Electric Hobs Market Share, Size, Trends, Industry Analysis Report

By Size (2 Burner, 3 Burner, 4 Burner, and 5 Burner); By Product Type; By Distribution Channel; By Region; Segment Forecast, 2022-2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2883

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

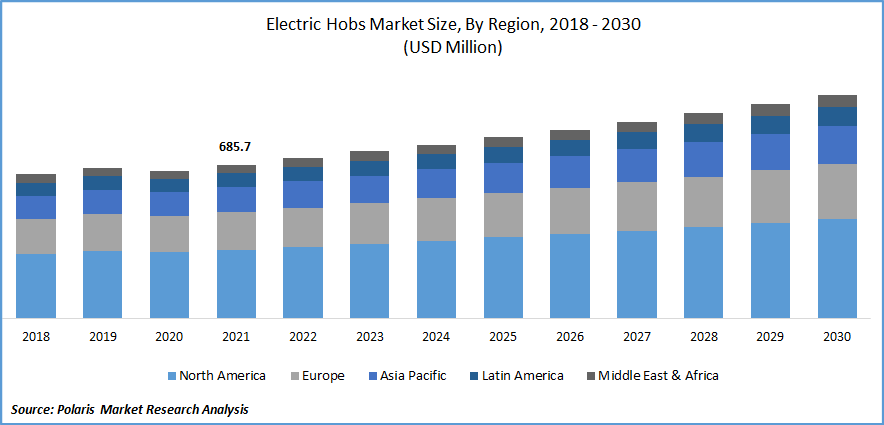

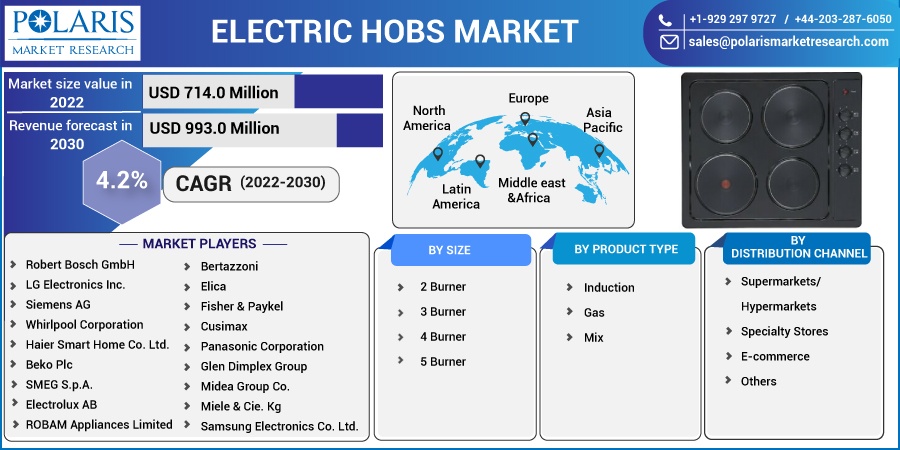

The global electric hobs market was valued at USD 685.7 million in 2021 and is expected to grow at a CAGR of 4.2% during the forecast period.

Rapid shift towards westernization, increasing per capita income, growing consumer purchasing power, and a large number of product innovations by several key market players across the globe are some of the major factors anticipated to drive the growth. Several manufacturers are highly focusing on new product innovations and focus on technological developments, driving the global market positively.

Know more about this report: Request for sample pages

Furthermore, an emerging trend of reduction on the supply side due to a rapid increase in the number of nuclear families across the world has led to the high adoption of electric hobs, which are more compact and have the same efficiency. Due to the rising prevalence of several advanced technologies, including IoT, customers are becoming more aware of the product's energy efficiency. Thus, these factors are likely to be another key factor driving the overall demand for electric hobs in the coming years.

However, the high price of electric hobs is expected to act like a major restraining factor for the market growth. These types of hobs are comparatively more costly to buy than other regular gas cooktops available in the market. The outbreak of the COVID-19 pandemic has significantly impacted the growth and demand of the global market. The overall performance of kitchen appliances has highly suffered as a result of the global pandemic issue. Low consumer spending on such types of equipment, due to several issues like job insecurity and lower spending power, were major causes for the decrease in sales. Additionally, many large corporations in the kitchen industry were reducing their production facilities and retail stores, which also had a negative impact on the global market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

High technological advancements in electric hobs, such as easy connectivity through smartphones via various wireless connections like Wi-Fi and Bluetooth, which can send alerts or notifications and can be easily controlled from any part of the house, is the primary factor propelling the growth of the global market. Various manufacturers across the globe are heavily investing in R&D activities for the expansion of their product line and to enhance their user experience is also playing a vital role in boosting the demand and growth of the market.

Furthermore, the quickness of electric hobs is one of its most appealing features driving the adoption of these hobs rapidly around the world. Since an electric hob directly creates heat in the pan, unlike other types of electric cooktops and gas, which need a middleman for transferring heat to the pan flame and electric burner. Due to this, electric hobs are gaining huge popularity worldwide and are likely to grow at a significant growth rate during the forecast period.

Report Segmentation

The market is primarily segmented based on size, product type, distribution channel, and region.

|

By Size |

By Product Type |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

4 burner hob segment accounted for the largest market share in 2021

The 4 burner segment accounted for the largest market share in 2021 and is anticipated to maintain its position throughout the forecast period. The growing need for more burners in cooking, mainly in developing countries like India and China, where families are large in size, is the primary factor boosting the growth of the segment growth significantly. Moreover, an extensive rise in the number of modern kitchens coupled with the rising trend of having a variety of cuisines in the meal is further fueling the adoption of 4 burner hobs across the globe.

However, the 3 burner segment is witnessing the fastest growth at a high CAGR over the study period. The increasing number of young working consumers worldwide who have less time to cook their meals are considered potential buyers of these segment products, thereby boosting market growth and adoption. In addition, the growing prevalence of small families, especially in Europe and North America region, making them prefer smaller hobs, hence playing a crucial role in the development of the segment market.

Mix product type segment expected to witness fastest growth during the projected period

The segment's growth is majorly driven by a large consumer base in the Asia Pacific and Middle-East Africa region, which still believes and prefers to use LPG for cooking several dishes. Changing consumer preferences towards electricity for cooking purposes because of the continuous rise in the prices of LPG is fostering segment growth. The cost of LPG has drastically changed and is rising continuously in counties like India, forcing consumers to shift to other alternatives like electric hobs and cooktops.

Moreover, in 2021, the induction segment led the global market with a significant revenue share and is expected to hold its position over the anticipated period. High usage of induction-based cooktops, especially in developed nations such as the United States, Canada, and France, coupled with the growing awareness about the harmful effects of smoke generated from cooking and heating, are driving the segment market growth in recent years.

For instance, according to the World Health Organization, about 2.4 billion people across the globe cook using inefficient stoves or open fires fueled by coal, kerosene, and biomass, which generates harmful and dangerous household air pollution. Household air pollution causes around 3.2 million deaths per year, including more than 237,00 deaths of children under the age of 5 years. Thus, consumers are switching to induction hobs, which are more beneficial than gas stoves from a health perspective.

Specialty stores segment held the significant revenue share

The specialty stores accounted for over one-third of the global market revenue share in 2021. The segment's growth can be attributed to benefits offered by specialty stores, such as immediate gratification and discounts on various occasions, resulting in high growth of the segment market. In addition, the vast presence of specialty stores and their easy access to consumers is also driving the segment growth.

However, the eCommerce segment is likely to grow at the fastest growth rate over the coming years because of the increasing adoption of mobile phones, rising penetration of the internet, and the high emergence of several online shopping platforms such as Amazon, Flipkart, and eBay. The growing popularity of these platforms due to the availability of a wide range of products, easy payment methods, and free delivery across all areas is propelling consumers to opt for online shopping instead of going to retail stores and supermarkets.

North America region dominated the electric hobs market in 2021

North American region dominated the market with a significant holding of market revenue share and is expected to witness considerable growth in the forecast period. The major factors driving the market growth in the region are the development and advancement of robust technologies in various countries, including the United States and Canada. In addition, high consumer awareness about the harmful effects of gas stoves operated by coal and kerosene is driving the market growth in the region.

Furthermore, Asia Pacific is expected to emerge as the fastest-growing region during the anticipated period due to rising consumer spending power and an extensive consumer base in the region. Increasing fuel prices and LPG is another factor compelling the consumers to opt for energy hobs based on energy saving.

Competitive Insight

Key players in the market include Robert Bosch GmbH, LG Electronics Inc., Siemens AG, Whirlpool Corporation, Haier Smart Home Co. Ltd., Beko Plc, SMEG S.p.A., Electrolux AB, ROBAM Appliances Limited, Bertazzoni, Elica, Fisher & Paykel, Cusimax, Panasonic Corporation, Glen Dimplex Group, Midea Group Co., Miele & Cie. Kg, Amica S.A., and Samsung Electronics Co. Ltd.

Recent Developments

In May 2021, SharkNinja Operating, an innovator in kitchen electric appliances, introduced a digital platform, that is expected introduce repository of cooking recipes & it is available for the consumers of U.S., U.K., France, and Germany. With this platform, the company efforts are mainly to influence the consumers towards advanced and innovated crockery products buying.

In July 2022, Beko Plc has announced about its partnership with The Salvation Army Trading Company, as a corporate donor. With this partnership, the consumers will be able to purchase their loved electrical items from over 240 outlets of Salvation Army.

Electric Hobs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 714.0 million |

|

Revenue forecast in 2030 |

USD 993.0 million |

|

CAGR |

4.2% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Size, By Product type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Robert Bosch GmbH, LG Electronics Inc., Siemens AG, Whirlpool Corporation, Haier Smart Home Co. Ltd., Beko Plc, SMEG S.p.A., Electrolux AB, ROBAM Appliances Limited, Bertazzoni, Elica, Fisher & Paykel, Cusimax, Panasonic Corporation, Glen Dimplex Group, Midea Group Co., Miele & Cie. Kg, Amica S.A., and Samsung Electronics Co. Ltd. |