EV Charging Stations Market Share, Size, Trends, Industry Analysis Report, By Charging Type (AC and DC); By Charger Type; By Connector; By Level of Charging; By Deployment; By Installation Type; By Connectivity; By Application; And By Region; Segment Forecast, 2024- 2023

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM1029

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

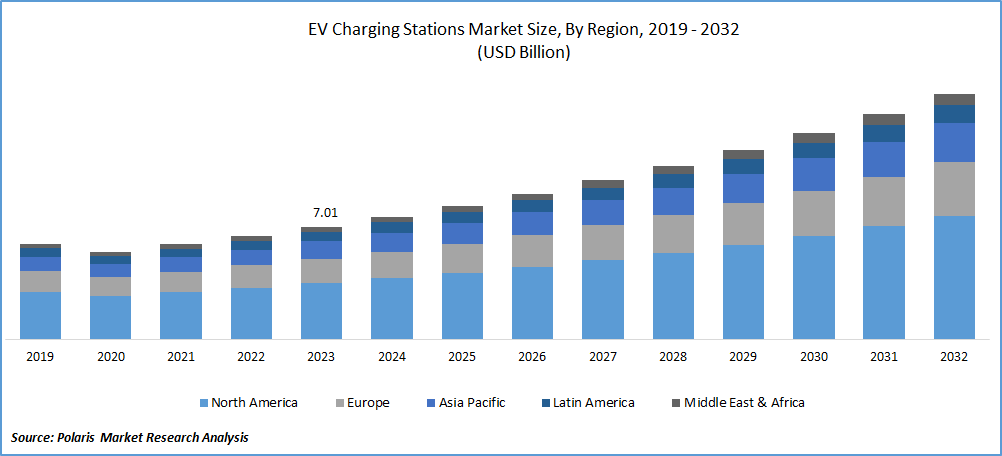

The EV charging stations market size was valued at USD 7.01 billion in 2023. The market is anticipated to grow from USD 7.64 billion in 2024 to USD 15.25 billion by 2032, exhibiting a CAGR of 9.0% during the forecast period

Industry Trend

The growth of the electric vehicle charging infrastructure market is driven by increasing concerns about carbon emissions and the global adoption of electric vehicles (EVs). Government regulations and tax incentives are also significant factors in promoting EV adoption, thereby boosting the demand for EV charging infrastructure solutions.

The increasing government support for developing EV charging stations, backed by the growing adoption of passenger and commercial electric vehicles, has propelled the demand for EV charging stations globally. The rising pollution awareness due to traditional vehicles has shifted consumers towards electric vehicles.

To Understand More About this Research:Request a Free Sample Report

This surge in EV adoption is reshaping the transportation landscape, fueled by a collective global effort to reduce greenhouse gas emissions, combat air pollution, and transition towards sustainable mobility solutions. As more consumers, businesses, and governments embrace EVs as a cleaner and more efficient alternative to traditional gasoline-powered vehicles, the demand for EV charging infrastructure escalates significantly.

The growing demand for EVs necessitates the development and expansion of charging station networks to cater to the needs of EV owners. With EV drivers requiring convenient and accessible charging options both at home and on the go, the proliferation of charging stations becomes paramount. Governments, municipalities, and private enterprises recognize this imperative and are actively investing in the deployment of charging infrastructure to support the growing EV market.

Additionally, continuous innovations in charging technology are revolutionizing the EV charging experience, making it faster, more convenient, and more efficient. Advancements such as wireless charging, high-power charging systems, and smart charging solutions are at the forefront of this transformation. These technologies not only enhance the speed and reliability of charging but also optimize energy usage by coordinating charging activities based on grid demand and the availability of renewable energy sources.

Moreover, the electric vehicle charging infrastructure market is witnessing substantial collaboration from private companies and investors keen to capitalize on the growing EV market. The attraction of new revenue streams, driven by the growing demand for charging services, combined with the opportunity to contribute to sustainable transportation initiatives, serves as a compelling incentive for investment in EV charging infrastructure.

- For instance, in January 2024, MAN and ABB E-mobility teamed up to develop new technology. On the Megawatt Charging System (MCS), Nickels elaborated, "At MCS, they worked with various initiative players to help charging capacities in the megawatt range, the way for sustainable and cost-effective long-distance heavy goods and passenger transport in the future."

The merging of increasing EV adoption, technological innovation, and investment in charging infrastructure underscores the transformative potential of the electric vehicle charging stations market. As the EV ecosystem continues to evolve and mature, the electric vehicle charging infrastructure market is poised for sustained growth, playing a pivotal role in shaping the future of transportation towards a cleaner, greener, and more sustainable example.

Key Takeaway

- Asia Pacific dominated the largest market and contributed to more than 38% of the share in 2023.

- The European market is expected to be the fastest-growing CAGR during the forecast period.

- By deployment, the public segment accounted for the largest market share in 2023.

- By application category, the commercial segment is projected to grow at a fastest CAGR during the projected period.

What are the market drivers driving the demand for the EV charging stations market?

Rising adoption of electric vehicles (EVs)have been projected to spur market demand.

The rising adoption of electric vehicles (EVs) is a key factor driving the growth of the Electric Vehicle Charging Stations Market. As more consumers, businesses, and governments embrace EVs as a cleaner and more sustainable mode of transportation, the demand for charging infrastructure increases accordingly. One of the primary drivers behind the growing adoption of EVs is the increasing awareness of environmental issues and the need to reduce carbon emissions. EVs produce fewer greenhouse gas emissions compared to traditional internal combustion engine vehicles, making them an attractive option for individuals and organizations looking to minimize their carbon footprint and contribute to environmental conservation efforts.

Additionally, advancements in EV technology have led to improvements in vehicle performance, driving range, and affordability, making EVs more accessible and appealing to a broader range of consumers. As EV technology continues to evolve and battery costs decline, the attractiveness of EVs as a viable alternative to conventional vehicles continues to grow. Furthermore, government initiatives and policies aimed at promoting the adoption of EVs play a significant role in driving market growth. Many countries around the world have implemented incentives such as tax credits, rebates, and subsidies for EV buyers, as well as regulations mandating the installation of EV charging infrastructure in new construction projects and public spaces. These supportive measures create a favorable environment for EV adoption and stimulate investment in charging infrastructure.

The increasing availability of charging infrastructure also plays a crucial role in encouraging EV adoption. As the network of EV charging stations expands, consumers become more confident in the accessibility and convenience of charging their vehicles, alleviating concerns about range anxiety and charging availability.

Which factor is restraining the demand for EV charging stations?

High cost of electric vehicle charging infrastructure are expected to hinder the growth of the market.

The installation of EV charging stations involves significant upfront investment, including the purchase of charging equipment, site preparation, installation costs, and necessary electrical infrastructure upgrades. These costs can be substantial, particularly for fast-charging stations or installations in remote areas where infrastructure development is required. In addition to the initial investment, operating expenses such as electricity costs, maintenance, repairs, and network management contribute to the overall cost of EV charging infrastructure. The ongoing operational expenses can be a significant financial burden, especially for charging station operators managing large networks of stations. Retrofitting existing infrastructure or deploying new infrastructure to support EV charging can incur additional costs. Upgrading electrical grids, expanding capacity, and ensuring reliable power supply to charging stations may require substantial investment from utilities and infrastructure providers.

Securing suitable locations for EV charging stations, especially in high-traffic areas or urban centers, often involves leasing or purchasing land or real estate, which adds to the overall cost of infrastructure deployment.

Report Segmentation

The market is primarily segmented based on charging type, charger type, connector, level of charging, deployment, installation type, connectivity, application and region.

|

By Charging Type |

By Charger Type |

By Connector |

By Level of Charging |

By Deployment |

By Installation Type |

By Connectivity |

By Application |

By Region |

|

|

|

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Deployment Insights

Based on deployment analysis, the market is segmented into private and public. The public segment held the largest market in 2023. Public EV charging stations offer convenient access to charging facilities for EV owners who may not have access to private charging infrastructure, such as home charging stations. These stations are strategically located in high-traffic areas, making them easily accessible to a wide range of users. Public EV charging stations help alleviate range anxiety among EV owners by providing comfort that charging infrastructure is readily available during travel. This encourages greater adoption of EVs and facilitates long-distance travel, contributing to the growth of the public charging segment.

Public EV charging stations present commercial opportunities for charging station operators, energy companies, real estate developers, and other stakeholders. Revenue generation models, such as pay-per-use charging, subscription-based services, advertising, and partnerships with retailers, can make public charging stations financially viable and attractive investment opportunities.

By Application Insights

Based on application analysis, the market has been segmented on the basis of apartments/societies, bus charging stations, commercial, destination charging stations, fleet charging stations, highway charging stations, private houses, and residential. The commercial segment is anticipated to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period concerning the EV charging stations market. Public transit agencies, ride-sharing companies, and other providers of shared mobility services are expanding their electric vehicle fleets and investing in charging infrastructure to support electric buses, taxis, and shared electric vehicles. The transition to electric mobility in the public transit and shared mobility sectors drives demand for charging infrastructure at transit hubs, depots, and ride-sharing pickup points.

Regional Insights

Asia Pacific

Asia Pacific region accounted for the largest market share in 2023. The Asia Pacific region has been experiencing rapid growth in the adoption of electric vehicles (EVs) driven by government incentives, supportive policies, and growing environmental awareness. Countries like China, Japan, and South Korea have implemented ambitious plans to promote EV adoption, leading to a significant increase in the demand for EV charging infrastructure. The region is characterized by dense urban populations and growing urbanization, which creates a high demand for convenient and accessible charging infrastructure. Both public and private entities in China have been investing heavily in EV charging infrastructure. State-owned utilities, charging station operators, real estate developers, and technology companies are among the key stakeholders involved in the deployment and operation of charging stations across the country.

China is at the forefront of technological innovation in the EV charging sector. The country is home to several leading manufacturers of EV charging equipment, including fast chargers, wireless charging systems, and smart charging solutions. Technological advancements made in China contribute to the efficiency, reliability, and affordability of EV charging infrastructure.

EuropeTop of Form

Europe is expected for the growth of fastest CAGR during the forecast period. The growing adoption of electric vehicles in Europe, fueled by consumer awareness, environmental consciousness, and expanding EV model offerings, contributes to the rising demand for charging infrastructure. As more consumers switch to electric mobility, the need for accessible and reliable charging solutions grows, boosting market growth. European countries have been at the forefront of promoting electric mobility through supportive government policies, incentives, and regulations. Subsidies, tax incentives, and grants for EV purchases, as well as funding programs for charging infrastructure deployment, stimulate market growth. European governments and private stakeholders are investing heavily in EV charging infrastructure to support the growing EV market.

Competitive Landscape

The competitive landscape of the Electric Vehicle Charging Stations Market, there are companies that specialize in manufacturing EV charging equipment, encompassing hardware like charging stations, connectors, cables, and infrastructure components. Additionally, entities are dedicated to operating, managing, and maintaining EV charging networks, covering public charging stations, private networks, and charging as a service (CaaS) providers. Moreover, automotive manufacturers are increasingly focusing on investing in EV charging infrastructure as a crucial aspect of their electric mobility strategy. Many automakers provide integrated charging solutions and collaborate with infrastructure providers to improve the overall EV ownership experience.

Some of the major players operating in the global market include:

- BP Chargemaster

- BYD

- ChargePoint, Inc.

- Delta Electronics Inc.

- Eaton

- EVBox

- Schneider Electric

- Shell International BV

- Siemens AG

- State Grid Corporation of China

- Tata Power

- Tesla Inc

- TGOOD Global Ltd

Recent Developments

- In February 2024, Raizen Power and BYD have developed a strategic alliance to promote sustainable electric mobility in Brazil. The partnership's goal is to substantially increase the public network of electric chargers substantially, offering users access to 100% clean and renewable energy while improving the recharging experience. With a target of capturing a 25% market share in Brazil's electromobility sector, Raízen Power plans to deploy around 600 new DC charge points. This expansion will add an extra 18 MW of installed power, enhancing nationwide EV recharging capabilities.

- In December 2023, Tata Power EV Charging Solutions Limited (TPEVCSL), a prominent provider of EV charging solutions, has joined into a Memorandum of Understanding (MoU) with Indian Oil Corporation Limited (IOCL). The deal aspires to deploy fast and ultra-fast electric vehicle (EV) charging issues throughout India. Under this partnership, Tata Power will install over 500 EV charging points across various IOCL retail outlets.

Report Coverage

The Electric Vehicle Charging Stations Market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, charging type, charger type, connector, level of charging, deployment, installation type, connectivity, application and their futuristic growth opportunities.

EV Charging Stations Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.64 Billion |

|

Revenue forecast in 2032 |

USD 15.25 billion |

|

CAGR |

9.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Charging Type, By Charger Type, By Connector, By Level of Charging, By Deployment, By Installation Type, By Connectivity, By Application, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Key companies in electric vehicle charging stations market are ChargePoint Inc., Tesla Inc., Schneider Electric, Shell International BV, BP Chargemaster, Siemens AG, EVBox, Eaton, BYD, TGOOD Global Ltd., State Grid Corporation of China.

The global electric vehicle charging stations market expected to grow at a CAGR of 42.3% in the forecast period.

The electric vehicle charging stations market report covering key segments are charging level, vehicle type, charger type, application, and region.

Key driving factors in electric vehicle charging stations market are rising adoption of electric vehicles (EVs) and increasing government support for developing EV charging stations.

The global electric vehicle charging systems market size is expected to reach USD 345.19 Billion by 2032.