforms enables real-time monitoring and analysis of water infrastructure, leading to improved efficiency and reduced losses. A research article on NCBI published in 2023 explored the application of machine learning algorithms for predictive maintenance of water distribution networks, minimizing downtime and optimizing resource allocation. The United States Geological Survey (USGS), in a 2022 report, detailed the use of remote sensing and satellite imagery for monitoring groundwater resources and predicting water availability. The National Institute of Standards and Technology (NIST), in 2021, released a publication on the cybersecurity implications of IoT-based water management systems, highlighting the importance of secure data transmission and analysis. These technological innovations are significantly enhancing the capabilities of smart water management solutions, thus substantially driving the smart water management market development.

Segment Insights

Market Assessment – By Water Meter

The market, by water meter, is segmented into AMR and AMI. the automatic meter reading (AMR) segment holds a substantial smart water management market share, driven by its established presence and the ongoing upgrades of traditional metering systems. AMR systems offer a cost-effective solution for utilities to enhance data collection and streamline billing processes, facilitating a gradual transition toward smarter water management. The increasing adoption of these systems by municipal water authorities, particularly in regions with existing infrastructure, contributes significantly to market dominance.

The advanced metering infrastructure (AMI) segment is experiencing the highest growth rate, fueled by its capacity to provide real-time data and enable sophisticated analytics. AMI systems offer comprehensive monitoring and control capabilities, supporting proactive leak detection, demand management, and enhanced customer engagement. The increasing demand for advanced solutions that facilitate efficient resource management and improve operational efficiency is driving the rapid adoption of AMI. The market potential of this segment is amplified by the growing emphasis on smart city initiatives and the integration of IoT technologies, indicating a strong positive market development.

Market Evaluation – By Solution

The market, by solution, is segmented into enterprise asset, analytics & data, security, advanced pressure management, network management, smart irrigation management, customer information system & billing, and others. The enterprise asset segment currently holds a substantial market share, driven by the critical need to maintain and optimize aging water infrastructure. Utilities are prioritizing investments in solutions that enhance asset longevity and operational efficiency. The integration of enterprise asset management systems allows for proactive maintenance, reducing downtime and improving overall resource allocation. This segment's established importance in ensuring reliable water distribution contributes to its significant market presence.

The analytics & data segment is experiencing the highest growth rate, fueled by the increasing demand for data-driven decision-making in water management. The ability to analyze real-time data from various sources enables utilities to optimize water usage, detect leaks, and improve demand forecasting. The growing adoption of advanced analytics platforms, including machine learning and AI, is driving this segment's rapid expansion. The market potential of this segment is further amplified by the increasing availability of cloud-based solutions and the need for enhanced operational intelligence, indicating a strong positive market development.

Market Assessment – By Service

The market, by service, is segmented into professional and managed. The professional segment holds a significant market share, driven by the need for expert consultation and implementation support. Utilities and organizations require specialized assistance in deploying and integrating complex smart water management systems. This segment's dominance reflects the demand for tailored solutions, including system design, installation, and training, ensuring effective adoption and operation of advanced technologies. The requirement for specialized skilled labor within the water industry is a key market driver in this segment.

The managed services segment is experiencing a higher growth rate, fueled by the increasing preference for outsourcing the ongoing management and maintenance of smart water infrastructure. This segment offers comprehensive support, including remote monitoring, data analysis, and system optimization, allowing utilities to focus on core operations. The rising adoption of cloud-based solutions and the need for continuous system upkeep are driving the rapid expansion of managed services. The market potential of this segment is amplified by the increasing complexity of smart water technologies and the desire for streamlined operational efficiency, indicating a strong positive market development.

Market Assessment – By End Use

By end use, the market is segmented into commercial & industrial and residential. The commercial & industrial segment holds a substantial market share, driven by the large-scale water consumption and the imperative for operational efficiency in these sectors. Industries and commercial entities are increasingly adopting smart water solutions to optimize resource utilization and comply with environmental regulations. This segment's dominance is attributed to the significant water savings and cost reductions achievable through advanced monitoring and control systems, representing a key market driver.

The residential segment is experiencing the highest growth rate, fueled by the rising awareness of water conservation and the increasing adoption of smart home technologies. The growing implementation of smart meters and leak detection systems in residential settings is driving this segment's rapid expansion. The market potential of this segment is further amplified by government initiatives promoting water efficiency and the increasing availability of user-friendly smart water solutions, indicating strong positive market development.

Regional Footprint

The global market exhibits diverse regional dynamics, with varying levels of adoption and growth. North America and Europe possess well-established infrastructures and stringent environmental regulations, driving significant market penetration. The Asia Pacific market is experiencing rapid growth, fueled by rising urbanization and increasing water scarcity. Latin America and the Middle East & Africa are also showing growing interest in smart water solutions, driven by the need for efficient resource management and infrastructure development. Each region's unique challenges and priorities shape its respective market outlook, influencing the overall market demand trends.

North America holds a significant share of the smart water management market revenue. This is largely attributed to the region's advanced technological infrastructure and stringent regulatory frameworks. The presence of numerous key industry players and substantial investments in smart city initiatives further boost market growth. The region's emphasis on sustainable water management practices and the need to address aging infrastructure are significant market growth factors. The well-established water utilities and the early adoption of advanced metering infrastructure contribute to the region's market dominance, thus influencing the market dynamics.

The Asia Pacific market is experiencing the highest growth rate, driven by rapid urbanization, increasing water scarcity, and government initiatives promoting smart water solutions. The region's expanding industrial sector and growing population necessitate efficient water management practices. The increasing adoption of IoT and data analytics solutions, coupled with rising investments in infrastructure development, is propelling market expansion. Countries in this region are actively implementing smart water technologies to address water challenges and enhance resource management, leading to significant market development and increased market potential.

Key Players and Competitive Insights

Several major players are active in the smart water management market ecosystem, providing a range of solutions and services. These include Siemens AG, IBM Corporation, Schneider Electric SE, Xylem Inc., Itron Inc., SUEZ, Honeywell International Inc., ABB Ltd., Landis+Gyr AG, and Trimble Inc. These companies offer diverse products and services, from advanced metering and network management to data analytics and automation solutions, catering to the evolving needs of the water industry.

Competitive analysis of the smart water management market reveals a landscape characterized by both established corporations and specialized technology providers. Competition is driven by factors such as technological innovation, product differentiation, and the ability to offer comprehensive solutions. Companies are focusing on developing advanced technologies such as IoT, AI, and data analytics to enhance their offerings and gain a competitive edge. Strategic partnerships, acquisitions, and collaborations are also prevalent, as companies seek to expand their market presence and enhance their capabilities. The market is witnessing a trend toward integrated solutions that address the complex challenges of water resource management, reflecting the market demand.

Siemens AG (Siemens), headquartered in Munich, Germany, delivers a broad portfolio of solutions for water and wastewater treatment, water supply networks, and water transport. Their offerings include automation systems, digital solutions, and services designed to improve efficiency, reduce water loss, and enhance the reliability of water infrastructure. Siemens provides technologies such as the SIMATIC PCS 7 distributed control system and digital twin platforms for optimizing water management processes.

IBM Corporation (IBM), based in Armonk, New York, USA, provides smart water management solutions that leverage its expertise in data analytics, IoT, and AI. IBM's solutions focus on real-time monitoring, predictive analytics, and optimizing water distribution. Their offerings, such as the IBM Intelligent Water software, help utilities manage water resources, detect leaks, and improve operational efficiency through data integration, visualization, and analysis.

List of Key Companies

- ABB Ltd.

- Honeywell International Inc.

- IBM Corporation

- Itron Inc.

- Landis+Gyr AG

- Schneider Electric SE

- Siemens AG

- SUEZ

- Trimble Inc.

- Xylem Inc.

Smart Water Management Market Industry Developments

- April 2025: SUEZ and the French National Centre for Scientific Research (CNRS) entered into a five-year strategic partnership. According to SUEZ, the partnership will focus on enhancing sustainable water management through the development of new technologies and research-backed solutions.

- April 2025: Metron unveiled WaterScope PLUS, a user-friendly business intelligence dashboard designed to make sophisticated water analytics accessible to utility companies, real estate developers, and commercial and industrial enterprises.

- February 2025: The Lucknow Municipal Corporation (LMC) is preparing to roll out an advanced Supervisory Control and Data Acquisition (SCADA) system as part of the AMRUT mission. This upgrade will enable real-time monitoring and automated control of water distribution, helping to optimize supply and prevent unexpected shortages.

Smart Water Management Market Segmentation

By Water Meter Outlook (Revenue – USD Billion, 2020–2034)

- AMR

- AMI

By Solution Outlook (Revenue – USD Billion, 2020–2034)

- Enterprise Asset

- Analytics & Data

- Security

- Advanced Pressure Management

- Network Management

- Smart Irrigation Management

- Customer Information System & Billing

- Others

By Service Outlook (Revenue – USD Billion, 2020–2034)

- Professional

- Managed

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Commercial & Industrial

- Residential

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Water Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 19.11 billion |

|

Market Size Value in 2025 |

USD 21.60 billion |

|

Revenue Forecast by 2034 |

USD 66.46 billion |

|

CAGR |

13.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The smart water management market has been segmented on the basis of water meter, solution, service, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

The smart water management market growth and marketing strategies emphasize the importance of educating stakeholders on the long-term benefits of adopting advanced technologies. Companies are focusing on showcasing the efficiency and sustainability gains achieved through smart solutions. Strategic partnerships with municipalities and industrial clients are crucial for market penetration. Targeted marketing campaigns highlight the potential for cost savings and regulatory compliance. Demonstrating real-world success stories and providing tailored solutions to address specific regional water challenges drive market adoption. Leveraging digital marketing and industry events facilitates broader market awareness and fosters client engagement.

FAQ's

The market size was valued at USD 19.11 billion in 2024 and is projected to grow to USD 66.46 billion by 2034.

The market is projected to register a CAGR of 13.3% during the forecast period.

North America had the largest share of the market in 2024.

A few key players in the market include Siemens AG, IBM Corporation, Schneider Electric SE, Xylem Inc., Itron Inc., SUEZ, Honeywell International Inc., ABB Ltd., Landis+Gyr AG, and Trimble Inc.

The AMR segment accounted for the larger market share in 2024.

Following are a few of the market trends: ? Increased Adoption of IoT and Sensor Technologies: Real-time monitoring and data collection are becoming standard practice. ? Growing Focus on Data Analytics and AI: Predictive maintenance, leak detection, and optimized resource allocation are driven by advanced analytics. ? Emphasis on Sustainable Water Management: Water conservation and efficient usage are top priorities due to increasing water scarcity.

Smart water management employs advanced technologies such as the Internet of Things (IoT), sensors, and data analytics to optimize water resource utilization and infrastructure. It involves real-time monitoring of water quality and quantity, leak detection, efficient distribution, and predictive maintenance of water systems. This approach aims to enhance sustainability, reduce water loss, and improve overall operational efficiency in water management, addressing challenges such as water scarcity and aging infrastructure through intelligent, data-driven solutions.