Electronic Flight Bag Market Share, Size, Trends, Industry Analysis Report

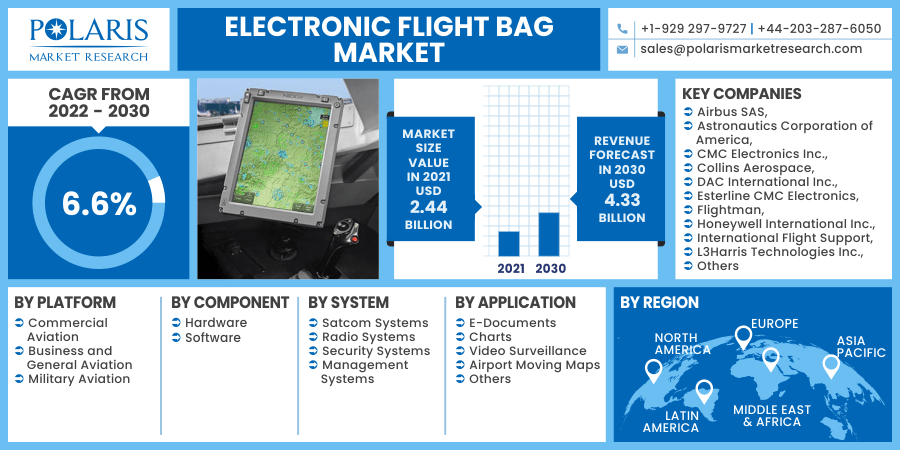

By Platform, By System (Satcom Systems, Radio Systems, Security Systems, Management Systems), By Application (E-Documents, Charts, Video Surveillance, Airport Moving Maps, Others), By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 115

- Format: PDF

- Report ID: PM2209

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

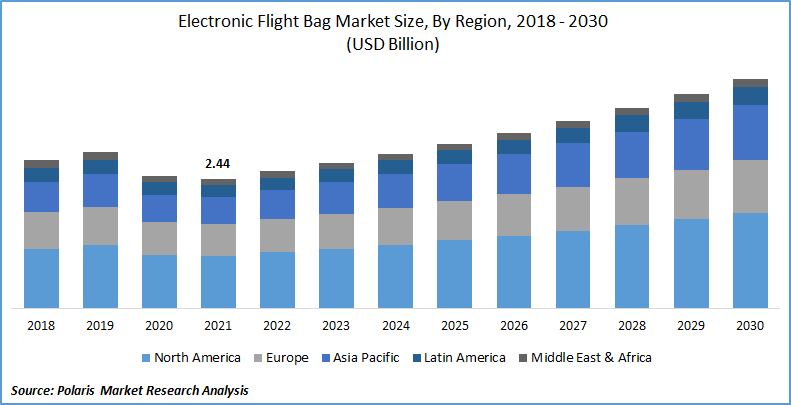

The global electronic flight bag market was valued at USD 2.44 billion in 2021 and is expected to grow at a CAGR of 6.6% during the forecast period. Flight logs, airport information, operational manuals, aeronautical charts, route information, and other relevant information are stored in electronic flight bags (EFB). Pilots can also get real-time data from their electronic flight bags. The pilots will be able to reduce the aircraft's weight due to this. Increase the aircraft's fuel economy, all of the information an airplane need is included in electronic bags.

Know more about this report: request for sample pages

It's helpful to have an easy-to-reference source for pertinent facts and information while dealing with an extensive and complex airspace system. Also, the availability of around 520 airport traffic control towers, 19,633 airports in the U.S., and 5.2% of the US GDP for aviation in 2020 boost the market demand for electronic bags. Besides, the rapid expansion in the number of commercial airplanes is expected to boost electronic bag growth.

However, different countries have regulatory frameworks, procedures, and certifications for EFBs flying in their airspace. As a result, EFB producers may need various regulatory permits and certificates. For instance, for an EFB to be used in the U.S., it must first be certified by the FAA and then recertified by the EASA for use in the European Union. This is one of the primary reasons limiting the electronic flight bag market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

In the last few decades, the market has observed extensive developments supported by various factors, such as reducing aircraft weight through electronic airplane bag installation. The aviation industry has worked hard to reduce vehicle weight and develop new techniques to use these bags. Pilots' traditional paper airplane bags can weigh up to 18 kgs or more, which is inconvenient and adds weight to the aircraft.

Aside from the bag itself, there are a variety of reference materials, emergency books, and manuals that can all be stored in a digital format in an EFB. An EFB removes the need for big, physical flying bags, weighing between 0.5 and 2.2 kg. In any situation, the aircraft's fuel efficiency improves due to the significant weight reduction.

Further, the need for more fuel-efficient air fleets is driving the expansion of the EFB market for the commercial aviation industry. For instance, according to the IATA, Using less fuel is a smart and efficient approach to cut costs. IATA is collaborating with industry partners worldwide to minimize the industry's fuel use. Furthermore, they are collaborating with specific airlines to ensure a solid internal "fuel efficiency program" in place.

Report Segmentation

The market is primarily segmented based on platform, component, system, application, and Geographic Region.

|

By Platform |

By Component |

By System |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Platform

Based on the platform segment, the commercial aviation segment is expected to be the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. Increased air transportation, a rise in middle-class expendable income, and increased trade and tourism worldwide have all contributed to the commercial aviation sector's significant expansion in recent years. Strong growth in this industry has increased by aircraft orders to meet the growing market demand for air travel.

Geographic Overview

In terms of geography, North America had the largest revenue share. The market for the North American region is anticipated to grow significantly as a result of the presence of several EFB manufacturers. Rapid expansion in aircraft manufacturing, technical advancements, and more air traffic is also driving the EFB market in this region.

For instance, in November 2021, Collins Aerospace, a Raytheon Technologies company, acquired FlightAware, a provider of airplane tracking software in the U.S., for an undisclosed sum. Predictive technologies, analytics, and decision-making tools are also available from FlightAware. After completing this purchase, the company will join the firm's Connected Aviation Solutions company, which was announced in August. This unit will promote Collins' connected ecosystem solutions.

Moreover, Asia-Pacific is expected to witness a high CAGR in the global electronic flight bag market. The rise in aircraft deliveries in industrialized countries can be linked to this development. Air traffic is expanding in developed countries, and a growing focus on fuel-efficient solutions will drive market expansion in this region. In addition, emerging countries are concentrating on signing agreements for updated EFB solutions, which would help the market grow.

In February 2021, Korean Air, the country's flag airline, agreed to adopt NAVBLUE's electronic flight bag (EFB) solution Flysmart+ on IOS devices to modernize and optimize its pilot operations. This cutting-edge system, which is also the most widely installed EFB on the ground, not only streamlines the take-off, landing, in-flight performance, documentation, and eQRH procedures but also offers several fuel-saving potentials. Korean Air will benefit from NAVBLUE's EFB solution to boost operating efficiency and optimize fleet performance computations. Korean Air was already using ROPS+. Flysmart+ is used by over 260 airlines, representing over 6,000 Airbus aircraft service personnel.

Competitive Insight

Some of the major players operating in the global electronic flight bag market include Airbus SAS, Astronautics Corporation of America, CMC Electronics Inc., Collins Aerospace, DAC International Inc., Esterline CMC Electronics, Flightman, Honeywell International Inc., International Flight Support, L3Harris Technologies Inc., Lufthansa Systems, Navarro AB, Rockwell Collins Inc., Teledyne Controls LLC, Thales Group, and The Boeing Company.

Electronic Flight Bag Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 2.44 billion |

|

Revenue forecast in 2030 |

USD 4.33 billion |

|

CAGR |

6.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Platform, By System, By Component, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Airbus SAS, Astronautics Corporation of America, CMC Electronics Inc., Collins Aerospace, DAC International Inc., Esterline CMC Electronics, Flightman, Honeywell International Inc., International Flight Support, L3Harris Technologies Inc., Lufthansa Systems, Navarro AB, Rockwell Collins Inc., Teledyne Controls LLC, Thales Group, and The Boeing Company. |