U.S. Food Preservatives Market Share, Size, Trends, Industry Analysis Report

By Label (Clean label, Conventional); By Type; By Function; By Application; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM4886

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

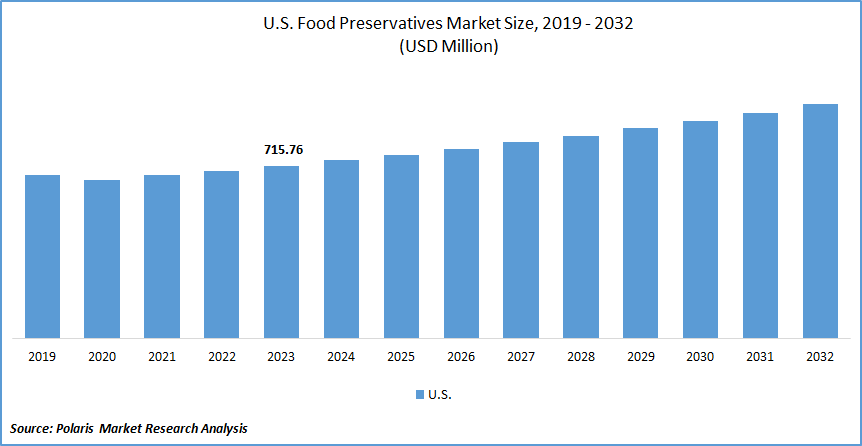

U.S. Food Preservatives Market size was valued at USD 715.76 million in 2023. The market is anticipated to grow from USD 737.80 million in 2024 to USD 970.41 million by 2032, exhibiting the CAGR of 3.5% during the forecast period.

Market Overview

Food preservatives are widely incorporated in the production of beverages, dairy products, and other packaged products, driven by their enormous potential to protect food items from spoilage, which is mostly caused by chemical reactions, oxidation, and bacterial growth. The worldwide market is observing a significant rise in the use of food preservatives with the transportation of goods from one country to another, as it creates the need for prolonged shelf-life to ensure food safety and quality. The presence of larger producers and exporters of food in the United States is anticipated to fuel market growth during the study periods.

To Understand More About this Research:Request a Free Sample Report

The development of food preservatives offering a longer shelf life without altering the flavor, taste, or quality of the goods is gaining attention from the food and beverage market players.

- For instance, in July 2023, BioVeritas, a Texas-based start-up company, introduced a clean-labeled mold inhibitor that can protect the flavor and texture of finished food products.

Moreover, an increased number of companies entering the food and beverage market, with growing demand for convenience foods, is playing a significant role in U.S. food preservatives market growth. The increased working population in the United States is facilitating an appealing market for the snacking industry, as snacks are mostly consumed in the workplace.

However, the stringent food regulations in the market, with the presence of advanced regulatory authorities in the United States, are likely to restrain the production of food preservatives by the market players.

Growth Drivers

The increasing investments in the food industry

The growing investments in the region, with the established market players in food and meat production, are expected to create significant demand potential for food preservatives in the United States. For instance, in December 2022, BELIEVER Meats, a meat producer, announced the development of North Carolina, which can produce at least 10,000 metric tons of meat at the time of operation. Furthermore, B&M Meats announced an investment of USD 18.5 million in its meat production center. These developments will likely create a need for food preservatives, as they play a prominent role in protecting meat from spoilage.

The growing demand for healthy food

The existence of health-conscious consumers in the United States necessitates the need for snack production. The snacking culture in the region gained momentum at the time of the COVID-19 outbreak, driven by the presence of stringent lockdowns, leading to a demand for snacks and convenience foods. Based on the Food and Health Survey conducted by the International Food Information Council (IFIC) 2020, 85% of Americans altered their food consumption behavior due to the coronavirus pandemic. This will certainly drive production in a way that raw materials demand, including food preservatives, in the coming years.

Restraining Factors

Increasing awareness about synthetic food additives

Some of the food additives and preservatives are considered harmful, with a rising number of researchers revealing the health effects of artificial food ingredients. This is motivating consumers to look at the ingredients utilized in the food production process. The growing concern about the use of synthetic preservatives is limiting their use among food producers. For instance, in October 2023, California announced the ban on four artificial food additives, which include propylparaben, which is mostly utilized in the production of packaged baked goods to extend their lifespan, mainly tortillas and pastries.

Report Segmentation

The market is primarily segmented based on label, type, function, application, and region.

|

By Label |

By Type |

By Function |

By Application |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

Synthetic segment is expected to witness the highest growth during the forecast period

The synthetic segment will grow rapidly, owing to its extensive potential to increase the longevity of products. The enhanced availability of synthetic food preservatives and their ease of production in the marketplace are driving their adoption among bakeries, dairy products, and beverage producers. One of the synthetic food preservatives, sodium sorbate, is mostly utilized in preserving cheese, ketchup, meat, and marmalade. According to the United States Department of Agriculture (USDA), in 2022, the consumption of cheese in the United States reached an all-time high of 42 pounds per person. This is bolstering the utility of sorbate and other synthetic preservatives in the United States market.

The natural segment led the U.S. Food Preservatives Market with a substantial revenue share in 2023, largely attributable to its ability to offer sustainable alternatives to conventional food preservatives. The presence of superior preservatives with both antimicrobial and antioxidant properties, specifically rosemary extracts and chitosan, is gaining utility in the region. The increased knowledge about natural preservatives in the region is likely to expand the food preservative market in the next few years.

By Function Analysis

Anti-microbial segment accounted for the largest U.S. food preservatives market share in 2023

The antimicrobial segment accounted for the largest market share. The increasing food waste and the existence of microbial activities driven by water, temperature, and pH levels are expected to increase the chances of food spoilage, driving the use of food preservatives in the marketplace. Furthermore, dairy products, such as milk and other frozen dairy products, necessitate food preservatives due to extensive microbial reactions.

Regional Insights

Texas region registered the largest food preservatives market share in 2023

The Texas region held the dominant food preservatives market share in 2023. This is driven by the increasing consumption of meat-based snacks and convenience products in the region, leading to more companies enhancing their food production capacity. For instance, HelloFresh, a meat kit company, introduced its new state-of-the-art facility in Irving, Texas, to meet increased demand for its food products. Furthermore, Goya Foods announced an investment of USD 80 million to expand its production facility in Brookshire. This trend is likely to influence the demand for food preservatives optimally in the long run.

The growing number of people willing to pay a premium amount is one of the major factors fuelling the demand for food preservatives in the country. According to the survey conducted by Ayana Bio, two-thirds (67%) of the people in America eat more and are willing to pay more for processed foods that incorporate nutritional ingredients.

Key Market Players & Competitive Insights

Rising product developments to drive the competition

The U.S. food preservative market is fragmented. The rising expansion activities and product innovations in the food preservatives market are optimally propelling market expansion. The increasing investments in the development of sustainable and clean-labeled food preservatives by market players in response to changing consumer purchasing patterns are anticipated to bolster U.S. Food Preservatives Market expansion.

Some of the major players operating in the global market include:

- Archer Daniels Midland Company

- BakeMark

- Barite World

- Cargill, Inc.

- Celanese Corporation

- Chemical Store, inc.

- CJ Chemicals

- DuPont de Nemours, Inc.

- Kemin Industries, Inc.

- TR International, inc.

Recent Developments in the Industry

- In September 2022, Kemin Industries launched its new clean-labeled mold inhibitor at the International Baking Industry Exposition, aiming to replace synthetic ingredients in Las Vegas. It is shown to offer a longer shelf life to the baked goods like tortillas and white bread.

Report Coverage

The U.S. food preservatives market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, function, and their futuristic growth opportunities.

U.S. Food Preservatives Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 737.80 million |

|

Revenue forecast in 2032 |

USD 970.41 million |

|

CAGR |

3.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

U.S. Food Preservatives Market report covering key segments are label, type, function, application, and region.

U.S. Food Preservatives Market Size Worth $ 970.41 Million By 2032

U.S. Food Preservatives Market exhibiting the CAGR of 3.5% during the forecast period

The key driving factors in U.S. Food Preservatives Market are The increasing investments in the food industry