Electric Scooter Market Share, Size, Trends, Industry Analysis Report

By Type (Plug-in, Battery-based); By Product; By Battery; By Voltage; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM1069

- Base Year: 2024

- Historical Data: 2020 - 2023

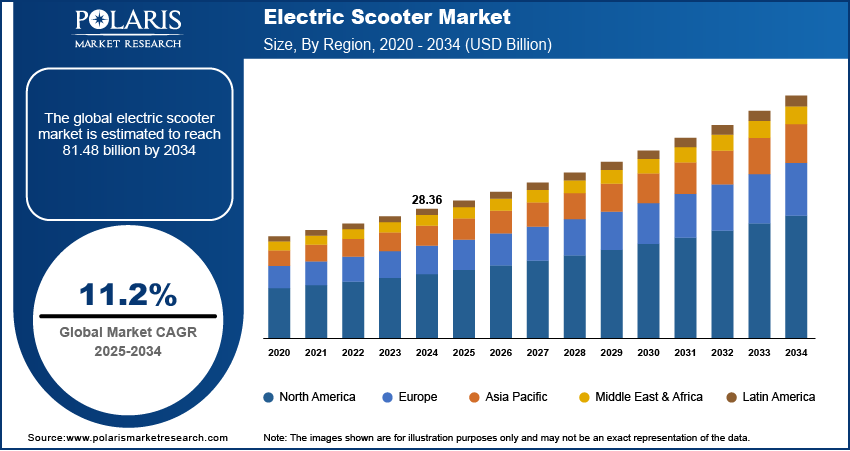

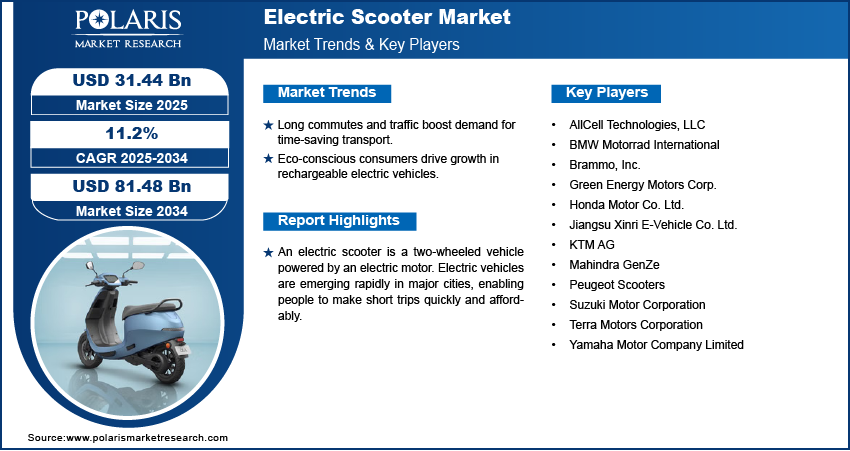

The global electric scooter market size was valued at USD 28.36 billion in 2024 and is anticipated to grow at a CAGR of 11.2% during the forecast period. Key factors driving the demand includes advancements in battery technologies, government incentives and subsidies, and lighter lithium-ion batteries have become massively cheaper.

Key Insights

- In 2024, the sealed lead-acid battery segment accounted for the largest market share. This is due to its capability to withstand up to 300 complete charge cycles before needing replacement.

- The folding variant is expected to witness a substantial CAGR over the forecast period. This is due to the emergence of smart vehicles belonging to the next generation, utilizing big data and IoT, and the need for product differentiation.

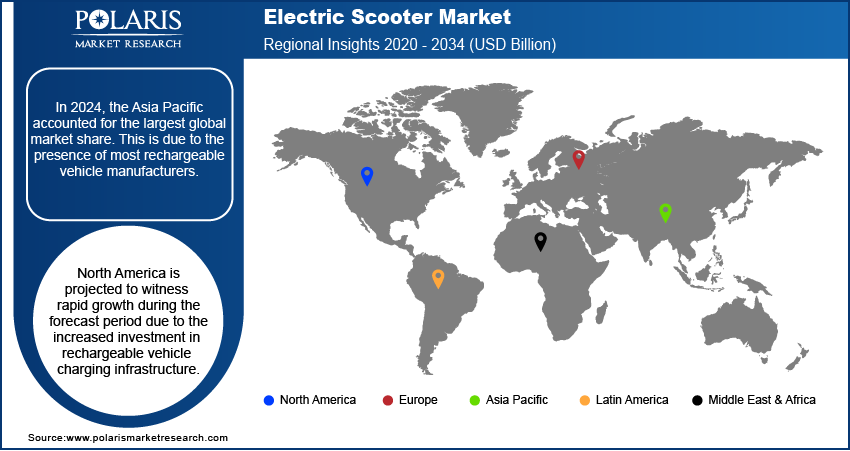

- In 2024, the Asia Pacific accounted for the largest global market share. This is due to the presence of most rechargeable vehicle manufacturers.

- North America is projected to witness rapid growth during the forecast period due to the increased investment in rechargeable vehicle charging infrastructure.

Industry Dynamics

- Long commutes and increasing traffic are encouraging consumers to adopt affordable and time-saving transportation options, highlighting market expansion.

- Demand for rechargable EVs is projected to increase as consumers aim for more eco-friendly options.

- Advances in technology pose a significant challenge, as longer ranges with fast charging at lower costs create a problem for consumer adoption.

- The rise of integrating into mobility-as-a-service platforms and public transit systems creates opportunities for expansion.

Market Statistics

- 2024 Market Size: USD 28.36 billion

- 2034 Projected Market Size: USD 81.48 billion

- CAGR (2025-2034): 11.2%

- Largest market in 2024: Asia Pacific

To Understand More About this Research: Request a Free Sample Report

AI Impact on Electric Scooters Market

- It reduces downtime and maintenance costs by analyzing scooter data to ensure a higher level of scooter availability for riders.

- Revenue maximization for operators and scooter availability is expected to be achieved through the adjustment of rental prices based on demand, location, and time.

- Collecting data helps companies identify good riding habits and reduce accidents by incorporating features such as collision detection and irresponsible riding detection, thereby improving safety.

An electric scooter is a two-wheeled vehicle powered by an electric motor. Electric vehicles are emerging rapidly in major cities, enabling people to make short trips quickly and affordably. Two major factors driving the market demand for electric vehicles are that solar energy has become the cheapest form of power in human history, and lighter lithium-ion batteries have become significantly cheaper. These inventions have permitted electric vehicle manufacturers to become competitive. Moreover, the growing adoption of rechargeable scooter-sharing services in countries such as the US, Germany, France, and Spain has driven demand for battery-powered two-wheelers. The market demand is anticipated to grow due to the rising price of petroleum.

Cheap solar power is integrated into the battery of rechargeable vehicles, offering running costs that are lower than those of fossil fuel engines. The maintenance cost is reduced by these engines, which is contributing to the industry's growth. Electronic systems are more systematic and resilient when compared to mechanical models, as they experience less wear and tear due to friction. The result of this is that two-wheeler vehicles are more durable and environmentally friendly, thereby accelerating the growth of the industry.

Electric vehicles are equipped with LED lights, which use a low amount of energy to power them. They also feature electronic braking systems that recycle up to 10% of the power back into the battery during braking. Thus, while riding, the carbon footprint is reduced. Electric vehicles have fewer parts to replace, resulting in less maintenance and a lower environmental impact compared to gas-powered vehicles. This factor is pushing the growth of the electric scooter industry.

Industry Dynamics

Growth Drivers

The ever-increasing traffic and rising trend of long travel are encouraging consumers to opt for time-efficient, convenient, and cost-effective modes of transportation to reach their destination, which in turn is projected to drive the growth of the market. In addition, with the surge in micro-mobility, industry players have created vehicle-sharing alternatives that enable people to avoid purchasing their own micro-mobility vehicles.

Public vehicles, such as taxis and buses, contribute to greenhouse gas emissions. The market demand is expected to grow over the forecast period as people move towards adopting rechargeable vehicles. Furthermore, growing concerns about environmental conservation encourage commuters to opt for individual transportation options, such as motor vehicles and cars, over public transportation. Therefore, the inclination toward eco-friendly modes of transport is boosting the electric scooter industry.

Report Segmentation

The market is primarily segmented on the basis of type, product, battery, voltage, and region.

|

By Type |

By Product |

By Battery |

By Voltage |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Battery Analysis

Based on the battery segment, the sealed lead-acid battery segment dominated the global electric scooter market in 2024 due to its strength and cost-effective benefits. These are rechargeable batteries that withstand up to 300 complete charge cycles before needing replacement. Furthermore, the growing awareness of the increasing adoption of eco-friendly batteries, along with their sustained performance over sealed lead-acid and NiMH batteries, has driven up the demand for lithium-ion batteries. Their adoption has raised the prices of electric vehicles in developing markets, as these batteries are more costly compared to the other two. These batteries are designed to withstand high discharge cycles, thereby preventing any harm.

Lithium-ion batteries are expected to account for a significant share during the forecast period due to their potential to offer longer charge cycles and high energy density. The growing demand for low self-discharge rates in rechargeable scooter batteries is the primary factor driving lithium-ion battery sales, while also encouraging payers to invest in research and development.

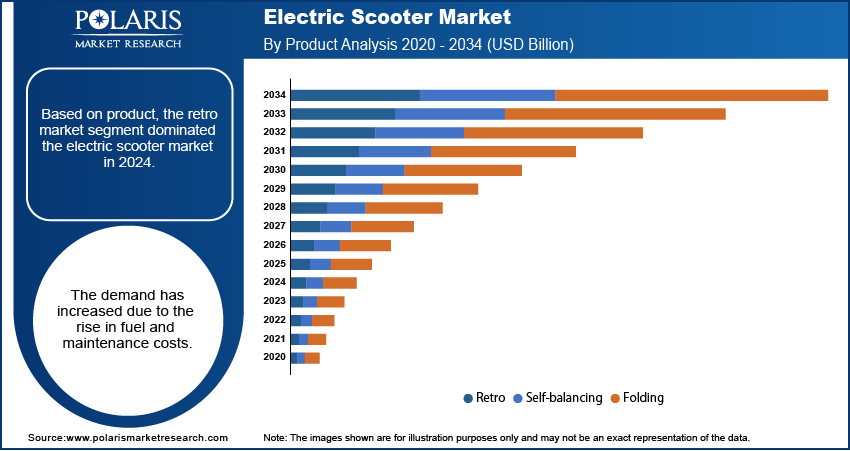

Product Analysis

Based on product, the retro market segment dominated the electric scooter market in 2024. The demand has increased due to the rise in fuel and maintenance costs. Since old-fashioned electric vehicles are still in demand among consumers, the demand is expected to continue growing. Furthermore, these scooters offers classic aesthetics with advances in technology to appeal customers seeking for nostalfia and practicality. The design of these scooters prioritize confort with padded seats and footboards to make them suitable for longer run. Manufacturers are adopting this change by updating their models with improved battery range and smart features for their continued appeal.

The folding variant is expected to witness a substantial CAGR over the forecast period. The establishment of smart vehicles belonging to the next generation, with big data and IoT, and the requirement for product differentiation have driven the growth of the folding scooter market.

These vehicles have become popular in the US and are liberated from the inherent limitations of strength and weight. Furthermore, the growing demand for traffic and mobility has compelled vendors to produce folding electric scooters.

Regional Analysis

Asia Pacific Electric Scooter Market Assessment

Asia Pacific dominated the global electric scooter market in 2024. This is due to the presence of most rechargeable vehicle manufacturers from Japan, Taiwan, and China, which collectively hold the largest share globally. Consumers has become increasingly conscious of the need to adopt clean energy transportation to reduce vehicular emissions. Moreover, government policies with the rise in investments especiallt for charging stations have boosted their adoption in this region. The densely populated areas in many countries, such as India and China, makes e-scooters a more convenient mode of transportation in congested areas, on busy roads, and for short distances. Thus, consumer demand, manufacturing dominance, and favourable government policies have also supported the expansion opportunities for electric scooters in this region.

North America Electric Scooter Market Insights

North America is projected to witness the highest CAGR during the forecast period. This is due to the increased investment in rechargeable vehicle charging infrastructure. The rise in consumer awareness of environmental issues with major automotive and tech companies in the e-vehicle sector has created a robust and competitive market. Moreover, government regulations on emissions and subsidies for manufacturers and consumers also contributes to the development of electric scooter market. The region's focus on innovation with advances in technology has contributed to the development of high-performance and advanced electric scooters for a broader demographic shift.

Competitive Insight

The leading players in the market include AllCell Technologies, LLC, BMW Motorrad International, Brammo, Inc., Green Energy Motors Corp., Honda Motor Co. Ltd, Jiangsu Xinri E-Vehicle Co. Ltd., KTM AG Peugeot Scooters, Mahindra GenZe, Suzuki Motor Corporation, Terra Motors Corporation, Yamaha Motor Company Limited.

Industry Developments

- August 2025: Swiggy collaborated with Bounce to accelerate the adoption of electric vehicles amongst its delivery partners. This collaboration aims to make electric mobility more accessible and affordable for Swiggy and Instamart delivery partners, while also reducing their carbon footprint.

- February 2025: Kinetic Green Energy and Power Solutions Limited launched a new television campaign for the E-Luna. This new campaign for E-Luna will bring a fresh perspective to sustainable mobility.

Electric Scooter Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 28.36 Billion |

| Market Size in 2025 | USD 31.44 Billion |

|

Forecast by 2034 |

USD 81.48 Billion |

|

CAGR |

11.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Product, By Battery, By Voltage, By Region |

|

Regional scope |

North America, Europe, APAC, South America and Middle East & Africa |

|

Key companies |

AllCell Technologies, LLC, BMW Motorrad International, Brammo, Inc., Green Energy Motors Corp., Honda Motor Co. Ltd, Jiangsu Xinri E-Vehicle Co. Ltd., KTM AG Peugeot Scooters, Mahindra GenZe, Suzuki Motor Corporation, Terra Motors Corporation, Yamaha Motor Company Limited |

FAQ's

• The global market size was valued at USD 28.36 billion in 2024 and is projected to grow to USD 81.48 billion by 2034.

• The global market is projected to register a CAGR of 11.2% during the forecast period.

• Asia Pacific dominated the global market share in 2024.

• A few key players are AllCell Technologies, LLC, BMW Motorrad International, Brammo, Inc., Green Energy Motors Corp., Honda Motor Co. Ltd, Jiangsu Xinri E-Vehicle Co. Ltd., KTM AG Peugeot Scooters, Mahindra GenZe, Suzuki Motor Corporation, Terra Motors Corporation, and Yamaha Motor Company Limited.

• In 2024, the sealed lead-acid battery segment accounted for the largest market share.

• The folding variant is expected to witness a substantial CAGR over the forecast period.