Electric Ship Market Share, Size, Trends, Industry Analysis Report

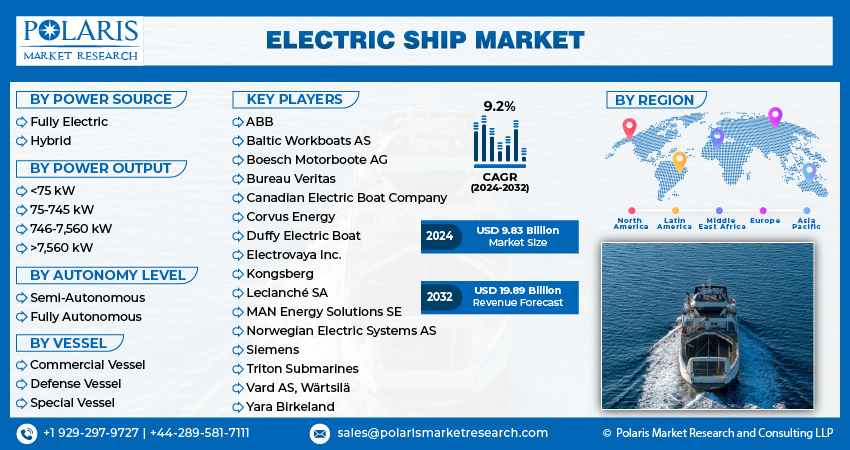

By Power Source (Fully Electric, Hybrid); By Vessel (Commercial, Defense, Special); By Power Output; By Autonomy Level; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM2037

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

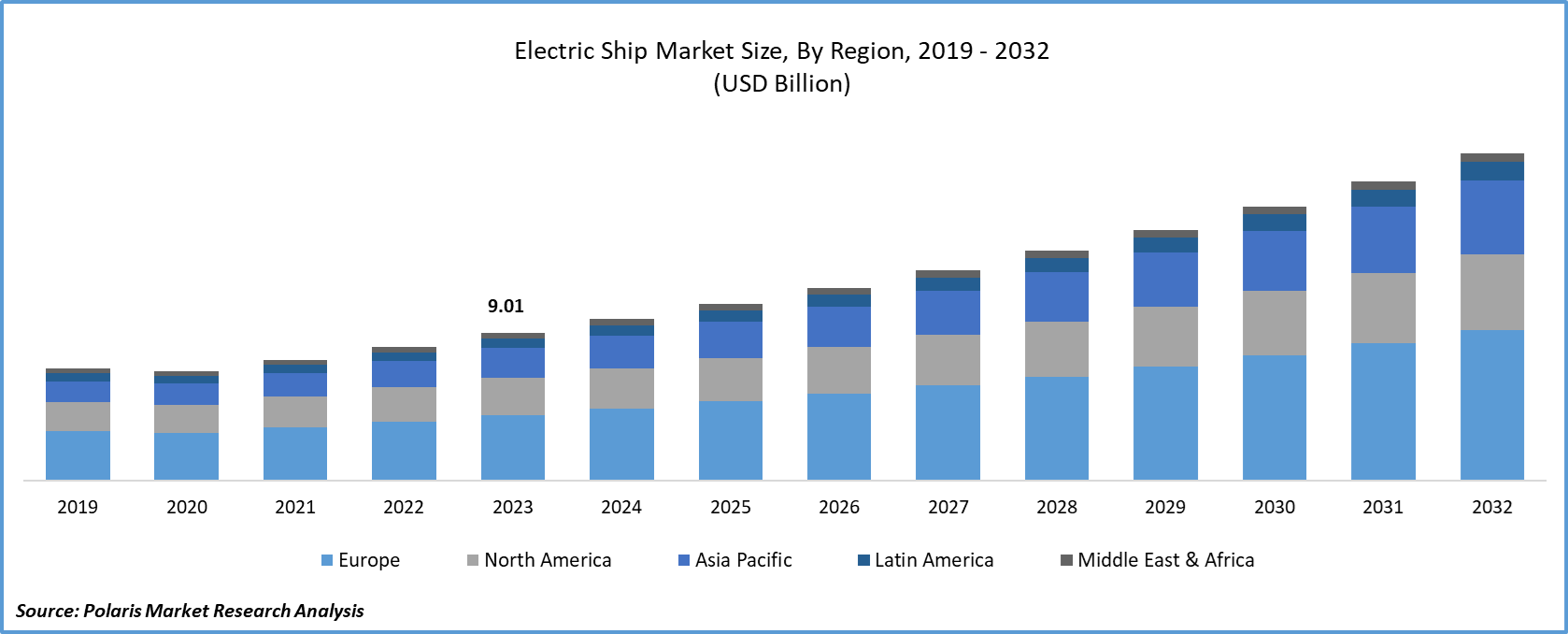

The global electric ship market size was valued at USD 9.01 billion in 2023. The market is anticipated to grow from USD 9.83 billion in 2024 to USD 19.89 billion by 2032, exhibiting the CAGR of 9.2% during the forecast period.

The continual rise in seaborne trade across the world, particularly in developed and developing economies, increasing adoption of fully electric passenger vehicles, and increasing government incentives regarding environment emission control, are the few prominent factors expected to accelerate the electric ship market growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, in 2020, Brodrene AA AS manufactured all-electric ferry - Rygerelektra, fabricated with carbon composite material and can carry up to 297 passengers. Moreover, the robust growth in adoption for the product and hybrid propulsion technologies for retrofitting ships and the implementation of the Sulphur 2020 rule by regulatory bodies is further boosting the preference for the electric ship market around the world.

Industry Dynamics

Growth Drivers

The market has observed extensive developments in the last few decades supported by various factors, such as the surge in maritime trade, increasing demand for emission-free ships, and growing preference and acceptance of fully autonomous passenger vessels. In 2020, Yara International commissioned an electric loader ship under the name of Yara Birkeland.

The total worth of this fully electric ferry is estimated at USD 30 million. Such friendly mobility in the water streams leads to positive investments scenario for the electric ship market. Escalating demand or implementation for the Sulphur cap in maritime operations, coupled with the operational benefits of ships that use the electric drive, improved safety, less noise, and reduced fuel consumption, are major reasons to proliferate the adoption of such products.

For instance, in January 2020, the International Maritime Organization (IMO) incorporated the global Sulphur cap that needs ships operating freestanding of emission control areas (ECAs) to utilize low Sulphur fuels. Nowadays, ships are required to use fuels with a Sulphur content of 0.5% or less compared to the earlier limit of 3.5% or less. Thus, these marine logistics vendors are launching environment-friendly ships to increase their adoption among ferry operators intending to reduce the use of Sulphur content and greenhouse gas emission during maritime trade globally.

Report Segmentation

The market is primarily segmented on the basis of power source, power output, autonomy level, vessel, and region.

|

By Power Source |

By Power Output |

By Autonomy Level |

By Vessel |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Power Source

Based on the power source segment, the hybrid segment is expected to be the largest revenue contributor in the global market in 2020 and is expected to maintain its dominance in the forthcoming period. This is due to its ability to use effective supplementary propulsion systems and sophisticated speed, which can mitigate the risk of failure and include higher distances in less time. This, in turn, created huge investments and demand for the product.

The fully-electric segment accounted for the nominal revenue share in 2020 and is likely to observe significant growth throughout the world. The demand for fully electric ships is anticipated to increase, backed by the increased adoption of the fully electric driving force for small passenger ships and ferries functioning on inland waterways. Furthermore, these products usually use solar energy, lithium or lead-acid batteries, or fuel cells as the main power source. For instance, Turkish-based ship designer Navtek Naval Technologies has manufactured an all-electric, battery-powered tugboat with an energy storage system (ESS). Such initiatives are likely to propel market growth.

Insight by Autonomy Level

The semi-autonomous vessels segment is expected to see significant revenue in the global market, owing to the prompt development of the semi-autonomous ships, thereby opening up new opportunities for new players in the marketplace. Further, these ships have pre-deployed components and systems, including cameras, sensors, and navigation systems. In addition, it can be installed in prevailing vessels that prior have a manual operation, and so, is accelerating the growth of the global market.

On the flip side, the fully autonomous segment is expected to pave a high market share in terms of revenue during the forecast period. It supports the efficient usage of ship space, lowers the risk of human errors, and risks the elimination of transport in the global market. Furthermore, the quick operations with the lower operational cost of such products are projected to impel the market growth during the foreseen period.

Geographic Overview

Geographically, Europe accounted for the largest share in 2020 and is projected to observe considerable growth in the global market due to the increasing popularity and adoption of these ships with increasing concern about maritime emission, along with the growing presence of advanced or digitalized ports and leading ship manufacturing vendors to offer the products in the market.

Further, the increasing popularity of electric leisure and recreational vessels in water adventures, fishing activities, and marine tourism is reinforcing the demand for the product from this region, which is continually expanding the market at a rapid pace considering the global market scenario.

Additionally, countries such as the United Kingdom, France, Spain, and Italy are further estimated to register the largest number of initiatives to opt for key technologies supporting port automation and digitalization, including the Internet of Things (IoT), artificial intelligence, unmanned vehicle, and equipment, and blockchain. Similarly, in countries such as Germany, most shipping and logistics companies are using the electric ferries.

It significantly reduces the level of carbon footprint by improving efficiency in the overall maritime market. For instance, in 2016, the German Government’s Climate Action Plan 2050 was introduced to set targets to reduce greenhouse gas emissions from the non-emission trading system (ETS) combined by 38% by 2030, compared to the level of 2005, which will considerably promote the demand in the region.

APAC is projected to witness the highest CAGR in the global market in 2020. The demand for these ships in the region is attributed to an increase over the study period, owing to the rising focus of prominent vendors, especially in Japan and China, to promote electrification in large-sized vessels along with surging trade from seaports together with the establishment and development of ports in the country.

According to the India Brand Equity Foundation (IBEF) publication released on the shipping market & ports in November 2020, nearly 95% of the country’s trading employing volume & over 70% by value is performed through maritime transport. Thus, many shipping and logistics companies have now recognized the acceptance of electric ships, and so, the market is gaining significant prominence across the region.

Competitive Landscape

Some of the Major Players operating the global market include ABB, Baltic Workboats AS, Boesch Motorboote AG, Bureau Veritas, Canadian Electric Boat Company, Corvus Energy, Duffy Electric Boat, Electrovaya Inc., Kongsberg, Leclanché SA, MAN Energy Solutions SE, Norwegian Electric Systems AS, Siemens, Triton Submarines, Vard AS, Wärtsilä, and Yara Birkeland.

Electric Ship Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 9.83 billion |

|

Revenue forecast in 2032 |

USD 19.89 billion |

|

CAGR |

9.2% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Power Source, By Power Output, By Autonomy Level, By Vessel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

ABB, Baltic Workboats AS, Boesch Motorboote AG, Bureau Veritas, Canadian Electric Boat Company, Corvus Energy, Duffy Electric Boat, Electrovaya Inc., Kongsberg, Leclanché SA, MAN Energy Solutions SE, Norwegian Electric Systems AS, Siemens, Triton Submarines, Vard AS, Wärtsilä, and Yara Birkeland |