Electronic Filtration Market Share, Size, Trends, Industry Analysis Report

By Product Type (Air Filters, Gas Filters, Liquid Filters, Others); By Filter Material; By Application; By End-Use Industry; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 116

- Format: PDF

- Report ID: PM4542

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

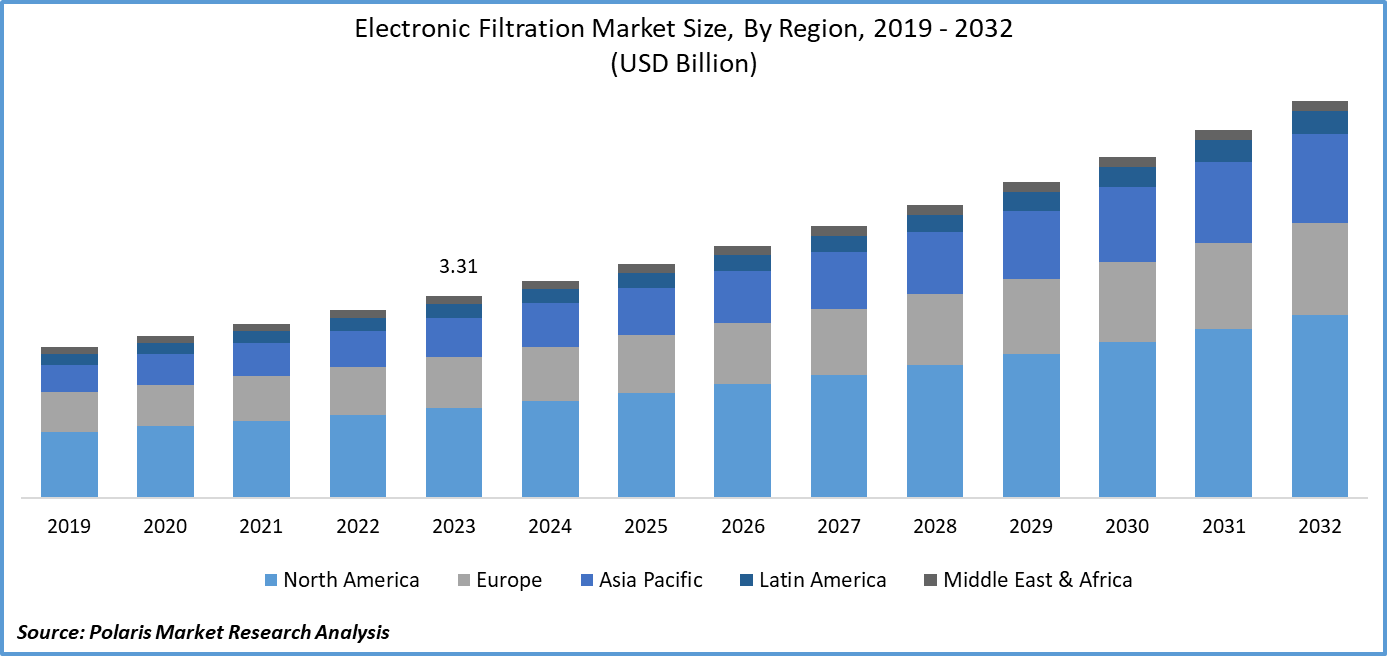

The global electronic filtration market size and trends was valued at USD 3.31 billion in 2023. The market is anticipated to grow from USD 3.56 billion in 2024 to USD 6.51 billion by 2032, exhibiting a CAGR of 7.8% during the forecast period.

Industry Trends

Electronic filtration refers to the use of electronic devices and systems to filter or remove impurities from various substances, such as air, gas, and liquid. The electronic filtration market holds great significance in the realm of semiconductor manufacturing. It plays a crucial role in ensuring the smooth functioning of processes that are vital for the production of electronic components. These filters are employed in a wide range of applications, including wet etching, photolithography, clean room environments, CVD, and PVD, among others. By removing contaminants, these filters optimize semiconductor fabrication, thereby ensuring the production of high-quality electronic components. The electronic filtration market caters to diverse end-use industries such as consumer electronics, industrial electronics, and semiconductors, among others.

The different types of filtration products include electronic air filters, which work by removing dust, pollen, smoke, and other pollutants from the air we breathe; gas filters, which purify gases such as nitrogen, oxygen, and natural gas by removing impurities and contaminants; and liquid filters, which remove impurities and contaminants from liquids such as water, chemicals, and fuels.

To Understand More About this Research: Request a Free Sample Report

During a recession, the market for electronic filtration systems faces numerous challenges. As industries cut back on capital expenditures, the demand for advanced filtration solutions may decline. Reduced industrial activities and manufacturing slowdowns can also lead to a decrease in the need for air and water filtration technologies. Furthermore, budgetary constraints may limit investments in innovative filtration systems, which could stifle technological advancements. Governments may also prioritize economic recovery over sustainability initiatives, potentially leading to relaxed environmental regulations. This could alter the enforcement and impact on air quality standards. In sectors that rely heavily on cleanroom environments, such as semiconductors and electronics, production cuts may occur, leading to a decrease in the demand for high-efficiency filtration systems.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the Electronic Filtration Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Key Takeaways

- North America region accounted for a significant market and contributed over 37% market share of the total market size in 2023.

- The Asia Pacific region is expected to witness the fastest-growing CAGR during the forecast period.

- By product type category, the air filter is expected to grow with a significant CAGR over the electronic filtration market forecast period.

- By end-use industry category, the consumer electronics segment accounted for the largest share of the global electronic filtration market share.

What are the market drivers driving the demand for electronic filtration market?

The Expansion of Semiconductor Industry

The semiconductor industry involves highly specialized manufacturing processes that require cleanroom environments with extremely low levels of airborne contaminants. As semiconductor manufacturing expands to meet the growing demand for electronic devices, there is a corresponding increase in the demand for advanced air filtration systems to maintain cleanroom cleanliness and protect sensitive semiconductor manufacturing processes from contamination. The filtration systems are designed to remove contaminants that could compromise the integrity and functionality of the semiconductor chips, including microscopic particles, chemical impurities, and trace elements of gases. Even the smallest number of contaminants can significantly disrupt the flow of electrons within a chip, leading to malfunctions or reduced performance.

Semiconductor manufacturing facilities adhere to stringent cleanroom standards, such as ISO Class 1 to ISO Class 9, to ensure product quality and yield. Electronic filtration systems, including high-efficiency particulate air (HEPA) filters and ultra-low penetration air (ULPA) filters, are essential components of cleanroom HVAC systems, helping to achieve and maintain the required cleanliness levels by removing airborne particles and contaminants. The semiconductor industry drives technological innovation and advancements in electronic filtration technologies to meet the increasingly stringent cleanliness requirements of semiconductor manufacturing processes. Research and development efforts focus on developing new filtration materials, technologies, and designs that offer higher filtration efficiency, lower pressure drop, longer service life, and improved reliability to support the evolving needs of semiconductor manufacturers.

Which factor is restraining the demand for Electronic Filtration?

The high cost associated with the advanced filtration solutions hampers the market growth.

The increasing complexity of chip designs demands filtration systems that can handle smaller particles and guarantee material purity. This requirement necessitates the adoption of advanced filtration solutions, such as HEPA or ULPA filters, specialized membranes, and sensor-based monitoring systems. However, these technologies come at a significant cost, posing a formidable challenge for smaller players in the market and impeding widespread adoption. The development of advanced electronic filtration technologies demands significant financial investments, limiting the capacity of smaller players to keep pace with rapid technological advancements. The high cost of incorporating these advanced technologies hinders innovation within the electronic filtration sector.

Report Segmentation

The market is primarily segmented based on product type, filter material, application, end-use industry, and region.

|

By Product Type |

By Filter Material |

By Application |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Type Insights

Based on product type analysis, the market has been segmented on the basis of air filters, gas filters, liquid filters, and others. The air filter segment is anticipated to grow with a substantial CAGR over the electronic filtration market forecast period. This is primarily due to the heightened focus on indoor air quality and health concerns. People are becoming increasingly aware of the harmful effects of airborne pollutants and allergens on their health and well-being. As a result, they are giving more priority to cleaner air. Moreover, the implementation of strict regulations and the growing eco-conscious mindset among consumers and industries are driving the adoption of advanced electronic filtration systems. This has led to a rapid expansion of the air filter segment in the market, making it the fastest-growing product type in the electronic filtration industry.

By End-Use Industry Insights

Based on end-use industry category analysis, the market has been segmented on the basis of consumer electronics, industrial electronics, semiconductor industry, telecommunications equipment, and others. The consumer electronics segment accounted for the largest market share in 2023, due to the widespread use of electronic devices such as smartphones, laptops, tablets, and televisions. These devices require high-quality filters to ensure optimal performance, reliability, and longevity. Also, the growing trend towards miniaturization and portability has led to a greater emphasis on compact and efficient filter designs, which has fueled innovation in the development of advanced filter technologies. Thus, the consumer electronics segment is expected to continue its dominant position in the market, driven by the rapid pace of technological advancements and the increasing adoption of electronic devices across various industries and applications.

Regional Insights

North America

The North American region accounted for a significant market share in 2023, accounting for a significant market share of the total market size. It can be attributed to several factors, including the presence of prominent players in the region, advanced technological infrastructure, and increasing demand from various industries such as healthcare, automotive, and electronics. Also, the growing trend of adopting smart homes and buildings, which require efficient air purification systems, has contributed to the growth of the market in North America. The region's stringent regulations regarding indoor air quality have further fueled the demand for high-quality electronic filters, making North America a prime market for companies operating in this space.

Asia Pacific

The Asia Pacific region is expected to witness the fastest-growing CAGR during the forecast period due to a range of factors, including urbanization, rapid industrialization, and heightened concerns regarding the environment. As industries expand, the need for effective air and water filtration systems has become increasingly critical. Furthermore, stringent regulations aimed at reducing pollution have further increased the demand for electronic filtration systems in the region. The Asia Pacific market is also experiencing a surge in the adoption of electronic filtration technologies due to dynamic economic growth and growing awareness of health and environmental issues.

Competitive Landscape

The global electronic filtration market is highly competitive, with various established players competing for market share. The market is dominated by a few large market key players, such as Parker Hannifin Corporation, Donaldson Company, and Entegris, which have strong brand recognition and extensive distribution networks. These key market players offer a wide range of products and services, including air and liquid filtration systems, filter elements, and maintenance services. They also have robust research and development capabilities, allowing them to innovate and improve their product offerings continuously.

Some of the major players operating in the global market include:

- 3M

- Camfil

- Donaldson Company, Inc.

- Entegris

- MANN+HUMMEL

- Merck KGaA

- Mott.

- Pall Corporation

- PARKER HANNIFIN CORP

- Porvair Filtration Group

Recent Developments

- In February 2023, Samsung unveiled its latest innovation an easily regenerable air purification filter technology incorporating photocatalysts. These developed filter effectively eliminates particulate matter and volatile organic chemicals, serving as a dual-purpose solution for primary air pollutants. It maintains its initial performance levels for up to two decades.

Report Coverage

The Electronic Filtration market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product type, filter material, application, end-use industry, and their futuristic growth opportunities.

Electronic Filtration Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.56 billion |

|

Revenue Forecast in 2032 |

USD 6.51 billion |

|

CAGR |

7.8% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Filter Material, By Application, By End-Use Industry, By Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Navigate through the intricacies of the 2024 electronic filtration market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2029. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Rubber Coated Fabric Market Size, Share 2024 Research Report

Surge Arrester Market Size, Share 2024 Research Report

Feed Phosphates Market Size, Share 2024 Research Report

Smart Transportation Market Size, Share 2024 Research Report

Thermal Spray Coatings Market Size, Share 2024 Research Report

FAQ's

key companies in Electronic Filtration Market are 3M, Camfil, Donaldson Company, Inc., Entegris, MANN+HUMMEL

Electronic filtration market exhibiting the CAGR of 7.8% during the forecast period.

The Electronic Filtration Market report covering key segments are product type, filter material, application, end-use industry, and region.

key driving factors in Electronic Filtration Market are expansion of semiconductor industries

The global electronic filtration market size is expected to reach USD 6.51 Billion by 2032